|

市场调查报告书

商品编码

1740841

冷藏拖车市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Refrigerated Trailer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

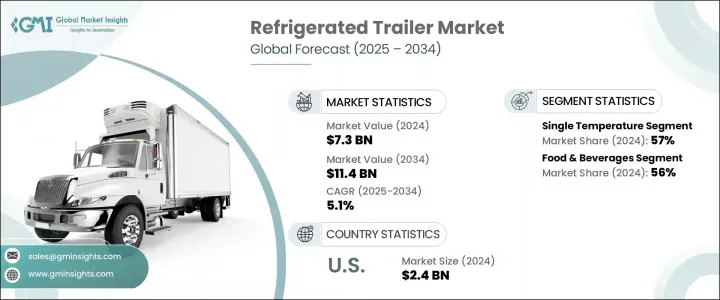

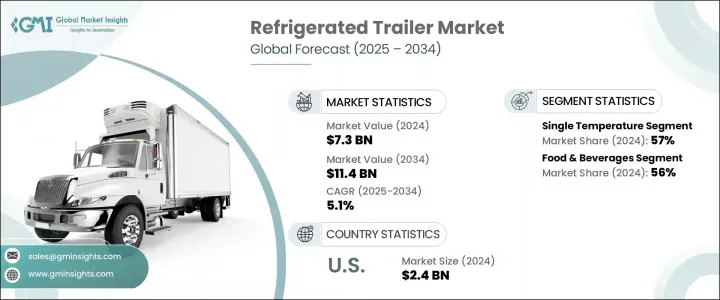

2024年,全球冷藏拖车市场规模达73亿美元,预计到2034年将以5.1%的复合年增长率成长,达到114亿美元。这一成长主要得益于供应链的全球化程度不断提高,以及对长距离高效运输易腐产品的需求日益增长。随着消费者偏好转向来自世界各地的新鲜、优质和反季节商品,对可靠冷链物流的需求激增。这一趋势在依赖特定温度范围来保证运输货物完整性和品质的行业尤其明显。随着越来越多的国际货运需要严格的温度控制,冷藏拖车已成为现代物流的重要组成部分。全球食品和製药网络的演变,加上城市化进程的加速和生活方式的改变,进一步加剧了对温控运输系统的需求。这些拖车在确保对温度敏感的货物安全抵达、满足消费者期望和监管标准方面发挥关键作用。

除了食品分销,製药和医疗保健产业在推动市场扩张方面也发挥越来越重要的作用。如今,许多医疗产品需要精确的温度条件才能在运输过程中保持有效。生物製剂和温敏疗法的日益普及,也加剧了对可靠冷链基础设施的需求。冷藏拖车提供了解决方案,可保障产品功效,支援遵守严格的业界准则,并增强病患安全。随着医疗系统和製药公司业务范围的扩大,对先进温控物流解决方案的需求预计将大幅成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 73亿美元 |

| 预测值 | 114亿美元 |

| 复合年增长率 | 5.1% |

根据温度类型,冷藏拖车市场分为单温区、多温区和低温区。 2024年,单温区约占全球市场的57%,预计到2034年复合年增长率将超过5%。单温区拖车因其在恆定温度条件下运输统一产品类型的效率而广受欢迎。该区受欢迎程度源自于其设计简单、操作简便以及与更复杂的配置相比更低的营运成本。车队经理通常倾向于使用单温区拖车进行长途运输,因为它们具有更高的有效载荷能力和更少的维护需求。它们的简易性也符合众多全球运输指南,这些指南要求保持特定的温度范围且不波动。

按应用分析,市场可分为食品饮料、药品、化学品和其他。 2024年,食品饮料领域占56%的市场份额,预计2025年至2034年的复合年增长率将超过5.4%。由于易腐货物在运输过程中始终需要冷藏以防止其变质,因此该领域将继续保持领先地位。饮食习惯的转变、冷冻食品消费量的增加以及食品杂货配送服务的扩展,使得冷藏拖车在该领域变得不可或缺。食品安全和储存方面的法规合规性也强化了温控物流的关键作用。国际供应链需求的增加和零售业态的不断发展,使得高效率的冷藏运输成为重中之重。

