|

市场调查报告书

商品编码

1740906

家用堆肥机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Household Composters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

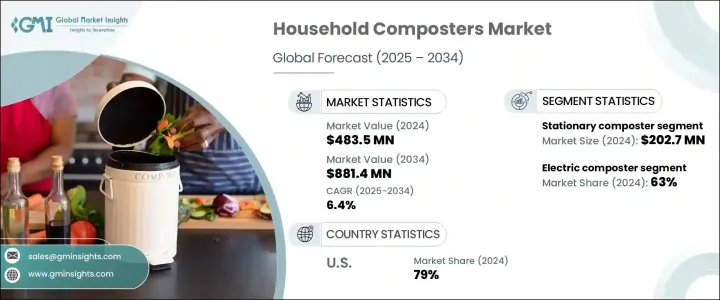

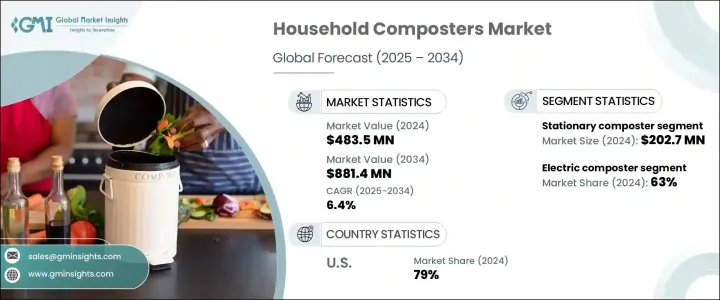

2024 年全球家用堆肥机市场价值为 4.835 亿美元,预计到 2034 年将以 6.4% 的复合年增长率增长至 8.814 亿美元。这一增长得益于消费者对有机废物和不当处置方式造成的环境破坏的认识不断提高。

人们日益担忧食物垃圾造成的污染以及垃圾掩埋场的碳足迹,这促使家庭采用堆肥作为实用且可持续的解决方案。堆肥不仅有助于减少垃圾掩埋场负担和甲烷排放,还能让人们将有机垃圾转化为营养丰富的土壤。这些土壤可以重新用于家庭菜园,促进更健康、更环保的生活方式。对永续发展的追求和更绿色生活习惯的养成正在重塑消费者行为,并推动对家庭堆肥解决方案的需求。越来越多的人正在寻找有效的家庭垃圾管理方法,尤其是在全球环境法规日益严格的背景下。消费者正在寻找能够支持零浪费生活方式并有助于更负责任的垃圾管理的堆肥机。此外,家庭园艺的日益普及,进一步加速了堆肥机的普及,使家庭能够轻鬆有效地回收食物残渣和有机材料。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.835亿美元 |

| 预测值 | 8.814亿美元 |

| 复合年增长率 | 6.4% |

堆肥技术的进步也对市场趋势产生了重大影响。现今的堆肥器使用起来更加便捷,具有消除异味和减少人工操作的功能。新一代型号配备了气味控制技术,使其更适合室内使用。随着智慧家庭的普及,配备自动化系统和连网功能的堆肥器也越来越受欢迎。这些智慧堆肥器简化了堆肥过程,节省了时间,同时符合永续发展目标。许多消费者,尤其是熟悉科技的消费者,现在更喜欢能够无缝融入智慧家庭的堆肥器。这些智慧堆肥器不仅具有环保效益,还能提高便利性和时间管理效率,尤其对于繁忙的家庭而言。透过加快有机废物的分解速度,这些先进的系统还可以帮助家庭减少垃圾产生量,同时有助于改善土壤和植物健康。

根据产品类型,市场细分为滚筒式、固定式和其他类型。固定式堆肥机类别在2024年占据市场主导地位,创造了2.027亿美元的收入。预计该细分市场在2025年至2034年期间的复合年增长率约为6.8%。固定式堆肥机因其维护成本低、设计经济实惠而备受青睐,成为新用户的首选。这些设备专为户外环境设计,能够承受各种天气条件。由再生塑胶和金属等环保材料製成的堆肥机越来越受欢迎,这支持了人们向永续产品选择的持续转变。其紧凑的尺寸和高效的气味管理也使其成为空间有限的城市家庭的理想选择。

