|

市场调查报告书

商品编码

1740896

客舱管理系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cabin Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

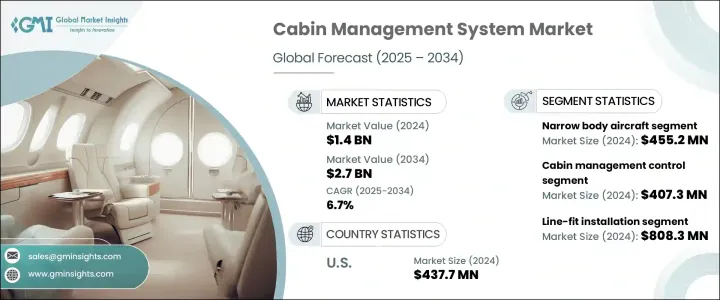

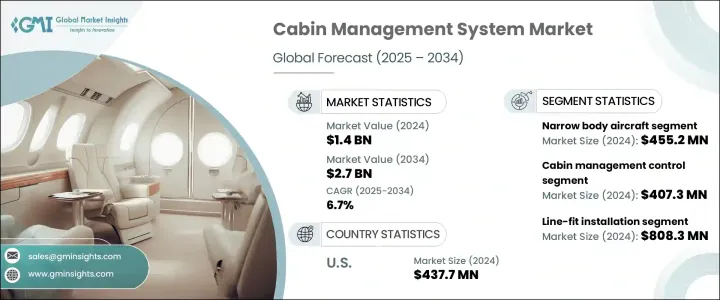

2024 年全球客舱管理系统市场规模为 14 亿美元,预计到 2034 年将以 6.7% 的复合年增长率成长至 27 亿美元。市场成长主要源自于对提升乘客舒适度的日益重视,以及高阶飞机队的扩张。随着全球航空旅行持续復苏和扩张,航空公司更加重视提供优质的飞行体验,这推动了对先进 CMS 技术的需求。这些系统能够无缝控制各种客舱功能,包括照明、温度、娱乐和通讯接口,从而显着提高乘客满意度和品牌忠诚度。增强型 CMS 解决方案也不断发展,以支援无线技术、即时自适应和智慧自动化,从而实现更智慧、更个人化的客舱设定。

近年来,全球贸易政策的变化对CMS市场产生了影响。某些国家对进口产品实施的关税规定提高了依赖外国零件的製造商的生产成本。这些成本上涨反过来又导致CMS产品价格上涨,对供应商和航空公司买家都产生了影响。这种情况促使许多製造商重新评估其供应链策略,其中一些製造商选择在国内生产或从其他地区采购替代品。虽然这种变化支持了本地製造业生态系统,但也导致了CMS定价和全球产品供应的广泛转变。航空公司,尤其是那些注重成本管理的航空公司,由于CMS安装和升级成本的增加,面临营运成本的上升。然而,这些发展正在逐步为该行业建立更具弹性和本地化的供应结构。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 27亿美元 |

| 复合年增长率 | 6.7% |

随着全球航空旅客数量的成长以及航空业竞争压力的加剧,对创新 CMS 解决方案的需求持续激增。航空公司正越来越多地采用智慧且直觉的技术,以满足日益增长的消费者期望。 CMS 平台现已整合物联网 (IoT) 感测器、基于应用程式的控制系统、语音辨识工具以及基于人工智慧的客製化功能,旨在提供无缝的机上体验。这些增强功能支援航空公司提供一致的优质服务,同时满足能源效率、噪音控制和系统可靠性方面的现代监管标准。

就飞机类型而言,窄体飞机市场领先,2024 年估值达 4.552 亿美元。这类飞机在註重成本的短程航线运作中日益普及,推动了对轻型、高效且经济实惠的 CMS 系统的需求。新兴市场国内航空旅行的日益增长也加剧了对先进且经济高效的 CMS 系统的需求,这些系统能够在不增加飞机重量或营运成本的情况下,提供更佳的乘客控制。

