|

市场调查报告书

商品编码

1740909

复合纸板管包装市场机会、成长动力、产业趋势分析及2025-2034年预测Composite Cardboard Tube Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

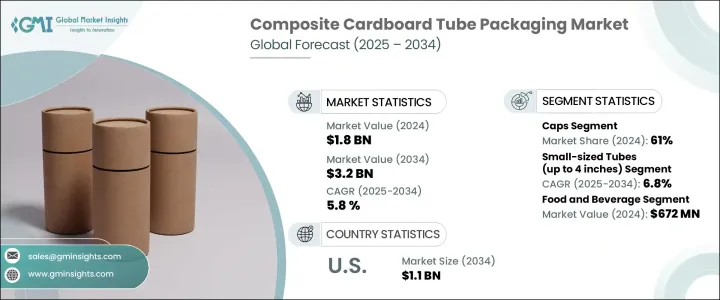

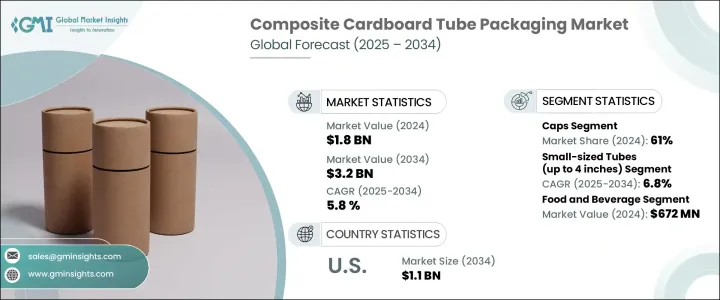

2024年,全球复合纸板管包装市场规模达18亿美元,预计到2034年将以5.8%的复合年增长率增长,达到32亿美元,这主要得益于环保包装需求的不断增长以及电子商务活动的兴起。各行各业的企业都在有意识地转向永续解决方案,而复合纸板管因其具备所有优势——耐用性、可回收性以及提升产品展示效果的美观外观——而备受青睐。从美容和个人护理到食品和工业品,各大品牌选择纸板管包装不仅是为了功能性,也是为了差异化。消费者行为的改变也推动了市场的演变,他们更倾向于减少浪费、可重复使用的包装以及更优质的开箱体验。随着对环保解决方案的需求不断增长,市场预计将迎来更大的创新,製造商将专注于客製化设计、提高材料强度并融入循环经济模式。 D2C(直销)零售的成长、订阅盒服务的兴起以及圆柱形包装礼品的广泛流行,共同塑造了这一发展势头。对于希望在提升货架吸引力的同时留下积极环境影响的品牌来说,复合纸板管是一种实用而时尚的解决方案。随着企业加大对ESG承诺和永续性指标的投入,这种包装形式正迅速成为全球供应链的首选。

儘管如此,市场仍面临着不容忽视的障碍。美国早期贸易政策最初对进口原料和零件征收关税,导致生产成本大幅飙升。製造商正处于抉择的十字路口——要么消化新增成本,要么提高消费者价格,要么转向本地供应商以避免高额进口关税。这种转变加剧了对优化供应链、寻找国内或替代原材料来源以及重新评估供应商合作关係的关注。此外,国际贸易和物流的持续中断也持续考验着库存策略的韧性。企业正在增加对敏捷库存系统的投资,并多样化采购方式,以确保稳定性。材料采购、自动化和营运效率的创新已成为在动盪的市场环境中保持竞争优势和利润率的关键差异化因素。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18亿美元 |

| 预测值 | 32亿美元 |

| 复合年增长率 | 5.8% |

就产品类型而言,瓶盖领域在2024年占据全球复合纸板管包装市场的61%份额,占据主导地位。瓶盖之所以受欢迎,很大程度上得益于其安全封盖功能,既能确保产品在运输过程中的安全,又能方便消费者使用。轻质瓶盖还能降低运输成本,并透过最大限度地减少材料使用,与永续发展目标完美契合。此外,各大品牌正利用这种包装形式,透过触感处理、压花标誌、二维码和智慧标籤技术来提升顾客体验。瓶盖能够将功能性安全与高端设计元素相结合,使其在多个垂直领域中——尤其是在食品、化妆品和个人护理领域——占据优势,因为在这些领域,保护和品牌塑造都至关重要。

