|

市场调查报告书

商品编码

1740824

汽车智慧表面市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Smart Surface Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

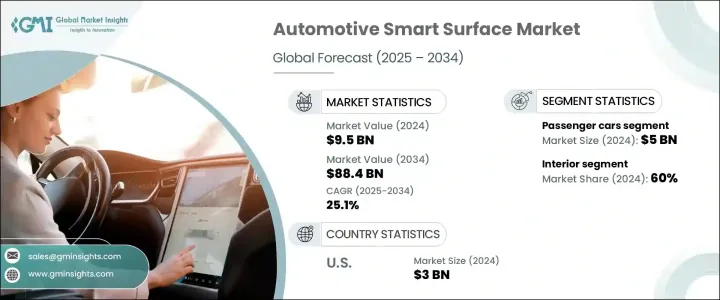

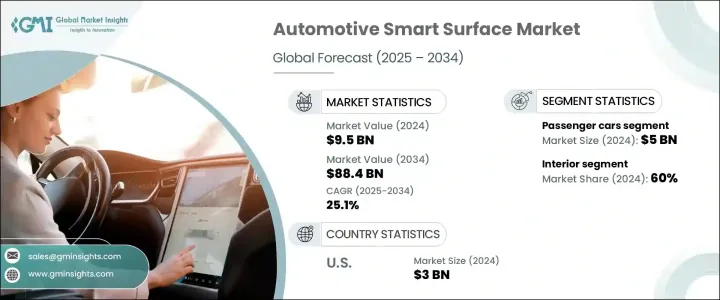

2024 年全球汽车智慧表面市场价值为 95 亿美元,预计到 2034 年将以 25.1% 的复合年增长率成长,达到 884 亿美元。这一令人印象深刻的成长得益于连网汽车内饰日益整合、材料和人机介面 (HMI) 的技术进步,以及消费者对更先进的数位化座舱体验的强烈追求。随着电动车和自动驾驶汽车的兴起,汽车製造商面临越来越大的压力,需要透过融合设计与功能来提升汽车内饰,而智慧表面则成为这一转变的核心。随着对汽车先进技术的需求不断增长,市场也正在经历一波创新浪潮,更智慧、更直觉的系统正在成为汽车设计的标准。

车辆的智慧表面不再仅仅起到美观的作用。这些尖端的表面将触控、动态照明、触觉回馈和数位显示器融入仪表板、车门板和中控台等关键内装部件。随着传统实体按钮的逐渐淘汰,新的电容式和手势控制技术正在被应用,以提升驾驶便利性并改善座舱的人体工学。可印刷电子和透明导电材料的进步推动了这项技术的发展,它们对于支援安全系统和资讯娱乐功能至关重要。此外,电动车和自动驾驶汽车对个人化、互联互通和节省空间的解决方案的需求也持续推动着这个市场的发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 95亿美元 |

| 预测值 | 884亿美元 |

| 复合年增长率 | 25.1% |

自修復涂层、表面整合感测器和曲面 3D 介面等关键创新正在彻底改变座舱设计。随着消费者对使用者友善高科技环境的需求日益增长,汽车原始设备製造商正大力投资智慧表面技术,以满足这些不断变化的需求。共享出行的兴起以及高端电动车 (EV) 的日益普及,进一步加速了人们对清洁、可自订且视觉上整合的智慧内装元素的需求。

就车辆类别而言,乘用车市场在2024年创造了50亿美元的收入,预计在整个预测期内仍将保持主导地位。该市场受益于消费者对座舱数位功能日益增长的需求,这些功能可提升舒适性、互动性和个人化。电动车和自动驾驶汽车的广泛普及,促使汽车製造商将响应式表面与嵌入式触控、氛围灯和感测器驱动的介面相集成,进一步契合未来主义、功能强大的座舱环境趋势。

在各种表麵类型中,到2024年,内装智慧表面将占据60%的份额。随着汽车製造商逐渐放弃传统的操控方式,他们正在投资于具有电容式触控、触觉回馈和动态照明功能的多功能无缝显示器。这些创新不仅提升了用户的便利性,而且对于豪华电动车和高端汽车而言至关重要,因为这些汽车的品牌价值与尖端技术的整合息息相关。

2024年,美国汽车智慧表面市场规模达30亿美元,预计到2034年复合年增长率将达25.4%。这一增长得益于美国先进的研发生态系统、对下一代技术的早期采用以及不断增长的豪华电动车市场。美国汽车製造商和一级供应商正加强合作,共同开发用于高阶和中阶车型的智慧人机介面 (HMI) 系统、互动式仪錶板和响应式内装面板。这些系统也正被融入更广泛的智慧出行趋势,例如驾驶辅助技术、人工智慧助理和互联资讯娱乐生态系统。

佛吉亚、科思创、现代、Dura、Canatu、Gentex、大陆、TactoTek、库尔兹和Flex等市场领导者正在积极塑造汽车智慧表面的未来。为了巩固市场地位,这些公司专注于与汽车原始设备製造商建立合作伙伴关係,扩大多功能材料的研发规模,并开发能够适应不断发展的汽车电子设备的模组化平台。一些企业也优先考虑可持续和轻量化的基材,而其他企业则投资在地化生产,以更好地满足区域需求,确保所有车型的能源效率、安全合规性和无缝的用户互动。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 配销通路分析

- 最终用途

- 利润率分析

- 供应商格局

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 对贸易的影响

- 技术与创新格局

- 专利分析

- 监管格局

- 成本細項分析

- 重要新闻和倡议

- 衝击力

- 成长动力

- 车载连线和使用者体验的需求不断增长

- 材料和製造技术的进步

- 电动车和自动驾驶汽车的成长

- OEM注重减轻重量和设计集成

- 产业陷阱与挑战

- 生产成本高

- 耐久性和环境敏感性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按表面,2021 - 2034 年

