|

市场调查报告书

商品编码

1740889

低密度聚乙烯包装(LDPE)市场机会、成长动力、产业趋势分析及2025-2034年预测Low-density Polyethylene Packaging (LDPE) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

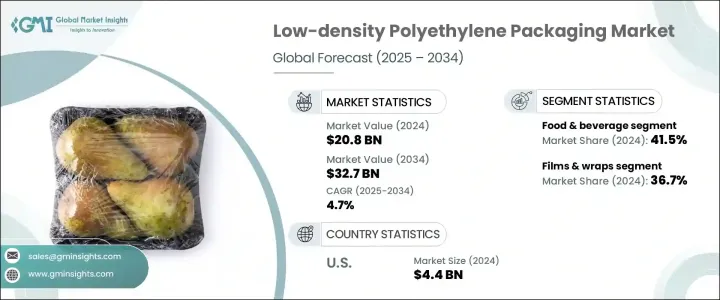

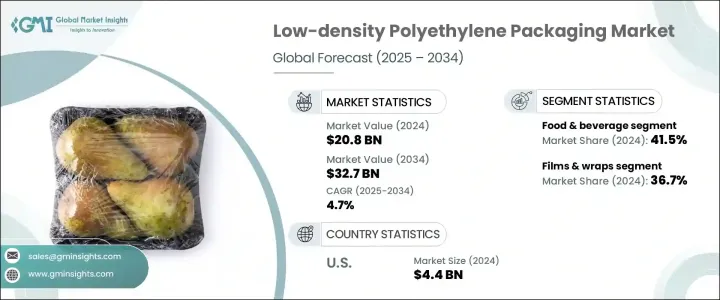

2024年,全球低密度聚乙烯包装市场规模达208亿美元,预计到2034年将以4.7%的复合年增长率成长,达到327亿美元,这主要得益于食品、製药和个人护理行业强劲的需求。这一增长反映了低密度聚乙烯包装在消费品和工业领域的应用日益广泛。随着全球包装产业的快速发展,低密度聚乙烯凭藉其柔韧性、耐用性、低生产成本和高防潮性,仍然是市场首选材料。由于企业和消费者都高度重视产品安全和保质期,因此低密度聚乙烯包装在确保各个供应链中产品完整性方面发挥关键作用。

电子商务和数位购物平台的兴起也刺激了对软包装材料的需求,这些材料能够承受运输和搬运的压力,同时保持产品的完好无损。此外,轻盈、节省空间的包装有助于降低运输成本,这使得低密度聚乙烯 (LDPE) 成为製造商的首选材料。食品安全和包装卫生监管力道的不断加大,进一步提升了市场潜力。在持续推动永续发展的背景下,製造商目前正在致力于生产可回收、环保的低密度聚乙烯 (LDPE) 包装解决方案,这些解决方案正受到注重环保的消费者和监管机构的青睐。旨在提升营运效率和品牌吸引力的包装形式和材料创新,正在塑造全球众多包装公司的策略方向。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 208亿美元 |

| 预测值 | 327亿美元 |

| 复合年增长率 | 4.7% |

低密度聚乙烯 (LDPE) 因其防潮性和柔韧性而被广泛应用于食品和饮料行业,是包装易腐产品的理想选择。随着生活方式的改变和城市化进程的推进,人们对方便食品的需求不断增长,这显着推动了低密度聚乙烯包装的使用。消费者越来越倾向于即食食品和单人份食品,尤其是在发展中经济体,这些国家依赖低密度聚乙烯薄膜和容器来维持食品的新鲜度和安全性。低密度聚乙烯 (LDPE) 凭藉其卫生特性,可延长食品的保质期,符合现代消费习惯和分销模式。

在医药和个人护理领域,由于人们日益增强的医疗意识、全球人口老化以及个人健康支出的增加,低密度聚乙烯 (LDPE) 包装持续受到青睐。尤其是在后疫情时代,人们对卫生和污染预防的重视程度不断提高,这加速了一次性和防篡改包装形式的转变。低密度聚乙烯 (LDPE) 具有成本效益高且易于加工的特点,在帮助製造商满足严格的安全和包装标准方面发挥核心作用。从药膏管和药袋到个人护理小袋,LDPE 正在多个产品类别中证明其多功能性和有效性。

然而,市场面临贸易相关干扰带来的不利因素。川普政府对钢铁、铝和中国零件征收关税,对整个包装供应链产生了连锁反应。这些政策导致低密度聚乙烯 (LDPE) 树脂和成品包装材料的成本上涨,对生产成本造成上行压力,最终推高了消费者价格。与墨西哥和加拿大等主要合作伙伴的贸易紧张局势也限制了原材料的流动,对关键零件的供应构成挑战,并增加了製造商的物流复杂性。

