|

市场调查报告书

商品编码

1740881

铝板及铝捲市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Aluminum Sheets and Coils Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

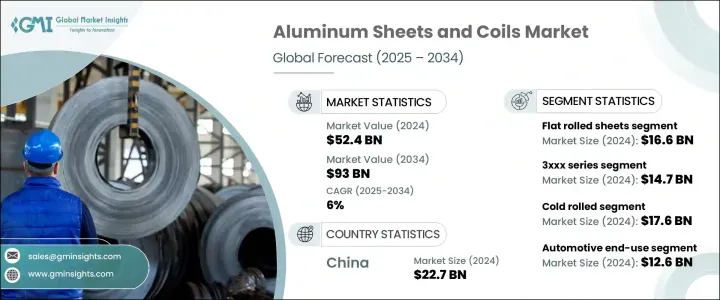

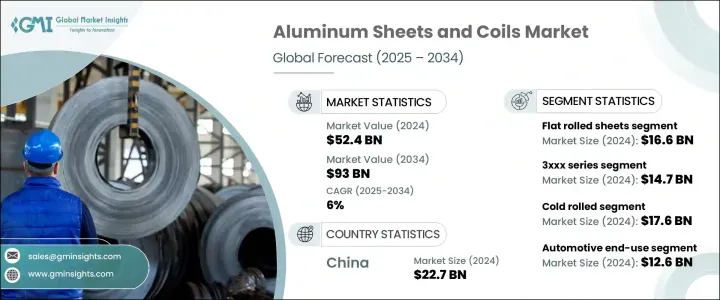

2024 年全球铝板带捲市场规模为 524 亿美元,预计到 2034 年将以 6% 的复合年增长率增长至 930 亿美元。这一增长主要源于工业生产率的持续提高和对可持续材料的日益青睐。铝的轻量化特性使其成为旨在提高能源效率和减少排放的行业的理想选择。随着各行各业拥抱电气化和先进技术,铝因其能够在不影响强度的情况下减轻产品重量而变得越来越不可或缺。向清洁能源和交通运输的加速转变,尤其是对电动车日益增长的需求,也在推动市场扩张。此外,自动化和数位化等不断发展的製造技术正在实现更快、更精确的生产,以满足日益增长的全球需求。这些效率至关重要,因为生产商竞相满足优先考虑轻质、耐用和可回收材料的行业需求。市场也受到激烈竞争和各地区对低排放生产解决方案日益增长的需求的影响,这加强了对符合全球永续发展目标的经济高效、高性能铝解决方案的需求。

2024年,扁平轧製铝板和铝捲的市场规模达166亿美元,预计2025年至2034年的复合年增长率将达到5.7%。其适应性和经济可行性使其成为核心产业的首选,尤其是在註重耐用性、柔韧性和轻量化特性以实现大规模生产的产业。这些材料因其易于处理且与多种製造工艺相容而广受青睐。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 524亿美元 |

| 预测值 | 930亿美元 |

| 复合年增长率 | 6% |

复合板和阳极氧化板在要求耐腐蚀、美观和表面耐用性的应用领域中持续受到青睐。这些铝材在精密度要求高的行业中备受青睐,并推动了涂层技术和合金成分的创新,以提高表面完整性。复合板和阳极氧化板的日益普及也加剧了专业产品类别的竞争。

诸如图案、波纹和穿孔铝板等纹理变体在美学和工业应用中都具有重要意义,体现了功能性设计的趋势,同时也增强了性能和结构。这些类型因其在结构加固和建筑细节方面的多功能性而备受关注。

在合金类型中,3xxx系列在2024年的估值达到147亿美元,预计到2034年将以6.1%的复合年增长率成长。该系列与1xxx系列一样,凭藉其耐腐蚀性、导电性和成本效益占据了主导市场份额。这些牌号在功能性能和价格承受能力至关重要的行业中尤其受欢迎,生产商注重保持高产出效率和稳定的质量,同时保持成本竞争力。

同时,5xxx 和 6xxx 系列在需要高强度、可焊接铝材的领域,尤其是在基础设施和重型应用领域,持续保持稳定的需求。 2xxx、7xxx 和 8xxx 系列等更高等级的铝材则满足了技术先进市场对性能的需求,因为这些市场对耐用性和精度的要求至关重要。

就加工方法而言,冷轧铝市场在2024年的市场价值为176亿美元,预计到2034年将以6.4%的复合年增长率成长。冷轧铝凭藉着卓越的表面光洁度、严格的公差和增强的机械性能,广泛应用于关键应用领域。虽然热轧铝的精度较低,但因其在严苛环境下的强度和可靠性,通常被广泛采用。

