|

市场调查报告书

商品编码

1740907

飞机电动机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Aircraft Electric Motors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

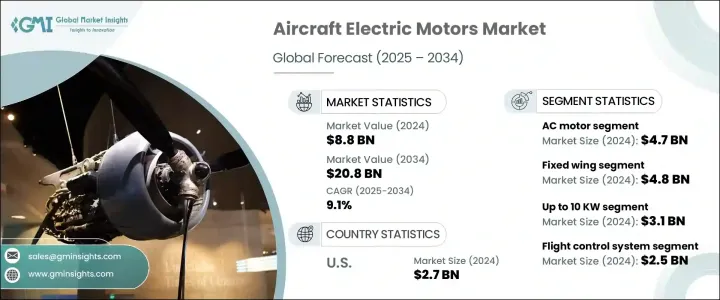

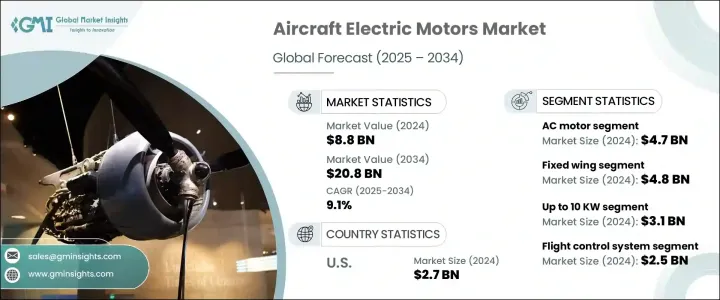

2024 年全球飞机电动马达市场价值为 88 亿美元,预计到 2034 年将以 9.1% 的复合年增长率成长,达到 208 亿美元。这一增长主要得益于对城市空中交通 (UAM) 和电动垂直起降 (eVTOL) 飞机不断增长的需求,以及分散式电力推进 (DEP) 的日益普及。市场也感受到了外部因素的影响,包括关税,尤其是针对中国航太和电气元件的关税,这些关税推高了原材料成本并扰乱了全球供应链。作为应对措施,製造商正在进行供应商多元化,并将部分生产重点转移,以减少对进口的依赖。航空业使用的电动马达正成为该产业开发更清洁、更永续技术的关键组成部分,随着环境问题和监管压力的加剧,预计这一趋势将会加速。

城市空中交通 (UAM) 和电动垂直起降 (eVTOL) 飞机的快速发展是飞机电动马达市场扩张的关键驱动力。这些飞机有望透过提供比传统地面出行更清洁、更有效率的替代方案,彻底改变城市交通。城市空中交通 (UAM) 和电动垂直起降 (eVTOL) 技术专为城市地区的短途高效飞行而设计,而交通拥堵已成为日常通勤的主要挑战。与传统飞机不同,电动垂直起降 (eVTOL) 飞机不需要长跑道,使其成为基础设施空间通常有限的城市环境的理想选择。其垂直起降能力,加上环保的电力推进系统,使其成为城市交通的未来。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 88亿美元 |

| 预测值 | 208亿美元 |

| 复合年增长率 | 9.1% |

就电动机本身而言,市场主要分为两类:交流电动机和直流电动机。到2024年,交流电动马达将占据市场主导地位,占据47亿美元的相当大的份额。交流电动马达的效率、低维护成本和持续的功率输出能力使其特别适合电动和混合动力飞机的高要求。电力电子技术的进步,包括变频驱动器(VFD),进一步提升了它们的普及度,尤其是在需要可靠、长期性能的航空应用中。交流电动马达对于航空业推动更永续、更有效率的飞行解决方案至关重要。

固定翼飞机市场是飞机电动马达市场成长的另一个主要动力,预计2024年其市场规模将达到48亿美元。该市场的扩张得益于对永续航空技术的日益重视。电动马达是短程和区域航班的理想选择,有助于降低排放和营运成本。随着政府和监管机构不断收紧环境标准,混合动力和全电动固定翼飞机的设计需求日益增长。製造商正在大力投资这些创新,致力于提高马达效率,同时减轻机身重量并提升整体性能。

