|

市场调查报告书

商品编码

1740886

汽车充气式避震器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Gas Charged Shock Absorber Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

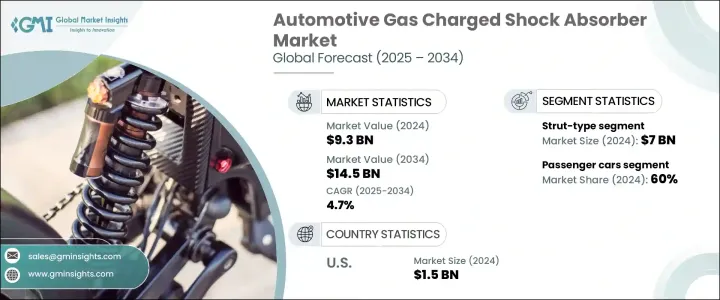

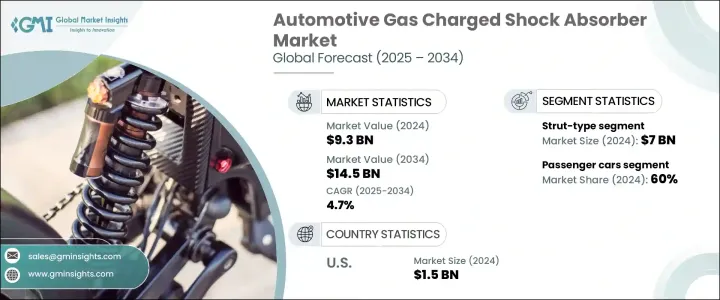

2024年,全球汽车充气避震器市场规模达93亿美元,预计2034年将以4.7%的复合年增长率成长,达到145亿美元。这得益于消费者对更高乘坐舒适度、更卓越的车辆操控性以及更安全的多地形驾驶体验的期望不断提升。随着汽车製造商持续转向先进的悬吊系统,对充气减震器等高性能零件的需求日益增长。这些减震器在减少振动、增强车辆稳定性和提供更平稳的驾驶体验方面发挥关键作用,尤其是在高速和越野条件下。

随着汽车技术的不断发展,消费者如今期望他们的车辆兼具舒适性和性能,这使得先进的减震系统成为汽车工程的重中之重。高端汽车市场的全球扩张、日益严重的城市交通拥堵以及长途驾驶习惯的兴起,共同推动了对更高效减震管理系统的需求。充气式减震器相较于传统液压减震器具有至关重要的优势,它能够有效防止空气进入和起泡,确保车辆在持续或激烈驾驶下始终保持性能稳定。随着汽车产业日益向电气化和智慧车辆系统靠拢,这些避震器正被客製化以支援动态负载,同时不影响能源效率或电池续航里程。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 93亿美元 |

| 预测值 | 145亿美元 |

| 复合年增长率 | 4.7% |

随着注重性能的汽车平台(尤其是SUV和跨界车)的快速普及,充气式减震器正成为乘用车和商用车的标准部件。它们能够提供卓越的阻尼效率,并在各种负载和条件下保持最佳平衡,使其成为当今悬吊系统中不可或缺的一部分。这些避震器的设计旨在满足消费者日益增长的需求,即提升操控性、减少车身侧倾、改善俯仰控制以及提升整体驾驶体验。汽车製造商正在将充气式减震器整合到新车型中,以创造差异化的性能特征,并满足消费者对卓越驾乘体验的需求。这种日益增长的偏好在城市和乡村地区尤其明显,因为这些地区的路况和驾驶预期差异很大,这进一步证明了充气式减震系统的多功能性。

受个人汽车保有量成长、可支配收入增加以及中产阶级人口不断壮大的推动,乘用车市场将在2024年占据60%的主导份额。消费者更重视舒适性、稳定性和操控性,尤其是在日常通勤和长途旅行中。在汽车销售蓬勃发展的新兴经济体中,随着消费者寻求能够提供无缝驾驶体验的车辆,对高端悬吊零件的关注度也日益提升。充气式避震器凭藉更佳的阻尼特性满足了这项需求,使其成为追求舒适性、操控性和安全性的现代汽车平台的首选。

