|

市场调查报告书

商品编码

1740913

eVTOL 飞机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测eVTOL Aircraft Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

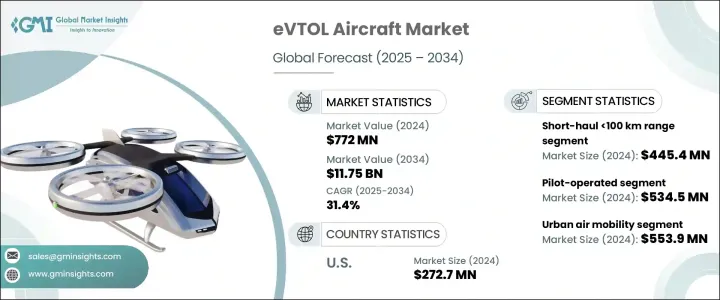

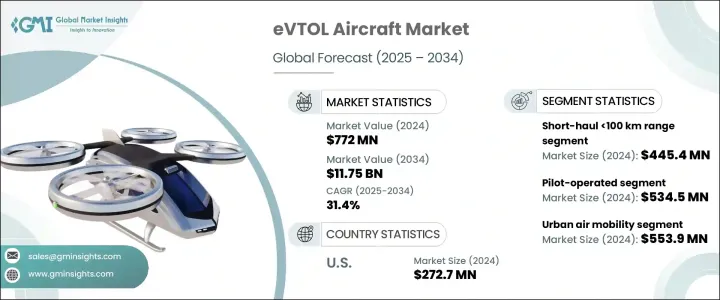

2024 年全球 eVTOL 飞机市场价值为 7.72 亿美元,预计到 2034 年将以 31.4% 的复合年增长率增长至 117.5 亿美元。快速的都市化步伐导致道路拥堵,从而降低了传统交通方式的效率。这种转变引发了人们对替代出行选择的浓厚兴趣,eVTOL 正成为短途、高效、点对点旅行的领先解决方案。政府和城市规划者正在积极鼓励这些飞机作为现代基础设施建设的一部分,并利用公私合作伙伴关係来支持实施。人们也越来越认识到,优化的城市交通系统可以促进整体经济表现。同时,全球对永续发展的推动正在加速向电动交通的转变,进一步提升了 eVTOL 技术在当今环保市场中的相关性。

然而,某些挑战阻碍了市场的成长轨迹。对钢铁、铝和航太零件等主要进口材料征收的关税推高了生产成本,尤其对依赖国际供应链的製造商影响尤为严重。这些成本的增加使得企业更难提供具有竞争力的价格,尤其是在价格高度敏感的市场中。更高的生产成本也转嫁给了消费者,导致零售价格上涨。此外,供应链中断导致最终交付延迟,给买家带来了不确定性,并降低了采用率。儘管存在这些障碍,本土製造商仍然看到了优势,因为减少的海外竞争为他们提供了更大的成长空间。从长远来看,预计该行业将进行重新调整,更多公司将转向国内采购并重新配置供应链,以降低受全球市场波动影响的风险。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.72亿美元 |

| 预测值 | 117.5亿美元 |

| 复合年增长率 | 31.4% |

电动垂直起降 (eVTOL) 越来越被视为解决地面交通低效率问题的实际可行的解决方案。它们能够绕过道路交通拥堵,提供快速直达的路线,这为其带来了极具吸引力的价值主张,尤其对城市通勤者而言。这些飞机采用垂直起降设计,非常适合空间有限的城市环境。各国政府也意识到其改变城市交通的潜力,并将其纳入长期交通规划。随着清洁交通成为国家和国际优先事项,电动航空正获得监管支持和私人投资的支持。

电池技术和电力推进系统的创新在提升电动垂直起降 (eVTOL) 商业可行性方面发挥关键作用。锂离子电池和新兴固态电池的进步正在延长飞行距离、增强安全性并提升有效载荷能力。同时,新材料和高效的推进设计正在降低整体营运成本。这些改进吸引了航太和汽车行业主要参与者的投资,他们看到了城市空中交通的长期潜力。开发商也正在使用轻质复合材料并探索节能马达技术,以在提升飞机性能的同时实现永续发展目标。

依航程划分,短程(100 公里以内)市场在 2024 年的市场规模为 4.454 亿美元。这个类别正蓬勃发展,成为城际和区域航空旅行最实用的解决方案,尤其适用于需要快速、频繁航班的场景。这些飞机非常适合空中计程车、医疗运输和物流等应用。电池的改进有助于延长飞行时间,同时提高有效载荷能力。政府和私人企业正在投资于起降区等配套基础设施,但仍需应对噪音、监管和公众信任等方面的挑战。

