|

市场调查报告书

商品编码

1740885

电气线路互连繫统 (EWIS) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electrical Wiring Interconnection System (EWIS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

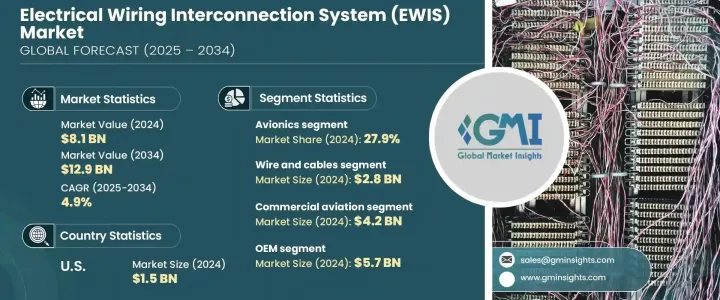

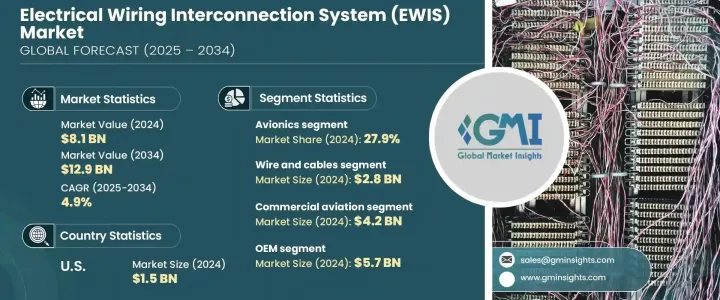

2024 年全球电气线路互连繫统市场价值为 81 亿美元,预计到 2034 年将以 4.9% 的复合年增长率增长,达到 129 亿美元,这主要得益于向全电动和多电动飞机的快速转型,这一转型在推动这一增长方面发挥了核心作用。航空业对整合电力系统的需求不断增长,加上机上娱乐和即时连接系统的使用日益增多,正在重塑线路基础设施。城市空中交通 (UAM) 平台和电动垂直起降 (eVTOL) 飞机的出现正在加速整个 EWIS 领域的创新。这些飞机需要能够处理复杂电气和资料传输任务的轻型高性能线路。人们对永续航空和增强电气化的兴趣日益浓厚,越来越依赖能够与不断发展的飞行技术无缝整合的先进线路系统。

然而,由于铝、铜和钢的关税导致材料成本上升,该行业面临压力。这些金属对于生产EWIS组件(包括连接器、电缆和外壳)至关重要。因此,製造商和最终用户的生产成本正在上升。此外,对从中国进口的电子产品和半导体征收的关税正在阻碍供应链,并影响下一代EWIS组件的开发,尤其是用于数位系统和自动化飞机平台的组件。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 81亿美元 |

| 预测值 | 129亿美元 |

| 复合年增长率 | 4.9% |

电线电缆产业在2024年创造了28亿美元的收入,这主要得益于对耐热性、讯号保真度和轻量化设计的先进材料的需求。随着现代飞机越来越多地采用数位和电气技术,对高性能布线系统(包括光纤和配电解决方案)的需求也日益增长。绝缘和屏蔽技术的创新使飞机的运作更加安全高效,同时有助于减轻飞机的整体重量。

在应用方面,航空电子设备领域在2024年占了27.9%的份额。随着驾驶舱控制、通讯系统和飞行资料处理的数位转型,对可靠紧凑的EWIS的需求正在显着增长。精确的航线规划、电磁干扰屏蔽以及与数位仪錶板的整合如今已成为标配,尤其是在军用和商用机队中。这些系统确保了先进飞机子系统内持续的电力传输和资料连接。

由于美国航太和国防领域的蓬勃发展,美国电气线路互连系统 (EWIS) 市场在 2024 年实现了 15 亿美元的产值。美国对电动飞机的重视、城市空中交通项目的推进以及国防预算的不断增长,为先进的 EWIS 部署提供了支持。自动化和模组化布线系统的投资,以及强大的OEM)和供应商网络,持续推动美国市场对 EWIS 的需求。

