|

市场调查报告书

商品编码

1740853

航太和国防热管理系统市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Aerospace and Defense Thermal Management Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

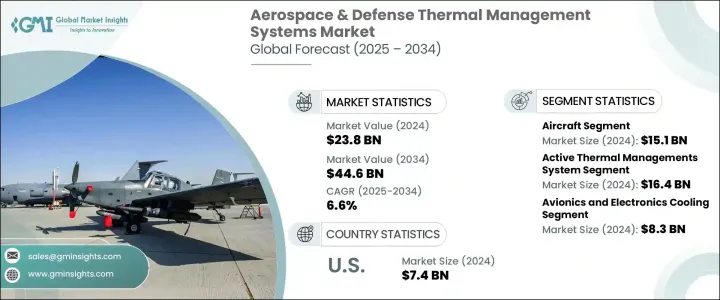

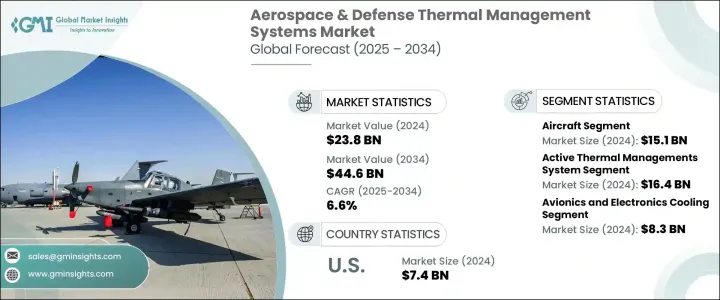

2024年,全球航太与国防热管理系统市场规模达238亿美元,预估年复合成长率为6.6%,到2034年将达到446亿美元,这得益于先进军事装备投资的不断增加以及下一代飞机的快速生产。随着世界各国政府增加国防预算以增强国家安全和战场优势,该产业正经历转型。随着日益紧凑和高功率密度平台的部署,热管理不再只是一个支援系统,而是一个关键任务元件。随着高性能电子设备、航空电子设备和推进系统的不断发展,对确保设备运作稳定性和长期耐用性的热解决方案的需求也在不断增长。人工智慧、定向能武器、高超音速系统和电力推进技术的融合,为热调节增添了新的复杂性,使其成为原始设备製造商(OEM)和国防承包商的首要任务之一。随着国防平台互联互通和资料驱动程度的提高,热管理系统的设计必须兼顾适应性、冗余性和智慧控制。这种转变促使製造商开发符合现代战争需求的动态、轻量化和模组化冷却系统。

贸易政策也在塑造市场成长曲线方面发挥重要作用。进口航太零件和原材料的关税显着影响了製造成本,尤其是在美国。铝、钢和热界面材料等必需投入品价格上涨,导致采购波动,交货週期延长。儘管一些贸易激励措施鼓励了本地采购,但许多製造商正在重新评估其供应链策略,以减少对进口的依赖,并建立更具韧性的生产生态系统。关税和贸易协定的不可预测性推动了市场向更聪明的物流、本地化生产和自适应采购策略的方向发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 238亿美元 |

| 预测值 | 446亿美元 |

| 复合年增长率 | 6.6% |

飞机继续引领航太和国防热管理系统市场平台细分市场,2024 年市场规模将达 151 亿美元。下一代军用喷射机和无人机将配备强大的航空电子设备、电子战系统和监视技术,这些技术会产生大量热量。为了保持任务就绪状态并延长平台使用寿命,这些飞机需要高效、轻量化的冷却系统。随着电力推进和混合动力配置的普及,对节能且不影响性能的热解决方案的需求变得愈发重要。虽然飞机在平台细分市场中占据主导地位,但陆基系统和海军舰艇正在迅速采用先进的热技术,以满足机载通讯、电子设备和武器系统日益增长的电力需求。

主动式热管理系统凭藉其卓越的高密度热负荷调节能力,在2024年以164亿美元的估值领先市场。液体冷却装置、热电模组和蒸汽压缩系统等技术如今已成为高风险国防行动的关键。这些系统的独特之处在于其实时自适应性——这得益于智慧感测器、嵌入式控制和人工智慧整合。这些特性使平台能够动态调整热负荷,即使在长时间高强度任务中也能保持最佳性能。国防应用日益复杂,使得主动系统成为军事和航太利益相关者的首选,旨在确保其技术堆迭面向未来。