按自动驾驶细分,2024 年,飞行员操作的电动垂直起降 (eVTOL) 飞机市场领先,估值达 5.345 亿美元。由于公众信任度较高且监管核准较顺畅,这类机型在商业部署初期较受青睐。虽然对训练有素的飞行员的需求会增加营运成本,但也确保了安全性和操控性,而这在该技术获得更广泛认可的背景下至关重要。各公司正在优先考虑使用者友善的介面和半自动驾驶舱系统,以支援操作员并减轻工作量。这些飞机是迈向完全自动驾驶的基石,有助于建立信誉并累积营运资料,最终将支援更先进的系统。

就区域需求而言,美国占据市场主导地位,2024 年估值达 2.727 亿美元。美国拥有强大的生态系统,由传统航太公司和敏捷的新创公司组成,并受到拥抱技术创新的文化支持。专注于电池和自动化技术的研究工作正在推动市场发展。儘管空中交通管制和公众情绪等整合挑战依然存在,但美国致力于将 eVTOL 服务商业化的决心已透过与旅游公司合作和基础设施投资得到体现。

製造商正采取策略性倡议,透过投资节能设计、降低飞机噪音和整合自动化技术来保持竞争力。一些製造商正在利用人工智慧进行空中交通管理和预测性维护,以简化营运。针对货运、医疗运输和高端航空旅行等细分领域的客製化正成为关键趋势。同时,合併、合作以及与监管机构的协作正在帮助企业扩大营运规模并顺利完成认证流程。数位孪生和机器人等新兴技术也有助于降低成本并提高生产线的安全性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 价格波动

- 供应链重组

- 生产成本影响

- 需求面影响

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 城市拥挤和高效出行需求

- 电池和电力推进技术的进步

- 环境永续性和减排目标

- 不断增加的投资和策略伙伴关係

- 产业陷阱与挑战

- 开发成本高

- 监管审批延迟

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依范围,2021-2034

- 主要趋势

- 短程<100公里

- 中程100-300公里

- 长途运输 >300 公里

第六章:市场估计与预测:依自治级别,2021-2034 年

- 主要趋势

- 先导式

- 遥控

- 完全自主

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 城市空中交通

- 空中救护车

- 旅游与休閒

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Joby Aviation

- Archer Aviation Inc.

- EHang

- Volocopter

- Lilium

- BETA Technologies

- Vertical Aerospace

- Wisk Aero

- Supernal, LLC

- Eve Air Mobility

- Autoflight

- Overair, Inc.

- AeroMobil

- SkyDrive Inc.

- Jaunt Air Mobility LLC.

- Urban Aeronautics

- Bell Textron Inc.

- DORONI AEROSPACE INC. ALL

- Guangdong Huitian Aerospace Technology Co., Ltd.

The Global eVTOL Aircraft Market was valued at USD 772 million in 2024 and is estimated to grow at a CAGR of 31.4% to reach USD 11.75 billion by 2034. The rapid pace of urbanization is driving up road congestion, making traditional transport modes less efficient. This shift is prompting significant interest in alternative mobility options, with eVTOLs emerging as a leading solution for short, efficient, point-to-point travel. Governments and city planners are actively encouraging these aircraft as part of modern infrastructure development, leveraging public-private partnerships to support implementation. There's also growing acknowledgment that an optimized urban transport system can contribute to overall economic performance. Meanwhile, the global push for sustainability is accelerating the transition toward electric-powered mobility, further boosting the relevance of eVTOL technology in today's eco-conscious markets.

However, certain challenges have tempered the market's growth trajectory. Tariffs imposed on key imported materials such as steel, aluminum, and aerospace components have driven up production costs, particularly impacting manufacturers relying on international supply chains. These increased costs have made it harder for companies to offer competitive pricing, especially in a market that is highly price sensitive. Higher production expenses are also being passed on to consumers, causing retail prices to climb. Additionally, supply chain interruptions have delayed final deliveries, creating uncertainty for buyers and slowing adoption rates. Despite these hurdles, local manufacturers have seen an advantage, as reduced foreign competition gives them more room to grow. Over the long term, the industry is expected to recalibrate, with more companies turning to domestic sourcing and reconfiguring supply chains to become less vulnerable to global disruptions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $772 Million |

| Forecast Value | $11.75 Billion |

| CAGR | 31.4% |

eVTOLs are increasingly being viewed as a practical answer to the inefficiencies of ground-based transportation. Their ability to bypass road traffic and enable swift, direct routes offers a compelling value proposition, especially for urban commuters. These aircraft are designed to land and take off vertically, making them ideal for city environments with limited space. Governments are also acknowledging their potential to transform urban mobility and are integrating them into long-term transportation planning. As clean transportation becomes a national and international priority, electric aviation is gaining support through both regulatory backing and private investment.

