|

市场调查报告书

商品编码

1740826

透明包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Transparent Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

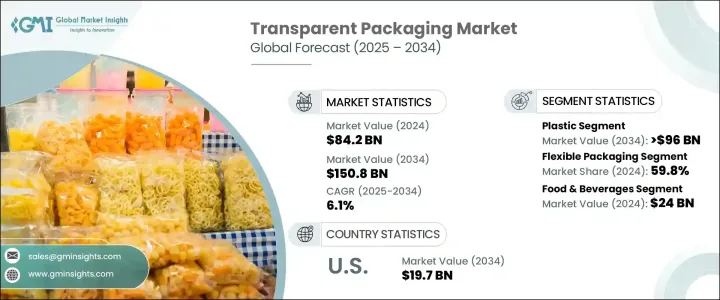

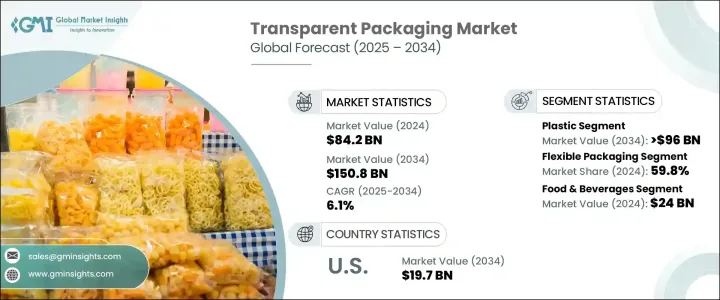

2024年,全球透明包装市场规模达842亿美元,预计到2034年将以6.1%的复合年增长率成长,达到1508亿美元。这主要得益于电子商务领域的快速扩张,以及对提升产品可见度和赢得消费者信任的包装需求的不断增长。随着消费者偏好的演变,品牌越来越重视不仅能保护产品,还能与消费者视觉沟通的包装。透明包装对于清晰呈现产品品质、新鲜度和真实性至关重要,尤其是在食品、饮料、个人护理和电子产品等行业。随着企业努力在竞争激烈的市场中脱颖而出,透明包装已成为重要的行销工具。永续解决方案的趋势也在重塑市场格局,製造商专注于可回收和可生物降解的材料,以符合环保标准并满足日益增长的环保消费者群体的需求。透明包装解决方案在全通路零售策略中发挥关键作用,它弥合了线上和线下购物体验之间的差距,同时提供了吸引现代消费者的耐用性、永续性和优质美感。

透明包装材料,包括聚对苯二甲酸乙二醇酯 (PET)、聚乙烯 (PE) 和聚丙烯 (PP),因其卓越的透明度、弹性和可回收性而备受青睐。随着消费者转向线上购物,对能够有效展示产品且不损害保护性能的包装的需求也日益增长。此外,对永续性的高度重视也促使企业在可生物降解和可回收材料方面进行创新,以满足环保要求和消费者期望。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 842亿美元 |

| 预测值 | 1508亿美元 |

| 复合年增长率 | 6.1% |

近期的贸易政策为透明包装市场带来了挑战。美国政府对来自中国和墨西哥等国的进口产品征收关税,并推高了PET、PE和PP树脂等关键原料的成本。生产成本的上升导致透明包装解决方案的价格上涨。为此,企业正在多元化供应链,寻找替代供应商,并提高国内生产能力,以应对关税影响并保持竞争力。

预计到2034年,包括PET、PE和PP在内的塑胶市场规模将达到960亿美元,这得益于塑胶的轻量、成本效益和耐用性。 PET和PP尤其因其卓越的透明度而备受青睐,消费者无需打开封条即可查看产品,从而提升了产品的吸引力和信任度。可回收和可生物降解塑胶的创新也使塑胶包装成为更永续、更有吸引力的环保消费者选择。

软包装占据了市场主导地位,到2024年将占据59.8%的市场份额,这得益于PE、PP和PET材料的多功能性和成本效益。轻质且富有弹性的软包装非常适合药品、个人护理以及食品和饮料产品,具有防篡改、可重复密封和增强产品可视性等特点。

受电子商务活动激增和环保包装需求成长的推动,预计到2034年,美国透明包装市场规模将达到197亿美元。食品和饮料产业仍然是最大的贡献者,透明、可密封的包装增强了消费者信心,并支撑了有机食品和即食食品消费的成长。