直径不超过4吋的小尺寸软管正日益成为成长最快的细分市场,预计到2034年,其复合年增长率将达到6.8%。推动这项需求成长的因素是消费者对紧凑、方便携带的包装的偏好,尤其是在护肤品、美容产品和便携式食品领域。这些软管不仅便携易用,而且经久耐用,触感舒适,提升了品牌体验。随着消费者寻求兼具简约风格和环保理念的包装,小尺寸软管在功能性和美观性方面都表现出色。

受永续包装意识增强和电商生态系统蓬勃发展的推动,美国复合纸板管包装市场预计到2034年将达到11亿美元。国内製造商正在加大投资力度,研发符合监管标准并提升货架可见度的可回收、可生物降解的管材创新产品。这些新设计透过优化重量和体积,帮助品牌减少运输排放,并透过更优的结构设计提升产品安全性。随着塑胶使用法规日益严格,企业越来越倾向于选择纸板管作为可靠、合规且品牌友善的解决方案。

Sonoco、Smurfit Kappa Group、Paper Tubes & Sales、Visican Ltd 和 Marshall Paper Tube Co., Inc. 等领先企业正在积极部署策略,以巩固其市场地位。这些策略包括:采用自动化生产线以提高产量并降低人力成本;合作取得安全原料;扩大产品客製化以服务利基市场;以及整合更高比例的再生材料。为了保持竞争力和领先地位,他们高度重视创新——将设计、永续性和性能融入单一包装解决方案,从而引起品牌和最终用户的共鸣。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 消费者对永续和可回收包装解决方案的偏好日益增长

- 电子商务渗透率不断上升,推动对保护性运输管的需求

- 高端品牌寻求独特品牌差异化的客製化需求日益增加

- 扩大在化妆品、药品和特种食品领域的应用

- 越来越重视永续包装

- 产业陷阱与挑战

- 原物料价格波动影响製造利润率

- 来自替代包装解决方案的竞争

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按关闭类型,2021 - 2034 年

- 主要趋势

- 帽子

- 盖子

第六章:市场估计与预测:按规模,2021 - 2034 年

- 主要趋势

- 小型管(最大 4 英吋)

- 中型管(4至10吋)

- 大尺寸管(超过 10 英吋)

第七章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 食品和饮料

- 製药

- 化妆品和个人护理

- 化学品

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 澳洲

- 韩国

- 日本

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

第九章:公司简介

- Ace Paper Tube Corp

- CBT Packaging

- Chicago Mailing Tube Co.

- Darpac P/L

- Hansen Packaging

- Heartland Products Group

- Marshall Paper Tube Co., Inc.

- Paper Tubes & Sales

- Smurfit Kappa Group

- Sonoco

- Valk Industries

- Visican Ltd

The Global Composite Cardboard Tube Packaging Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 3.2 billion by 2034, driven by the growing demand for eco-friendly packaging and the rise in e-commerce activity. Businesses across industries are making conscious shifts toward sustainable solutions, and composite cardboard tubes are gaining strong traction as they check off all the right boxes-durability, recyclability, and an attractive visual appeal that enhances product presentation. From beauty and personal care to food and industrial goods, brands are turning to tube packaging not just for function but for differentiation. The market's evolution is also being fueled by changing consumer behaviors that favor minimal waste, reusable packaging, and a better unboxing experience. As demand for environmentally responsible solutions climbs, the market is expected to witness greater innovation, with manufacturers focusing on customizing designs, improving material strength, and aligning with circular economy models. The growth of D2C (direct-to-consumer) retail, rising subscription box services, and the widespread popularity of gifting products in cylindrical packaging formats are collectively shaping the momentum. Composite cardboard tubes serve as a practical and stylish solution for brands looking to leave a positive environmental impact while boosting shelf appeal. As companies double down on ESG commitments and sustainability metrics, this packaging format is fast becoming a preferred option across global supply chains.

That said, the market still faces hurdles that can't be ignored. Tariffs on imported raw materials and components, originally introduced under earlier U.S. trade policies, have led to a noticeable spike in production costs. Manufacturers are at a crossroads-either absorb the added costs, increase prices for consumers, or pivot to local suppliers to avoid high import duties. This shift has intensified the focus on optimizing supply chains, finding domestic or alternative raw material sources, and reevaluating supplier partnerships. On top of that, ongoing disruptions in international trade and logistics continue to test the resilience of inventory strategies. Companies are increasingly investing in agile inventory systems and diversifying sourcing methods to ensure stability. Innovation in material sourcing, automation, and operational efficiency has emerged as a critical differentiator in staying ahead of the competition and maintaining margins in a volatile market landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 5.8% |

In terms of product type, the caps segment led the global composite cardboard tube packaging market with a dominant 61% share in 2024. Their popularity is largely due to secure closure features that ensure product safety during shipping while maintaining ease of use for consumers. Lightweight caps also support cost-effective transportation and align well with sustainability goals by minimizing material usage. Additionally, brands are leveraging this format to enhance customer experience through tactile finishes, embossed logos, QR codes, and smart labeling technologies. The ability to blend functional security with high-end design elements gives caps an edge across multiple verticals-particularly in food, cosmetics, and personal care-where both protection and branding are equally critical.

