|

市场调查报告书

商品编码

1740932

血管摄影设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Angiography Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

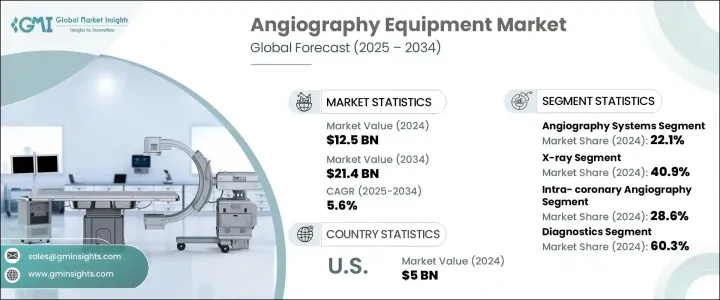

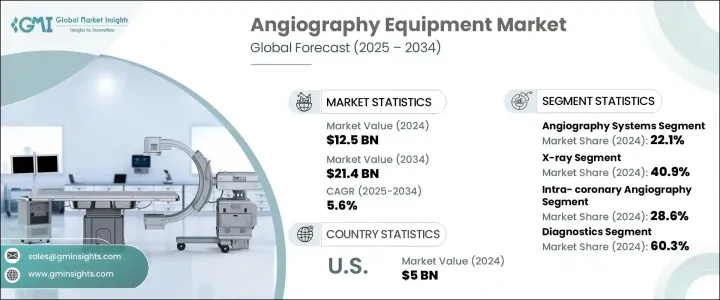

2024年,全球血管摄影设备市场规模达125亿美元,预计年复合成长率将达5.6%,2034年将达214亿美元。这主要得益于心血管疾病负担的加重以及全球人口老化加剧,导致诊断和介入治疗需求频繁增加。高血压、糖尿病和肥胖等慢性疾病的盛行率不断上升,显着增加了需要血管影像检查的患者数量。随着全球医疗保健领域转向早期发现和微创治疗,对先进血管造影设备的需求预计将大幅成长。医院和诊断中心正在迅速采用尖端技术,以改善临床疗效、缩短手术时间并最大程度地减少患者的放射线暴露。

3D影像、平板侦测器和人工智慧增强成像软体等技术突破正在彻底改变血管疾病的诊断和治疗方法。不断增长的医疗保健投资、优惠的报销方案以及人们对预防性心臟保健日益增长的认识,为全球血管造影设备製造商创造了新的机会。新兴经济体的医疗保健基础设施正在显着改善,推动先进诊断工具的普及。随着政府和私营机构加强应对非传染性疾病的力度,预计未来十年,血管造影系统等高精度成像解决方案的采用将实现强劲增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 125亿美元 |

| 预测值 | 214亿美元 |

| 复合年增长率 | 5.6% |

在所有产品类型中,血管摄影系统在2024年的市占率为22.1%。这些系统仍然是诊断和介入手术中详细血管影像的首选。它们能够提供即时、准确和动态的成像,在处理复杂的心血管、神经血管和肿瘤病例方面发挥着至关重要的作用。持续的创新投入带来了许多改进,例如降低辐射剂量和提高影像清晰度,帮助医院提供更安全、更有效率的病患治疗方案。易用性的提升和使用者介面设计的改进,进一步推动了它们在各种医疗环境中的普及。

根据具体操作方法,冠状动脉内造影在2024年占据了28.6%的市场。随着心血管疾病持续上升,冠状动脉内造影对于急诊介入和择期手术都至关重要。血流储备分数(FFR)和光学相干断层扫描(OCT)等创新技术已将重点从单纯的解剖评估转向功能评估,从而改善了干预期间的决策。随着冠状动脉疾病日益加重全球健康负担,冠状动脉内造影的作用将持续扩大,尤其是在其整合到混合手术室和先进的导管室之后。

受不断增长的临床需求和强大的医疗保健体系推动,美国血管造影设备市场规模在2024年达到50亿美元。肥胖、高血压和人口老化率的上升,推动了国家层级推广早期诊断和预防性筛检的措施。保险覆盖范围的扩大和综合医疗网络的兴起,使得血管造影评估在门诊中心和农村地区更加便捷。此外,数位平台的采用使得血管摄影能够无缝整合到常规心血管评估中,从而提高了速度和准确性。

全球血管摄影设备市场的领导公司包括美敦力、佳能医疗系统、通用电气医疗、Cordis、飞利浦、Merit Medical、东芝医疗系统、Angiodynamics、西门子医疗、微创医疗科学、康德乐健康、贝朗、雅培、波士顿科学和岛津製作所。主要参与者正在大力投资研发,以推出整合人工智慧的低辐射系统,并扩大全球合作伙伴关係以扩大市场覆盖范围,同时根据新兴市场的本地化临床需求和法规客製化产品。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 心血管疾病盛行率不断上升

