|

市场调查报告书

商品编码

1740855

生物製药包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Biopharmaceutical Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

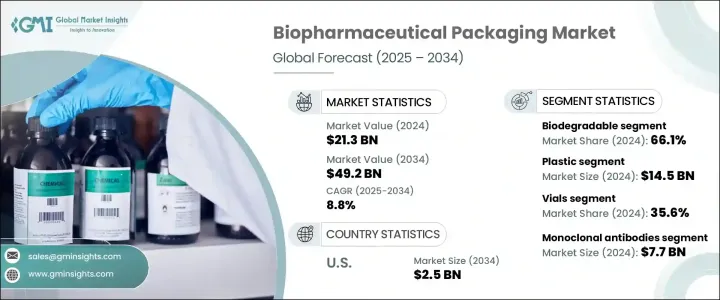

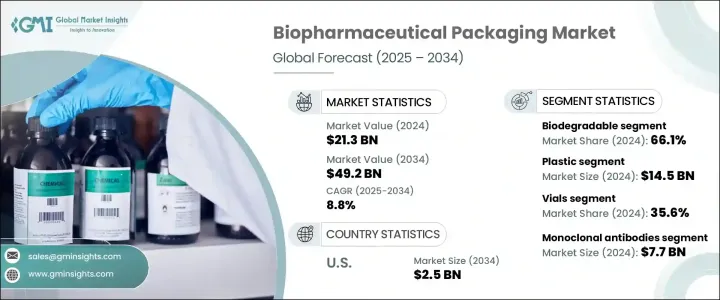

2024年,全球生物製药包装市场规模达213亿美元,预计到2034年将以8.8%的复合年增长率成长,达到492亿美元。这得归功于对能够保护敏感生物药品完整性和功效的专业包装解决方案日益增长的需求。随着生物製药产业不断扩大对复杂高价值疗法(包括单株抗体、细胞和基因疗法以及基于mRNA的药物)的关注,先进包装解决方案的重要性也急剧上升。生物製药对环境变化高度敏感,需要可控制的储存和运输条件。这导致对旨在保护整个供应链药品稳定性的创新材料和技术的需求激增。随着全球监管机构不断收紧包装安全标准,製药公司正在重新思考如何保护其生物製剂。此外,随着越来越多的生物製剂进入全球市场,对能够确保无菌、实现即时监控并符合永续发展目标的包装形式的要求也越来越高。

冷链物流投资的不断增长以及全球生物製药消费者群体的不断扩大,进一步推动了人们转向更具创新性和更坚固的包装解决方案。生物製药公司正积极采用高性能材料,以应对极端温度环境,并在整个生产现场和护理点的整个过程中保持产品功效。对永续性的日益重视也影响着设计选择。随着医疗保健提供者和最终用户都要求更安全、更环保的选择,包装公司正在加速开发可回收、可生物降解和可重复使用的解决方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 213亿美元 |

| 预测值 | 492亿美元 |

| 复合年增长率 | 8.8% |

贸易政策的变化,尤其是对医药相关进口产品征收的报復性关税,进一步加剧了市场动态的复杂性。这些关税正在推高原料成本,尤其是国际采购的高级塑胶和药用级玻璃。由此产生的成本飙升使得国内製造成本更高,进而影响了整个价值链的采购策略。企业目前正在探索在地化供应链和替代采购模式,以抵消不断上涨的投入成本,同时维持合规性和品质标准。

同时,科技正在重塑生物製药产品的包装和监控方式。智慧包装形式正在改变产业格局,尤其对于温度敏感的生物製剂。整合RFID标籤和感测器的解决方案能够即时追踪温度、湿度和产品完整性等关键参数。这些智慧系统有助于最大限度地减少浪费,降低产品受损风险,并提高患者的整体安全性。随着对药物精准输送和储存的需求不断增长,智慧包装正迅速从奢侈品变为这个高风险产业的必需品。

2024年,可生物降解包装材料占据全球市场的66.1%,彰显了迈向永续发展的决定性转变。这一趋势不仅体现了消费者日益增强的环保意识,也反映了监管部门日益增强的压力,要求逐步淘汰製药应用中的一次性塑胶。可生物降解材料已取得显着发展,现已具备製药应用所需的耐用性、耐化学性和阻隔保护性能。这些创新帮助可生物降解包装超越了小众市场的地位,成为众多药品包装中传统塑胶解决方案的有力替代者。

儘管发生了这种转变,塑胶包装在2024年仍然占据主导地位,市值达145亿美元。其成本效益、设计灵活性和卓越的保护性能继续支撑着塑胶包装的广泛应用。塑胶尤其适用于需要防篡改功能、高防潮性以及与儿童安全封盖和一次性系统等专用组件相容的应用。聚合物科学的不断进步提升了塑胶包装的性能,使其能够满足日益严格的药品储存和分销需求。