2024年,美国航太与国防热管理系统市场产值达74亿美元,这得益于高超音速飞弹、先进隐形轰炸机和定向能武器等高科技国防平台的快速创新。这些技术产生巨大的热量输出,需要具备精准度和可扩展性的下一代冷却系统。美国国防计画日益重视整合式热架构,以支援海陆空无缝协同作战。从无人地面车辆到驱逐舰和隐形飞机,军方优先考虑符合数位转型目标和战场准备状态的冷却解决方案。因此,製造商正在大力投资模组化、可重构的系统,这些系统可以根据任务需求进行演进,并缩短整合时间。

霍尼韦尔国际、西嘉航太、马洛塔控制、莱尔德热力系统、巴斯科姆·亨特和英国航宇系统等主要参与者正在加倍投入研发,以打造更智能、更轻、更具可扩展性的散热解决方案。他们正在与国防承包商和新兴科技公司建立战略合作伙伴关係,共同开发兼具性能与灵活性的智慧冷却系统。各公司也纷纷采用积层製造技术,以简化生产流程并缩短高需求专案的交付週期,从而进一步提升其在这个快速发展的市场中的竞争力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(销售价格)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 先进军用飞机产量上升

- 电动和混合动力推进系统的采用日益增多

- 卫星和太空任务的扩展

- 无人机和无人驾驶飞机业务的成长

- 全球军费开支不断增加

- 产业陷阱与挑战

- 开发和整合成本高

- 网路安全和系统漏洞风险

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按平台,2021 - 2034 年

- 主要趋势

- 飞机

- 陆地系统

- 海军系统

第六章:市场估计与预测:按系统类型,2021 - 2034 年

- 主要趋势

- 主动热管理系统

- 被动式热管理系统

第七章:市场估计与预测:按组成部分,2021 - 2034 年

- 主要趋势

- 冷板

- 热交换器

- 风扇和鼓风机

- 泵浦和压缩机

- 阀门和感测器

- 隔热材料

- 其他的

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 航空电子设备和电子设备冷却

- 引擎冷却

- 储能冷却

- 武器系统冷却

- 客舱舒适度

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Advanced Cooling Technologies

- AMETEK

- BAE Systems

- Bascom Hunter

- Boyd Corporation

- Collins Aerospace

- Crane Aerospace and Electronics

- Honeywell International

- Laird Thermal Systems

- Liebherr Aerospace

- Marotta Controls

- Meggitt

- Signia Aerospace

- TAT Technologies

The Global Aerospace and Defense Thermal Management Systems Market was valued at USD 23.8 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 44.6 billion by 2034, fueled by rising investments in advanced military equipment and the rapid production of next-gen aircraft. The industry is undergoing a transformation as governments across the globe increase their defense budgets to enhance national security and battlefield superiority. With the deployment of increasingly compact and power-dense platforms, thermal management is no longer just a support system-it's now a mission-critical component. As high-performance electronics, avionics, and propulsion systems continue to evolve, so does the demand for thermal solutions that ensure both operational stability and long-term equipment durability. The integration of artificial intelligence, directed energy weapons, hypersonic systems, and electric propulsion technologies is adding new layers of complexity to thermal regulation, making it one of the top priorities for OEMs and defense contractors. As defense platforms become more interconnected and data-driven, thermal management systems must be engineered with adaptability, redundancy, and smart control in mind. This shift is pushing manufacturers to develop dynamic, lightweight, and modular cooling systems that align with modern warfare requirements.

