|

市场调查报告书

商品编码

1740916

汽车盘式联轴器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Disc Couplings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

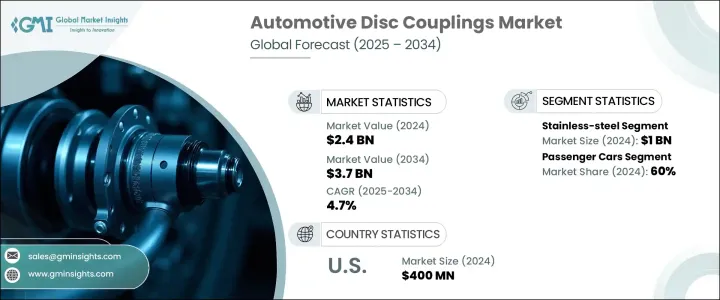

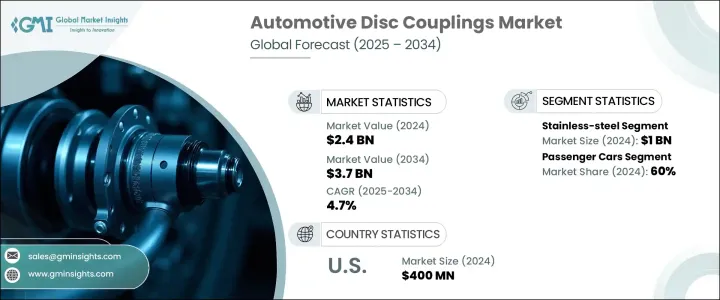

2024年,全球汽车盘式联轴器市场规模达24亿美元,预计2034年将以4.7%的复合年增长率成长,达到37亿美元。这得归功于市场对精密互动式汽车内装日益增长的需求,以及智慧技术在汽车领域的日益普及。随着汽车製造商持续向电气化和自动化转型,盘式联轴器已成为支援兼顾功能性和美观性的高性能係统的关键部件。这些零件在连接机械和电子子系统方面发挥着至关重要的作用,尤其是在电动车(EV)和自动驾驶平台中,无缝整合和以用户为中心的体验已成为常态。

汽车产业正在快速发展,重点关注下一代出行方式和更智慧的座舱技术。随着驾驶者偏好转向更直觉、更沉浸式的驾驶体验,膜片联轴器正在协助开发超越传统开关和控制装置的创新系统。消费者正在寻找具有触控响应、多功能表面、整合触觉和智慧介面的车辆,而膜片联轴器有助于弥合硬体和软体之间的差距,从而提高安全性、响应速度和舒适性。汽车製造商越来越多地采用先进的动力传动系统和控制技术,这些技术需要可靠、轻量化、高强度的零件,能够承受恶劣条件、振动和高负载。随着这种需求的不断增长,膜片联轴器正被整合到电动传动系统、资讯娱乐模组和内部控制系统中,以确保更平稳的运作和更高的能源效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 24亿美元 |

| 预测值 | 37亿美元 |

| 复合年增长率 | 4.7% |

技术不断重新定义汽车膜片联轴器的功能。最新研发成果包括嵌入式感测器和3D触控表面,顺应了智慧汽车系统日益增长的趋势。这些创新在电动车和自动驾驶汽车领域尤其重要,因为这些汽车的座舱技术正在不断发展,以提供免持、语音控制和响应迅速的使用者介面。随着汽车製造商致力于降低传统控制的复杂性并增强驾驶员互动,膜片联轴器推动了向简洁、互动式仪錶板和集中控制中心的转变。触觉回馈、动态氛围照明和自适应资讯娱乐系统等功能依赖精确的机电连接,这使得膜片联轴器不可或缺。

就材料细分而言,市场包括不銹钢、铝和塑胶膜片联轴器。其中,不锈钢以2024年约10亿美元的估值占据市场领先地位。这种优势源自于其卓越的强度、耐热性和高耐用性——这些特性是高性能和电动车的关键特性。不銹钢联轴器能够有效承受剧烈振动和极端条件,使其成为长期可靠性和性能一致性要求严格的应用的理想选择。随着汽车製造商强调永续和高输出动力传动系统,不銹钢仍然是工程师在设计高性能和长寿命产品时的首选材料。

