|

市场调查报告书

商品编码

1740866

聚乙烯 (PE) 热成型包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Polyethylene (PE) Thermoform Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

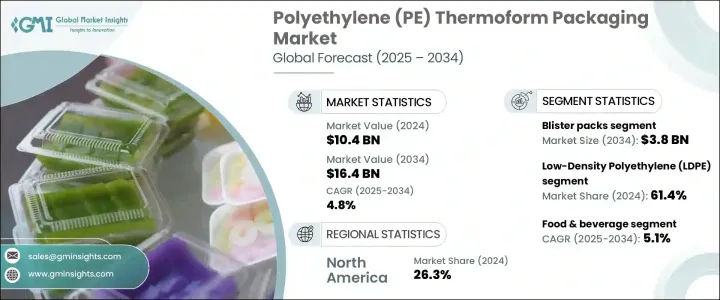

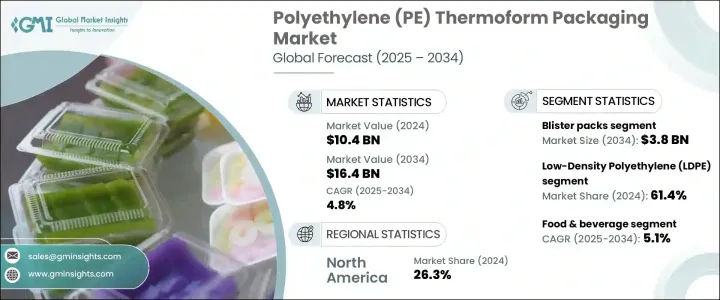

2024年,全球聚乙烯热成型包装市场规模达104亿美元,预计到2034年将以4.8%的复合年增长率成长,达到164亿美元。这得益于电子商务产业的蓬勃发展,也带动了对轻量、耐用和可回收包装解决方案的需求。随着网购成为日常消费行为的核心部分,越来越多的零售商倾向于选择聚乙烯 (PE) 热成型包装,因为它兼具价格实惠、功能设计和永续优势。 PE 与单一材料包装趋势的兼容性也进一步增强了其吸引力,这与全球永续发展目标以及品牌减少塑胶垃圾的承诺相契合。

受对易上架、防篡改和美观包装形式日益增长的需求推动,食品、个人护理、药品和电子产品等行业的市场应用也呈现激增态势。随着热成型技术的进步,製造商现在可以提供不影响透明度、柔韧性或产品保护的包装。随着可回收性和循环经济模式的普及,PE热成型解决方案已成为推动下一代包装转型的领导者。消费者意识的不断提升,加上北美、欧洲和亚洲地区包装法规的日益严格,进一步强化了大众市场对PE等永续材料的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 104亿美元 |

| 预测值 | 164亿美元 |

| 复合年增长率 | 4.8% |

然而,该行业并非没有挑战。持续的贸易争端和前几届美国政府制定的关税结构重塑了包装产业的成本格局。这些贸易政策持续推高进口原料(尤其是聚合物和特殊薄膜)的成本,导致生产成本上升,造成供应链状况难以预测。因此,製造商面临越来越大的压力,要么进行本地化运营,要么实现供应商网路多元化,以减少对高风险市场的依赖。许多公司正在重新评估其采购策略,并投资于材料成分的再设计,使其既符合可回收性标准,也符合性能基准。此外,人们越来越关注将消费后回收材料整合到PE热成型解决方案中,同时又不影响其耐用性、透明度或成型精度。

展望未来,聚乙烯 (PE) 热成型包装市场中的泡罩包装部分预计到 2034 年将达到 38 亿美元。此类包装形式因其卓越的产品可视性、密封性和延长保质期的能力,在製药、化妆品和个人护理行业中日益受到青睐。在医疗保健等受监管的行业中,泡罩包装提供安全、防篡改且易于使用的单位剂量包装,有助于确保剂量准确性并提高产品安全性。其阻隔性能有助于保护敏感产品免受湿气、氧气和光照的影响,使其成为高价值和易腐烂产品的理想选择。