Trade policies are also playing a major role in shaping the growth curve of the market. Tariffs on imported aerospace components and raw materials have significantly impacted manufacturing costs, particularly in the United States. Higher prices for essential inputs like aluminum, steel, and thermal interface materials have introduced procurement volatility and stretched lead times. While some trade incentives have encouraged local sourcing, many manufacturers are re-evaluating their supply chain strategies to reduce dependency on imports and build more resilient production ecosystems. The unpredictability of tariffs and trade agreements has driven the market toward smarter logistics, localized production, and adaptive sourcing strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.8 Billion |

| Forecast Value | $44.6 Billion |

| CAGR | 6.6% |

Aircraft continue to lead the platform segment of the aerospace and defense thermal management systems market, accounting for USD 15.1 billion in 2024. Next-generation military jets and UAVs are being equipped with powerful avionics, electronic warfare systems, and surveillance technologies that generate substantial heat. To maintain mission readiness and platform longevity, these aircraft require highly efficient, lightweight cooling systems. As electric propulsion and hybrid configurations gain traction, the need for thermal solutions that conserve energy without compromising performance is becoming even more critical. While aircraft dominate the platform segment, land-based systems and naval vessels are rapidly adopting advanced thermal technologies to support the growing power demands of onboard communications, electronics, and weapons systems.

Active thermal management systems led the market with a valuation of USD 16.4 billion in 2024, thanks to their superior ability to regulate high-density thermal loads. Technologies like liquid cooling units, thermoelectric modules, and vapor compression systems are now essential for high-stakes defense operations. What sets these systems apart is their real-time adaptability-enabled by smart sensors, embedded controls, and AI integration. These features allow platforms to adjust thermal loads dynamically, maintaining peak performance even during extended, high-intensity missions. The growing complexity of defense applications has made active systems the go-to choice for military and aerospace stakeholders aiming to future-proof their technology stacks.

The United States Aerospace and Defense Thermal Management Systems Market generated USD 7.4 billion in 2024, driven by rapid innovation in high-tech defense platforms including hypersonic missiles, advanced stealth bombers, and directed energy weapons. These technologies produce massive thermal outputs, demanding next-gen cooling systems that offer precision and scalability. U.S. defense programs are increasingly focusing on integrated thermal architectures that support seamless operation across air, land, and sea domains. From unmanned ground vehicles to destroyers and stealth aircraft, the military is prioritizing cooling solutions that align with digital transformation goals and battlefield readiness. As a result, manufacturers are investing heavily in modular, reconfigurable systems that can evolve with mission requirements and reduce integration timelines.

Key players such as Honeywell International, Signia Aerospace, Marotta Controls, Laird Thermal Systems, Bascom Hunter, and BAE Systems are doubling down on RandD efforts to build smarter, lighter, and more scalable thermal solutions. They're entering into strategic partnerships with defense contractors and emerging tech firms to co-develop intelligent cooling systems that combine performance with flexibility. Companies are also turning to additive manufacturing to streamline production and shorten lead times in high-demand projects, further boosting their competitiveness in this fast-evolving market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-Side Impact

- 3.2.2.1.1 Price volatility in Key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (Selling Price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-Side Impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rise in advanced military aircraft production

- 3.3.1.2 Growing adoption of electric and hybrid-electric propulsion

- 3.3.1.3 Expansion of satellite and space missions

- 3.3.1.4 Growing UAV and drone operations

- 3.3.1.5 Rising military spending globally

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High development and integration costs

- 3.3.2.2 Cybersecurity and system vulnerability risks

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Platform, 2021 - 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Aircraft

- 5.3 Land systems

- 5.4 Naval systems

Chapter 6 Market Estimates and Forecast, By System Type, 2021 - 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Active thermal management systems

- 6.3 Passive thermal management systems

Chapter 7 Market Estimates and Forecast, By Component, 2021 - 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Cold plates

- 7.3 Heat exchangers

- 7.4 Fans & blowers

- 7.5 Pumps & compressors

- 7.6 Valves & sensors

- 7.7 Thermal insulation materials

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 Avionics & electronics cooling

- 8.3 Engine cooling

- 8.4 Energy storage cooling

- 8.5 Weapons systems cooling

- 8.6 Cabin comfort

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Advanced Cooling Technologies

- 10.2 AMETEK

- 10.3 BAE Systems

- 10.4 Bascom Hunter

- 10.5 Boyd Corporation

- 10.6 Collins Aerospace

- 10.7 Crane Aerospace and Electronics

- 10.8 Honeywell International

- 10.9 Laird Thermal Systems

- 10.10 Liebherr Aerospace

- 10.11 Marotta Controls

- 10.12 Meggitt

- 10.13 Signia Aerospace

- 10.14 TAT Technologies