从产品细分来看,薄膜和包装材料类别在2024年的市占率为36.7%。这些产品因其适应性和防潮性能,广泛应用于食品包装、工业包装和电商运输。其价格实惠、使用方便,使其成为寻求优化包装成本并确保产品安全的企业的首选。随着各行各业对保护性包装的需求不断增长,这个细分市场也持续蓬勃发展。

2024年,食品饮料产业成为主导的终端应用领域,占41.5%的市场。低密度聚乙烯(LDPE)包装被广泛用于保鲜和卫生,是冷冻食品、零食、乳製品和加工食品不可或缺的材料。随着消费者拥抱快节奏、便利的生活方式,对低密度聚乙烯(LDPE)等柔性耐用包装的依赖预计只会增长,尤其是在包装食品消费量激增的新兴市场。

2024年,美国低密度聚乙烯 (LDPE) 包装市场规模达44亿美元。该市场的成长主要得益于食品、製药和电商产业的持续需求。加工技术的进步以及对安全、卫生和法规合规性的日益重视,正在推动创新。同时,人们对永续包装的兴趣日益浓厚,也促使製造商投资再生LDPE解决方案。这些努力使企业能够满足客户期望,同时与全球永续发展目标保持一致。

全球低密度聚乙烯 (LDPE) 包装市场的主要参与者包括康斯坦莎柔性包装 (Constantia flexibles)、贝里环球公司 (Berry Global Inc.)、希悦尔 (Sealed Air) 和安姆科公司 (Amcor plc)。这些公司正在利用技术升级和永续实践来保持竞争力。关键策略包括扩大产品线、提高供应链弹性以及增强低密度聚乙烯产品的可回收性,以应对环境问题和不断变化的监管框架。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 主要原物料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 衝击力

- 成长动力

- 包装食品和饮料行业的成长

- 药品和个人护理需求不断增长

- 电子商务和零售分销的扩张

- 在工业和农业应用中的采用率不断提高

- 轻量化和材料效率

- 产业陷阱与挑战

- 环境问题和监管压力

- 回收率低,循环性有限

- 成长动力

- 成长潜力分析

- 科技与创新格局

- 专利分析

- 重要新闻和倡议

- 未来市场趋势

- 波特的分析

- PESTEL分析

- 监管格局

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按包装类型,2021 - 2034 年

- 主要趋势

- 包包和小袋

- 瓶子和容器

- 薄膜和包装

- 管

- 其他的

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 食品和饮料

- 个人护理和化妆品

- 电气和电子产品

- 消费品

- 製药

- 电子商务

- 其他的

第七章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Amcor plc

- BENZ Packaging

- Berry Global Inc.

- Constantia Flexibles

- EPL Limited

- FKuR

- Inteplast Group

- Origin Pharma Packaging

- RKW Group

- SABIC

- Sealed Air

- Silgan Holdings

- Sirane Group

- Sonoco Products Company

- Strobel GmbH

- TC Transcontinental

- Thermo Fisher Scientific Inc.

- Westlake Corporation

The Global Low-Density Polyethylene Packaging Market was valued at USD 20.8 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 32.7 billion by 2034, driven by robust demand across food, pharmaceutical, and personal care industries. This growth reflects the expanding applications of LDPE packaging in both consumer and industrial sectors. With the global packaging industry rapidly evolving, LDPE remains a preferred material due to its flexibility, durability, low production cost, and high resistance to moisture. As businesses and consumers alike prioritize product safety and shelf-life, LDPE packaging plays a key role in ensuring product integrity across various supply chains.

The rising trend of e-commerce and digital shopping platforms also fuels the demand for flexible packaging materials that can withstand shipping and handling stress while keeping products intact. In addition, the shift toward lightweight, space-saving packaging that helps reduce transportation costs is making LDPE a go-to material for manufacturers. Growing regulatory focus on food safety and packaging hygiene is further enhancing the market potential. Amid ongoing efforts toward sustainability, manufacturers are now working on producing recyclable and eco-friendly LDPE packaging solutions, which are gaining traction among environmentally conscious consumers and regulators. Innovation in packaging formats and materials, aimed at boosting operational efficiency and brand appeal, is shaping the strategic direction of many packaging firms globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.8 billion |

| Forecast Value | $32.7 billion |

| CAGR | 4.7% |

LDPE is widely used in the food and beverage sector due to its moisture resistance and flexibility, making it ideal for packaging perishable products. The increasing demand for convenience food, driven by changing lifestyles and urbanization, is significantly boosting the use of LDPE-based packaging. Consumers are leaning heavily toward ready-to-eat meals and single-serve food products, especially in developing economies, which rely on LDPE films and containers to maintain freshness and safety. With its hygienic attributes, LDPE ensures an extended shelf life for food items, aligning with modern consumption habits and distribution models.