按安装类型划分,支柱式充气避震器市场领先,2024 年估值达 70 亿美元。此类部件因其集成结构(将螺旋弹簧和减震器集成为一个紧凑单元)而被广泛采用。这种结构有助于提高前悬吊布局的空间效率,并有助于减轻车辆总重,从而提高燃油效率并降低排放。此外,该设计还易于安装和维护,使支柱式减震器成为大规模汽车製造的经济高效的解决方案。

2024年,北美汽车充气避震器市场规模达15亿美元,预计2025年至2034年期间的复合年增长率将达到4.9%。这一增长得益于该地区强劲的汽车产量、大型原始设备製造商的布局,以及消费者对皮卡和跨界车等大型车辆日益增长的需求,这些车辆需要高耐用性的悬吊系统。该地区的电气化进程也推动了对先进减震器的需求,这些减震器不仅符合现代动力传动系统的要求,还能减轻车辆重量并提高能源效率。

日立Astemo、HL Mando、Gabriel India、KYB、昭和、采埃孚、Chassis Brakes、Endurance Technologies、Cofap和天纳克等领先公司正透过创新和策略合作积极巩固其市场地位。这些公司正在大力投资研发,以提高减震器性能,扩大其全球生产布局,并与原始设备製造商建立重要的合作关係。许多公司还透过开发基于道路反馈和驾驶行为提供即时自适应能力的电子控制减震系统来丰富其产品线,以适应智慧和自动驾驶汽车的未来发展。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 配销通路分析

- 最终用途

- 利润率分析

- 供应商格局

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 对贸易的影响

- 技术与创新格局

- 专利分析

- 监管格局

- 成本細項分析

- 价格趋势

- 地区

- 车辆

- 重要新闻和倡议

- 衝击力

- 成长动力

- 对乘坐舒适性和操控稳定性的需求日益增长

- 电动和混合动力车的普及率不断上升

- 悬吊系统的技术进步

- 全球汽车生产的扩张

- 产业陷阱与挑战

- 与液压减震器相比成本更高

- 严格的环境和安全法规

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 双管气体

- 单管气体

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第七章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 支撑式

- 伸缩式

第八章:市场估计与预测:按销售管道 2021 - 2034

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- AL-KO Fahrzeugtechnik

- Bilstein

- Chassis Brakes

- Cofap

- Endurance

- Gabriel

- Hitachi Astemo

- ITW

- Jiangsu Huachuan

- KYB

- Liuzhou Shuangfei

- Magneti Marelli

- Mando

- Ride Control

- S&T Motiv

- Showa

- Tenneco

- Tokico

- YSS Suspension

- ZF Friedrichshafen

The Global Automotive Gas Charged Shock Absorber Market was valued at USD 9.3 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 14.5 billion by 2034, supported by rising consumer expectations for enhanced ride comfort, superior vehicle handling, and safer driving experiences across diverse terrains. As automakers continue to shift toward advanced suspension systems, the demand for high-performance components like gas-charged shock absorbers is gaining significant traction. These absorbers play a key role in reducing vibrations, enhancing vehicle stability, and delivering smoother rides, especially in high-speed and off-road conditions.

With evolving automotive technologies, consumers now expect their vehicles to offer both comfort and performance, which has placed advanced damping systems at the forefront of vehicle engineering. The global expansion of premium vehicle segments, growing urban traffic congestion, and a surge in long-distance driving habits are collectively fueling the need for better shock management systems. Gas-charged shock absorbers provide a crucial advantage over traditional hydraulic shocks by offering resistance to aeration and foaming, which ensures consistent performance under continuous or aggressive driving. As the automotive sector leans more into electrification and smart vehicle systems, these absorbers are being tailored to support dynamic loads without compromising energy efficiency or battery range.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.3 Billion |

