|

市场调查报告书

商品编码

1740865

肺气肿治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Emphysema Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

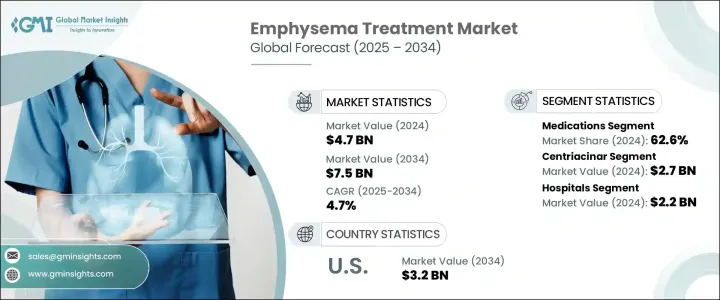

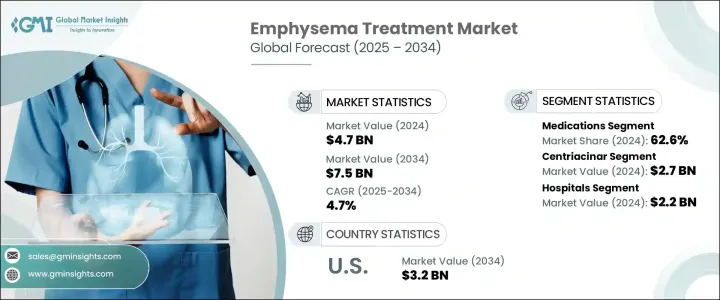

2024年,全球肺气肿治疗市场规模达47亿美元,预计2034年将以4.7%的复合年增长率成长,达到75亿美元。肺气肿是一种慢性呼吸系统疾病,会对肺泡造成永久性损伤,导致呼吸困难,并降低人体维持健康氧含量的能力。儘管该疾病无法逆转,但治疗策略着重于控制症状、最大程度减少病情恶化以及增强肺功能,从而改善生活品质。随着医疗保健提供者重视早期介入、慢性病管理和改善患者预后,该市场正在稳步增长。

肺部健康意识的提升、非侵入性诊断技术的进步以及呼吸治疗的普及也推动了这一增长。诸如针对慢性阻塞性肺病 (COPD) 患者的远距医疗咨询、数位吸入器以及针对特定患者的康復计划等创新正在改变肺气肿的治疗方式。各国政府和私人医疗机构正在进行广泛的筛检项目,鼓励病患儘早医。随着医疗技术的不断发展,越来越多的人能够及时获得诊断,并获得针对自身需求的个人化治疗。随着全球人口老化、城市污染水平不断上升以及长期吸烟等生活方式因素的影响,全球对先进肺气肿治疗方案的需求正在不断增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 47亿美元 |

| 预测值 | 75亿美元 |

| 复合年增长率 | 4.7% |

随着全球医疗体系将慢性呼吸系统疾病的主动管理置于优先地位,肺气肿治疗市场正在蓬勃发展。老化人口尤其容易出现肺部退化,而肺气肿仍然是慢性阻塞性肺病 (COPD) 最常见的诊断形式之一。工业污染物、职业粉尘和城市空气毒素的暴露显着提高了已开发经济体和新兴经济体的发生率。儘管一些国家的吸烟率正在下降,但吸烟仍然是新增肺气肿病例的重要原因。公共卫生运动的加强和肺部筛检的普及有助于在早期发现疾病,从而能够及时干预并制定长期护理计划。

药物疗法继续主导肺气肿治疗领域,2024 年将占 62.6% 的市场。随着全球慢性阻塞性肺病 (CPD) 病例的增加,针对气道发炎、支气管收缩和感染预防的药物干预措施仍然至关重要。持续的药物创新正在改善肺部功能,并改善患者的日常生活。呼吸系统药物研发投资的不断增加必将加速未来市场的扩张。

依疾病类型划分,2024年,肺泡中心型肺气肿市场规模达27亿美元。此亚型主要与慢性吸烟有关,在慢阻肺(COPD)患者中较为常见。民众对吸烟相关疾病的认识不断提高,以及卫生法规的加强,正在推动对以肺部復健和症状管理为重点的肺泡中心型肺气肿特异性治疗方案的需求。

预计到 2034 年,美国肺气肿治疗市场规模将达到 32 亿美元。人口老化、慢性肺病发病率上升、全面的报销框架以及更好的保险渗透率,正在推动全国范围内大力采用药物治疗和非侵入性呼吸护理服务。

全球肺气肿治疗市场的领导者包括雅培实验室、勃林格殷格翰、凯西製药、奥林巴斯、诺华、波士顿科学、美敦力、阿斯特捷利康、葛兰素史克、荷兰皇家飞利浦、泰利福、瑞思迈、百特国际、Pulmonx Corporation 和 Grifols。各公司正大力投资研发,透过策略合作和授权合作,将先进的复合吸入器、长效支气管扩张剂、再生肺疗法和非侵入性治疗设备推向市场。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性阻塞性肺病盛行率不断上升

- 微创治疗的进展

- 老年人口不断增加

- 产业陷阱与挑战

- 先进疗法和治疗费用高昂

- 发展中地区的认知与诊断有限

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依治疗类型,2021 年至 2034 年

- 主要趋势

- 药物

- 支气管扩张剂

- 类固醇

- 其他药物

- 外科手术干预

- 肺减容手术(LVRS)