就类型而言,市场分为电动和手动堆肥机。 2024年,电动堆肥机占了近63%的市场。电动堆肥机需求的成长归因于其能够透过自动化功能加速堆肥过程。这些设备可在几天内分解食物垃圾和有机物,是产生大量垃圾的家庭的理想选择。它们简化分解过程的能力吸引了寻求快速、简单和有效堆肥解决方案的消费者。自动化、易用性和更快的产出是电动堆肥机日益受到青睐的关键因素,而非手动堆肥机。

从地区来看,美国在北美家用堆肥机市场占据主导地位,约占该地区总收入的79%,预计到2024年将达到1.2亿美元。永续发展意识的增强以及对自给自足生活日益增长的兴趣推动了这一增长。堆肥机设计的技术创新进一步推动了其普及。许多美国居民选择在家中堆肥,以防止有机垃圾最终被填埋。一些州也透过食物垃圾转移政策鼓励堆肥,进一步推动了市场成长。家庭园艺和后院种植食物的流行也刺激了需求,尤其是对使用者友善的电动堆肥机的需求。

家用堆肥机市场较为分散,排名前五的厂商——Lomi、Harp Renewables、Subpod、Reencle 和 Vitami——合计占 8% 至 12% 的市占率。这些公司专注于拓展产品线、建立策略合作伙伴关係并加强全球影响力,以保持竞争优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製成品

- 经销商

- 零售商

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 政府法规和废弃物管理政策

- 食物浪费问题日益严重

- 产业陷阱与挑战

- 难闻的气味和害虫问题

- 食物垃圾堆肥困难

- 成长动力

- 成长潜力分析

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 产品偏好

- 首选价格范围

- 首选配销通路

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 固定式

- 不倒翁

- 其他(压缩等)

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 电动堆肥机

- 手动堆肥机

第七章:市场估计与预测:依产能,2021 - 2034 年

- 主要趋势

- 10公升以下

- 10升至20公升

- 20升至40公升

- 40公升以上

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 室内的

- 户外的

第九章:市场估计与预测:按价格,2021 - 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 在线的

- 公司网站

- 电子商务

- 离线

- 超市/大卖场

- 专卖店

- 其他(大型零售商店等)

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十二章:公司简介

- Airthereal

- Beyond Green Biotech

- Geme

- GRAF

- Harp Renewables

- Involly

- Lasso

- Lomi

- Mantis

- Reencle

- Subpod

- Topmake Environment

- Vego

- Vitamix

- Zeosta

The Global Household Composters Market was valued at USD 483.5 million in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 881.4 million by 2034. This growth is fueled by a surge in consumer awareness surrounding the environmental damage caused by organic waste and improper disposal practices.

Growing concerns over pollution caused by food waste and the carbon footprint of landfill dumping are prompting households to adopt composting as a practical and sustainable solution. Composting not only helps reduce landfill burden and methane emissions but also enables individuals to turn organic waste into nutrient-rich soil. This soil can be reused for home gardens, promoting a healthier and more eco-conscious lifestyle. The push toward sustainability and the adoption of greener living habits are reshaping consumer behavior and driving up the demand for at-home composting solutions. More people are looking for effective ways to manage household waste, especially as environmental regulations tighten globally. Consumers are seeking composters that support a zero-waste lifestyle and contribute to more responsible waste management. In addition, the popularity of home gardening is increasing, further accelerating the adoption of composters that allow households to recycle food scraps and organic materials easily and efficiently.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $483.5 Million |