受美国强大的製药生态系统和生物技术创新的推动,预计2034年,美国生物製药包装市场规模将达到25亿美元。严格的监管标准以及消费者对安全性、完整性和永续性日益增长的期望,正推动包装公司加快创新步伐。随着业界适应药物输送和合规性的新挑战和机会,智慧、可追溯且环保的包装形式正变得至关重要。

安姆科 (Amcor)、肖特 (Schott AG)、格雷斯海姆 (Gerresheimer AG)、碧迪 (Becton, Dickinson & Co.) 和丝芙兰 (CCL Industries) 等公司正积极投资研发,以保持领先地位。这些公司正与製药公司合作,共同开发下一代包装解决方案,扩大环保替代品的规模,并采用数位化工具来提高供应链透明度和监管合规性。随着全球市场的成熟,生物製药包装的策略创新仍将是支持安全且有效率地交付全球最先进疗法的核心。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 对永续和环保包装解决方案的需求不断增长

- 医疗保健基础设施的全球扩张和现代化

- 慢性病和生活方式疾病的日益流行

- 智慧包装系统等快速的技术创新

- 生物製剂和个人化药物研发投资不断增加

- 产业陷阱与挑战

- 初期投资和营运成本高

- 复杂的供应链物流和严格的品质标准

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 可生物降解

- 非生物分解

第六章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 塑胶

- 聚氯乙烯(PVC)

- 聚丙烯(PP)

- 聚对苯二甲酸乙二酯(PET)

- 聚苯乙烯(PS)

- 聚乙烯(PE)

- 高密度聚乙烯

- 低密度聚乙烯

- 线型低密度聚乙烯

- 其他的

- 玻璃

第七章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 小瓶

- 安瓿

- 瓶子

- 预充式註射器

- 墨水匣

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 疫苗

- 细胞因子

- 酵素

- 单株抗体

- 基因疗法

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 澳洲

- 韩国

- 日本

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- Adelphi

- Amcor

- Becton, Dickinson & Co.

- Berry Global

- CCL Industries

- Gerresheimer AG

- LOG Pharma Packaging

- Medical Packaging Inc., LLC

- Merck KGaA

- PCI

- Piramal Glass Private Limited

- Schott AG

- Shandong Pharmaceutical Glass Co

- Sonoco

- Stevanato Group

- West Pharmaceutical Services, Inc.

The Global Biopharmaceutical Packaging Market was valued at USD 21.3 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 49.2 billion by 2034, fueled by the rising demand for specialized packaging solutions capable of preserving the integrity and efficacy of sensitive biological drugs. As the biopharma sector keeps expanding its focus on complex, high-value therapies-including monoclonal antibodies, cell and gene therapies, and mRNA-based drugs-the importance of advanced packaging solutions is rising sharply. Biopharmaceuticals are highly sensitive to environmental changes, requiring controlled storage and transportation conditions. This has led to a surge in demand for innovative materials and technologies designed to protect drug stability throughout the supply chain. With regulatory authorities around the globe tightening packaging safety standards, pharmaceutical companies are rethinking how they protect their biologics. On top of that, as more biologics enter the global market, there's a stronger push for packaging formats that ensure sterility, enable real-time monitoring, and align with sustainability goals.

The shift toward more innovative and robust packaging solutions is further supported by growing investments in cold chain logistics and an expanding global base of biologic drug consumers. Biopharmaceutical companies are responding by adopting high-performance materials that can endure extreme temperatures and maintain product efficacy from manufacturing sites to point-of-care delivery. Rising emphasis on sustainability is also influencing design choices. As healthcare providers and end users alike demand safer and greener options, packaging firms are accelerating the development of recyclable, biodegradable, and reusable solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.3 Billion |

| Forecast Value | $49.2 Billion |

| CAGR | 8.8% |

Trade policy shifts, especially the retaliatory tariffs placed on pharma-related imports, have added another layer of complexity to market dynamics. These tariffs are increasing raw material costs, particularly for high-grade plastics and pharmaceutical-grade glass sourced internationally. The resulting cost surge has made domestic manufacturing more expensive, which is impacting procurement strategies across the value chain. Companies are now exploring localized supply chains and alternative sourcing models to offset rising input costs while maintaining compliance and quality standards.

