|

市场调查报告书

商品编码

1740903

数位故障记录器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Digital Fault Recorder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

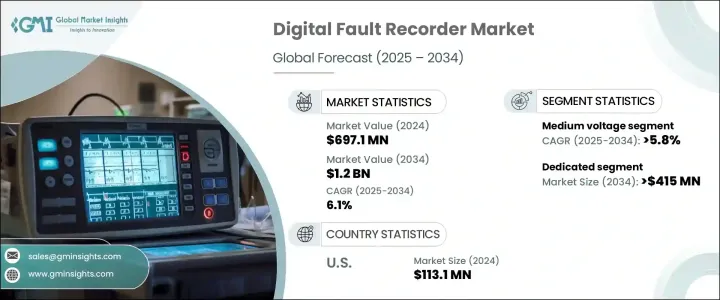

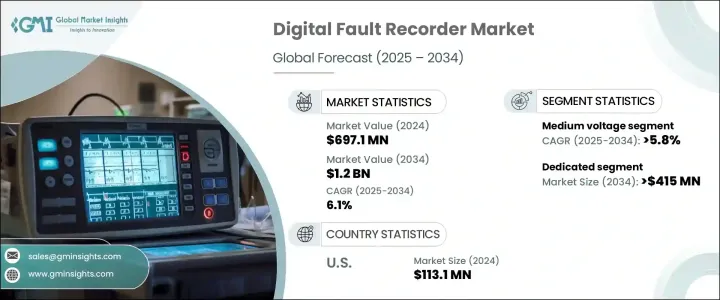

2024年,全球数位故障记录器市场规模达6.971亿美元,预计随着电力基础设施的大规模现代化,该市场规模将以6.1%的复合年增长率增长,到2034年达到12亿美元。随着能源系统从传统模式向智慧自动化网路演进,精确监控和快速故障诊断的需求变得比以往任何时候都更加重要。数位故障记录器(DFR)正成为这个转型过程中不可或缺的工具,它为公用事业公司提供电网行为的即时洞察,使其能够快速做出营运决策,最大限度地减少停电,并保持稳定的电力传输。

现代电力系统正在整合更多再生能源、分散式能源资产和智慧技术,从而建立高度复杂的网路。这种复杂性需要超越传统功能的先进诊断工具。数位故障记录器透过提供高速资料采集、远端系统存取和进阶分析功能来满足这些要求。它们使公用事业公司能够执行详细的事件重建并精确定位故障根源,不仅可以减少停机时间,还可以提高电网的长期效率。数位变电站和智慧电网解决方案的广泛应用正在加速这一趋势,进一步推动对智慧、响应迅速的故障检测系统的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.971亿美元 |

| 预测值 | 12亿美元 |

| 复合年增长率 | 6.1% |

随着产业重点转向弹性和营运透明度,数位故障记录器 (DFR) 在电力管理策略中发挥越来越重要的作用。其数位架构可无缝整合到更广泛的控制系统中,使其在现代电网环境中具有高度适应性。数位故障记录器能够自动收集资料并提供可操作的洞察,使公用事业公司能够实现更精简、更具预测性的维护方案。这符合全球能源目标,即专注于电网可靠性、永续电力分配和经济高效的基础设施升级。

然而,数位故障记录器产业也难以免受到宏观经济压力的影响。对进口商品征收的关税,尤其是与电子产品、钢铁和铝相关的商品,正在影响各行各业的零件成本。由于数位故障记录器包含半导体、通讯模组和金属外壳,这些投入的任何价格波动都可能影响生产成本和利润率。市场参与者必须透过优化供应链、投资在地化製造以及追求减少对敏感材料依赖的设计创新来应对这些挑战。

就产品类型而言,专用DFR细分市场预计到2034年将创造超过4.15亿美元的市场价值。这些设备专为故障记录而设计,比多功能係统具有更高的精度和稳定性。专用记录器设计为独立于其他电网控制元件运行,在对不间断性能至关重要的高可靠性装置中尤其重要。其精确度和专注的功能使其成为需要可靠故障检测且不受辅助製程干扰的行业的首选。

中压类别通常涵盖1kV至36kV的系统,预计到2034年,其复合年增长率将超过5.8%。这一增长是由配电网、工业运营以及可再生能源整合设施对故障监控日益增长的需求所推动的。公用事业公司正在积极升级传统电网基础设施,透过嵌入数位监控工具来提高故障定位精度并减少服务中断。因此,分散式故障復原器 (DFR) 正成为中压电网现代化专案的关键组件,其支援本地诊断和遥测的能力可增强系统可靠性。

在美国,数位故障记录器市场持续稳定发展。 2022年,该市场规模达1.035亿美元,2023年攀升至1.081亿美元,2024年再次回升至1.131亿美元。老化基础设施升级的投资不断增加,加上电网对极端天气事件和波动性能源需求的脆弱性增加,促使公用事业公司采用更复杂的故障分析解决方案。其重点是确保营运连续性,并保护电网免受可预测和意外中断的影响。

行业领导者凭藉广泛的全球营运和成熟的研发能力保持竞争优势。市占率超过 20% 的公司在北美、欧洲和亚洲等关键地区拥有生产基地。他们的全球布局使其能够实现经济高效的生产和快速的产品交付。凭藉其在创新和可靠性方面的长期声誉,这些公司预计将在数位故障记录器行业深入数位化时代之际,影响其发展轨迹。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依类型,2021 - 2034