低密度聚乙烯 (LDPE) 继续占据全球市场主导地位,2024 年的市占率为 61.4%。 LDPE 以其柔韧性、透明度和易于热成型的优势脱颖而出,成为托盘、容器、盖子和其他客製化包装类型的最佳选择。其卫生、不黏的表面以及在不牺牲结构完整性的情况下适应不同形状的特性,使其成为食品包装、医疗保健和个人护理领域的首选材料。随着各大品牌转向单一材料设计以确保报废后的可回收性,LDPE 对这些要求的兼容性使其在长期永续发展策略中更有价值。

受消费者不断变化的偏好以及注重永续性和便利性的零售创新的推动,美国聚乙烯 (PE) 热成型包装市场预计在 2034 年达到 35 亿美元。即食食品、便携零食和预包装产品的日益普及,使得可回收热成型包装成为美国零售商和食品服务品牌的重要组成部分。此外,联邦和州政府推广的循环包装模式正在鼓励企业采用基于 PE 的包装形式,以支持材料回收并减少垃圾掩埋。消费者对环保包装日益增长的需求也进一步支持了这些措施。

塑造聚乙烯热成型包装市场未来的主要参与者包括康斯坦莎软包装公司 (Constantia flexibles)、希悦尔 (Sealed Air)、安姆科公司 (Amcor plc)、贝里环球公司 (Berry Global Inc.) 和索诺科产品公司 (Sonoco Products Company)。这些公司正在加倍投入研发,以开发尖端的单一材料包装生产线,以满足不断变化的监管法规和消费者期望。他们的策略包括投资可回收解决方案,与领先的食品、个人护理和製药品牌合作,并在材料和包装形式方面进行创新,以满足特定行业的需求。透过专注于生态设计、供应链优化和产品定制,市场领导者正在为更聪明、更永续的包装未来奠定基础。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 价格波动

- 供应链重组

- 生产成本影响

- 需求面影响

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 对轻量、经济型包装的需求不断增长

- 加强永续性和可回收性倡议

- 电子商务产业蓬勃发展

- PE树脂技术的进步

- 闭环回收计划日益受到关注

- 产业陷阱与挑战

- 高阻隔应用的技术限制

- 消费后废弃物流中的污染

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

- 金属化薄膜

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 泡罩包装

- 蛤壳

- 瓶子

- 托盘和容器

- 盖膜

- 其他的

第六章:市场估计与预测:按聚乙烯 (PE) 类型,2021-2034 年

- 主要趋势

- 低密度聚乙烯(LDPE)

- 高密度聚乙烯(HDPE)

第七章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 食品和饮料

- 製药和医疗保健

- 消费品和零售

- 汽车

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Amcor plc

- Anchor Packaging LLC

- Berry Global Inc.

- Constantia Flexibles

- Greiner Packaging

- Huhtamaki

- Klockner Pentaplast

- Nelipak Healthcare Packaging

- NOVA Chemicals Corporate.

- Pactiv Evergreen Inc.

- Placon

- PlastiPAK INDUSTRIES Inc.

- Schur

- Sealed Air

- Silgan Dispensing Systems

- Sonoco Products Company

- Tekni-Plex, Inc.

- UFlex Limited

The Global Polyethylene Thermoform Packaging Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 16.4 billion by 2034, fueled by the rising momentum of the e-commerce industry, which has led to higher demand for lightweight, durable, and recyclable packaging solutions. As online shopping becomes a core part of everyday consumer behavior, more retailers are leaning toward polyethylene (PE) thermoform packaging for its balance of affordability, functional design, and sustainability benefits. PE's compatibility with mono-material packaging trends adds further traction, aligning with global sustainability goals and brand-led commitments to reduce plastic waste.

The market is also seeing a surge in adoption across sectors like food, personal care, pharmaceuticals, and electronics-driven by the growing need for shelf-ready, tamper-evident, and visually appealing packaging formats. With advancements in thermoforming technologies, manufacturers can now deliver packaging that doesn't compromise on clarity, flexibility, or product protection. As recyclability and circular economy models gain ground, PE thermoform solutions are positioned as a frontrunner in driving next-gen packaging transformations. Rising consumer awareness, coupled with stricter packaging mandates across North America, Europe, and Asia, further reinforces the need for sustainable materials like PE in mass-market applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $16.4 Billion |

| CAGR | 4.8% |

The industry, however, is not without its challenges. Ongoing trade disputes and tariff structures enacted by prior U.S. administrations have reshaped the cost dynamics of the packaging landscape. These trade policies continue to elevate the cost of imported raw materials-especially polymers and specialty films-causing an uptick in production costs and creating unpredictable supply chain conditions. As a result, manufacturers are under growing pressure to either localize operations or diversify supplier networks to reduce reliance on high-risk markets. Many companies are now reevaluating their procurement strategies and investing in the re-engineering of material compositions that meet both recyclability standards and performance benchmarks. There's also a growing interest in integrating post-consumer recycled content into PE thermoform solutions without compromising on durability, clarity, or molding precision.

