|

市场调查报告书

商品编码

1740834

道路限速器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Road Speed Limiter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

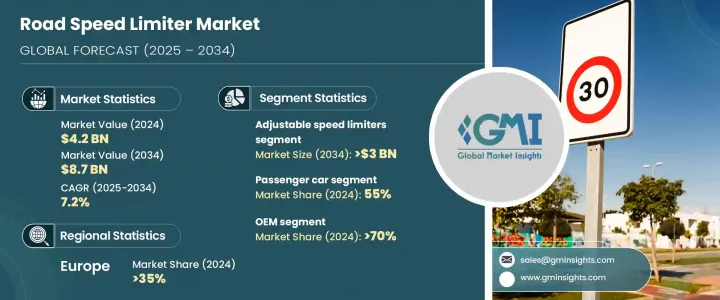

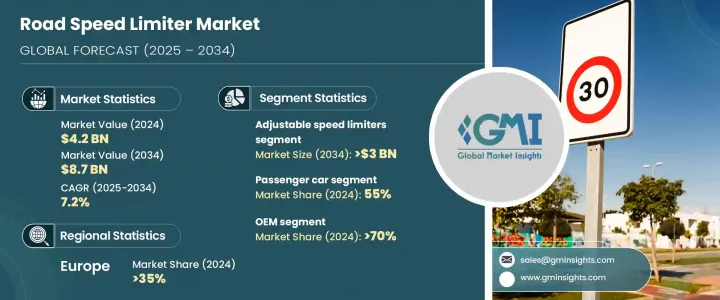

2024 年全球道路限速器市场价值为 42 亿美元,预计到 2034 年将以 7.2% 的复合年增长率增长至 87 亿美元。这一增长是由监管执法、日益增长的道路安全问题和技术创新共同推动的。世界各国政府都在执行更严格的安全法,要求商用车和乘用车安装限速系统。这些法规旨在减少交通事故、最大限度地减少排放并促进更安全的驾驶习惯。随着全球汽车产量持续攀升,製造商越来越多地采用先进的限速系统来满足合规性和消费者期望。同时,都市化进程的加速和汽车保有量的增加也加剧了对速度控制机制的需求,以减少道路拥塞并支持环境目标。此外,智慧出行和车辆远端资讯处理的发展正在将限速器从简单的控制设备转变为智慧的数据驱动系统。

汽车技术的快速发展显着提升了限速器的效率和智慧化程度。新一代系统整合了GPS、人工智慧(AI)和各种驾驶辅助技术,能够根据路况、车辆位置和交通模式即时调整车速。这使得限速系统更具适应性、反应速度更快、更人性化。汽车製造商正在积极拥抱这些升级,使此类系统成为许多新车型的标准配备。随着汽车产业持续向网联和自动驾驶汽车转型,智慧限速的重要性日益凸显。消费者也越来越青睐安全功能,这进一步推动了对先进限速器的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 42亿美元 |

| 预测值 | 87亿美元 |

| 复合年增长率 | 7.2% |

根据产品类型,道路限速器市场细分为可调式限速器、智慧型限速器 (ISL)、电子限速器 (ESL)、基于 GPS 的系统和机械限速器。可调式限速器在 2024 年占据主导地位,占整个市场的 50% 以上,预计到 2034 年将超过 30 亿美元。这些系统提供了适应不同地区驾驶条件、法律要求和车辆类别所需的灵活性。它们能够快速轻鬆地进行修改,这对于跨辖区运营的车队尤其有用。这种适应性在提高合规性和防止违规方面发挥着至关重要的作用,使其成为商业营运商和物流供应商的首选解决方案。

依车辆类型划分,市场分为乘用车和商用车。 2024年,乘用车占了全球55%的市场。这一增长很大程度上得益于针对乘客安全的监管压力加大,以及全球个人汽车保有量的整体成长。随着汽车安全标准不断收紧,尤其是在人口密集的地区,对乘用车嵌入式限速器系统的需求正在强劲增长。这些系统正成为现代安全套件的重要组成部分,有助于减少超速驾驶的发生率,并鼓励负责任的驾驶行为。

根据最终用途,市场分为原始设备製造商 (OEM) 和售后市场。 2024 年,OEM 占据了全球 70% 以上的市场。随着消费者对内建安全技术和智慧驾驶功能的兴趣日益浓厚,汽车製造商正在将限速系统直接整合到生产阶段。这种积极主动的方法符合人们对环保和科技型汽车日益增长的需求。 OEM 越来越多地将可调式智慧限速技术嵌入高级驾驶辅助生态系统,以确保符合不断发展的法律标准,并提高车辆的整体性能和安全性。