从材料角度来看,铝凭藉其轻质、高强度和耐环境磨损等优势,在市场上占据领先地位。预计铝製拖车将继续占据主导地位,因为它们能够提高燃油效率和载重。到2024年,铝将成为製造商和最终用户的首选。其优异的导热性确保内部温度保持稳定,这对于保存对温度敏感的货物至关重要。其较长的使用寿命和较低的维护要求也有助于降低营运成本。此外,其可回收的特性也吸引了那些优先考虑环境永续运输方式的公司。

从地区来看,美国在2024年引领北美冷藏拖车市场,占据近86%的地区份额,创造了约24亿美元的收入。美国强大的市场地位得益于其广泛的物流网络、对温度敏感产品的大规模分销以及严格的运输标准的实施。拖车技术的进步,包括节能係统和智慧监控功能,使冷链运作更加高效可靠。因此,营运商正在投资新的车队技术和即时追踪技术,以确保温度合规并降低货物变质风险。

主要的市场参与者包括那些大力投资永续技术、先进隔热技术和智慧远端资讯处理技术,以满足环境目标和营运需求的公司。这些公司也正在开发电动和混合冷冻设备,以提高能源效率并降低排放。产品创新是核心重点,各公司优先考虑更轻的材料、模组化设计和可客製化功能,以满足多样化的产业需求。策略合作和地理扩张仍是巩固市场地位和提升跨区域客户服务能力的重要策略。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 零件製造商

- 拖车製造商

- 经销商和分销商

- 最终用途

- 利润率分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 其他国家的报復措施

- 对产业的影响

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 展望与未来考虑

- 对贸易的影响

- 技术与创新格局

- 价格趋势

- 地区

- 成本細項分析

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 食品贸易日益全球化,易腐食品需求不断增加

- 对加工食品和冷冻食品的需求不断增长

- 製药和医疗保健产业的成长

- 冷冻设备的技术进步

- 严格的食品安全和监管标准

- 产业陷阱与挑战

- 初始成本和营运成本高

- 严格的温度控制要求

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按温度,2021 - 2034 年

- 主要趋势

- 单温

- 多温度

- 低温

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 食品和饮料

- 製药

- 化学品

- 其他的

第七章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 铝

- 钢

- 合成的

- 塑胶

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 运输

- 贮存

- 分配

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Carrier Transicold

- Faymonville

- Fruehauf Trailers

- Gray & Adams

- Great Dane Trailers

- Hwasung Thermo

- Hyundai Translead

- Kidron

- Kogel Trailer

- Krone Trailer

- Lamberet

- Manac

- MaxiTRANS

- Montracon

- Schmitz Cargobull

- Singamas Container

- Sinotruk

- Thermo King

- Utility Trailer Manufacturing Company

- Wabash National

The Global Refrigerated Trailer Market was valued at USD 7.3 billion in 2024 and is estimated to expand at a CAGR of 5.1% to reach USD 11.4 billion by 2034. This growth is largely fueled by the increasing globalization of supply chains and the rising need for efficient transportation of perishable products across long distances. As consumer preferences shift toward fresh, high-quality, and out-of-season items from around the world, the demand for reliable cold chain logistics has surged. This trend is particularly evident in sectors that depend on maintaining specific temperature ranges to preserve the integrity and quality of transported goods. With more international shipments requiring strict temperature control, refrigerated trailers have become a vital component of modern logistics. The evolution of global food and pharmaceutical networks, combined with growing urbanization and lifestyle changes, has further intensified the need for temperature-controlled transportation systems. These trailers play a key role in ensuring that temperature-sensitive goods arrive safely, meeting both consumer expectations and regulatory standards.

In addition to food distribution, the pharmaceutical and healthcare industries are playing an increasingly important role in driving market expansion. Many medical items now require precise temperature conditions to remain effective throughout transit. The growing use of biologics and temperature-sensitive therapeutics has heightened the need for dependable cold chain infrastructure. Refrigerated trailers provide a solution that safeguards product efficacy, supports compliance with strict industry guidelines, and enhances patient safety. As health systems and pharmaceutical companies expand their reach, the demand for advanced temperature-controlled logistics solutions is expected to grow significantly.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.3 Billion |

| Forecast Value | $11.4 Billion |

| CAGR | 5.1% |

By temperature type, the refrigerated trailer market is segmented into single temperature, multi-temperature, and cryogenic categories. In 2024, the single temperature segment accounted for approximately 57% of the global market and is projected to register a CAGR of over 5% through 2034. Single temperature trailers are widely preferred due to their efficiency in transporting uniform product types under consistent thermal conditions. This segment's popularity stems from its straightforward design, ease of operation, and lower operational costs compared to more complex configurations. Fleet managers often favor single-temperature units for long-distance hauls, as they offer higher payload capacity and demand less maintenance. Their simplicity also aligns with numerous global transportation guidelines, which require specific temperature ranges to be maintained without fluctuation.