在美国市场,飞机电动机的需求也在激增。 2024年,美国飞机电动马达市场规模达27亿美元,这得益于联邦政府对先进混合动力电动研发的大量投资。诸如美国国家航空暨太空总署(NASA)的电力传动系统飞行演示计画等政府支持的倡议,正透过加速民用和军用航空电力推进系统的技术突破,在这一增长中发挥重要作用。这些措施也致力于克服电动马达与飞机系统的整合挑战,确保该技术的广泛应用可行性。

飞机电动马达市场的领导者包括 Emrax、赛峰集团、H3X Technologies、利勃海尔航空航太、THINGAP 和 Electromech Technologies。这些公司正在大力投资研发,以提高其电动马达的效率、耐用性和整体性能。他们还与飞机製造商建立战略合作伙伴关係,将电力推进系统整合到新的飞机设计中。透过专注于创新并开发专为混合动力电动应用量身定制的电动机,这些公司正处于日益增长的可持续航空解决方案需求的前沿。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业回应

- 供应链重构

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 城市空中交通 (UAM) 和 eVTOL 发展激增

- 短程航班需求不断成长

- 分散式电力推进(DEP)的兴起

- 混合动力电动飞机开发

- 电动机的技术进步

- 产业陷阱与挑战

- 电池能量密度有限

- 热管理和安全风险

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 交流马达

- 直流马达

第六章:市场估计与预测:按飞机类型,2021 - 2034 年

- 主要趋势

- 固定翼

- 旋翼机

- 无人机

- 先进的空中机动性

第七章:市场估计与预测:按输出功率,2021 - 2034 年

- 主要趋势

- 高达 10 千瓦

- 10–200 千瓦

- 200度以上

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 推进系统

- 飞行控制系统

- 环境控制系统

- 执行系统

- 客舱内部系统

- 其他

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- AMETEK

- ARC Systems

- Electromech Technologies

- Emrax

- Evolito

- H3X Technologies

- KDE Direct

- Liebherr Aerospace

- Maxon

- Meggitt

- MGM Compro

- Moog

- Safran Group

- THINGAP

- Turnigy Power Systems

- Windings

- Wright Electric

- Xoar International

The Global Aircraft Electric Motors Market was valued at USD 8.8 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 20.8 billion by 2034. This growth is primarily fueled by the rising demand for Urban Air Mobility (UAM) and electric Vertical Takeoff and Landing (eVTOL) aircraft, along with the increasing adoption of distributed electric propulsion (DEP). The market has also felt the impact of external factors, including tariffs, especially on Chinese aerospace and electrical components, which have driven up raw material costs and disrupted global supply chains. In response, manufacturers are diversifying suppliers and reshoring some production efforts to lessen dependence on imports. The electric motors used in aviation are becoming a critical part of the industry's efforts to develop cleaner, more sustainable technologies, and this trend is expected to accelerate as environmental concerns and regulatory pressures intensify.

The rapid development of Urban Air Mobility and eVTOL aircraft is a key driver of the aircraft electric motors market expansion. These aircraft are poised to revolutionize urban transportation by offering a cleaner and more efficient alternative to traditional ground travel. UAM and eVTOL technologies are specifically designed for short-distance, high-efficiency flights in urban areas, where congestion and traffic jams have become major challenges for daily commuters. Unlike traditional aircraft, eVTOLs do not require long runways, making them ideal for city environments where space for infrastructure is often limited. Their vertical takeoff and landing capabilities, coupled with their eco-friendly electric propulsion systems, are positioning them as the future of urban transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.8 Billion |

| Forecast Value | $20.8 Billion |

| CAGR | 9.1% |

As for the electric motors themselves, the market is divided into two main types: AC and DC motors. In 2024, AC motors dominate the market, holding a substantial share of USD 4.7 billion. The efficiency, low maintenance, and sustained power output capabilities of AC motors make them particularly well-suited for the high demands of electric and hybrid-electric aircraft. Technological advancements in power electronics, including variable frequency drives (VFDs), have further bolstered their popularity, especially for aviation applications requiring reliable, long-term performance. AC motors are crucial to the aviation industry's push toward more sustainable and efficient flight solutions.

