|

市场调查报告书

商品编码

1740908

热塑性胶黏膜市场机会、成长动力、产业趋势分析及2025-2034年预测Thermoplastic Adhesive Films Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

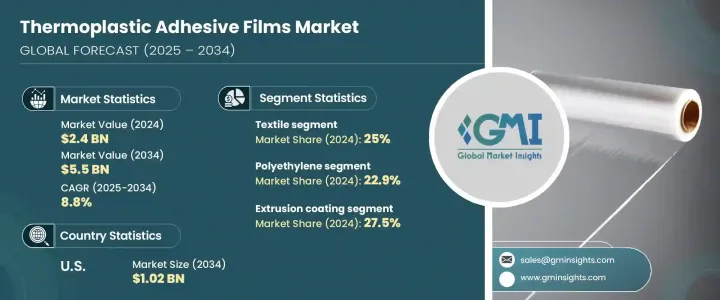

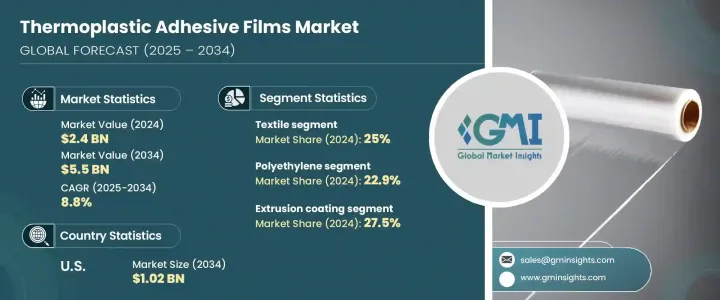

2024年,全球热塑性胶黏膜市场规模达24亿美元,预计到2034年将以8.8%的复合年增长率成长,达到55亿美元。这一成长趋势主要源自于多个终端产业对轻量化材料的日益青睐,尤其是在汽车和电子製造业。热塑性胶黏膜正越来越多地用于黏合零件,同时显着降低产品整体重量。它们能够支持燃油效率目标并有助于减少排放,这与全球日益严格的环境法规和永续发展基准相契合。

在紧凑型电子产品和穿戴式装置中,这些薄膜具有出色的耐热性,这对于在微型高密度产品设计中保持性能至关重要。它们能够在智慧型手机、柔性电子设备和下一代消费设备等空间受限的应用中实现清洁加工和可靠黏合。此外,医疗技术领域正在成为一个潜力巨大的新兴领域,生物相容性、耐化学性和易于灭菌至关重要。这些薄膜可用于各种医疗穿戴式装置和一次性医疗保健产品,提供持久且非侵入性的黏合。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 24亿美元 |

| 预测值 | 55亿美元 |

| 复合年增长率 | 8.8% |

永续性正成为塑造需求的核心主题。热塑性胶黏膜因其无溶剂和可回收特性,被视为环保解决方案,非常适合那些寻求最大限度减少挥发性有机化合物 (VOC) 排放的行业。製造商越来越多地采用环保型胶合剂替代品,以符合监管框架以及环境、社会和治理 (ESG) 目标。薄膜流延和热熔应用等加工技术的进步,提高了胶黏膜的热性能、密封性和黏性,使其在工业层压板和光学系统等高精度要求领域的应用范围不断扩大。

就材料细分而言,2024 年的市场包括聚乙烯、聚酰胺、热塑性聚氨酯、聚酯、聚丙烯、聚烯烃和其他材料类型。 2024 年市值为 24 亿美元,预计到 2034 年将大幅成长至 55 亿美元。其中,聚乙烯占 2024 年总份额的 22.9%,主要原因是其价格实惠、柔韧性好,且能与各种基材良好黏合。聚乙烯用于包装和汽车等领域,但随着各行各业转向更先进的高性能薄膜,其成长率仍然温和。热塑性聚氨酯凭藉其弹性、透明度和优异的耐磨性,正经历着显着的发展动能。对小型化和柔性组件日益增长的需求,支持了其在新兴应用领域的应用。

从技术面来看,2024 年的市场细分为挤出涂覆、热熔胶、树脂共混、薄膜流延和其他加工技术。挤出涂覆法凭藉其高速生产能力和在各种基材上始终如一的涂层质量,以 27.5% 的市场份额占据该细分市场的首位。热熔胶因其无溶剂、环保特性和可靠的黏合强度而迅速发展,尤其是在电子和卫生相关产品领域。树脂共混虽然有利于客製化薄膜特性(例如黏性和耐热性),但由于配方要求复杂且生产成本较高而受到限制。薄膜流延在高精度环境中越来越受欢迎,因为在这些环境中,光滑、无缺陷的薄膜至关重要,尤其是在光学和医疗级应用中。