按组件划分,客舱管理控制器在2024年占据最大份额,市场规模达4.073亿美元。随着智慧感测器和自动化客舱技术的兴起,对能够管理多种客舱功能的集中控制单元的需求激增。航空公司和製造商优先考虑模组化、紧凑型、低功耗且易于升级或更换的控制器,以减少停机时间和维护工作。

按安装类型划分,线装系统市场在2024年以8.083亿美元的价值成为市场领导者。随着新飞机交付数量的增加,人们对原厂安装的CMS系统的偏好也日益增长。高阶飞机的买家尤其青睐支援先进多媒体功能、动态照明和智慧控制功能的全整合系统,从而在生产初期就打造出高阶的客舱环境。

从地区来看,美国在CMS市场占据主导地位,2024年的估值为4.377亿美元。美国对豪华CMS升级和先进连接选项的强劲需求,尤其是在私人和商务航空领域,持续推动市场成长。此外,主要原始设备製造商和维修供应商的参与也为改装和新安装活动提供了支持,巩固了美国作为关键市场的地位。

客舱管理系统市场仍高度分散,既有成熟的全球企业,也有创新新创公司。前三名的公司合计占据超过29.7%的市场份额,主要专注于下一代解决方案。这些进步反映了从孤立的硬体系统向全面整合的数位客舱生态系统的广泛转变。该行业正快速转向智慧模组化架构,以提供更佳的个人化和营运效率,这反映了航空平台向更电动化和互联化发展的大趋势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 乘客对飞行舒适度的需求不断增长

- 扩大公务机和贵宾飞机队

- 长途航班的成长

- 飞机产量增加

- 与智慧型设备集成

- 产业陷阱与挑战

- 安装和维护成本高

- 系统相容性问题

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按飞机类型,2021 - 2034 年

- 主要趋势

- 窄体飞机

- 宽体飞机

- 支线喷射机

- 公务机

第六章:市场估计与预测:按组成部分,2021 - 2034 年

- 主要趋势

- 客舱管理控制器

- 控制显示和使用者介面

- 音讯/视讯介面模组

- 客舱管理软体

- 连接模组

- 其他的

第七章:市场估计与预测:按安装类型,2021 - 2034 年

- 主要趋势

- 线路安装

- 改造安装

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Alto Aviation

- Astronics

- BAE Systems

- Bombardier

- Collins

- Diehl Aviation

- Gogo Business Aviation

- Heads Up Technologies

- Honeywell

- KID Systeme

- Lufthansa Technik

- Rosen Aviation

- Safran Cabin

- Satcom Direct

- STG Aerospace

- Thales

The Global Cabin Management System Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 2.7 billion by 2034. This market's growth is primarily driven by a rising emphasis on enhancing passenger comfort, combined with the expansion of high-end aircraft fleets. As air travel continues to recover and expand globally, airline operators are placing a greater focus on offering a premium in-flight experience, which is fueling the need for advanced CMS technologies. These systems enable seamless control over various cabin features, including lighting, temperature, entertainment, and communication interfaces, all of which significantly improve passenger satisfaction and brand loyalty. Enhanced CMS solutions are also evolving to support wireless technology, real-time adaptability, and intelligent automation, allowing smarter and more personalized cabin settings.

In recent years, shifting global trade policies have impacted the CMS market. Tariff regulations imposed on imports from certain countries raised production costs for manufacturers relying on foreign components. These cost hikes, in turn, led to increased prices of CMS products, affecting both suppliers and airline buyers. This situation encouraged many manufacturers to reevaluate their supply chain strategies, with several opting for domestic production or sourcing alternatives from other regions. Although this change supported local manufacturing ecosystems, it also contributed to a broader shift in CMS pricing and global product availability. Airlines, particularly those focused on cost management, have faced increased operational costs due to the higher expense of CMS installations and upgrades. Nevertheless, these developments are gradually fostering a more resilient and localized supply structure for the industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.7 Billion |

