|

市场调查报告书

商品编码

1740934

造粒机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Granulator Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

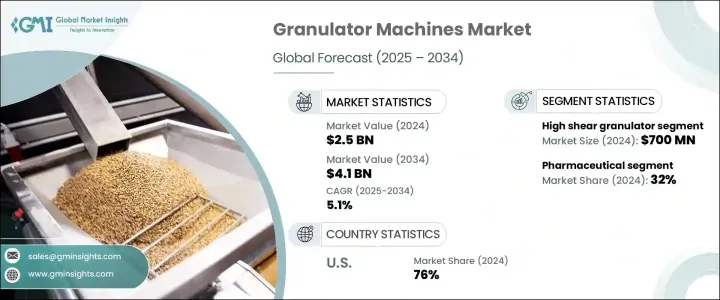

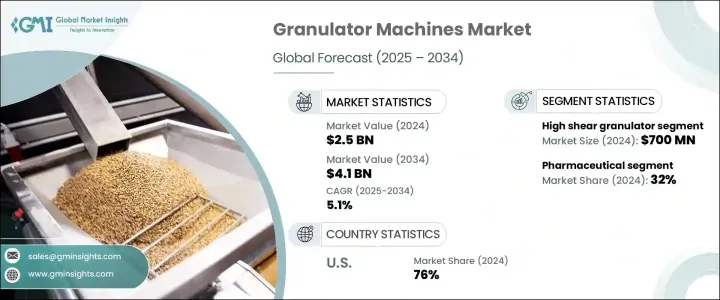

2024年,全球造粒机市场规模达25亿美元,预估年复合成长率为5.1%,2034年将达41亿美元。这一成长主要源于多个行业日益增长的需求,尤其是在製药业,造粒机对于生产药片、胶囊和其他剂型至关重要。随着药物配方日益复杂,以及对精确粒度的需求日益增长,各公司纷纷投资先进的造粒设备,以确保产品的品质、一致性并符合严格的法规要求。

製药技术的创新和对高品质製剂日益增长的需求极大地影响了现代製粒机的应用。这些机器透过提供均匀的颗粒,在满足生产标准方面发挥关键作用,这对于控制药物释放和增强吸收至关重要。製药业的不断发展,以及机械设计和自动化技术的进步,推动了对能够处理大量物料并保持稳定品质的精密设备的需求。这种日益增长的需求也反映在其他行业,例如化学品、食品加工、塑胶和回收利用,高性能製粒设备是这些行业高效运作不可或缺的一部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 25亿美元 |

| 预测值 | 41亿美元 |

| 复合年增长率 | 5.1% |

2024年,高剪切造粒机成为领先的机器类型,创造了约7亿美元的收入。这些机器因其能够提供可自订的颗粒尺寸和形状而备受推崇,使其成为精度至关重要的应用的理想选择。该细分市场的受欢迎程度很大程度上归功于其先进的功能,这些功能使製造商能够微调造粒参数以获得最佳效果。同时,旋转滚筒造粒机预计将在预测期内录得最快成长,预计2025年至2034年的复合年增长率约为5.4%。其高容量处理能力使其特别适合需要大量生产的行业,例如化学品和肥料製造。

自动化和即时监控技术的日益普及正在改变製粒机的运作方式。製造商正在采用物联网驱动的系统,以便更好地控制混合时间和水分含量等变量,最终提高产品品质并最大限度地减少批次间差异。这些智慧增强功能还使操作员能够即时调整生产参数,确保高效率并降低营运成本。在旋转滚筒製粒机中,较新的型号现在配备了先进的温度和湿度控制系统,并提高了能源效率,以满足日益严格的环境和永续性标准。

市场根据终端行业进行分类,包括製药、化学品、食品、塑胶、回收等。 2024年,製药业占据了整个市场的32%,反映出其在推动高精度造粒设备需求方面发挥主导作用。製药生产日益复杂,尤其是在生产一致均匀的颗粒方面,这促使人们转向能够提供更佳製程控制的设备。高剪切造粒机和旋转造粒机因其能够保持颗粒均匀性并提供可扩展的生产能力,正日益得到应用。

