|

市场调查报告书

商品编码

1740876

陆基地球物理服务市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Land Based Geophysical Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

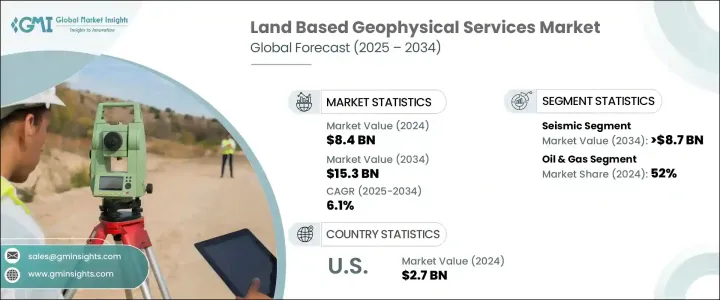

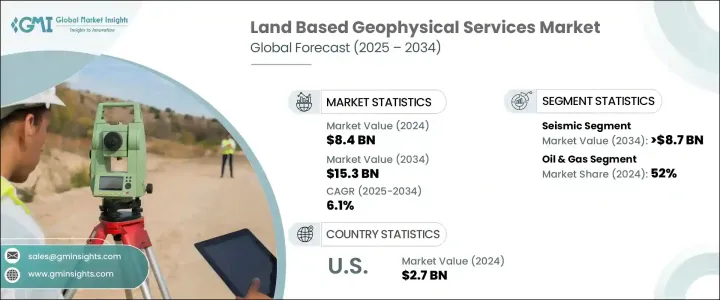

2024 年全球陆基地球物理服务市场价值为 84 亿美元,预计到 2034 年将以 6.1% 的复合年增长率增长,达到 153 亿美元,这得益于快速的城市化、蓬勃发展的建筑活动以及对精确地下资料的需求激增。随着世界各地城市的扩张和现代化,对安全、有弹性的基础设施的需求日益增加。建筑商、开发商和城市规划者越来越依赖先进的地球物理技术来绘製地下公用设施图、评估地面稳定性并在启动大型专案之前降低地震风险。陆基地球实体服务的角色已从支援功能转变为规划、工程和风险管理策略的核心要素。

日益增长的环境问题、日益严格的监管框架以及对灾害韧性基础设施的迫切需求,进一步刺激了市场需求。技术创新也在重塑产业格局,利害关係人寻求即时、非侵入式的勘测方法,以提供更快、更安全、更准确的结果。随着新兴经济体加速城市发展和资源勘探项目,对经济高效且环保的地球实体服务的需求正在加速成长。企业正在大力投资人工智慧整合解决方案、行动勘测单元和遥感平台,以在註重速度、永续性和精准度的不断发展的市场中保持竞争力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 84亿美元 |

| 预测值 | 153亿美元 |

| 复合年增长率 | 6.1% |

世界各国政府正在加大对韧性基础设施和减灾措施的投资,这推动了对先进陆基地球物理服务的持续需求。如今,客户期望更智慧的勘测技术能够在不破坏环境的情况下提供精准的洞察。在新兴地区,传统的陆地勘探方法由于营运成本和环境挑战而越来越难以为继,这为创新地球物理解决方案创造了机会。为此,各参与者纷纷推出基于人工智慧的平台,这些平台不仅能够满足不断升级的安全和永续性标准,还能提供即时资料,帮助企业做出更明智的决策。

环境管理正成为一个关键因素,促使利害关係人在土地復垦、资源开采和环境清理计画中更倾向于采用非侵入式、环保的勘测方法。在发展中地区,由于营运障碍和高昂的勘探成本,地球物理服务成为高效能矿产和能源资源识别的诱人选择。政府贸易政策的改变也影响设备采购和服务模式,促使供应商采用成本效益高、技术驱动的策略。对即时、高精度地下资讯的需求正在推动产业勘探和开发方式的根本性转变。

预计到2034年,地震勘探市场规模将达到87亿美元,这得益于成像解析度的提升以及时移地震技术的日益普及。地震服务仍然是高清地下资料的黄金标准,对油气探勘至关重要。磁法和电磁法勘探正日益受到青睐,尤其是在难以到达的矿区,精确的地质测绘至关重要。

石油和天然气产业在终端应用领域占据主导地位,到2024年将占52%,重力和磁力勘探在降低钻井成本和改善勘探成果方面将继续发挥至关重要的作用。电子和再生能源产业对关键矿物的需求不断增长,也推动了地球物理服务在采矿应用中的广泛应用。

2024年,美国陆基地球实体服务市场规模达27亿美元,这得益于大规模基础设施投资以及促进永续和电气化营运的监管激励措施。地震折射和探地雷达技术广泛应用于地下设施测绘和施工安全。在加拿大,非侵入式、环境敏感勘测方法的推广也日益深入,尤其是在自然资源评估和环境復垦领域。

定义竞争格局的关键参与者包括 CGG、Fugro、SLB、Getech Group、Abitibi Geophysics、Weatherford、TGS、PGS、Gardline、Ramboll Group、Dawson Geophysical Company、SAExploration 和 Spectrum Geophysics。各公司正专注于即时资料分析、人工智慧整合以及向新兴市场扩张,以巩固其地位。与能源和采矿业的策略合作伙伴关係以及对永续勘测方法的投资正成为核心成长策略。行动勘测设备和遥感技术的创新正成为在以精度和速度为驱动力的市场中的主要差异化因素。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 地震