The fixed-wing aircraft segment, valued at USD 4.8 billion in 2024, is another major contributor to the aircraft electric motors market's growth. This segment's expansion is driven by the growing emphasis on sustainable aviation technologies. Electric motors are ideal for short-haul and regional flights, where they help to lower emissions and reduce operational costs. As governments and regulators tighten environmental standards, there is an increasing push for hybrid and fully electric fixed-wing aircraft designs. Manufacturers are heavily investing in these innovations, focusing on improving motor efficiency while reducing airframe weight and enhancing overall performance.

In the U.S. market, the demand for aircraft electric motors is also surging. In 2024, the U.S. aircraft electric motors market generated USD 2.7 billion, supported by substantial federal investments in advanced hybrid-electric research and development. Government-backed initiatives, such as NASA's electric powertrain flight demonstration program, are playing a significant role in this growth by helping to accelerate technological breakthroughs in electric propulsion systems for both civil and military aviation applications. These initiatives are also focused on overcoming the integration challenges of electric motors into aircraft systems, ensuring the technology's feasibility for widespread use.

Leading players in the Aircraft Electric Motors Market include Emrax, Safran Group, H3X Technologies, Liebherr Aerospace, Moog, Maxon, Wright Electric, THINGAP, and Electromech Technologies. These companies are heavily investing in research and development to enhance the efficiency, durability, and overall performance of their electric motors. They are also forming strategic partnerships with aircraft manufacturers to integrate electric propulsion systems into new aircraft designs. By focusing on innovation and developing motors specifically tailored for hybrid-electric applications, these companies are positioning themselves at the forefront of the growing demand for sustainable aviation solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump Administration Tariffs

- 3.2.1 Impact on Trade

- 3.2.1.1 Trade Volume Disruptions

- 3.2.1.2 Retaliatory Measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-Side Impact

- 3.2.2.1.1 Price Volatility in Key Components

- 3.2.2.1.2 Supply Chain Restructuring

- 3.2.2.1.3 Production Cost Implications

- 3.2.2.2 Demand-Side Impact (Selling Price)

- 3.2.2.2.1 Price Transmission to End Markets

- 3.2.2.2.2 Market Share Dynamics

- 3.2.2.2.3 Consumer Response Patterns

- 3.2.2.1 Supply-Side Impact

- 3.2.3 Key Companies Impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on Trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Surge in urban air mobility (UAM) & eVTOL development

- 3.3.1.2 Increasing demand for short-haul flights

- 3.3.1.3 Rise of distributed electric propulsion (DEP)

- 3.3.1.4 Hybrid-electric aircraft development

- 3.3.1.5 Technological advancements in electric motors

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Limited energy density of batteries

- 3.3.2.2 Thermal management & safety risks

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 AC motor

- 5.3 DC motor

Chapter 6 Market Estimates and Forecast, By Aircraft Type, 2021 - 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Fixed wing

- 6.3 Rotary wing

- 6.4 Unmanned aerial vehicles

- 6.5 Advanced air mobility

Chapter 7 Market Estimates and Forecast, By Output Power, 2021 - 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Up to 10 kW

- 7.3 10–200 kW

- 7.4 Above 200 kW

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 Propulsion systems

- 8.3 Flight control systems

- 8.4 Environmental control systems

- 8.5 Actuation systems

- 8.6 Cabin interior systems

- 8.7 Other

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AMETEK

- 10.2 ARC Systems

- 10.3 Electromech Technologies

- 10.4 Emrax

- 10.5 Evolito

- 10.6 H3X Technologies

- 10.7 KDE Direct

- 10.8 Liebherr Aerospace

- 10.9 Maxon

- 10.10 Meggitt

- 10.11 MGM Compro

- 10.12 Moog

- 10.13 Safran Group

- 10.14 THINGAP

- 10.15 Turnigy Power Systems

- 10.16 Windings

- 10.17 Wright Electric

- 10.18 Xoar International