- 主要趋势

- 内部的

- 外部的

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 运输

- 电子产品

- 建造

- 医疗保健

- 活力

- 其他的

第八章:市场估计与预测:依技术分类 2021 - 2034

- 主要趋势

- 触控萤幕介面

- 自修復表面

- 嵌入式感测器

- 自适应表面

- 自清洁表面

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- 3M

- BASF

- Canatu

- Continental

- Covestro

- Dura

- Faurecia

- Flex

- Gentex

- Hyundai Mobis

- KURZ

- LG

- Marelli

- Motherson

- Panasonic

- Preh

- Sekisui

- TactoTek

- Toyota Boshoku

- Yanfeng

The Global Automotive Smart Surface Market was valued at USD 9.5 billion in 2024 and is estimatedected to grow at a CAGR of 25.1% to reach USD 88.4 billion by 2034. This impressive growth is fueled by the increasing integration of connected vehicle interiors, technological advancements in materials and human-machine interfaces (HMIs), and a strong consumer shift toward more advanced digital in-cabin experiences. With the rise of electric and autonomous vehicles, automakers are under increasing pressure to enhance vehicle interiors by blending design and functionality, placing smart surfaces at the heart of this transformation. As demand for advanced technology in vehicles grows, the market is also witnessing a wave of innovation, with smarter, more intuitive systems becoming a standard in vehicle designs.

Smart surfaces in vehicles no longer serve merely an aesthetic function. These cutting-edge surfaces incorporate touch-responsive controls, dynamic lighting, haptic feedback, and digital displays into key interior components such as dashboards, door panels, and center consoles. As traditional physical buttons phase out, new capacitive and gesture-based controls are being implemented to enhance driver convenience and improve cabin ergonomics. The growth of this technology is propelled by the progress in printable electronics and transparent conductive materials, which are pivotal in supporting safety systems and infotainment functions. Moreover, the demand for personalized, connected, and space-saving solutions in electric and autonomous vehicles continues to drive this market forward.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.5 Billion |

| Forecast Value | $88.4 Billion |

| CAGR | 25.1% |

Key innovations such as self-healing coatings, surface-integrated sensors, and curved 3D interfaces are revolutionizing cabin design. As consumers increasingly demand user-friendly, high-tech environments, automotive OEMs are heavily investing in smart surface technologies that meet these evolving expectations. The shift toward shared mobility and the increasing popularity of premium electric vehicles (EVs) further accelerate the need for clean, customizable, and visually integrated smart interior elements.

In terms of vehicle categories, the passenger cars segment generated USD 5 billion in 2024 and is expected to maintain its dominance throughout the forecast period. This segment benefits from the rising consumer demand for in-cabin digital features, which enhance comfort, interactivity, and personalization. The widespread adoption of EVs and autonomous models is pushing automakers to integrate responsive surfaces with embedded touch controls, ambient lighting, and sensor-driven interfaces, further aligning with the trend toward futuristic, highly functional cabin environments.

Among surface types, interior smart surfaces accounted for a 60% share in 2024. As vehicle manufacturers move away from traditional controls, they are investing in multifunctional, seamless displays with capacitive touch, haptic feedback, and dynamic lighting features. These innovations not only enhance user convenience but are also crucial in luxury EVs and high-end vehicles, where brand value is closely tied to the integration of cutting-edge technology.

The United States automotive smart surface market generated USD 3 billion in 2024 and is expected to experience a CAGR of 25.4% through 2034. This growth is driven by the country's advanced R&D ecosystem, early adoption of next-generation technologies, and a growing luxury EV market. U.S.-based OEMs and Tier 1 suppliers are increasingly working together to develop intelligent HMI systems, interactive dashboards, and responsive interior panels for premium and mid-range models. These systems are also being integrated into broader smart mobility trends, such as driver assistance technologies, AI assistants, and connected infotainment ecosystems.

Leading players in the market, including Faurecia, Covestro, Hyundai, Dura, Canatu, Gentex, Continental, TactoTek, KURZ, and Flex, are actively shaping the future of automotive smart surfaces. To strengthen their market position, these companies are focusing on partnerships with automotive OEMs, scaling R&D for multifunctional materials, and developing modular platforms that can adapt to evolving vehicle electronics. Some players are also prioritizing sustainable and lightweight substrates, while others are investing in localized production to better serve regional demands, ensuring energy efficiency, safety compliance, and seamless user interaction across all vehicle types.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End Use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for in-vehicle connectivity and UX

- 3.8.1.2 Technological advancements in materials & manufacturing

- 3.8.1.3 Growth in electric and autonomous vehicles

- 3.8.1.4 OEM focus on weight reduction and design integration

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High production costs

- 3.8.2.2 Durability and environmental sensitivity

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Surface, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Interior

- 5.3 Exterior

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Transportation

- 7.3 Electronics

- 7.4 Construction

- 7.5 Medical & healthcare

- 7.6 Energy

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Technology 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Touchscreen interfaces

- 8.3 Self-Healing surfaces

- 8.4 Embedded sensors

- 8.5 Adaptive surfaces

- 8.6 Self-cleaning surfaces

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 3M

- 10.2 BASF

- 10.3 Canatu

- 10.4 Continental

- 10.5 Covestro

- 10.6 Dura

- 10.7 Faurecia

- 10.8 Flex

- 10.9 Gentex

- 10.10 Hyundai Mobis

- 10.11 KURZ

- 10.12 LG

- 10.13 Marelli

- 10.14 Motherson

- 10.15 Panasonic

- 10.16 Preh

- 10.17 Sekisui

- 10.18 TactoTek

- 10.19 Toyota Boshoku

- 10.20 Yanfeng