|

市场调查报告书

商品编码

1740842

特种炭黑市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Specialty Carbon Black Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

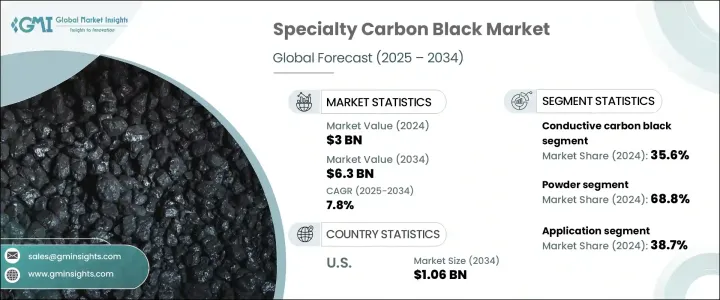

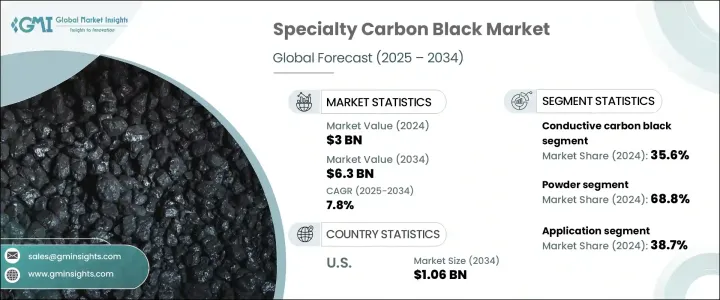

2024年,全球特种炭黑市场规模达30亿美元,预计2034年将以7.8%的复合年增长率成长至63亿美元。由于各行各业对高性能添加剂(例如导电性、抗紫外线和增强的机械耐久性)的需求不断增长,特种炭黑市场正呈现稳定成长动能。主要成长动力之一是特种炭黑在先进电池技术中的应用日益广泛,尤其是在储能係统中,稳定的性能和稳定性至关重要。塑胶和聚合物产业也呈现类似的成长趋势,这些产业正将特种炭黑应用于包装材料和各种高性能塑胶零件中,以发挥其增强和导电性能。从汽车到农业,各行各业对永续高效材料解决方案的兴趣日益浓厚,进一步推动了这项需求。农业薄膜和工业包装袋对特种炭黑的应用,进一步增加了户外应用的需求,因为这些应用对紫外线防护和物理弹性至关重要。市场参与者也认识到其在下一代材料持续开发中的潜力,这使得特种炭黑成为创新管道中的重要组成部分。

就形态而言,2024 年特种炭黑市场细分为粉末和颗粒,总市值达 30 亿美元。粉末型特种炭黑占据主导地位,占总市占率的 68.8%。此形态广泛应用于导电材料、高效涂料和锂离子电池组件的生产,这些产品中,细颗粒分散性和材料相容性对性能至关重要。塑胶产业也是粉末特种炭黑的主要消费领域,尤其是在需要外观均匀性和结构完整性的精密应用中。儘管颗粒形态目前市场占有率较小,但由于其无尘特性和更佳的加工性能,其市场吸引力逐渐增强,成为清洁高效工业环境的理想选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 30亿美元 |

| 预测值 | 63亿美元 |

| 复合年增长率 | 7.8% |

市场也依等级划分,主要细分市场包括导电炭黑、纤维炭黑、食品级炭黑等。 2024年,导电炭黑成为领先细分市场,占整体市场的35.6%。此等级的市场偏好主要源自于其在增强导电性、改善电荷保持率以及延长关键应用中组件使用寿命的有效性。在不断发展的能源领域以及电子应用的先进材料开发中,导电炭黑持续受到欢迎。纤维炭黑在该细分市场细分中紧随其后,在高耐久性材料生产中保持着重要的相关性。

按应用领域划分,橡胶产业在2024年占据了最大的市场份额,占全球需求的38.7%。这种主导地位源于其在轮胎和非轮胎橡胶製品中的广泛应用,而这些产品对补强和耐环境性能至关重要。特种炭黑与橡胶化合物的结合可以延长产品的使用寿命、提高表面稳定性和保护功能,使其成为各种橡胶製品生产週期中的基础材料。

从地理分布来看,美国在全球特种炭黑市场中占有显着份额,2024年占16.1%。这一份额相当于4.9亿美元的市场价值,预计2034年将成长至约10.6亿美元。美国市场的强劲表现与其先进的製造业生态系统、汽车和储能产业的需求以及对永续材料创新的持续投资密切相关。政府支持的推广生物基替代品的措施也促进了生物基替代品的采用和国内生产能力的稳定提升。

特种炭黑产业的竞争格局由多家全球企业塑造,这些企业积极透过策略联盟、产品创新和区域扩张来扩大市场份额。各企业正致力于增强供应链、提高产品品质并实现永续发展目标,以在快速发展的市场格局中脱颖而出。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 主要出口国

- 主要进口国

註:以上贸易统计仅针对重点国家。

- 利润率分析

- 供应商格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 导电应用需求不断成长

- 汽车产业不断扩张,轻量化趋势

- 塑胶和聚合物产业的成长

- 蓬勃发展的电动车(EV)和储能市场

- 高性能涂料和油漆的应用日益增多

- 聚合物复合材料的进展

- 产业陷阱与挑战

- 原材料成本高且供应链波动

- 严格的碳排放环境法规

- 来自替代材料(石墨烯、二氧化硅和奈米管)的竞争

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依形式,2021 年至 2034 年

- 主要趋势

- 粉末

- 颗粒

第六章:市场估计与预测:依等级,2021 年至 2034 年

- 主要趋势

- 导电碳黑

- 纤维炭黑

- 食品级炭黑

- 其他的

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 橡皮

- 塑胶

- 印刷油墨和碳粉

- 油漆和涂料

- 电池电极

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Asahi Carbon Co. Ltd.

