|

市场调查报告书

商品编码

1740858

心臟映射市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cardiac Mapping Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

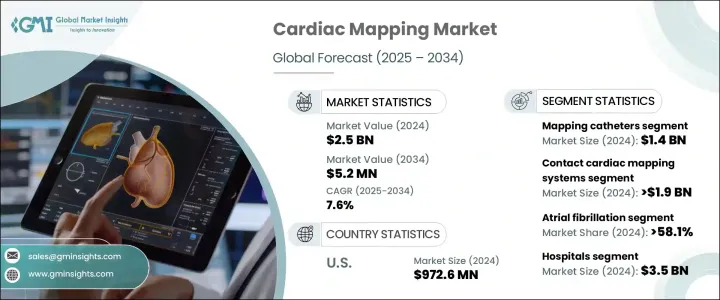

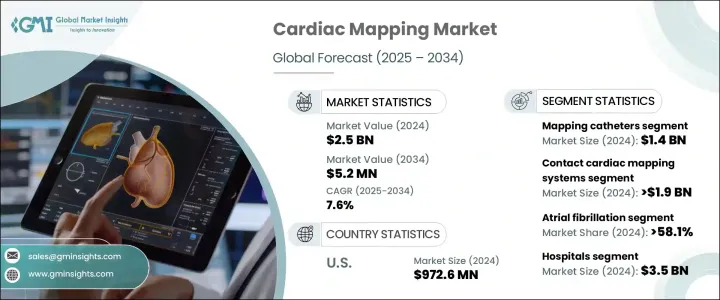

2024年,全球心臟测绘市场规模达25亿美元,预计年复合成长率为7.6%,到2034年将达52亿美元。推动这一成长轨迹的因素有很多,包括电生理学(EP)手术的激增、优惠的报销政策以及全球心血管疾病发病率的上升。技术进步和医疗基础设施的改善进一步推动了对创新心臟测绘系统的需求。 EP实验室数量的持续增长和心臟消融手术数量的增加直接促进了这些系统的普及。由于EP手术创伤小且疗效持久,医疗保健提供者正在将心臟测绘作为心律管理策略的核心组成部分。

拥有先进医疗保健体系的国家已将心臟测绘纳入标准化报销结构,使医院能够以经济高效的方式整合这些系统。同时,新兴市场由于医疗保健覆盖率的扩大和基础设施投资的增加而展现出良好的前景。因此,这些地区为製造商和供应商提供了尚未开发的机会。随着电生理实验室越来越多地采用测绘解决方案进行精准干预,已开发经济体和发展中经济体的前景仍然强劲。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 25亿美元 |

| 预测值 | 52亿美元 |

| 复合年增长率 | 7.6% |

按类型划分,市场分为接触式心臟标测系统和非接触式心臟标测系统。接触式心臟标测系统领域在2024年占据主导地位,估值超过19亿美元。此领域表现强劲,尤其体现在诊断和管理复杂心律不整(如心房扑动、心房颤动和室性心动过速)。这些系统使用配备电极的专用导管,可直接接触心臟组织,从而即时捕捉高解析度电讯号。这种精细的标测使电生理学家能够准确检测不规则电活动,并以更高的精度指导治疗。

根据适应症,心臟测绘市场涵盖心房颤动、心房扑动及其他相关疾病。心房颤动在2024年占据超过58.1%的市场份额,占据市场主导地位。这种主导地位可能与全球范围内该疾病发病率的上升有关,尤其是在人口老化以及高血压、糖尿病和肥胖等相关併发症日益普遍的情况下。心臟测绘已成为心房颤动诊断和治疗的重要工具,它能够提供更有针对性的治疗方案,从而改善预后。心律不整病例的日益复杂性也凸显了详细测绘对于提高疗效和降低復发率的重要性。

就最终用户而言,市场分为医院、心臟中心和其他护理机构。医院在2024年成为表现最佳的细分市场,预计2034年其市场价值将达到35亿美元。医院的主导地位归功于其拥有训练有素的专业人员、整合的电生理实验室以及先进的诊断和治疗技术。这些机构是治疗复杂心律不整的主要枢纽,提供住院和急诊护理,这使其成为心臟标测系统的理想环境。医院正在广泛部署3D电解剖标测平台和高密度标测导管,以支援先进的消融手术。这种整合支援即时高清成像,从而以更高的精度指导干预。

此外,三级医疗机构微创手术的稳定成长以及发展中国家公立和私立医院基础设施的不断扩展,正在创造新的机会。这些医疗中心的心律不整转诊量也不断增加,并受益于更有利的消融治疗报销框架。

从地区来看,北美市场处于领先地位,其中美国在2024年的收入为9.726亿美元。预计2025年至2034年期间,美国市场的复合年增长率将达到6.5%。美国市场表现强劲,得益于其心律不整的高发病率、密集的医疗机构网络以及电生理检查(EP)程序的高采用率。占据较大市场份额的主要参与者正在积极开发更有效率、更用户友好的映射系统,改善工作流程,并专注于以患者为中心的创新。这些公司也大力投资专业培训,并在成本敏感市场拓展其技术的普及范围,以确保其技术能得到更广泛的应用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 心血管疾病发生率高

- 提高对心血管疾病治疗方案的认识

- 政府对研究和资助的优惠政策

- 产品技术进步

- 产业陷阱与挑战

- 心臟测绘系统成本高昂

- 缺乏熟练且经验丰富的电生理学家

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 报销场景

- 技术格局

- 波特的分析

- 差距分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 公司市占率分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 测绘导管