- 肺大泡切除术

- 肺移植

- 氧气治疗

第六章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 中心泡

- 帕纳希纳尔

- 隔旁

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 专科诊所

- 门诊手术中心

- 居家照护环境

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- AstraZeneca

- Baxter International

- Boehringer Ingelheim

- Boston Scientific Corporation

- Chiesi Farmaceutici

- GlaxoSmithKline

- Grifols

- Koninklijke Philips

- Medtronic

- Novartis

- Olympus Corporation

- Pulmonx Corporation

- ResMed

- Teleflex

The Global Emphysema Treatment Market was valued at USD 4.7 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 7.5 billion by 2034. Emphysema, a chronic respiratory condition, causes permanent damage to the alveoli in the lungs, making breathing increasingly difficult and reducing the body's ability to maintain healthy oxygen levels. Even though the disease cannot be reversed, treatment strategies focus on managing symptoms, minimizing exacerbations, and enhancing lung function to improve quality of life. The market is steadily growing as healthcare providers emphasize early intervention, chronic disease management, and improved patient outcomes.

Rising awareness about pulmonary health, advancements in non-invasive diagnostics, and wider access to respiratory therapies are also fueling growth. Innovations like telemedicine consultations for COPD patients, digital inhalers, and patient-specific rehabilitation programs are changing the way emphysema is managed. Governments and private health organizations are running extensive screening programs, encouraging patients to seek medical advice earlier. As medical technology continues to evolve, more people are receiving timely diagnoses and accessing therapies tailored to their specific needs. With an aging global population, escalating urban pollution levels, and lifestyle factors like prolonged smoking habits, the need for sophisticated emphysema treatment options is expanding worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.7 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 4.7% |

The emphysema treatment market is gaining momentum as global healthcare systems prioritize proactive management of chronic respiratory diseases. Aging demographics are particularly susceptible to lung degeneration, and emphysema remains one of the most commonly diagnosed forms of COPD. Exposure to industrial pollutants, occupational dust, and urban air toxins is significantly raising disease incidence across developed and emerging economies. Although smoking rates are declining in some countries, it still contributes heavily to new emphysema cases. Increased public health campaigns and widespread availability of pulmonary screenings are helping detect the condition at earlier stages, enabling timely intervention and long-term care planning.

Medication-based therapies continue to dominate the emphysema treatment landscape, accounting for 62.6% of the market share in 2024. As chronic obstructive pulmonary disease cases rise globally, pharmaceutical interventions targeting airway inflammation, bronchoconstriction, and infection prevention remain critical. Continuous drug innovations are improving lung performance and enhancing patients' day-to-day living. Expanding investments in respiratory drug development are set to accelerate future market expansion.

By disease type, the centriacinar emphysema segment generated USD 2.7 billion in 2024. This subtype, primarily linked to chronic smoking, is widespread among COPD patients. Growing public awareness of smoking-related diseases and stronger health regulations are fostering demand for centriacinar-specific therapeutic options focused on lung rehabilitation and symptom management.

The United States emphysema treatment market is forecasted to reach USD 3.2 billion by 2034. An aging population, increased rates of chronic lung diseases, comprehensive reimbursement frameworks, and better insurance penetration are driving strong adoption of both pharmaceutical treatments and non-invasive respiratory care services across the country.

Leading players in the global emphysema treatment market include Abbott Laboratories, Boehringer Ingelheim, Chiesi Farmaceutici, Olympus Corporation, Novartis, Boston Scientific Corporation, Medtronic, AstraZeneca, GlaxoSmithKline, Koninklijke Philips, Teleflex, ResMed, Baxter International, Pulmonx Corporation, and Grifols. Companies are heavily investing in R&D to bring advanced combination inhalers, long-acting bronchodilators, regenerative lung therapies, and non-invasive treatment devices to market through strategic collaborations and licensing partnerships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic obstructive pulmonary disease

- 3.2.1.2 Advancements in minimally invasive treatments

- 3.2.1.3 Growing geriatric population

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of advanced therapies and treatments

- 3.2.2.2 Limited awareness and diagnosis in developing regions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Medications

- 5.2.1 Bronchodilators

- 5.2.2 Steroids

- 5.2.3 Other medications

- 5.3 Surgical interventions

- 5.3.1 Lung volume reduction surgery (LVRS)

- 5.3.2 Bullectomy

- 5.3.3 Lung transplantation

- 5.4 Oxygen therapy

Chapter 6 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Centriacinar

- 6.3 Panacinar

- 6.4 Paraseptal

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Ambulatory surgical centers

- 7.5 Home care settings

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 AstraZeneca

- 9.3 Baxter International

- 9.4 Boehringer Ingelheim

- 9.5 Boston Scientific Corporation

- 9.6 Chiesi Farmaceutici

- 9.7 GlaxoSmithKline

- 9.8 Grifols

- 9.9 Koninklijke Philips

- 9.10 Medtronic

- 9.11 Novartis

- 9.12 Olympus Corporation

- 9.13 Pulmonx Corporation

- 9.14 ResMed

- 9.15 Teleflex