- 主要趋势

- 投入的

- 多功能的

第六章:市场规模及预测:按电压,2021 - 2034

- 主要趋势

- 中压

- 高压

- 超高压

第七章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 高速扰动

- 低速扰动

- 稳定状态

第 8 章:市场规模与预测:按安装量,2021 年至 2034 年

- 主要趋势

- 世代

- 传染

- 分配

第九章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第十章:公司简介

- ABB

- Ametek

- Ducati Energia

- Eaton

- Elspec

- E-Max Instruments

- Erlphase

- General Electric

- Hitachi

- Kinkei

- Kocos

- Logiclab

- Mehta Tech

- Qualitrol

- Schneider Electric

- Siemens

The Global Digital Fault Recorder Market was valued at USD 697.1 million in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 1.2 billion by 2034 as power infrastructure undergoes widespread modernization. As energy systems evolve from traditional models to intelligent, automated networks, the need for precise monitoring and rapid fault diagnosis is becoming more critical than ever. DFRs are emerging as indispensable tools in this transformation, offering utilities real-time insight into grid behavior, allowing them to make swift operational decisions, minimize outages, and maintain consistent power delivery.

Modern electrical systems are integrating more renewable energy sources, distributed energy assets, and smart technologies, creating highly complex networks. This complexity demands advanced diagnostic tools that go beyond conventional capabilities. Digital fault recorders meet these requirements by offering high-speed data capture, remote system access, and advanced analytics. They enable utilities to perform detailed event reconstruction and pinpoint the origin of faults, which not only reduces downtime but also enhances long-term grid efficiency. The widespread adoption of digital substations and smart grid solutions is accelerating this trend, further boosting demand for intelligent, responsive fault detection systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $697.1 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 6.1% |

As industry priorities shift toward resilience and operational transparency, DFRs are playing an increasingly vital role in power management strategies. Their digital architecture allows seamless integration into broader control systems, making them highly adaptable in modern grid environments. With their ability to automate data collection and provide actionable insights, digital fault recorders are empowering utilities to achieve more streamlined and predictive maintenance regimes. This aligns with global energy goals focused on grid reliability, sustainable power distribution, and cost-effective infrastructure upgrades.

However, the DFR industry is not immune to macroeconomic pressures. Tariffs introduced on imported goods, particularly those related to electronics, steel, and aluminum, are impacting component costs across various industrial sectors. Since digital fault recorders include semiconductors, communication modules, and metal casings, any price volatility in these inputs can influence production costs and profit margins. Market participants must navigate these challenges by optimizing supply chains, investing in localized manufacturing, and pursuing design innovations that reduce dependency on sensitive materials.

In terms of product types, the dedicated DFR segment is expected to generate more than USD 415 million by 2034. These devices are purpose-built for fault recording and offer higher accuracy and stability than multifunctional systems. Designed to operate independently of other grid control elements, dedicated recorders are especially valued in high-reliability installations where uninterrupted performance is critical. Their precision and focused functionality make them a preferred choice for sectors that demand robust fault detection without the interference of ancillary processes.

The medium voltage category, typically covering systems between 1kV and 36kV, is forecast to expand at a CAGR exceeding 5.8% through 2034. This growth is driven by heightened demand for fault monitoring within distribution networks, industrial operations, and facilities integrating renewable energy. Utilities are actively upgrading legacy grid infrastructure by embedding digital monitoring tools that improve fault location accuracy and reduce service interruptions. As a result, DFRs are becoming key components in medium-voltage network modernization projects, where their ability to support local diagnostics and telemetry enhances system reliability.

Within the United States, the digital fault recorder market continues to show steady progress. It reached USD 103.5 million in 2022, climbed to USD 108.1 million in 2023, and rose again to USD 113.1 million in 2024. The growing investment in aging infrastructure upgrades, along with increased grid vulnerability to extreme weather events and fluctuating energy demands, is encouraging utilities to adopt more sophisticated fault analysis solutions. The focus is on ensuring operational continuity and protecting the grid from both predictable and unexpected disruptions.

Industry leaders maintain a competitive edge through extensive global operations and well-established research and development capabilities. Companies holding more than 20% of the market share collectively operate manufacturing facilities in key regions including North America, Europe, and Asia. Their global presence allows for cost-effective production and quick product delivery. With long-standing reputations for innovation and reliability, these firms are positioned to influence the trajectory of the digital fault recorder industry as it moves deeper into the digital age.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Dedicated

- 5.3 Multifunctional

Chapter 6 Market Size and Forecast, By Voltage, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Medium voltage

- 6.3 High voltage

- 6.4 Extra high voltage

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 High speed disturbance

- 7.3 Low speed disturbance

- 7.4 Steady state

Chapter 8 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Generation

- 8.3 Transmission

- 8.4 Distribution

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Russia

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Turkey

- 9.5.4 South Africa

- 9.5.5 Egypt

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Ametek

- 10.3 Ducati Energia

- 10.4 Eaton

- 10.5 Elspec

- 10.6 E-Max Instruments

- 10.7 Erlphase

- 10.8 General Electric

- 10.9 Hitachi

- 10.10 Kinkei

- 10.11 Kocos

- 10.12 Logiclab

- 10.13 Mehta Tech

- 10.14 Qualitrol

- 10.15 Schneider Electric

- 10.16 Siemens