以2024年的最终用途分析,市场可分为纺织、汽车、电子电气、医疗、防弹、建筑和其他领域。随着服装、家居和智慧纺织品对无缝层压的需求不断增长,纺织业占据了25%的市场份额,占据主导地位。黏合膜在无溶剂纺织品黏合解决方案中发挥关键作用。在汽车领域,对轻量化的追求以及降低噪音、振动和声振粗糙度(NVH)的需求增强了这些薄膜的重要性。医疗应用也在快速发展,尤其是用于健康监测设备和诊断工具的皮肤敏感型和可灭菌薄膜。防弹和国防应用利用高强度薄膜作为防护复合材料的分层材料。

从地区来看,美国在2024年占据全球市场的17.8%,价值约4.3亿美元,预计2034年将成长至10.2亿美元。这一主导地位得益于热塑性胶黏膜在汽车、航太、医疗和电子等先进製造业领域的日益普及。美国对无溶剂胶黏剂的重视及其扶持性政策环境,包括贸易法规和国内采购策略的调整,正在推动本土生产和创新。

推动产业竞争的主要参与者包括陶氏公司、3M 公司、巴斯夫公司、汉高公司和科思创公司等公司,它们各自采用不同的方法来加强其市场地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 汽车轻量化需求不断成长

- 消费性电子产品和穿戴式装置的成长

- 医疗器材产业的扩张

- 越来越青睐可持续黏合剂

- 薄膜流延与热熔技术进步

- 纺织业创新不断涌现(例如智慧纺织品)

- 产业陷阱与挑战

- 原料成本高(例如TPU、聚酰胺)

- 与热固性塑胶相比,耐热性和耐化学性有限

- 多层结构的复杂可回收性

- 成长动力

- 川普政府关税的影响—结构化概述

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 聚乙烯

- 聚酰胺

- 热塑性聚氨酯

- 聚酯纤维

- 聚丙烯

- 聚光学透镜

- 其他材料

第六章:市场估计与预测:依技术分类,2021 年至 2034 年

- 主要趋势

- 挤压涂层

- 热熔胶

- 树脂混合

- 电影选角

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 纺织品

- 汽车

- 电气和电子

- 医疗的

- 防弹保护

- 建造

- 其他最终用途

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- 3M Company

- Arkema SA

- Ashland Global

- Avery Dennison

- BASF SE

- Covestro AG

- Dow Inc.

- DuPont

- EMS-Chemie Holding AG

- HB Fuller

- Henkel AG

- Huntsman Corporation

- Mitsui Chemicals Inc.

- Sika AG

The Global Thermoplastic Adhesive Films Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 5.5 billion by 2034. This upward trend is largely fueled by the growing preference for lightweight materials across several end-use industries, especially in automotive and electronics manufacturing. Thermoplastic adhesive films are being increasingly used to bond components while significantly reducing overall product weight. Their ability to support fuel efficiency goals and contribute to reduced emissions aligns well with tightening environmental regulations and sustainability benchmarks globally.

In compact electronics and wearable devices, these films offer excellent thermal resistance, which is essential for maintaining performance in miniature, high-density product designs. They allow for clean processing and reliable bonding in space-constrained applications such as smartphones, flexible gadgets, and next-gen consumer devices. Additionally, the medical technology sector is emerging as a high-potential area, where biocompatibility, chemical resistance, and easy sterilization are vital. These films are used in a variety of medical wearables and disposable healthcare products, delivering durable yet non-invasive adhesion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $5.5 Billion |

| CAGR | 8.8% |

Sustainability is becoming a central theme in shaping demand. Thermoplastic adhesive films are seen as an eco-conscious solution due to their solvent-free nature and recyclability, making them suitable for industries seeking to minimize VOC emissions. Manufacturers are increasingly adopting environmentally friendly adhesive alternatives to align with regulatory frameworks and environmental, social, and governance (ESG) goals. Advances in processing technologies like film casting and hot melt applications have improved the thermal behavior, sealing ability, and tack properties of adhesive films, expanding their use in areas that demand high precision, such as industrial laminates and optical systems.

In terms of material segmentation, the market in 2024 includes polyethylene, polyamide, thermoplastic polyurethane, polyester, polypropylene, polyolefins, and other material types. With the market valued at USD 2.4 billion in 2024, it is forecast to grow substantially and reach USD 5.5 billion by 2034. Among these, polyethylene accounted for 22.9% of the total share in 2024, primarily due to its affordability, flexibility, and ability to bond well with various substrates. It is used in sectors like packaging and automotive, although its growth rate remains modest as industries shift toward more advanced performance films. Thermoplastic polyurethane is experiencing significant momentum thanks to its elasticity, transparency, and superior abrasion resistance. The growing need for miniaturized and flexible components is supporting its adoption across emerging applications.