- Atlas Organics Private Limited

- Birla Carbon

- Black Bear Carbon BV

- Cabot Corporation

- Continental Carbon Company

- Denka Company Limited

- Himadri Specialty Chemical Ltd

- Omsk Carbon Group

- Orion Engineered Carbons GmbH

- Phillips Carbon Black Limited

- Ralson

- Tokai Carbon Co., Ltd.

The Global Specialty Carbon Black Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 6.3 billion by 2034. The market is witnessing steady momentum due to increasing utilization across several industries demanding high-performance additives with specific attributes like electrical conductivity, ultraviolet resistance, and enhanced mechanical durability. One of the primary growth drivers is the rising adoption of specialty carbon black in advanced battery technologies, particularly in energy storage systems where consistent performance and stability are critical. A parallel growth trend is observed in the plastics and polymer industries, which are incorporating specialty carbon black for its reinforcing and conductive properties in packaging materials and various high-performance plastic components. This demand is further supported by increased interest in sustainable and efficient material solutions across sectors ranging from automotive to agriculture. The use of specialty carbon black in agricultural films and industrial sacks adds another layer of demand in outdoor applications, where UV protection and physical resilience are essential. Market participants are also recognizing its potential in the ongoing development of next-generation materials, which positions specialty carbon black as a vital component in the innovation pipeline.

In terms of form, the specialty carbon black market in 2024 was segmented into powder and granules, with a combined market value of USD 3 billion. Powder-based specialty carbon black dominated the segment, accounting for 68.8% of the total share. This form is widely used in the production of conductive materials, high-efficiency coatings, and lithium-ion battery components, where fine particle dispersion and material compatibility are essential for performance. The plastics sector is also a key consumer of powder specialty carbon black, particularly in precision applications where visual uniformity and structural integrity are required. Although the granule form currently holds a smaller portion of the market, it is gradually gaining traction due to its dust-free properties and improved processing performance, making it a desirable option for clean and efficient industrial environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $6.3 Billion |

| CAGR | 7.8% |

The market is also categorized by grade, with the major segments including conductive carbon black, fiber carbon black, food-grade carbon black, and others. In 2024, conductive carbon black emerged as the leading segment, representing 35.6% of the overall market. The preference for this grade is largely driven by its effectiveness in enhancing electrical conductivity, improving charge retention, and extending the operational life of components in critical applications. It continues to gain popularity in the evolving energy sector and advanced material development for electronic applications. Fiber carbon black follows closely in the segment breakdown, maintaining strong relevance in high-durability material production.

By application, the rubber industry held the largest market share in 2024, accounting for 38.7% of the global demand. This dominance stems from its broad use in both tire and non-tire rubber products, where reinforcement and environmental resistance are essential. The integration of specialty carbon black in rubber compounds improves product lifespan, surface stability, and protective functionality, making it a cornerstone material in the production cycle of various rubber-based goods.

Geographically, the United States accounted for a significant share of the global specialty carbon black market, capturing 16.1% of the total market in 2024. This share translates to a market value of USD 490 million, with projections indicating growth to approximately USD 1.06 billion by 2034. The strong market performance in the U.S. is closely linked to its advanced manufacturing ecosystem, demand from the automotive and energy storage sectors, and ongoing investments in sustainable material innovations. Government-backed initiatives promoting bio-based alternatives are also contributing to a steady increase in adoption and domestic production capabilities.

The competitive structure of the specialty carbon black industry is shaped by the presence of several global players actively working to expand their market share through strategic alliances, product innovations, and regional expansions. Companies are focusing on enhancing their supply chains, improving product quality, and addressing sustainability goals to differentiate themselves in a rapidly evolving market landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Profit margin analysis

- 3.5 Supplier landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for conductive applications

- 3.8.1.2 Expanding automotive sector and lightweighting trend

- 3.8.1.3 Growth in plastics and polymers industry

- 3.8.1.4 Booming electric vehicle (EV) and energy storage market

- 3.8.1.5 Increasing use in high-performance coatings and paints

- 3.8.1.6 Advancements in polymer composite materials

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High raw material costs and supply chain volatility

- 3.8.2.2 Stringent environmental regulations on carbon emissions

- 3.8.2.3 Competition from alternative materials (graphene, silica, and nanotubes)

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Form, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Powder

- 5.3 Granules

Chapter 6 Market Estimates and Forecast, By Grade, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Conductive carbon black

- 6.3 Fiber carbon black

- 6.4 Food-grade carbon black

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Rubber

- 7.3 Plastics

- 7.4 Printing inks & toners

- 7.5 Paints & coatings

- 7.6 Battery electrodes

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Asahi Carbon Co. Ltd.

- 9.2 Atlas Organics Private Limited

- 9.3 Birla Carbon

- 9.4 Black Bear Carbon B.V.

- 9.5 Cabot Corporation

- 9.6 Continental Carbon Company

- 9.7 Denka Company Limited

- 9.8 Himadri Specialty Chemical Ltd

- 9.9 Omsk Carbon Group

- 9.10 Orion Engineered Carbons GmbH

- 9.11 Phillips Carbon Black Limited

- 9.12 Ralson

- 9.13 Tokai Carbon Co., Ltd.