技术进步也使造粒设备的应用范围拓展到食品加工领域。自动化程度的提高和精简的控制系统使这些机器更适合生产质地和品质一致的加工和包装食品。在化学和化肥行业,转鼓造粒机因其能够在不影响一致性和效率的情况下处理大规模生产的能力而日益受到青睐。

从地理分布来看,美国在2024年占据了北美製粒机市场的主导地位,占据了近76%的市场份额,创造了约6亿美元的市场收入。美国强大的製药和化学製造基础在维持这一成长势头方面发挥着重要作用。随着製药业的持续扩张,对符合监管标准的先进製粒设备的需求也不断增长。高剪切和振盪製粒机因其卓越的产出品质和可靠性,越来越受到製造商的青睐。

在化学领域,向大批量、高品质生产的转变推动了智慧造粒机的广泛应用。这些机器帮助製造商在实现大量生产的同时保持产品的一致性,使其成为现代化工加工设施的关键部件。

造粒机产业拥有多家知名企业,它们正积极投资技术开发和策略合作,以增强市场影响力。这些措施旨在提供更有效率、更具适应性、更便利的解决方案,以满足不断变化的产业需求。透过提升技术能力并进行创新合作,各企业致力于提供先进的造粒解决方案,进而提升不同终端应用领域的生产力与产品品质。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製成品

- 经销商

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 製药业需求不断成长

- 化工和化肥行业的成长

- 产业陷阱与挑战

- 初期投资及维护成本高

- 机器操作和训练的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按机器类型,2021 - 2034 年

- 主要趋势

- 振盪製粒机

- 高剪切製粒机

- 振动製粒机

- 旋转滚筒造粒机

- 滚压式製粒机

- 其他(圆盘造粒机等)

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 湿式製粒机

- 干式製粒机

第七章:市场估计与预测:依营运模式,2021 - 2034 年

- 主要趋势

- 手动的

- 半自动

- 全自动

第八章:市场估计与预测:依产能,2021 - 2034 年

- 主要趋势

- 低于500公斤/小时

- 500至1000公斤/小时

- 1000至1500公斤/小时

- 1500公斤/小时以上

第九章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 製药

- 化学

- 食品工业

- 塑胶工业

- 回收业

- 其他(化妆品行业等)

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直销

- 间接销售

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十二章:公司简介

- Allpack

- Cumberland

- Fluid Air

- Freund-Vector

- GEA

- Getecha

- Glatt

- GlobePharma

- Levstal

- Rapid Granulator

- ServoLiFT

- THM recycling solutions

- Vaner Machinery

- Wittmann

- Xertecs

The Global Granulator Machines Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 4.1 billion by 2034. This growth is primarily driven by rising demand across several industries, particularly in pharmaceutical manufacturing, where granulator machines are crucial for producing tablets, capsules, and other dosage forms. With the increasing complexity of drug formulations and the need for precise particle size, companies are investing in advanced granulation equipment to ensure quality, consistency, and compliance with stringent regulations.

Innovations in pharmaceutical technology and the growing demand for high-quality formulations have significantly influenced the adoption of modern granulators. These machines play a critical role in meeting production standards by delivering uniform granules, essential for controlled drug release and enhanced absorption. The expanding pharmaceutical sector, along with technological advancements in machine design and automation, is fueling the need for precision equipment capable of handling large volumes while maintaining consistent quality. This rising need is also being mirrored in other sectors, such as chemicals, food processing, plastics, and recycling, where high-performance granulation equipment is integral to efficient operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 5.1% |

In 2024, high shear granulators emerged as the leading machine type, generating approximately USD 700 million in revenue. These machines are particularly valued for their ability to deliver customizable granule sizes and shapes, making them ideal for applications where precision is critical. The segment's popularity is largely attributed to its advanced features that allow manufacturers to fine-tune granulation parameters for optimal results. Meanwhile, rotary drum granulators are anticipated to record the fastest growth during the forecast period, with a projected CAGR of about 5.4% from 2025 to 2034. Their high-capacity processing capabilities make them particularly suitable for industries that require bulk production, such as chemical and fertilizer manufacturing.