2024年,汽车业使用的铝板和铝捲市场规模达126亿美元,占市场份额的24%,预计在预测期内将以6.1%的复合年增长率成长。这些材料是现代汽车设计中不可或缺的一部分,尤其有助于减轻车重并提高燃油效率。随着製造商继续在主流汽车架构中采用更多铝材,它们的应用范围涵盖结构部件和储能係统。

建筑业也对铝的需求贡献巨大,利用铝的韧性、轻盈和美观特性,满足结构、屋顶和隔热需求。在包装和电子产品领域,铝因其安全性、可回收性和抗污染性仍然是可靠的选择。全球对回收的重视进一步提升了铝在消费包装应用的价值。

从区域来看,中国以2024年227亿美元的估值引领市场,预计2034年将以5.9%的复合年增长率成长。凭藉强劲的国内需求和全球最广泛的铝产能,中国仍是主导力量。同时,在支持基础建设和能源转型的政策转变的推动下,美国的消费模式持续保持稳定。然而,两国都在应对复杂的全球贸易动态,这些动态正在塑造采购策略并鼓励本地化供应链。

主要市场参与者包括美国铝业公司、中国宏桥集团、俄罗斯铝业公司、力拓集团和挪威海德鲁公司。这些公司正透过低排放技术和对永续铝生产的策略性投资来提升生产能力。行业领导者正专注于数位创新、高级合金和扩大回收业务,以在快速发展的市场中保持竞争力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 主要出口国

- 主要进口国

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 汽车产业对轻量化材料的需求不断增长

- 政府推动永续基础建设的倡议

- 航太和国防领域的成长

- 消费性电子产品需求不断扩大

- 产业陷阱与挑战

- 原物料价格波动

- 铝生产对环境的影响

- 成长动力

- 成长潜力分析

- 波特的分析

- Pestel 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 平轧钢板

- 卷材

- 复合板材

- 阳极处理板

- 图案床单

- 瓦楞板

- 穿孔板

第六章:市场估计与预测:依等级/合金类型,2021-2034

- 主要趋势

- 1xxx系列

- 2xxx系列

- 3xxx系列

- 5xxx系列

- 6xxx系列

- 7xxx系列

- 8xxx系列

第七章:市场估计与预测:依加工方法,2021-2034 年

- 主要趋势

- 冷轧

- 热轧

- 连续铸造

- 直接冷铸(DC)

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 汽车

- 建筑与施工

- 航太

- 电气和电子产品

- 食品和饮料

- 机械设备

- 耐久性消费品

- 其他的

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Alcoa Corporation

- Novelis Inc.

- Arconic Corporation

- Kaiser Aluminum

- Hindalco Industries

- Constellium SE

- UACJ Corporation

- Norsk Hydro ASA

- JW Aluminum

- Aleris Corporation

- Hindalco Industries Ltd.

- BALCO (Bharat Aluminium)

- China Hongqiao Group

The Global Aluminum Sheets And Coils Market was valued at USD 52.4 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 93 billion by 2034. This growth stems largely from the ongoing rise in industrial productivity and the increasing preference for sustainable materials. Aluminum's lightweight properties make it ideal for sectors aiming to improve energy efficiency and reduce emissions. As industries embrace electrification and advanced technologies, aluminum is becoming more integral due to its ability to contribute to lower product weight without compromising strength. The accelerating shift toward cleaner energy and transportation, especially the rising demand for electric mobility, is also fueling market expansion. Alongside this, evolving manufacturing techniques, such as automation and digitalization, are enabling faster, more precise production to match growing global demand. These efficiencies are critical as producers race to meet the needs of industries prioritizing lightweight, durable, and recyclable materials. The market is also shaped by fierce competition and the increasing push for low-emission production solutions across regions, reinforcing the need for cost-effective, high-performance aluminum solutions that align with global sustainability goals.

Flat rolled aluminum sheets and coils commanded a market size of USD 16.6 billion in 2024 and are expected to grow at a CAGR of 5.7% from 2025 to 2034. Their adaptability and economic feasibility make them a top choice across core industries, especially where durability, flexibility, and lightweight characteristics are valued for mass production. These materials are commonly favored due to their ease of handling and compatibility with multiple manufacturing processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $52.4 Billion |

| Forecast Value | $93 Billion |

| CAGR | 6% |

Clad and anodized sheets continue to attract interest for applications requiring corrosion resistance, visual appeal, and surface durability. These aluminum variants are preferred in precision-demanding sectors and are prompting innovation in coating technologies and alloy compositions to improve surface integrity. Their increased adoption is intensifying competition in specialized product categories.