泰科电子 (TE Connectivity)、柯林斯航太)、霍尼韦尔国际公司 (Honeywell International Inc.)、安费诺公司 (Amphenol Corporation) 和赛峰集团 (Safran) 等领先企业正在采取扩张研发设施、投资轻量化材料创新以及增强模组化设计能力等策略。许多公司正在与飞机製造商和国防机构建立战略合作伙伴关係,共同开发下一代解决方案。这些公司专注于数位整合、智慧诊断和可扩展布线系统,以支援快速飞机组装和长期运行可靠性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 商用和国防领域飞机交付量激增

- 轻型和省油飞机的需求成长

- 向多电动和全电动飞机转变的趋势日益明显(MEA/AESA)

- 机上娱乐 (IFE) 和连接系统日益普及

- 城市空中交通 (UAM) 和 eVTOL 飞机的出现

- 产业陷阱与挑战

- 开发和製造成本高

- 严格的监管合规和认证延迟

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 电线电缆(每英尺)

- 连接器

- 电气接地和连接装置

- 电气接头

- 夹具

- 压力密封

- 其他的

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 航空电子设备

- 驾驶舱控制装置

- 飞行控制系统(FCS)

- 飞行管理系统(FMS)

- 其他的

- 内饰

- 机上娱乐 (IFE)

- 厨房

- 座椅电源

- 客舱管理

- 推进系统

- 引擎

- 辅助动力装置(APU)

- 其他

- 机体

- 翅膀

- 尾巴

- 其他的

第七章:市场估计与预测:依航空类型,2021 - 2034 年

- 主要趋势

- 商业航空

- 窄体飞机(NBA)

- 宽体飞机(WBA)

- 超大型飞机(VLA)

- 区域运输飞机(RTA)

- 军事航空

- 战斗机

- 运输飞机

- 军用直升机

- 商务及通用航空

- 公务机

- 直升机

- 活塞式飞机

- 涡轮螺旋桨飞机

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Amphenol Corporation

- Boeing

- Collins Aerospace (Raytheon Technologies)

- Co-Operative Industries Aerospace & Defense (kSARIA)

- Ducommun

- EIS Electronics GmbH

- Elektro Metall Export

- Honeywell International Inc.

- InterConnect Wiring

- JST Sales America

- kSARIA Corporation

- Leonardo

- Molex

- PEI-Genesis

- Pic Wire & Cable (Angelus Corporation)

- Safran

- TE Connectivity

- WL Gore & Associates

The Global Electrical Wiring Interconnection System Market was valued at USD 8.1 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 12.9 billion by 2034, driven by the rapid transition toward all-electric and more-electric aircraft playing a central role in driving this growth. Increased demand for integrated electric systems in aviation, combined with the rising use of in-flight entertainment and real-time connectivity systems, is reshaping wiring infrastructure. The emergence of Urban Air Mobility (UAM) platforms and electric vertical takeoff and landing (eVTOL) aircraft are accelerating innovation across the EWIS landscape. These aircraft require lightweight, high-performance wiring capable of handling complex electrical and data transmission tasks. Rising interest in sustainable aviation and enhanced electrification is increasing dependency on advanced wiring systems that integrate seamlessly with evolving flight technologies.

However, the industry faces pressure due to elevated material costs from tariffs on aluminum, copper, and steel. These metals are critical to producing EWIS components, including connectors, cables, and enclosures. As a result, manufacturers and end-users are experiencing increased production costs. In addition, tariffs on electronic and semiconductor imports from China are hampering supply chains and affecting the development of next-gen EWIS components, particularly those used in digital systems and automated aircraft platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.1 Billion |

| Forecast Value | $12.9 Billion |

| CAGR | 4.9% |

The wire and cables segment generated USD 2.8 billion in 2024, largely due to demand for advanced materials that offer thermal resistance, signal fidelity, and lightweight designs. As modern aircraft increasingly incorporate digital and electric technologies, there's a heightened requirement for high-performance wiring systems, including fiber optics and power distribution solutions. Innovations in insulation and shielding technologies enable safer and more efficient operations while helping reduce overall aircraft weight.