From a technology standpoint, the 2024 market is segmented into extrusion coating, hot melt adhesives, resin blending, film casting, and other processing techniques. The extrusion coating method led the segment with a 27.5% market share due to its high-speed production capability and consistent coating quality across various substrates. Hot melt adhesives are expanding quickly, especially in electronics and hygiene-related products, driven by their solvent-free, environmentally sound properties and dependable bond strength. Resin blending, while advantageous for customizing film characteristics like tack and heat resistance, faces constraints due to complex formulation requirements and elevated production costs. Film casting is finding preference in high-precision environments where smooth, defect-free films are essential, particularly for optical and medical-grade applications.

When analyzed by end use in 2024, the market is divided into textiles, automotive, electrical and electronics, medical, ballistic protection, construction, and other sectors. The textile industry led with a 25% share, as demand rises for seamless lamination in garments, home furnishings, and smart textiles. Adhesive films are playing a key role in solvent-free textile bonding solutions. In the automotive domain, the push for lighter vehicles and the need to mitigate noise, vibration, and harshness (NVH) have reinforced the relevance of these films. Medical uses are also advancing rapidly, particularly in skin-sensitive and sterilizable films for health-monitoring devices and diagnostic tools. Ballistic and defense applications leverage high-strength films for layering purposes in protective composites.

Regionally, the United States held a 17.8% share in the global market in 2024, valued at approximately USD 430 million, and is projected to grow to USD 1.02 billion by 2034. This dominance is attributed to the increasing penetration of thermoplastic adhesive films in advanced manufacturing sectors like automotive, aerospace, medical, and electronics. The country's focus on solvent-free adhesives and its supportive policy environment, including adjustments in trade regulations and domestic sourcing strategies, are boosting local production and innovation.

Major players driving competition in the industry include companies like Dow Inc., 3M Company, BASF SE, Henkel AG, and Covestro AG, each adopting different approaches to strengthen their market presence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand in automotive lightweighting

- 3.6.1.2 Growth in consumer electronics and wearables

- 3.6.1.3 Expansion of the medical device industry

- 3.6.1.4 Increasing preference for sustainable adhesives

- 3.6.1.5 Technological advancements in film casting and hot melt

- 3.6.1.6 Rising textile industry innovations (e.g., smart textiles)

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High raw material costs (e.g., TPU, polyamide)

- 3.6.2.2 Limited heat and chemical resistance compared to thermosets

- 3.6.2.3 Complex recyclability of multi-layer structures

- 3.6.1 Growth drivers

- 3.7 Impact of trump administration tariffs – structured overview

- 3.7.1 Impact on trade

- 3.7.1.1 Trade volume disruptions

- 3.7.1.2 Retaliatory measures

- 3.7.2 Impact on the industry

- 3.7.2.1 Supply-side impact (raw materials)

- 3.7.2.1.1 Price volatility in key materials

- 3.7.2.1.2 Supply chain restructuring

- 3.7.2.1.3 Production cost implications

- 3.7.2.2 Demand-side impact (selling price)

- 3.7.2.2.1 Price transmission to end markets

- 3.7.2.2.2 Market share dynamics

- 3.7.2.2.3 Consumer response patterns

- 3.7.2.1 Supply-side impact (raw materials)

- 3.7.3 Key companies impacted

- 3.7.4 Strategic industry responses

- 3.7.4.1 Supply chain reconfiguration

- 3.7.4.2 Pricing and product strategies

- 3.7.4.3 Policy engagement

- 3.7.4.4 Outlook and future considerations

- 3.7.1 Impact on trade

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polyethylene

- 5.3 Polyamide

- 5.4 Thermoplastics polyurethane

- 5.5 Polyester

- 5.6 Polypropylene

- 5.7 Polyolens

- 5.8 Other materials

Chapter 6 Market Estimates and Forecast, By Technologies, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Extrusion coating

- 6.3 Hot melt adhesive

- 6.4 Resin blending

- 6.5 Film casting

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Textile

- 7.3 Automotive

- 7.4 Electrical and electronics

- 7.5 Medical

- 7.6 Ballistic protection

- 7.7 Construction

- 7.8 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M Company

- 9.2 Arkema SA

- 9.3 Ashland Global

- 9.4 Avery Dennison

- 9.5 BASF SE

- 9.6 Covestro AG

- 9.7 Dow Inc.

- 9.8 DuPont

- 9.9 EMS-Chemie Holding AG

- 9.10 H.B. Fuller

- 9.11 Henkel AG

- 9.12 Huntsman Corporation

- 9.13 Mitsui Chemicals Inc.

- 9.14 Sika AG