Innovation in battery technology and electric propulsion systems is playing a pivotal role in making eVTOLs more commercially viable. Advances in lithium-ion and emerging solid-state batteries are extending flight range, enhancing safety, and increasing payload capacity. At the same time, new materials and efficient propulsion designs are lowering overall operational costs. These improvements are attracting investments from major players in the aerospace and automotive sectors, who see long-term potential in urban air mobility. Developers are also using lightweight composites and exploring energy-efficient motor technologies to enhance aircraft performance while meeting sustainability goals.

By range, the short-haul (up to 100 km) segment accounted for USD 445.4 million in 2024. This category is gaining momentum as the most practical solution for intra-city and regional air travel, especially for use cases requiring quick, frequent flights. These aircraft are well-suited for applications like air taxis, medical transportation, and logistics. Battery improvements are helping extend flight times while increasing payload capacity. Governments and private firms are investing in supporting infrastructure like takeoff and landing zones, though challenges related to noise, regulation, and public trust still need to be addressed.

When broken down by autonomy, pilot-operated eVTOLs led the market in 2024 with a valuation of USD 534.5 million. These models are preferred during the initial stages of commercial deployment due to greater public trust and smoother regulatory approval. While the requirement for trained pilots increases operational costs, it also ensures safety and control, which is critical as the technology gains broader acceptance. Companies are prioritizing user-friendly interfaces and semi-automated cockpit systems to support operators and reduce workload. These aircraft serve as a stepping stone to full autonomy, helping to build credibility and operational data that will eventually support more advanced systems.

In terms of regional demand, the U.S. dominated the market with a valuation of USD 272.7 million in 2024. The country offers a strong ecosystem of legacy aerospace firms and agile startups, supported by a culture that embraces technological innovation. Research efforts focused on battery and automation technologies are pushing the market forward. While integration challenges like air traffic control and public sentiment remain, the country's commitment to commercializing eVTOL services is evident through partnerships with mobility companies and infrastructure investments.

Manufacturers are taking strategic steps to remain competitive by investing in energy-efficient designs, reducing aircraft noise, and integrating automation. Some are leveraging AI for air traffic management and predictive maintenance to streamline operations. Customization for niche sectors like cargo, medical transport, and premium air travel is becoming a key trend. At the same time, mergers, partnerships, and collaborations with regulatory authorities are helping firms scale operations and navigate certification processes. Emerging technologies like digital twins and robotics are also helping reduce costs and increase safety across production lines.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Urban congestion and need for efficient mobility

- 3.3.1.2 Advancements in battery and electric propulsion technologies

- 3.3.1.3 Environmental sustainability and emission reduction goals

- 3.3.1.4 Rising investments and strategic partnerships

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High development costs

- 3.3.2.2 Regulatory approval delays

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Range, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Short-Haul <100 km

- 5.3 Medium-Haul 100-300 km

- 5.4 Long-Haul >300 km

Chapter 6 Market Estimates & Forecast, By Autonomy Level, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Pilot-operated

- 6.3 Remote-piloted

- 6.4 Fully autonomous

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Urban air mobility

- 7.3 Air ambulance

- 7.4 Tourism & leisure

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Joby Aviation

- 9.2 Archer Aviation Inc.

- 9.3 EHang

- 9.4 Volocopter

- 9.5 Lilium

- 9.6 BETA Technologies

- 9.7 Vertical Aerospace

- 9.8 Wisk Aero

- 9.9 Supernal, LLC

- 9.10 Eve Air Mobility

- 9.11 Autoflight

- 9.12 Overair, Inc.

- 9.13 AeroMobil

- 9.14 SkyDrive Inc.

- 9.15 Jaunt Air Mobility LLC.

- 9.16 Urban Aeronautics

- 9.17 Bell Textron Inc.

- 9.18 DORONI AEROSPACE INC. ALL

- 9.19 Guangdong Huitian Aerospace Technology Co., Ltd.