In the pharmaceutical and personal care segments, LDPE packaging continues to gain traction due to rising healthcare awareness, an aging global population, and higher spending on personal wellness. The heightened focus on hygiene and contamination prevention, particularly in the post-pandemic landscape, is accelerating the shift toward single-use and tamper-proof packaging formats. LDPE, being cost-effective and easy to process, is playing a central role in helping manufacturers meet stringent safety and packaging standards. From ointment tubes and medicine pouches to personal care sachets, LDPE is proving its versatility and effectiveness across multiple product categories.

However, the market has faced headwinds in the form of trade-related disruptions. Tariffs on steel, aluminum, and Chinese components introduced during the Trump administration caused a ripple effect throughout the packaging supply chain. These policies led to increased costs for LDPE resins and finished packaging materials, putting upward pressure on production expenses and ultimately raising consumer prices. Trade tensions with key partners like Mexico and Canada also restricted raw material flow, challenging the availability of essential components and adding to logistical complexity for manufacturers.

In terms of product segmentation, the films and wraps category accounted for a 36.7% market share in 2024. These products are widely used in food packaging, industrial wrapping, and e-commerce shipping due to their adaptability and moisture barrier properties. Their affordability and ease of use make them a preferred choice for businesses looking to optimize packaging costs while ensuring product safety. As the need for protective packaging grows across sectors, this segment continues to thrive.

The food and beverage industry emerged as the dominant end-use segment in 2024, holding a 41.5% market share. LDPE packaging is extensively used to safeguard freshness and hygiene, making it indispensable for frozen foods, snacks, dairy, and processed meals. As consumers embrace fast-paced, on-the-go lifestyles, the reliance on flexible and durable packaging like LDPE is only expected to grow, especially in emerging markets where packaged food consumption is surging.

The United States Low-Density Polyethylene (LDPE) Packaging Market was valued at USD 4.4 billion in 2024. Growth here is primarily driven by consistent demand from the food, pharmaceutical, and e-commerce sectors. Technological advancements in processing and the rising focus on safety, hygiene, and regulatory compliance are driving innovation. At the same time, increased interest in sustainable packaging is pushing manufacturers to invest in recycled LDPE solutions. These efforts are enabling businesses to meet customer expectations while aligning with global sustainability goals.

Major players in the global LDPE packaging market include Constantia Flexibles, Berry Global Inc., Sealed Air, and Amcor plc. These companies are leveraging technological upgrades and sustainable practices to stay competitive. Key strategies involve expanding product lines, improving supply chain resilience, and enhancing the recyclability of LDPE products to address environmental concerns and evolving regulatory frameworks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key raw material

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 key companies impacted

- 3.2.4 strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growth in packaged food & beverage sector

- 3.3.1.2 Rising demand in pharmaceuticals & personal care

- 3.3.1.3 Expansion of e-commerce & retail distribution

- 3.3.1.4 Increased adoption in industrial and agricultural applications

- 3.3.1.5 Lightweighting and material efficiency

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 Environmental concerns and regulatory pressure

- 3.3.2.2 Low recycling rate and limited circularity

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Technological & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news and initiatives

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Regulatory landscape

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Packaging Type, 2021 - 2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Bags & pouches

- 5.3 Bottles & containers

- 5.4 Films & wraps

- 5.5 Tubes

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Food and beverages

- 6.3 Personal care & cosmetics

- 6.4 Electricals & electronics

- 6.5 Consumer goods

- 6.6 Pharmaceuticals

- 6.7 E-commerce

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Amcor plc

- 8.2 BENZ Packaging

- 8.3 Berry Global Inc.

- 8.4 Constantia Flexibles

- 8.5 EPL Limited

- 8.6 FKuR

- 8.7 Inteplast Group

- 8.8 Origin Pharma Packaging

- 8.9 RKW Group

- 8.10 SABIC

- 8.11 Sealed Air

- 8.12 Silgan Holdings

- 8.13 Sirane Group

- 8.14 Sonoco Products Company

- 8.15 Strobel GmbH

- 8.16 TC Transcontinental

- 8.17 Thermo Fisher Scientific Inc.

- 8.18 Westlake Corporation