| Forecast Value | $14.5 Billion |

| CAGR | 4.7% |

With the rapid adoption of performance-focused vehicle platforms, particularly SUVs and crossovers, gas-charged shock absorbers are becoming a standard component in both passenger and commercial vehicle categories. Their ability to deliver advanced damping efficiency and maintain optimal balance under varying loads and conditions makes them indispensable in today's suspension systems. These shock absorbers are engineered to meet the growing consumer need for better handling, reduced body roll, improved pitch control, and overall smoother rides. Automakers are integrating gas-charged absorbers into newer models to differentiate performance features and meet the demand for premium ride quality. This growing preference is evident in both urban and rural settings, where road conditions and driving expectations vary significantly, further validating the versatility of gas-charged systems.

The passenger vehicle segment commanded a dominant 60% share in 2024, driven by the increasing rate of personal car ownership, rising disposable incomes, and an expanding middle-class demographic. Consumers are prioritizing vehicles that offer improved comfort, stability, and handling-particularly for daily commutes and longer journeys. In emerging economies, where car sales are booming, the focus on premium suspension components is intensifying as buyers look for vehicles that deliver a seamless driving experience. Gas-charged shock absorbers meet this demand by providing better damping characteristics, making them a preferred choice in modern vehicle platforms aimed at comfort, control, and safety.

Based on mounting type, strut-type gas charged shock absorbers led the market with a valuation of USD 7 billion in 2024. These components are widely adopted due to their integrated construction, which combines the coil spring and shock absorber into one compact unit. This configuration supports space efficiency in front suspension layouts and helps reduce the vehicle's overall weight, contributing to fuel efficiency and lower emissions. The design also offers ease of installation and simplified maintenance, making strut-type shock absorbers a cost-effective solution for large-scale automotive manufacturing.

The North America Automotive Gas Charged Shock Absorber Market accounted for USD 1.5 billion in 2024 and is projected to grow at a CAGR of 4.9% from 2025 to 2034. This growth is backed by strong regional vehicle production, the presence of major OEMs, and a rising preference for larger vehicles like pickups and crossovers that demand high-durability suspension systems. The region's push toward electrification is also boosting demand for advanced shock absorbers that align with modern drivetrain requirements while supporting weight reduction and energy efficiency.

Leading companies such as Hitachi Astemo, HL Mando, Gabriel India, KYB, Showa, ZF Friedrichshafen, Chassis Brakes, Endurance Technologies, Cofap, and Tenneco are actively strengthening their market positions through innovation and strategic collaborations. These players are investing heavily in R&D to enhance shock absorber performance, expand their manufacturing footprint globally, and form key partnerships with OEMs. Many are also diversifying their offerings by developing electronically controlled damping systems that provide real-time adaptability based on road feedback and driving behavior, aligning with the future of smart and autonomous vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Price trend

- 3.7.1 Region

- 3.7.2 Vehicle

- 3.8 Key news & initiatives

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing demand for ride comfort & handling stability

- 3.9.1.2 Rising adoption of electric and hybrid vehicles

- 3.9.1.3 Technological advancements in suspension systems

- 3.9.1.4 Expansion of global automotive production

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Higher cost compared to hydraulic shock absorbers

- 3.9.2.2 Stringent environmental & safety regulations

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Twin-tube gas

- 5.3 Monotube gas

Chapter 6 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Mount, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Strut-type

- 7.3 Telescopic

Chapter 8 Market Estimates & Forecast, By Sales Channel 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AL-KO Fahrzeugtechnik

- 10.2 Bilstein

- 10.3 Chassis Brakes

- 10.4 Cofap

- 10.5 Endurance

- 10.6 Gabriel

- 10.7 Hitachi Astemo

- 10.8 ITW

- 10.9 Jiangsu Huachuan

- 10.10 KYB

- 10.11 Liuzhou Shuangfei

- 10.12 Magneti Marelli

- 10.13 Mando

- 10.14 Ride Control

- 10.15 S&T Motiv

- 10.16 Showa

- 10.17 Tenneco

- 10.18 Tokico

- 10.19 YSS Suspension

- 10.20 ZF Friedrichshafen