- 磁的

- 电磁

- 梯度法

- 其他的

第六章:市场规模及预测:依最终用途,2021 - 2034

- 主要趋势

- 石油和天然气

- 矿业

- 农业

- 其他的

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 挪威

- 俄罗斯

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 伊拉克

- 伊朗

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- Abitibi Geophysics

- CGG

- Dawson Geophysical Company

- Fugro

- Gardline

- Getech Group

- PGS

- Ramboll Group

- SAExploration

- SLB

- Spectrum Geophysics

- TGS

- Weatherford

The Global Land Based Geophysical Services Market was valued at USD 8.4 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 15.3 billion by 2034, driven by rapid urbanization, booming construction activities, and surging demand for precise subsurface data. As cities worldwide expand and modernize, the need for safe, resilient infrastructure is intensifying. Builders, developers, and urban planners are increasingly relying on advanced geophysical technologies to map underground utilities, assess ground stability, and mitigate seismic risks before launching large-scale projects. The role of land based geophysical services has shifted from a supportive function to a core element of planning, engineering, and risk management strategies.

Rising environmental concerns, tighter regulatory frameworks, and the urgent need for disaster-resilient infrastructure are further boosting market demand. Technological innovation is also reshaping the industry, with stakeholders seeking real-time, non-invasive survey methods that provide faster, safer, and more accurate results. As emerging economies ramp up urban development and resource exploration projects, the appetite for cost-effective and eco-conscious geophysical services is accelerating. Companies are investing heavily in AI-integrated solutions, mobile survey units, and remote sensing platforms to stay competitive in an evolving market that prioritizes speed, sustainability, and precision.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.4 Billion |

| Forecast Value | $15.3 Billion |

| CAGR | 6.1% |

Governments worldwide are stepping up investments in resilient infrastructure and disaster mitigation, helping fuel consistent demand for advanced land based geophysical services. Customers today expect smarter survey technologies that deliver accurate insights without disrupting the environment. In emerging regions, traditional land exploration methods are increasingly unviable due to operational costs and environmental challenges, creating opportunities for innovative geophysical solutions. Players are responding with AI-powered platforms that meet evolving safety and sustainability standards while delivering real-time data for better decision-making.

Environmental stewardship is becoming a crucial factor, pushing stakeholders to prefer non-invasive, eco-friendly surveying methods for land reclamation, resource extraction, and environmental cleanup projects. In developing regions, operational hurdles and high exploration costs make geophysical services an attractive option for efficient mineral and energy resource identification. Shifts in government trade policies are also impacting equipment sourcing and service models, pushing providers to adopt cost-efficient, technology-driven strategies. The need for real-time, high-precision subsurface insights is driving a fundamental shift in how the industry approaches exploration and development.

The seismic segment is expected to reach USD 8.7 billion by 2034, supported by advancements in imaging resolution and the growing use of time-lapse seismic technologies. Seismic services remain the gold standard for high-definition subsurface data, critical to hydrocarbon exploration. Magnetic and electromagnetic surveys are gaining traction, especially in hard-to-reach mining areas where accurate geological mapping is essential.

The oil and gas sector dominated the end-use segment with a 52% share in 2024, where gravity and magnetic surveys continue to play a vital role in reducing drilling costs and improving exploration outcomes. Rising demand for critical minerals needed in electronics and renewable energy industries is also fueling greater adoption of geophysical services in mining applications.

The U.S. Land Based Geophysical Services Market stood at USD 2.7 billion in 2024, powered by major infrastructure investments and regulatory incentives promoting sustainable and electrified operations. Seismic refraction and ground-penetrating radar technologies are widely used for underground utility mapping and construction safety. In Canada, the push for non-invasive, environmentally sensitive survey methods is also gaining ground, particularly for natural resource assessment and environmental reclamation.

Key players defining the competitive landscape include CGG, Fugro, SLB, Getech Group, Abitibi Geophysics, Weatherford, TGS, PGS, Gardline, Ramboll Group, Dawson Geophysical Company, SAExploration, and Spectrum Geophysics. Companies are focusing on real-time data analytics, AI integration, and expanding into emerging markets to strengthen their positions. Strategic partnerships with energy and mining sectors, along with investments in sustainable survey methods, are becoming core growth strategies. Innovation in mobile survey units and remote sensing technologies is emerging as a major differentiator in a market driven by precision and speed.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034, (USD Million)

- 5.1 Key trends

- 5.2 Seismic

- 5.3 Magnetic

- 5.4 Electromagnetic

- 5.5 Gradiometric

- 5.6 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034, (USD Million)

- 6.1 Key trends

- 6.2 Oil & gas

- 6.3 Mining

- 6.4 Agriculture

- 6.5 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034, (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Norway

- 7.3.5 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.5 Middle East & Africa

- 7.5.1 UAE

- 7.5.2 Saudi Arabia

- 7.5.3 Iraq

- 7.5.4 Iran

- 7.5.5 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Abitibi Geophysics

- 8.2 CGG

- 8.3 Dawson Geophysical Company

- 8.4 Fugro

- 8.5 Gardline

- 8.6 Getech Group

- 8.7 PGS

- 8.8 Ramboll Group

- 8.9 SAExploration

- 8.10 SLB

- 8.11 Spectrum Geophysics

- 8.12 TGS

- 8.13 Weatherford