| CAGR | 6.7% |

With rising global air passenger numbers and competitive pressures in the aviation sector, the demand for innovative CMS solutions continues to surge. Airlines are increasingly adopting smart and intuitive technologies that align with growing consumer expectations. CMS platforms now feature integrations with Internet of Things (IoT) sensors, app-based control systems, voice recognition tools, and AI-based customization, all designed to deliver a seamless onboard experience. These enhancements support airlines in delivering consistent, premium service while meeting modern regulatory standards in terms of energy efficiency, noise control, and system reliability.

In terms of aircraft types, the narrow-body aircraft segment led the market with a valuation of USD 455.2 million in 2024. The popularity of these aircraft in cost-conscious and short-haul operations is propelling the need for lightweight, efficient, and affordable CMS installations. Growing domestic air travel in emerging markets has also intensified demand for advanced yet cost-effective CMS setups that offer enhanced passenger control without increasing aircraft weight or operational expense.

By component, cabin management controllers accounted for the largest share in 2024, generating USD 407.3 million. The demand for centralized control units capable of managing multiple cabin functionalities has surged, particularly with the rise in smart sensors and automated cabin technologies. Airlines and manufacturers are prioritizing modular, compact, and low-power controllers that can be easily upgraded or replaced, helping reduce downtime and maintenance efforts.

Based on installation type, the line-fit segment emerged as the market leader with a value of USD 808.3 million in 2024. The increasing number of new aircraft deliveries has led to a growing preference for factory-installed CMS setups. Buyers of premium aircraft are especially keen on fully integrated systems that support advanced multimedia functions, dynamic lighting, and smart control capabilities, delivering a high-end cabin environment straight from production.

Regionally, the United States dominated the CMS market with a valuation of USD 437.7 million in 2024. The country's strong demand for luxurious CMS upgrades and advanced connectivity options, particularly in private and business aviation, continues to drive market growth. In addition, the presence of major OEMs and maintenance providers supports both retrofit and new installation activities, reinforcing the U.S.'s position as a key market.

The cabin management system landscape remains highly fragmented, with a mix of established global players and innovative startups. The top three companies collectively control over 29.7% of the market, focusing heavily on next-generation solutions. These advancements reflect a wider transition from isolated hardware systems to fully integrated digital cabin ecosystems. The industry is rapidly moving toward intelligent, modular architectures that offer enhanced personalization and operational efficiency, reflecting the broader trend toward more electric and connected aviation platforms.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for in-flight passenger comfort

- 3.3.1.2 Expansion of business jet and vip aircraft fleets

- 3.3.1.3 Growth in long-haul flights

- 3.3.1.4 Increase in aircraft production

- 3.3.1.5 Integration with smart devices

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High installation and maintenance costs

- 3.3.2.2 System compatibility issues

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Aircraft Type, 2021 - 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Narrow-body aircraft

- 5.3 Wide-body aircraft

- 5.4 Regional jets

- 5.5 Business jets

Chapter 6 Market Estimates and Forecast, By Component, 2021 - 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Cabin management controllers

- 6.3 Control displays and user interfaces

- 6.4 Audio/video interface modules

- 6.5 Cabin management software

- 6.6 Connectivity modules

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Installation Type, 2021 - 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Line-fit installation

- 7.3 Retrofit installation

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alto Aviation

- 9.2 Astronics

- 9.3 BAE Systems

- 9.4 Bombardier

- 9.5 Collins

- 9.6 Diehl Aviation

- 9.7 Gogo Business Aviation

- 9.8 Heads Up Technologies

- 9.9 Honeywell

- 9.10 KID Systeme

- 9.11 Lufthansa Technik

- 9.12 Rosen Aviation

- 9.13 Safran Cabin

- 9.14 Satcom Direct

- 9.15 STG Aerospace

- 9.16 Thales