Looking ahead, the blister packs segment within the polyethylene (PE) thermoform packaging market is projected to reach USD 3.8 billion by 2034. These packaging formats are gaining traction across pharmaceuticals, cosmetics, and personal care industries due to their superior product visibility, airtight sealing, and ability to extend shelf life. In regulated sectors like healthcare, blister packs offer secure, tamper-resistant, and easy-to-use unit-dose packaging, supporting dosage accuracy and improving product safety. Their barrier properties help protect sensitive products from moisture, oxygen, and light-making them ideal for high-value and perishable goods.

The low-density polyethylene (LDPE) segment continues to dominate the global market, accounting for a 61.4% share in 2024. LDPE stands out for its flexibility, clarity, and ease of thermoforming, making it an optimal choice for trays, containers, lids, and other custom-formed packaging types. Its hygienic, non-stick surface and adaptability to different shapes without sacrificing structural integrity have made it a go-to material in food packaging, healthcare, and personal care sectors. As brands pivot toward mono-material designs to ensure end-of-life recyclability, LDPE's compatibility with these requirements makes it even more valuable in long-term sustainability strategies.

The United States Polyethylene (PE) Thermoform Packaging Market is on track to reach USD 3.5 billion by 2034, driven by evolving consumer preferences and retail innovations that prioritize sustainability and convenience. The growing popularity of ready-to-eat meals, on-the-go snacks, and pre-packaged products has made recyclable thermoform packaging an essential component for U.S. retailers and food service brands. Additionally, federal and state-level policies promoting circular packaging models are encouraging businesses to adopt PE-based formats that support material recovery and reduce landfill waste. These initiatives are further supported by growing consumer demand for eco-conscious packaging options.

Major players shaping the future of the polyethylene thermoform packaging market include Constantia Flexibles, Sealed Air, Amcor plc, Berry Global Inc., and Sonoco Products Company. These companies are doubling down on RandD to develop cutting-edge mono-material packaging lines that meet evolving regulatory and consumer expectations. Their strategies include investing in recyclable solutions, partnering with leading food, personal care, and pharma brands, and innovating across materials and formats to serve sector-specific needs. By focusing on eco-design, supply chain optimization, and product customization, market leaders are setting the stage for a smarter, more sustainable packaging future.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (Raw material)

- 3.2.2.1.1 Price volatility

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (Raw material)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for lightweight and cost-effective packaging

- 3.3.1.2 Increasing sustainability and recyclability initiatives

- 3.3.1.3 Growing e-commerce sector

- 3.3.1.4 Advancements in PE resin technology

- 3.3.1.5 Rising focus on closed-loop recycling programs

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Technical limitations for high-barrier applications

- 3.3.2.2 Contamination in post-consumer waste streams

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

- 4.6 Metalized films

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Blister packs

- 5.3 Clamshells

- 5.4 Bottles

- 5.5 Trays & containers

- 5.6 Lidding films

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Polyethylene (PE) Type, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Low-density polyethylene (LDPE)

- 6.3 High-density polyethylene (HDPE)

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Pharmaceuticals & healthcare

- 7.4 Consumer goods & retail

- 7.5 Automotive

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor plc

- 9.2 Anchor Packaging LLC

- 9.3 Berry Global Inc.

- 9.4 Constantia Flexibles

- 9.5 Greiner Packaging

- 9.6 Huhtamaki

- 9.7 Klockner Pentaplast

- 9.8 Nelipak Healthcare Packaging

- 9.9 NOVA Chemicals Corporate.

- 9.10 Pactiv Evergreen Inc.

- 9.11 Placon

- 9.12 PlastiPAK INDUSTRIES Inc.

- 9.13 Schur

- 9.14 Sealed Air

- 9.15 Silgan Dispensing Systems

- 9.16 Sonoco Products Company

- 9.17 Tekni-Plex, Inc.

- 9.18 UFlex Limited