At the same time, technology is reshaping how biopharmaceutical products are packaged and monitored. Smart packaging formats are becoming a game changer, especially for temperature-sensitive biologics. Solutions integrated with RFID tags and sensors are enabling real-time tracking of critical parameters like temperature, humidity, and product integrity. These intelligent systems help minimize waste, reduce the risk of compromised products, and improve overall patient safety. As demand for precision in drug delivery and storage continues to grow, smart packaging is quickly moving from a luxury to a necessity in this high-stakes industry.

In 2024, biodegradable packaging materials accounted for 66.1% of the global market, underlining a decisive shift toward sustainability. This trend reflects not just a response to growing environmental awareness among consumers but also stronger regulatory pressure to phase out single-use plastics in pharmaceutical applications. Biodegradable materials have evolved significantly and now offer the durability, chemical resistance, and barrier protection required for pharmaceutical use. These innovations have helped biodegradable packaging move beyond niche status, making it a competitive alternative to traditional plastic solutions across a broad range of drug formats.

Despite this shift, plastic packaging still held a dominant position in 2024, with a market value of USD 14.5 billion. Its widespread use continues to be supported by its cost-effectiveness, design flexibility, and excellent protective qualities. Plastics are especially favored in applications requiring tamper-evident features, high moisture resistance, and compatibility with specialized components like child-safe closures and single-use systems. Continuous advancements in polymer science have enhanced the performance of plastic packaging, enabling it to meet the increasingly stringent demands of pharmaceutical storage and distribution.

The U.S. Biopharmaceutical Packaging Market is projected to hit USD 2.5 billion by 2034, driven by the country's strong pharmaceutical manufacturing ecosystem and innovation in biotech. A combination of strict regulatory standards and rising consumer expectations around safety, integrity, and sustainability is pushing packaging firms to innovate faster. Smart, traceable, and eco-conscious packaging formats are becoming essential as the industry adapts to new challenges and opportunities in drug delivery and compliance.

Companies like Amcor, Schott AG, Gerresheimer AG, Becton, Dickinson & Co., and CCL Industries are actively investing in R&D to stay ahead. These firms are partnering with pharmaceutical companies to co-develop next-gen packaging solutions, scale up eco-friendly alternatives, and adopt digital tools for supply chain visibility and regulatory alignment. As the global market matures, strategic innovation in biopharmaceutical packaging will remain central to supporting the safe and efficient delivery of the world's most advanced therapies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research Approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.2 Supply-side impact (raw materials)

- 3.2.2.1 Price volatility in key materials

- 3.2.2.2 Supply chain restructuring

- 3.2.2.3 Production cost implications

- 3.2.3 Demand-side impact (selling price)

- 3.2.3.1 Price transmission to end markets

- 3.2.3.2 Market share dynamics

- 3.2.3.3 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing demand for sustainable and eco-friendly packaging solutions

- 3.3.1.2 Global expansion and modernization of healthcare infrastructure

- 3.3.1.3 The growing prevalence of chronic and lifestyle diseases

- 3.3.1.4 Rapid technological innovations such as smart packaging systems

- 3.3.1.5 Rising investments in R&D for biologics and personalized medicines

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial investment and operational costs

- 3.3.2.2 Complex supply chain logistics and stringent quality standards

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Biodegradable

- 5.3 Non-biodegradable

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.2.1 Polyvinyl Chloride (PVC)

- 6.2.2 Polypropylene (PP)

- 6.2.3 Polyethylene Terephthalate (PET)

- 6.2.4 Polystyrene (PS)

- 6.2.5 Polyethylene (PE)

- 6.2.5.1 HDPE

- 6.2.5.2 LDPE

- 6.2.5.3 LLDPE

- 6.2.6 Others

- 6.3 Glass

Chapter 7 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn & Units)

- 7.1 Key trends

- 7.2 Vials

- 7.3 Ampoules

- 7.4 Bottles

- 7.5 Pre-filled syringes

- 7.6 Cartridges

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 Vaccines

- 8.3 Cytokines

- 8.4 Enzymes

- 8.5 Monoclonal antibodies

- 8.6 Gene therapies

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Australia

- 9.4.4 South Korea

- 9.4.5 Japan

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 U.A.E.

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Adelphi

- 10.2 Amcor

- 10.3 Becton, Dickinson & Co.

- 10.4 Berry Global

- 10.5 CCL Industries

- 10.6 Gerresheimer AG

- 10.7 LOG Pharma Packaging

- 10.8 Medical Packaging Inc., LLC

- 10.9 Merck KGaA

- 10.10 PCI

- 10.11 Piramal Glass Private Limited

- 10.12 Schott AG

- 10.13 Shandong Pharmaceutical Glass Co

- 10.14 Sonoco

- 10.15 Stevanato Group

- 10.16 West Pharmaceutical Services, Inc.