根据最终用途,汽车膜片联轴器市场可分为乘用车和商用车。 2024年,乘用车占了全球市场的60%。这一强劲成长得益于电动和自动驾驶技术在消费性汽车中的日益普及。原始设备製造商更专注于透过智慧介面、轻量化传动系统组件和无缝内装控制系统来优化驾驶体验——所有这些都需要整合坚固耐用的膜片联轴器系统。从小型电动车到高端自动驾驶汽车,膜片联轴器确保从资讯娱乐到动力传输的每个部件都能平稳安全地运作。

从地区来看,北美汽车盘式联轴器市场在2024年的产值达到4亿美元。美国汽车产业持续引领尖端动力传动系统技术的实施。美国国内汽车製造商正在大力投资电气化,并采用先进的盘式联轴器来提升性能和驾驶舒适度。随着电动车在美国的普及,对能够承受电动传动系统热负荷和振动的高品质联轴器的需求正在大幅增长。该地区的研究活动也不断增加,旨在开发轻量化、高效的零件,以支援汽车电气化目标。

全球汽车碟式联轴器市场的主要参与者包括弗兰德 (Flender)、约翰克兰 (John Crane)、爱斯科 (ESCO)、铁姆肯 (Timken)、REICH 和 Rathi Transpower。这些公司正透过策略联盟、持续的产品创新以及高度重视研发来提升竞争优势。他们正在投资轻量化、耐腐蚀材料和模组化联轴器设计,以提高与下一代汽车平台的兼容性。许多参与者还透过整合智慧功能来提升产品性能,以满足不断变化的消费者期望以及原始设备OEM)对节能和性能驱动解决方案的要求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 配销通路分析

- 最终用途

- 利润率分析

- 供应商格局

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 对贸易的影响

- 技术与创新格局

- 专利分析

- 监管格局

- 成本細項分析

- 重要新闻和倡议

- 衝击力

- 成长动力

- 向电动车和自动驾驶汽车转变

- 材料和感测技术的进步

- 向电动车和自动驾驶汽车转变

- OEM客製化与品牌差异化倡议

- 产业陷阱与挑战

- 开发和整合成本高

- 与旧系统的兼容性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 挠性联轴器

- 刚性联轴器

- 膜片联轴器

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 传动系统

- 传动系统

- 动力传动系统

第八章:市场估计与预测:按材料 2021 - 2034

- 主要趋势

- 不銹钢

- 铝

- 塑胶

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Altra

- ASA Electronics

- Challenge

- Coupling

- CURRAX

- Dodge

- ESCO

- Flender

- John Crane

- Korea Coupling

- Lovejoy

- R+W Coupling

- Rathi Transpower

- Regal Rexnord

- REICH

- RENK-MAAG

- Renold

- Timken

- Tsubakimoto

- Voith

The Global Automotive Disc Couplings Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 3.7 billion by 2034, fueled by the increasing demand for sophisticated, interactive vehicle interiors and the rising integration of smart technologies into the automotive sector. As vehicle manufacturers continue transitioning toward electrification and automation, disc couplings have become vital in supporting high-performance systems that prioritize both functionality and aesthetics. These components play a crucial role in linking mechanical and electronic subsystems, especially in electric vehicles (EVs) and autonomous platforms, where seamless integration and user-centric experiences are now the norm.

The automotive industry is evolving rapidly, with a sharp focus on next-gen mobility and smarter in-cabin technologies. As driver preferences shift toward more intuitive and immersive driving experiences, disc couplings are enabling the development of innovative systems that go beyond traditional switches and controls. Consumers are looking for vehicles that offer touch-responsive, multifunctional surfaces, integrated haptics, and smart interfaces-and disc couplings help bridge the gap between hardware and software, enhancing safety, responsiveness, and comfort. Automakers are increasingly embracing advanced drivetrain and control technologies that demand reliable, lightweight, and high-strength components capable of withstanding harsh conditions, vibrations, and high loads. With this demand on the rise, disc couplings are being integrated into electric drivetrains, infotainment modules, and interior control systems to ensure smoother operation and improved energy efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $3.7 Billion |