从地理来看,欧洲已成为领先的区域市场,2024 年占全球 35% 以上的份额。该地区的领先地位得益于其严格的汽车安全法规和广泛采用的车辆安全技术。强而有力的政策架构和产业标准持续鼓励製造商部署先进的限速系统。这些监管支援正在为限速器的部署营造统一的格局,并巩固该地区在全球市场的主导地位。

道路限速器领域的主要参与者包括AVS、奥托立夫、大陆集团、远端控制技术公司 (RCT)、电装株式会社、罗伯特·博世、法雷奥集团、沃达丰汽车、SABO电子技术公司和采埃孚。这些公司正在大力投资研发和策略合作,以开发兼具安全性、燃油效率和环保性能的先进解决方案。随着车辆互联互通和自动化程度的不断提高,限速器的未来在于智慧集成,以确保更安全、更清洁、更负责任的出行。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 汽车原厂设备製造商

- 限速装置厂商

- 基于软体和人工智慧的远端资讯处理提供商

- 硬体组件供应商

- 监管和安全技术提供者

- 最终用途

- 利润率分析

- 川普行政关税

- 对贸易的影响

- 跨境合规中断

- 区域监管差异

- 对产业的影响

- 供应方影响(零件和技术供应商)

- 电子元件价格波动

- 采购和装配链调整

- 需求面影响(原始设备製造商和车队营运商)

- 车辆成本和价格敏感度增加

- 船队采购动态的变化

- 供应方影响(零件和技术供应商)

- 受影响的主要公司

- 策略产业反应

- 垂直整合和零件本地化

- 与原始设备製造商和监管机构建立策略合作伙伴关係

- 自适应定价和产品定位

- 展望与未来考虑

- 对贸易的影响

- 利润率分析

- 技术与创新格局

- 专利分析

- 价格趋势

- 地区

- 车辆

- 重要新闻和倡议

- 监管格局

- 案例研究

- 对部队的影响

- 成长动力

- 严格的政府法规和安全标准

- 车辆系统的技术进步

- 道路安全和燃油效率意识不断提高

- 商业船队营运成长

- 产业陷阱与挑战

- 安装和维护成本高

- 来自司机和操作员的抵制

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品,2021 - 2034 年

- 主要趋势

- 可调限速器

- 智慧型限速器(ISL)

- 电子限速器(ESL)

- 基于GPS的限速系统

- 机械式限速器

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- Aptiv

- Autograde International

- AutoKontrol

- Autoliv

- AVS LTD

- Continental

- Denso

- Elson

- Highway Digital (Nigeria) Limited

- MKP Parts

- Pricol Limited

- Remote Control Technologies (RCT)

- Robert Bosch

- Rosmerta Technologies

- SABO Electronic Technology

- Sturdy

- Transtronix India

- Valeo

- Vodafone Automotive

- ZF Friedrichshafen

The Global Road Speed Limiter Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 8.7 billion by 2034. This growth is being driven by a combination of regulatory enforcement, rising road safety concerns, and technological innovation. Governments around the world are enforcing stricter safety laws that mandate the installation of speed limiting systems in both commercial and passenger vehicles. These regulations aim to reduce traffic accidents, minimize emissions, and promote safer driving habits. As vehicle production continues to climb globally, manufacturers are increasingly incorporating advanced speed limiter systems to meet compliance and consumer expectations. Simultaneously, rising urbanization and growing vehicle ownership have intensified the need for speed control mechanisms to reduce road congestion and support environmental goals. Moreover, the evolution of smart mobility and vehicle telematics is transforming speed limiters from simple control devices to intelligent, data-driven systems.

The rapid advancement in automotive technology has significantly improved the efficiency and intelligence of speed limiters. New-generation systems are now integrated with GPS, Artificial Intelligence (AI), and various driver assistance technologies, allowing real-time speed adjustments based on road conditions, vehicle location, and traffic patterns. This makes speed limiting more adaptive, responsive, and user-friendly. Vehicle manufacturers are embracing these upgrades, making such systems a standard feature in many new models. As the automotive industry continues its shift toward connected and automated vehicles, the relevance of intelligent speed control is becoming more pronounced. Consumers are also showing a growing preference for safety-oriented features, further pushing the demand for sophisticated speed limiters.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 7.2% |

Based on product type, the road speed limiter market is segmented into adjustable speed limiters, intelligent speed limiters (ISL), electronic speed limiters (ESL), GPS-based systems, and mechanical speed limiters. Adjustable speed limiters held the dominant share in 2024, accounting for over 50% of the total market, and are projected to surpass USD 3 billion by 2034. These systems provide the flexibility needed to adapt to different regional driving conditions, legal requirements, and vehicle classes. Their ability to be modified quickly and easily makes them especially useful for fleets operating across various jurisdictions. This adaptability plays a crucial role in enhancing compliance and preventing violations, making them a preferred solution for commercial operators and logistics providers.