全球透明包装产业的主要参与者包括 Futamura Group、NatureWorks LLC、Amcor plc、Biome Bioplastics、Bio Futura、Corbion、Genpak、IIC AG、FKuR、ITC Packaging、Novamont SpA、Sealed Air Corporation、J. Landworth Company、Stora Enso、TIPAPA LTD、Tetrad Pakak。各公司正在透过多元化供应链、提高自动化程度、密切关注贸易政策变化、利用数据驱动策略以及专注于永续材料和创新包装设计等增值产品来应对关税挑战,以保持竞争优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 电子商务产业的成长

- 永续包装日益普及

- 包装材料的进步

- 製药业的扩张

- 高端和奢华包装需求激增

- 产业陷阱与挑战

- 塑胶废弃物的环境问题和监管压力

- 生产成本高且材料限制

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 塑胶

- PET(聚对苯二甲酸乙二醇酯)

- PP(聚丙烯)

- PVC(聚氯乙烯)

- 生物塑胶(PLA、PHA)

- 再生塑胶

- 玻璃

- 杂交种

第六章:市场估计与预测:依包装类型,2021 - 2034 年

- 主要趋势

- 硬质包装

- 瓶子和罐子

- 托盘和容器

- 蛤壳

- 软包装

- 小袋和小袋

- 袋子和包装

- 电影

- 其他的

第七章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 食品和饮料

- 食物

- 新鲜食品

- 加工食品

- 乳製品

- 烘焙和糖果

- 饮料

- 水和软性饮料

- 酒精饮料

- 果汁和乳製品饮料

- 食物

- 消费品

- 电子产品

- 家居用品

- 製药

- 製药

- 医疗器材

- 个人护理和化妆品

- 保养品

- 护髮

- 化妆品

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Amcor plc

- Bio Futura

- Biome Bioplastics

- Corbion

- FKuR

- Futamura Group

- Genpak

- IIC AG

- ITC Packaging

- J. Landworth Company

- NatureWorks LLC

- Novamont SpA

- Sealed Air Corporation

- Stora Enso

- Tetra Pak International SA

- TIPA LTD

- Walki Group Oy

- Xiamen Changsu Industrial Co., Ltd.

The Global Transparent Packaging Market was valued at USD 84.2 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 150.8 billion by 2034, driven by the rapid expansion of the e-commerce sector and the rising demand for packaging that enhances product visibility and builds consumer trust. As consumer preferences evolve, brands are increasingly prioritizing packaging that not only protects products but also visually connects with shoppers. Transparent packaging has become essential for delivering a clear view of product quality, freshness, and authenticity, especially across sectors like food, beverages, personal care, and electronics. With companies striving to differentiate themselves in a highly competitive marketplace, clear packaging has emerged as a vital marketing tool. The trend toward sustainable solutions is also reshaping the market landscape, with manufacturers focusing on recyclable and biodegradable materials to align with environmental standards and meet the growing eco-conscious consumer base. Transparent packaging solutions are playing a critical role in omnichannel retail strategies, bridging the gap between online and offline shopping experiences while offering durability, sustainability, and premium aesthetics that appeal to modern consumers.

Transparent packaging materials, including polyethylene terephthalate (PET), polyethylene (PE), and polypropylene (PP), are gaining significant traction for their excellent clarity, resilience, and recyclability. The shift toward online shopping has intensified the need for packaging that showcases products effectively without compromising protection. In addition, a strong emphasis on sustainability is pushing companies to innovate with biodegradable and recyclable materials to satisfy environmental mandates and consumer expectations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $84.2 Billion |

| Forecast Value | $150.8 Billion |

| CAGR | 6.1% |

Recent trade policies have created hurdles for the transparent packaging market. The U.S. administration's tariffs on imports from countries like China and Mexico have pushed up the cost of key raw materials such as PET, PE, and PP resins. Rising production costs are leading to higher prices for transparent packaging solutions. In response, companies are diversifying supply chains, seeking alternative suppliers, and ramping up domestic production capabilities to manage the tariff impact and maintain competitiveness.