Textured variants like patterned, corrugated, and perforated aluminum sheets find relevance in aesthetic and industrial applications, reflecting a trend towards functional design that also enhances performance and structure. These types are gaining attention for their versatility in structural reinforcement and architectural detailing.

Among alloy types, the 3xxx series reached a valuation of USD 14.7 billion in 2024 and is forecasted to grow at a CAGR of 6.1% through 2034. This series, along with the 1xxx group, dominates market share due to its corrosion resistance, electrical conductivity, and cost-effectiveness. These grades are especially popular in sectors where functional performance and affordability are key factors, and producers are focused on maintaining high output efficiency and consistent quality while keeping costs competitive.

Meanwhile, the 5xxx and 6xxx series continue to find steady demand in sectors requiring high-strength, weldable aluminum, notably in infrastructure and heavy-duty applications. Higher-grade aluminum from the 2xxx, 7xxx, and 8xxx series fulfills the need for performance in technologically advanced markets, where durability and precision are crucial.

In terms of processing methods, the cold rolled aluminum segment held a market value of USD 17.6 billion in 2024 and is anticipated to grow at a CAGR of 6.4% through 2034. This category benefits from superior surface finish, tight tolerances, and enhanced mechanical properties, contributing to its extensive use across critical applications. While hot rolled variants are less precise, they are often chosen for their strength and reliability in demanding environments.

Aluminum sheets and coils used in the automotive sector accounted for USD 12.6 billion in 2024, representing a 24% market share and are poised to grow at 6.1% CAGR through the forecast period. These materials are integral in modern vehicle design, particularly for reducing vehicle weight and achieving better fuel efficiency. Their application spans structural components and energy storage systems, as manufacturers continue to incorporate more aluminum into mainstream vehicle architecture.

The building and construction industry also contributes significantly to demand, leveraging aluminum's resilience, light weight, and aesthetic properties for structural, roofing, and insulation needs. In packaging and electronics, aluminum remains a reliable choice due to its safety, recyclability, and resistance to contamination. The global emphasis on recycling further enhances its value in consumer packaging applications.

In regional terms, China led the market with a valuation of USD 22.7 billion in 2024, and it is expected to expand at a CAGR of 5.9% through 2034. With high domestic demand and the world's most extensive aluminum production capacity, China remains a dominant force. Meanwhile, the United States continues to register stable consumption patterns, bolstered by policy shifts supporting infrastructure development and energy transformation. However, both nations navigate complex global trade dynamics, which are shaping sourcing strategies and encouraging localized supply chains.

Major market participants include Alcoa Corporation, China Hongqiao Group, Rusal, Rio Tinto, and Norsk Hydro ASA. These companies are advancing production capabilities through low-emission technologies and strategic investments in sustainable aluminum manufacturing. Industry leaders are focusing on digital innovation, high-grade alloys, and expanding recycling operations to remain competitive in a rapidly evolving market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for lightweight materials in automotive industry

- 3.7.1.2 Government initiatives for sustainable infrastructure

- 3.7.1.3 Growth in aerospace and defense sector

- 3.7.1.4 Expanding demand in consumer electronics

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Fluctuating raw material prices

- 3.7.2.2 Environmental impact of aluminum production

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Flat rolled sheets

- 5.3 Coiled sheets

- 5.4 Clad sheets

- 5.5 Anodized sheets

- 5.6 Patterned sheets

- 5.7 Corrugated sheets

- 5.8 Perforated sheets

Chapter 6 Market Estimates & Forecast, By Grade/Alloy Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 1xxx series

- 6.3 2xxx series

- 6.4 3xxx series

- 6.5 5xxx series

- 6.6 6xxx series

- 6.7 7xxx series

- 6.8 8xxx series

Chapter 7 Market Estimates & Forecast, By Processing Method, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Cold rolled

- 7.3 Hot rolled

- 7.4 Continuous casting

- 7.5 Direct chill (DC) casting

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Building & construction

- 8.4 Aerospace

- 8.5 Electrical & electronics

- 8.6 Food & beverage

- 8.7 Machinery & equipment

- 8.8 Consumer durables

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alcoa Corporation

- 10.2 Novelis Inc.

- 10.3 Arconic Corporation

- 10.4 Kaiser Aluminum

- 10.5 Hindalco Industries

- 10.6 Constellium SE

- 10.7 UACJ Corporation

- 10.8 Norsk Hydro ASA

- 10.9 JW Aluminum

- 10.10 Aleris Corporation

- 10.11 Hindalco Industries Ltd.

- 10.12 BALCO (Bharat Aluminium)

- 10.13 China Hongqiao Group