Small-sized tubes measuring up to 4 inches are gaining traction as the fastest-growing segment, projected to expand at a CAGR of 6.8% through 2034. What is fueling this demand is the consumer shift toward compact, travel-friendly packaging options, especially in skincare, beauty, and on-the-go food products. These tubes are not only portable and user-friendly but also provide durability and a premium touch that elevates brand experience. As consumers seek packaging that combines minimalism with eco-conscious appeal, small tubes are delivering on both fronts-functionality and form.

The United States Composite Cardboard Tube Packaging Market is expected to reach USD 1.1 billion by 2034, driven by heightened awareness of sustainable packaging and a robust e-commerce ecosystem. Domestic manufacturers are stepping up by investing in recyclable, biodegradable tube innovations that meet regulatory benchmarks while enhancing shelf visibility. These new designs are helping brands cut down on transportation emissions by optimizing weight and volume and are boosting product safety with better structural design. As regulations around plastic usage become more stringent, businesses are gravitating toward cardboard tubes as a reliable, compliant, and brand-friendly solution.

Leading players such as Sonoco, Smurfit Kappa Group, Paper Tubes & Sales, Visican Ltd, and Marshall Paper Tube Co., Inc. are actively deploying strategies to strengthen their footprint in the market. These include embracing automated production lines to ramp up output and cut labor costs, partnering for secure raw material access, expanding product customization to serve niche markets, and integrating higher percentages of recycled content. To stay relevant and ahead, they are banking heavily on innovation-blending design, sustainability, and performance into a single packaging solution that resonates with both brands and end users.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analyisis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.4 Supply-side impact (raw materials)

- 3.2.1.4.1.1 Price volatility in key materials

- 3.2.1.4.1.2 Supply chain restructuring

- 3.2.1.4.1.3 Production cost implications

- 3.2.1.5 Demand-side impact (selling price)

- 3.2.1.5.1.1 Price transmission to end markets

- 3.2.1.5.1.2 Market share dynamics

- 3.2.1.5.1.3 Consumer response patterns

- 3.2.1.6 Key companies impacted

- 3.2.1.7 Strategic industry responses

- 3.2.1.7.1.1 Supply chain reconfiguration

- 3.2.1.7.1.2 Pricing and product strategies

- 3.2.1.7.1.3 Policy engagement

- 3.2.1.8 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing consumer preference for sustainable and recyclable packaging solutions

- 3.3.1.2 Rising e-commerce penetration driving demand for protective shipping tubes

- 3.3.1.3 Increasing customization needs for premium brands seeking unique brand differentiation

- 3.3.1.4 Expanding applications in cosmetics, pharmaceuticals and specialty food sectors

- 3.3.1.5 Increasing focus on sustainable packaging

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Volatility in raw material prices impacting manufacturing margins

- 3.3.2.2 Competition from alternative packaging solutions

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Closure Type, 2021 - 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Caps

- 5.3 Lids

Chapter 6 Market Estimates and Forecast, By Size, 2021 - 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 Small-sized tubes (up to 4 inches)

- 6.3 Medium-sized tubes (4 to 10 inches)

- 6.4 Large-sized tubes (over 10 inches)

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 ($ Mn & Units)

- 7.1 Key trends

- 7.2 Food and Beverage

- 7.3 Pharmaceuticals

- 7.4 Cosmetics and Personal Care

- 7.5 Chemicals

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Australia

- 8.4.4 South Korea

- 8.4.5 Japan

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 U.A.E.

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Ace Paper Tube Corp

- 9.2 CBT Packaging

- 9.3 Chicago Mailing Tube Co.

- 9.4 Darpac P/L

- 9.5 Hansen Packaging

- 9.6 Heartland Products Group

- 9.7 Marshall Paper Tube Co., Inc.

- 9.8 Paper Tubes & Sales

- 9.9 Smurfit Kappa Group

- 9.10 Sonoco

- 9.11 Valk Industries

- 9.12 Visican Ltd