The increasing implementation of automation and real-time monitoring technologies is transforming how granulation machines operate. Manufacturers are incorporating IoT-driven systems that allow for better control over variables like mixing duration and moisture content, ultimately improving product quality and minimizing batch-to-batch inconsistencies. These smart enhancements also enable operators to adjust production parameters on the fly, ensuring high efficiency and reduced operational costs. In rotary drum granulators, newer models now offer advanced temperature and moisture control systems, along with improved energy efficiency to meet growing environmental and sustainability standards.

The market is categorized based on end-use industries, which include pharmaceuticals, chemicals, food, plastics, recycling, and others. In 2024, the pharmaceutical sector accounted for 32% of the overall market, reflecting its dominant role in driving demand for high-precision granulation equipment. The growing complexity in pharmaceutical manufacturing, particularly in producing consistent and uniform granules, is prompting a shift toward equipment that offers better process control. High shear and rotary granulators are increasingly being used due to their ability to maintain granule uniformity and deliver scalable production output.

Technological advancements are also expanding the applications of granulation equipment into the food processing sector. Enhanced automation and streamlined control systems are making these machines more adaptable for producing processed and packaged food products with consistent texture and quality. In the chemical and fertilizer industries, rotary drum granulators are gaining traction due to their ability to handle large-scale production without compromising on consistency and efficiency.

Geographically, the United States dominated the North American granulator machines market in 2024, capturing nearly 76% of the regional share and generating revenue of approximately USD 600 million. The country's strong pharmaceutical and chemical manufacturing base is playing a significant role in sustaining this growth. As the pharmaceutical sector continues to expand, the demand for sophisticated granulation equipment that ensures compliance with regulatory standards is on the rise. Manufacturers are increasingly favoring high shear and oscillating granulators for their superior output quality and reliability.

In the chemical sector, the shift toward high-volume, high-quality production has led to the widespread adoption of smart granulators. These machines help manufacturers maintain product consistency while achieving bulk output, making them a key component in modern chemical processing facilities.

The granulator machines industry includes several prominent players who are actively investing in technology development and strategic partnerships to strengthen their market presence. These efforts are geared toward offering more efficient, adaptable, and user-friendly solutions that align with evolving industry demands. By enhancing their technological capabilities and collaborating on innovation, companies aim to deliver advanced granulation solutions that improve productivity and product quality across diverse end-use sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand from the pharmaceutical industry

- 3.6.1.2 Growth in the chemical and fertilizer industries

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment and maintenance costs

- 3.6.2.2 Complexity in machine operation and training

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Oscillating granulators

- 5.3 High shear granulators

- 5.4 Vibrating granulators

- 5.5 Rotary drum granulators

- 5.6 Roller compactor granulators

- 5.7 Others (disc pan granulator etc.)

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Wet granulators

- 6.3 Dry granulators

Chapter 7 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Semi-automatic

- 7.4 Fully automatic

Chapter 8 Market Estimates & Forecast, By Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Below 500 Kg/hr

- 8.3 500 to 1000 Kg/hr

- 8.4 1000 to 1500 Kg/hr

- 8.5 Above 1500 Kg/hr

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Pharmaceutical

- 9.3 Chemical

- 9.4 Food industry

- 9.5 Plastic industry

- 9.6 Recycling industry

- 9.7 Others (cosmetics industry etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Allpack

- 12.2 Cumberland

- 12.3 Fluid Air

- 12.4 Freund-Vector

- 12.5 GEA

- 12.6 Getecha

- 12.7 Glatt

- 12.8 GlobePharma

- 12.9 Levstal

- 12.10 Rapid Granulator

- 12.11 ServoLiFT

- 12.12 THM recycling solutions

- 12.13 Vaner Machinery

- 12.14 Wittmann

- 12.15 Xertecs