| Forecast Value | $881.4 Million |

| CAGR | 6.4% |

Advancements in composting technology are also making a significant impact on market trends. Today's composters are far more convenient, offering features that eliminate unpleasant odors and reduce the manual effort involved. New-age models come with odor-control technology, making them more suitable for indoor use. As smart home adoption grows, composters equipped with automated systems and connected features are becoming increasingly desirable. These smart composters simplify the composting process, saving time while aligning with sustainability goals. Many consumers, especially those comfortable with technology, now prefer composters that integrate seamlessly into their connected homes. These smart composters offer not only environmental benefits but also improve convenience and time management, especially for busy households. By enabling faster decomposition of organic waste, these advanced systems also help households reduce the volume of trash generated while contributing to soil improvement and plant health.

Based on product type, the market is segmented into tumblers, stationary, and others. The stationary composter category led the market in 2024, generating revenue of USD 202.7 million. This segment is projected to grow at a CAGR of approximately 6.8% from 2025 to 2034. Stationary composters are favored due to their low maintenance and budget-friendly design, making them a go-to option for new users. Designed for outdoor environments, these units are built to withstand a range of weather conditions. Composters made from eco-conscious materials such as recycled plastics and metals are gaining popularity, supporting the ongoing shift toward sustainable product choices. Their compact size and efficient odor management also make them a great option for urban households with limited space.

In terms of type, the market is divided into electric and manual composters. Electric composters held nearly 63% of the total market share in 2024. The rising demand for electric units is attributed to their ability to accelerate the composting process using automated functions. These units break down food waste and organic material within days, making them ideal for households generating high volumes of waste. Their ability to simplify the decomposition process appeals to consumers looking for quick, easy, and effective composting solutions. Automation, ease of use, and faster output are key drivers behind the growing preference for electric composters over manual alternatives.

Regionally, the United States dominated the North American household composters market, accounting for approximately 79% of the regional revenue and estimated to reach USD 120 million in 2024. Increased awareness around sustainability and growing interest in self-sufficient living have contributed to this growth. Technological innovations in composter design are further boosting adoption. Many U.S. residents are choosing to compost at home to prevent organic waste from ending up in landfills. Certain states also encourage composting through food waste diversion policies, further pushing market growth. The popularity of home gardening and growing food in backyards is also fueling demand, especially for user-friendly electric composters.

The household composters market is moderately fragmented, with the top five players- Lomi, Harp Renewables, Subpod, Reencle, and Vitami-holding a collective market share of 8% to 12%. These companies are focused on expanding product lines, forming strategic partnerships, and strengthening their global presence to maintain a competitive edge.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Government regulations and waste management policies

- 3.6.1.2 Rising food waste concerns

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Unpleasant odors and pest issues

- 3.6.2.2 Difficulty in composting food waste

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Consumer buying behavior analysis

- 3.9 Demographic trends

- 3.9.1 Factors affecting buying decisions

- 3.9.2 Product Preference

- 3.9.3 Preferred price range

- 3.9.4 Preferred distribution channel

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Stationary

- 5.3 Tumbler

- 5.4 Others (compacting etc.)

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Electric composter

- 6.3 Manual composter

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Below 10L

- 7.3 10L to 20L

- 7.4 20L to 40L

- 7.5 Above 40L

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Indoor

- 8.3 Outdoor

Chapter 9 Market Estimates & Forecast, By Price, 2021 - 2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 Company websites

- 10.2.2 E-commerce

- 10.3 Offline

- 10.3.1 Supermarket/hypermarket

- 10.3.2 Specialty store

- 10.3.3 Others (mega retail store etc.)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Airthereal

- 12.2 Beyond Green Biotech

- 12.3 Geme

- 12.4 GRAF

- 12.5 Harp Renewables

- 12.6 Involly

- 12.7 Lasso

- 12.8 Lomi

- 12.9 Mantis

- 12.10 Reencle

- 12.11 Subpod

- 12.12 Topmake Environment

- 12.13 Vego

- 12.14 Vitamix

- 12.15 Zeosta