The plastics segment, which includes PET, PE, and PP materials, is forecasted to generate USD 96 billion by 2034, fueled by plastics' lightweight, cost-efficiency, and durability. PET and PP, in particular, are prized for their exceptional transparency, allowing consumers to inspect products without breaking seals, thus enhancing product appeal and trust. Innovations in recyclable and biodegradable plastics are also making plastic packaging a more sustainable and attractive choice for eco-conscious buyers.

Flexible packaging dominated the market, holding a 59.8% share in 2024, driven by the versatility and cost-efficiency of PE, PP, and PET materials. Lightweight and resilient, flexible packaging is well-suited for pharmaceuticals, personal care, and food and beverage products, offering tamper resistance, resealability, and enhanced product visibility.

The U.S. Transparent Packaging Market is projected to reach USD 19.7 billion by 2034, fueled by surging e-commerce activities and the growing demand for eco-friendly packaging. The food and beverage sector remains the top contributor, with transparent, sealable packaging boosting consumer confidence and supporting the rising consumption of organic and ready-to-eat foods.

Key players in the Global Transparent Packaging Industry include Futamura Group, NatureWorks LLC, Amcor plc, Biome Bioplastics, Bio Futura, Corbion, Genpak, IIC AG, FKuR, ITC Packaging, Novamont S.p.A., Sealed Air Corporation, J. Landworth Company, Stora Enso, TIPA LTD, Tetra Pak International S.A., Walki Group Oy, and Xiamen Changsu Industrial Co., Ltd. Companies are navigating tariff challenges by diversifying supply chains, boosting automation, closely monitoring trade policy shifts, leveraging data-driven strategies, and focusing on value-added offerings such as sustainable materials and innovative packaging designs to maintain a competitive edge.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (Raw Materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (Raw Materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growth in e-commerce industry

- 3.3.1.2 Rising popularity of sustainable packaging

- 3.3.1.3 Advancements in packaging materials

- 3.3.1.4 Expansion of the pharmaceutical sector

- 3.3.1.5 Surge in premium & luxury packaging demand

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Environmental concerns & regulatory pressure on plastic waste

- 3.3.2.2 High production costs & material limitations

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn & Million Tons)

- 5.1 Key trends

- 5.2 Plastics

- 5.2.1 PET (polyethylene terephthalate)

- 5.2.2 PP (polypropylene)

- 5.2.3 PVC (polyvinyl chloride)

- 5.2.4 Bioplastics (PLA, PHA)

- 5.2.5 Recycled plastics

- 5.3 Glass

- 5.4 Hybrid

Chapter 6 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 ($ Mn & Million Tons)

- 6.1 Key trends

- 6.2 Rigid packaging

- 6.2.1 Bottles & jars

- 6.2.2 Trays & containers

- 6.2.3 Clamshells

- 6.3 Flexible packaging

- 6.3.1 Pouches & sachets

- 6.3.2 Bags & wraps

- 6.3.3 Films

- 6.3.4 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 ($ Mn & Million Tons)

- 7.1 Key trends

- 7.2 Food and beverage

- 7.2.1 Food

- 7.2.1.1 Fresh food

- 7.2.1.2 Processed food

- 7.2.1.3 Dairy products

- 7.2.1.4 Bakery & confectionery

- 7.2.2 Beverage

- 7.2.2.1 Water & soft drinks

- 7.2.2.2 Alcoholic beverages

- 7.2.2.3 Juices & dairy drinks

- 7.2.1 Food

- 7.3 Consumer goods

- 7.3.1 Electronics

- 7.3.2 Household products

- 7.4 Pharmaceuticals

- 7.4.1 Pharmaceuticals

- 7.4.2 Medical devices

- 7.5 Personal care & cosmetics

- 7.5.1 Skincare

- 7.5.2 Haircare

- 7.5.3 Makeup

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Million Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor plc

- 9.2 Bio Futura

- 9.3 Biome Bioplastics

- 9.4 Corbion

- 9.5 FKuR

- 9.6 Futamura Group

- 9.7 Genpak

- 9.8 IIC AG

- 9.9 ITC Packaging

- 9.10 J. Landworth Company

- 9.11 NatureWorks LLC

- 9.12 Novamont S.p.A.

- 9.13 Sealed Air Corporation

- 9.14 Stora Enso

- 9.15 Tetra Pak International S.A.

- 9.16 TIPA LTD

- 9.17 Walki Group Oy

- 9.18 Xiamen Changsu Industrial Co., Ltd.