| CAGR | 4.7% |

Technology continues to redefine the functionality of automotive disc couplings. The latest developments feature embedded sensors and 3D touch surfaces that align with the growing trend of intelligent vehicle systems. These innovations are particularly relevant in EVs and autonomous vehicles, where in-cabin technology is evolving to deliver hands-free, voice-controlled, and responsive user interfaces. As automakers work to reduce the complexity of traditional controls and enhance driver interaction, disc couplings enable the shift toward clean, interactive dashboards and centralized control hubs. Features like haptic feedback, dynamic ambient lighting, and adaptive infotainment systems rely on precise mechanical-electronic connectivity-making disc couplings indispensable.

In terms of material segmentation, the market includes stainless steel, aluminum, and plastic disc couplings. Among these, stainless steel led the market with a valuation of around USD 1 billion in 2024. This dominance stems from its superior strength, resistance to heat, and high durability-key attributes for use in high-performance and electric vehicles. Stainless steel couplings can efficiently handle intense vibrations and extreme conditions, making them ideal for applications where long-term reliability and performance consistency are non-negotiable. As automakers emphasize sustainable and high-output drivetrains, stainless steel remains the go-to material for engineers designing for performance and longevity.

Based on end use, the automotive disc couplings market is categorized into passenger cars and commercial vehicles. Passenger cars accounted for 60% of the global market in 2024. This stronghold is attributed to the increasing adoption of electric and autonomous technologies in consumer vehicles. OEMs are placing greater focus on optimizing the driving experience with smart interfaces, lightweight drivetrain components, and seamless interior controls-all of which demand the integration of robust disc coupling systems. From compact EVs to high-end autonomous cars, disc couplings ensure that every element, from infotainment to power transmission, operates smoothly and safely.

Regionally, the North America Automotive Disc Couplings Market generated USD 400 million in 2024. The U.S. automotive industry continues to lead with the implementation of cutting-edge drivetrain technologies. Domestic automakers are investing heavily in electrification and are incorporating advanced disc couplings to boost performance and driver comfort. With EV adoption gaining momentum across the U.S., the need for high-quality couplings that can handle thermal loads and vibration in electric drivetrains is growing substantially. This region is also witnessing increased research activity aimed at developing lightweight, efficient components to support vehicle electrification targets.

Key players in the global automotive disc couplings market include Flender, Dodge, Regal Rexnord, RENK-MAAG, Voith, John Crane, ESCO, Timken, REICH, and Rathi Transpower. These companies are sharpening their competitive edge through strategic alliances, continuous product innovation, and a strong emphasis on research and development. They are investing in lightweight, corrosion-resistant materials and modular coupling designs to improve compatibility with next-gen automotive platforms. Many of these players are also advancing product capabilities by integrating smart features that align with evolving consumer expectations and OEM requirements for energy efficiency and performance-driven solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Shift toward electric and autonomous vehicles

- 3.8.1.2 Advancements in material and sensing technology

- 3.8.1.3 Shift toward electric and autonomous vehicles

- 3.8.1.4 OEM initiatives for customization and brand differentiation

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High development and integration costs

- 3.8.2.2 Compatibility issues with legacy systems

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Flexible couplings

- 5.3 Rigid couplings

- 5.4 Disc couplings

Chapter 6 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial Vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Drivetrain system

- 7.3 Transmission system

- 7.4 Powertrain system

Chapter 8 Market Estimates & Forecast, By Material 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Stainless steel

- 8.3 Aluminum

- 8.4 Plastic

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Altra

- 10.2 ASA Electronics

- 10.3 Challenge

- 10.4 Coupling

- 10.5 CURRAX

- 10.6 Dodge

- 10.7 ESCO

- 10.8 Flender

- 10.9 John Crane

- 10.10 Korea Coupling

- 10.11 Lovejoy

- 10.12 R+W Coupling

- 10.13 Rathi Transpower

- 10.14 Regal Rexnord

- 10.15 REICH

- 10.16 RENK-MAAG

- 10.17 Renold

- 10.18 Timken

- 10.19 Tsubakimoto

- 10.20 Voith