In terms of application, the avionics segment held a 27.9% share in 2024. With the digital transformation of cockpit controls, communication systems, and flight data processing, the demand for reliable and compact EWIS is growing significantly. Precision routing, electromagnetic interference shielding, and integration with digital dashboards are now standard, especially in military and commercial fleets. These systems ensure consistent power flow and data connectivity within advanced aircraft subsystems.

U.S. Electrical Wiring Interconnection System (EWIS) Market generated USD 1.5 billion in 2024 due to its expanding aerospace and defense sectors. The country's focus on more electric aircraft, increasing urban air mobility projects, and rising defense budgets support advanced EWIS deployment. Investments in automation and modular wiring systems, along with strong OEM and supplier networks, continue to fuel national demand.

Leading players such as TE Connectivity, Collins Aerospace, Honeywell International Inc., Amphenol Corporation, and Safran are adopting strategies like expanding RandD facilities, investing in lightweight material innovation, and enhancing modular design capabilities. Many are forming strategic partnerships with aircraft manufacturers and defense agencies to co-develop next-gen solutions. Companies focus on digital integration, smart diagnostics, and scalable wiring systems that support rapid aircraft assembly and long-term operational reliability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in aircraft deliveries across commercial and defense segments

- 3.7.1.2 Growth in demand for lightweight and fuel-efficient aircraft

- 3.7.1.3 Rise in shift toward more-electric and all-electric aircraft (MEA/AESA)

- 3.7.1.4 Increasing proliferation of in-flight entertainment (IFE) and connectivity systems

- 3.7.1.5 Emergence of Urban Air Mobility (UAM) and eVTOL Aircraft

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High development and manufacturing costs

- 3.7.2.2 Stringent regulatory compliance and certification delays

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Million, Foot & Units)

- 5.1 Key trends

- 5.2 Wire and cables (per foot)

- 5.3 Connectors

- 5.4 Electrical grounding and bonding devices

- 5.5 Electrical splices

- 5.6 Clamps

- 5.7 Pressure seals

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Avionics

- 6.2.1 Cockpit controls

- 6.2.2 Flight control systems (FCS)

- 6.2.3 Flight management systems (FMS)

- 6.2.4 Others

- 6.3 Interiors

- 6.3.1 Inflight entertainment (IFE)

- 6.3.2 Galleys

- 6.3.3 In-seat power

- 6.3.4 Cabin management

- 6.4 Propulsion system

- 6.4.1 Engine

- 6.4.2 Auxiallry power unit (APU)

- 6.4.3 Other

- 6.5 Airframe

- 6.5.1 Wings

- 6.5.2 Tail

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Aviation Type, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Commercial aviation

- 7.2.1 Narrow body aircraft (NBA)

- 7.2.2 Wide body aircraft (WBA)

- 7.2.3 Very large aircraft (VLA)

- 7.2.4 Regional transport aircraft (RTA)

- 7.3 Military aviation

- 7.3.1 Fighter jets

- 7.3.2 Transport aircraft

- 7.3.3 Military helicopters

- 7.4 Business and general aviation

- 7.4.1 Business jets

- 7.4.2 Helicopters

- 7.4.3 Piston aircraft

- 7.4.4 Turboprop aircraft

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amphenol Corporation

- 10.2 Boeing

- 10.3 Collins Aerospace (Raytheon Technologies)

- 10.4 Co-Operative Industries Aerospace & Defense (kSARIA)

- 10.5 Ducommun

- 10.6 E.I.S. Electronics GmbH

- 10.7 Elektro Metall Export

- 10.8 Honeywell International Inc.

- 10.9 InterConnect Wiring

- 10.10 JST Sales America

- 10.11 kSARIA Corporation

- 10.12 Leonardo

- 10.13 Molex

- 10.14 PEI-Genesis

- 10.15 Pic Wire & Cable (Angelus Corporation)

- 10.16 Safran

- 10.17 TE Connectivity

- 10.18 W. L. Gore & Associates