When analyzed by application, the market is categorized into food and beverages, pharmaceuticals, chemicals, and others. In 2024, the food and beverages segment dominated with a 56% market share and is expected to grow at a CAGR exceeding 5.4% from 2025 to 2034. This segment continues to lead due to the consistent need for cold storage during transport to prevent spoilage of perishable goods. Shifting dietary patterns, the rise in frozen food consumption, and the expansion of grocery delivery services have made refrigerated trailers indispensable in this field. Regulatory compliance surrounding food safety and storage also reinforces the critical role of temperature-controlled logistics. Enhanced demand from international supply chains and evolving retail formats has made efficient cold transport a top priority.

From a materials standpoint, aluminum holds the leading position in the market due to its favorable attributes, such as lightweight construction, strength, and resistance to environmental wear. Aluminum-based trailers are projected to maintain dominance due to their ability to improve fuel efficiency and increase load capacity. In 2024, aluminum was the preferred choice among manufacturers and end-users alike. Its excellent thermal conductivity ensures that internal temperatures remain stable, which is essential for preserving temperature-sensitive goods. Its long service life and low maintenance requirements also contribute to reduced operating costs. Furthermore, its recyclable nature appeals to companies prioritizing environmentally sustainable transport options.

Regionally, the United States led the refrigerated trailer market in North America in 2024, accounting for nearly 86% of the regional share and generating around USD 2.4 billion in revenue. The country's strong position is driven by its extensive logistics networks, large-scale distribution of temperature-sensitive products, and the implementation of strict transportation standards. Advancements in trailer technologies, including energy-efficient systems and smart monitoring features, have made cold chain operations more efficient and reliable. As a result, operators are investing in new fleet technologies and real-time tracking to ensure temperature compliance and reduce spoilage risks.

Key market participants include companies that are investing heavily in sustainable technologies, advanced insulation, and smart telematics to meet environmental targets and operational needs. These companies are also developing electric and hybrid refrigeration units, offering better energy efficiency and lower emissions. Product innovation is a core focus, with firms prioritizing lighter materials, modular designs, and customizable features to serve diverse industry requirements. Strategic collaborations and geographic expansion remain essential tactics for reinforcing their market presence and enhancing customer service capabilities across regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Trailer manufacturers

- 3.2.4 Dealers and distributors

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.6.1 Region

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Increasing globalization of food trade and demand for perishable goods

- 3.11.1.2 Rising demand for processed and frozen foods

- 3.11.1.3 Growth in the pharmaceutical and healthcare sectors

- 3.11.1.4 Technological advancements in refrigeration units

- 3.11.1.5 Stringent food safety and regulatory standards

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial and operational costs

- 3.11.2.2 Stringent temperature control requirements

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Temperature, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Single temperature

- 5.3 Multi-temperature

- 5.4 Cryogenic

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Food & beverages

- 6.3 Pharmaceuticals

- 6.4 Chemicals

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Aluminum

- 7.3 Steel

- 7.4 Composite

- 7.5 Plastic

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Transportation

- 8.3 Storage

- 8.4 Distribution

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Carrier Transicold

- 10.2 Faymonville

- 10.3 Fruehauf Trailers

- 10.4 Gray & Adams

- 10.5 Great Dane Trailers

- 10.6 Hwasung Thermo

- 10.7 Hyundai Translead

- 10.8 Kidron

- 10.9 Kogel Trailer

- 10.10 Krone Trailer

- 10.11 Lamberet

- 10.12 Manac

- 10.13 MaxiTRANS

- 10.14 Montracon

- 10.15 Schmitz Cargobull

- 10.16 Singamas Container

- 10.17 Sinotruk

- 10.18 Thermo King

- 10.19 Utility Trailer Manufacturing Company

- 10.20 Wabash National