By vehicle type, the market is categorized into passenger cars and commercial vehicles. In 2024, passenger vehicles captured 55% of the global share. A significant portion of this growth can be credited to heightened regulatory pressures targeting passenger safety and the overall increase in personal vehicle ownership worldwide. As automotive safety standards continue to tighten, especially in densely populated regions, demand for embedded speed limiter systems in passenger vehicles is gaining strong momentum. These systems are becoming essential components of modern safety packages, helping to reduce the incidence of speeding and encouraging responsible driving behavior.

On the basis of end use, the market is divided into OEMs (Original Equipment Manufacturers) and aftermarket. In 2024, OEMs held more than 70% of the global market. With rising consumer interest in built-in safety technologies and intelligent driving features, automotive manufacturers are integrating speed limiter systems directly at the production stage. This proactive approach aligns with the growing demand for environmentally friendly and tech-savvy vehicles. OEMs are increasingly embedding adjustable and intelligent speed limiting technologies as part of advanced driver assistance ecosystems, ensuring compliance with evolving legal standards and improving overall vehicle performance and safety.

Geographically, Europe emerged as the leading regional market, commanding over 35% of the global share in 2024. The region's leadership is fueled by its rigorous automotive safety laws and widespread adoption of vehicle safety technologies. Strong policy frameworks and industry-wide standards continue to encourage manufacturers to implement cutting-edge speed control systems. This regulatory support is creating a unified landscape for speed limiter deployment and solidifying the region's dominance in the global market.

Key players in the road speed limiter space include AVS, Autoliv, Continental, Remote Control Technologies (RCT), Denso Corporation, Robert Bosch, Valeo SA, Vodafone Automotive, SABO Electronic Technology, and ZF Friedrichshafen. These companies are investing heavily in R&D and strategic collaborations to develop advanced solutions that combine safety, fuel efficiency, and environmental performance. With vehicle connectivity and automation on the rise, the future of speed limiters lies in smart integrations that ensure safer, cleaner, and more responsible mobility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Automotive OEMs

- 3.2.2 Speed limit device manufacturers

- 3.2.3 Software & AI-based telematics providers

- 3.2.4 Hardware component suppliers

- 3.2.5 Regulatory and safety technology providers

- 3.2.6 End Use

- 3.3 Profit margin analysis

- 3.4 Trump administrative tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Cross-border compliance disruptions

- 3.4.1.2 Regional regulatory divergence

- 3.4.2 Impact on the industry

- 3.4.2.1 Supply-side impact (component & tech suppliers)

- 3.4.2.1.1 Electronic component price fluctuations

- 3.4.2.1.2 Sourcing and assembly chain adjustments

- 3.4.2.2 Demand-side impact (OEMs & fleet operators)

- 3.4.2.2.1 Increased vehicle cost and price sensitivity

- 3.4.2.2.2 Changes in fleet procurement dynamics

- 3.4.2.1 Supply-side impact (component & tech suppliers)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Vertical integration and component localization

- 3.4.4.2 Strategic partnerships with OEMs and regulators

- 3.4.4.3 Adaptive pricing and product positioning

- 3.4.5 Outlook and Future Considerations

- 3.4.1 Impact on trade

- 3.5 Profit margin analysis

- 3.6 Technology & innovation landscape

- 3.7 Patent analysis

- 3.8 Price trend

- 3.8.1 Region

- 3.8.2 Vehicle

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 1.1 Case studies

- 3.11 Impact on forces

- 3.11.1 Growth drivers

- 3.11.1.1 Stringent government regulations and safety standards

- 3.11.1.2 Technological advancements in vehicle systems

- 3.11.1.3 Rising awareness of road safety and fuel efficiency

- 3.11.1.4 Growth in commercial fleet operations

- 3.11.2 Industry pitfalls & challenges

- 3.11.3 High installation and maintenance costs

- 3.11.4 Resistance from drivers and operators

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Adjustable Speed Limiters

- 5.3 Intelligent speed limiters (ISL)

- 5.4 Electronic speed limiters (ESL)

- 5.5 Gps-based speed limiting systems

- 5.6 Mechanical speed limiters

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Aptiv

- 9.2 Autograde International

- 9.3 AutoKontrol

- 9.4 Autoliv

- 9.5 AVS LTD

- 9.6 Continental

- 9.7 Denso

- 9.8 Elson

- 9.9 Highway Digital (Nigeria) Limited

- 9.10 MKP Parts

- 9.11 Pricol Limited

- 9.12 Remote Control Technologies (RCT)

- 9.13 Robert Bosch

- 9.14 Rosmerta Technologies

- 9.15 SABO Electronic Technology

- 9.16 Sturdy

- 9.17 Transtronix India

- 9.18 Valeo

- 9.19 Vodafone Automotive

- 9.20 ZF Friedrichshafen