- 地图系统

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 接触式心臟测绘系统

- 非接触式心臟测绘系统

第七章:市场估计与预测:按适应症,2021 - 2034 年

- 主要趋势

- 心房震颤

- 心房扑动

- 其他适应症

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 心臟中心

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Abbott Laboratories

- Acutus Medical

- APN Health

- BioSig Technologies

- Biotronik

- Boston Scientific

- Catheter Precision

- Coremap

- Epmap-System

- Johnson & Johnson

- Kardium

- Koninklijke Philips

- Lepu Medical

- Medtronic

- MicroPort Scientific

The Global Cardiac Mapping Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 5.2 billion by 2034. Several factors are driving this growth trajectory, including the surge in electrophysiology (EP) procedures, favorable reimbursement policies, and an increasing prevalence of cardiovascular conditions worldwide. Technological advancements and improved healthcare infrastructure are further pushing demand for innovative cardiac mapping systems. A consistent rise in EP labs and the volume of cardiac ablation procedures has directly contributed to the increased adoption of these systems. Because EP procedures are minimally invasive and offer long-term results, healthcare providers are making cardiac mapping a core component of cardiac rhythm management strategies.

Countries with advanced healthcare systems have incorporated cardiac mapping into standardized reimbursement structures, making it cost-effective for hospitals to integrate these systems. At the same time, emerging markets are showing promise due to expanding healthcare access and infrastructure investments. As a result, these regions present untapped opportunities for manufacturers and providers. With EP labs increasingly adopting mapping solutions for precision-based interventions, the outlook remains strong across both developed and developing economies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 7.6% |

By type, the market is split into contact cardiac mapping systems and non-contact cardiac mapping systems. The contact cardiac mapping systems segment captured a dominant position in 2024, with a valuation exceeding USD 1.9 billion. This segment is showing robust performance, particularly because of its role in diagnosing and managing complex arrhythmias like atrial flutter, atrial fibrillation, and ventricular tachycardia. These systems use specialized catheters equipped with electrodes that make direct contact with cardiac tissue, allowing for real-time capture of high-resolution electrical signals. This detailed mapping enables electrophysiologists to accurately detect irregular electrical activity and guide treatment with enhanced precision.

On the basis of indication, the cardiac mapping market includes atrial fibrillation, atrial flutter, and other related conditions. Atrial fibrillation led the market with a commanding share of over 58.1% in 2024. This dominance can be linked to the growing incidence of the condition globally, particularly as aging populations and related comorbidities such as hypertension, diabetes, and obesity become more common. Cardiac mapping has become an essential tool in the diagnosis and treatment of atrial fibrillation, offering a more targeted approach that supports improved outcomes. The increasing complexity of arrhythmia cases has also highlighted the importance of detailed mapping to enhance treatment efficacy and reduce recurrence rates.

In terms of end users, the market is divided into hospitals, cardiac centers, and other care facilities. Hospitals emerged as the top-performing segment in 2024 and are projected to reach a market value of USD 3.5 billion by 2034. Their dominance is attributed to the presence of trained professionals, integrated EP labs, and access to advanced diagnostic and therapeutic technologies. These facilities are the primary hubs for treating complex arrhythmias, offering both inpatient and emergency care, which makes them an ideal environment for cardiac mapping systems. Hospitals are widely deploying 3D electroanatomical mapping platforms and high-density mapping catheters to support advanced ablation procedures. This integration supports real-time, high-definition imaging that guides interventions with improved accuracy.

Additionally, the steady growth of minimally invasive procedures in tertiary care facilities and expanded infrastructure in public and private hospitals across developing nations are creating new opportunities. These healthcare centers are also receiving increased referrals for arrhythmia services and benefiting from more supportive reimbursement frameworks for ablation therapies.

Regionally, North America leads the market, with the United States generating USD 972.6 million in revenue in 2024. The U.S. market is poised to grow at a CAGR of 6.5% from 2025 to 2034. The country's strong performance is due to the high prevalence of cardiac arrhythmias, a dense network of healthcare institutions, and a high rate of adoption of EP procedures. Major players with significant market share are actively developing more efficient and user-friendly mapping systems, improving workflows, and focusing on patient-centered innovation. These companies are also heavily investing in professional training and expanding access to their technologies in cost-sensitive markets to ensure broader adoption.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 High incidence of cardiovascular diseases

- 3.2.1.2 Rising awareness about the treatment options for cardiovascular diseases

- 3.2.1.3 Favourable government policies for research and funding

- 3.2.1.4 Technological advancements in the products

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of the cardiac mapping systems

- 3.2.2.2 Lack of skilled and experienced electrophysiologists

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Reimbursement scenario

- 3.7 Technology landscape

- 3.8 Porter's analysis

- 3.9 GAP analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Company market share analysis

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Mapping catheters

- 5.3 Mapping systems

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Contact cardiac mapping systems

- 6.3 Non-contact cardiac mapping systems

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Atrial fibrillation

- 7.3 Atrial flutter

- 7.4 Other indications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Cardiac centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Acutus Medical

- 10.3 APN Health

- 10.4 BioSig Technologies

- 10.5 Biotronik

- 10.6 Boston Scientific

- 10.7 Catheter Precision

- 10.8 Coremap

- 10.9 Epmap-System

- 10.10 Johnson & Johnson

- 10.11 Kardium

- 10.12 Koninklijke Philips

- 10.13 Lepu Medical

- 10.14 Medtronic

- 10.15 MicroPort Scientific