- 人口老化加剧

- 成像技术的技术进步

- 越来越多的公共卫生措施旨在早期发现心臟病

- 产业陷阱与挑战

- 设备采购维护成本高

- 与辐射暴露相关的风险

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 技术格局

- 未来市场趋势

- 差距分析

- 专利分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 血管摄影系统

- 导管

- 导丝

- 气球

- 显影剂

- 血管闭合装置

- 血管摄影配件

第六章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- X射线

- 影像增强器

- 平板探测器

- MRA

- CT

第七章:市场估计与预测:按程序,2021 年至 2034 年

- 主要趋势

- 冠状动脉造影

- 血管内血管摄影

- 神经血管摄影

- 肿瘤血管摄影

- 其他血管摄影程序

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 诊断

- 疗法

第九章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院和诊所

- 诊断和影像中心

- 其他最终用途

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Abbott

- Angiodynamics

- B. BRAUN

- Boston Scientific

- Canon Medical System

- Cardinal Health

- Cordis

- GE Healthcare

- Koninklijke Philips

- Medtronic

- Merit Medical

- Microport Scientific

- Shimadzu

- Siemens Healthineers

- Toshiba Medical System

The Global Angiography Equipment Market was valued at USD 12.5 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 21.4 billion by 2034, driven by the rising burden of cardiovascular diseases and an increasingly aging global population that demands frequent diagnostic and interventional care. The escalating prevalence of chronic conditions like hypertension, diabetes, and obesity is significantly increasing the number of patients who require vascular imaging procedures. As the global healthcare landscape shifts toward early detection and minimally invasive treatments, the demand for advanced angiography equipment is expected to soar. Hospitals and diagnostic centers are rapidly adopting cutting-edge technologies to enhance clinical outcomes, reduce procedure time, and minimize patient exposure to radiation.

Technological breakthroughs such as 3D imaging, flat-panel detectors, and AI-enhanced imaging software are revolutionizing the way vascular disorders are diagnosed and treated. Growing healthcare investments, favorable reimbursement scenarios, and rising awareness about preventative cardiac care are creating new opportunities for angiography equipment manufacturers worldwide. Emerging economies are witnessing major improvements in healthcare infrastructure, fueling broader access to advanced diagnostic tools. As governments and private organizations ramp up efforts to tackle non-communicable diseases, the adoption of high-precision imaging solutions like angiography systems is expected to experience robust growth over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.5 Billion |

| Forecast Value | $21.4 Billion |

| CAGR | 5.6% |

Among all product types, the angiography systems segment accounted for a 22.1% share in 2024. These systems continue to be the preferred choice for detailed vessel imaging in both diagnostic and interventional procedures. Their ability to deliver real-time, accurate, and dynamic imaging has made them crucial in managing complex cardiovascular, neurovascular, and oncological cases. Continuous investments in innovation have led to improvements such as reduced radiation doses and enhanced imaging clarity, helping hospitals deliver safer, more efficient patient outcomes. Enhanced ease of use and advancements in user interface design are further driving their adoption across various care settings.

Based on the procedure, the intra-coronary angiography segment generated a 28.6% share in 2024. As cardiovascular diseases maintain a rising trend, intra-coronary angiography remains vital for both emergency interventions and elective procedures. Innovations like fractional flow reserve (FFR) and optical coherence tomography (OCT) have shifted the focus from purely anatomical assessments to functional evaluations, improving decision-making during interventions. With coronary artery disease presenting a growing global health burden, the role of intra-coronary angiography is set to expand, especially with its integration into hybrid ORs and advanced cath labs.

The U.S. Angiography Equipment Market reached USD 5 billion in 2024, fueled by rising clinical demand and a strong healthcare system. The growing rates of obesity, hypertension, and an aging population have driven national initiatives promoting early diagnostics and preventative screenings. Expanded insurance coverage and the rise of integrated healthcare networks have made angiographic evaluations more accessible across outpatient centers and rural areas. Additionally, the adoption of digital platforms has enabled seamless integration of angiography into routine cardiovascular assessments, boosting speed and accuracy.

Leading companies operating in the Global Angiography Equipment Market include Medtronic, Canon Medical System, GE Healthcare, Cordis, Philips, Merit Medical, Toshiba Medical System, Angiodynamics, Siemens Healthineers, Microport Scientific, Cardinal Health, B. Braun, Abbott, Boston Scientific, and Shimadzu Corporation. Major players are heavily investing in R&D to launch AI-integrated, low-radiation systems and expanding global partnerships to strengthen market reach while tailoring products for emerging markets with localized clinical needs and regulations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular diseases

- 3.2.1.2 Rise in aging population

- 3.2.1.3 Technological advancements in imaging techniques

- 3.2.1.4 Growing public health initiatives for early detection of cardiac diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated to equipment procurement and maintenance

- 3.2.2.2 Risk related to radiation exposure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Patent analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Angiography systems

- 5.3 Catheters

- 5.4 Guidewire

- 5.5 Balloons

- 5.6 Contrast media

- 5.7 Vascular closure devices

- 5.8 Angiography accessories

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 X-ray

- 6.2.1 Image intensifiers

- 6.2.2 Flat-panel detectors

- 6.3 MRA

- 6.4 CT

Chapter 7 Market Estimates and Forecast, By Procedure, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Coronary angiography

- 7.3 Endovascular angiography

- 7.4 Neuroangiography

- 7.5 Onco-angiography

- 7.6 Other angiography procedures

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Diagnostics

- 8.3 Therapeutics

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and clinics

- 9.3 Diagnostic and imaging centers

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherland

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott

- 11.2 Angiodynamics

- 11.3 B. BRAUN

- 11.4 Boston Scientific

- 11.5 Canon Medical System

- 11.6 Cardinal Health

- 11.7 Cordis

- 11.8 GE Healthcare

- 11.9 Koninklijke Philips

- 11.10 Medtronic

- 11.11 Merit Medical

- 11.12 Microport Scientific

- 11.13 Shimadzu

- 11.14 Siemens Healthineers

- 11.15 Toshiba Medical System