|

市场调查报告书

商品编码

1740936

电动大众运输系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electric Public Transport System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

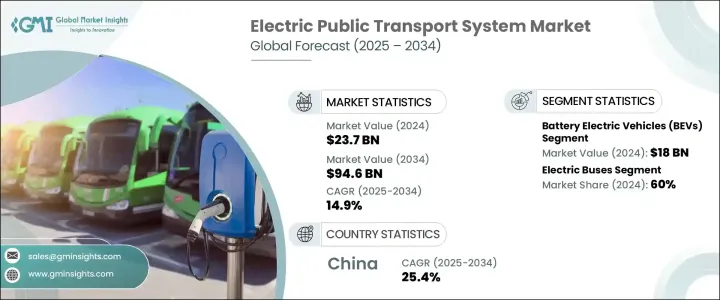

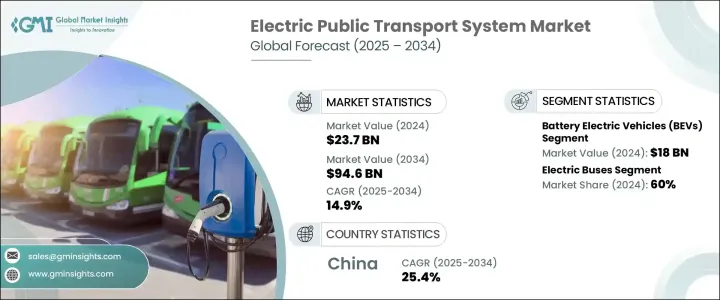

2024 年全球电动公共交通系统市场价值为 237 亿美元,预计到 2034 年将以 14.9% 的复合年增长率增长,达到 946 亿美元,这得益于城市密度增加、环境法规更加严格以及全球向清洁出行解决方案迈进的势头。世界各国政府和交通运输机构都将向永续的智慧交通系统转变为优先事项,以应对不断上升的排放、交通拥堵和城市扩张。随着城市密度增加和人口激增,对节能、低排放公共交通网络的需求正成为当务之急。电动公共交通系统结合了自动化、数位化和零排放技术,正在重新定义城市交通的未来。各个城市正在大力投资电动车队、现代化基础设施和智慧交通管理系统,为数百万通勤者创造无缝的移动体验。电池技术、远端资讯处理和无线充电方面的创新进一步提高了电动车队的营运效率和可靠性。随着智慧城市计画在全球扩展,电动大众运输正成为下一代城市交通生态系统的支柱,使大众运输更加环保、快速、智慧。

随着城市致力于降低碳足迹和升级交通基础设施,公共部门对电动大众运输(包括电车、公车和地铁)的投资正在迅速增加。电气化与数位连接和自动化相结合,正在改变城市交通,为日常交通运营带来先进的功能和更高的效率。电动大众运输网路目前正在整合智慧路线规划、零排放车辆和即时车队追踪系统。营运商正在采用电池管理系统、快速充电解决方案和再生煞车等节能技术,以降低营运成本并提高效能。同时,对以乘客为中心的创新的需求也在不断增长,例如高级驾驶辅助系统、车载监控系统和整合数位票务。这些升级不仅提高了交通安全性和乘客舒适度,也增加了对乘客的吸引力。无线软体更新、轻量复合材料和无线能量传输系统等技术突破正在加速市场的成长轨迹。随着电动替代品逐渐取代基于化石燃料的交通方式,市场蓬勃发展,不断创新,致力于提高永续性、自动化和通勤体验。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 237亿美元 |

| 预测值 | 946亿美元 |

| 复合年增长率 | 14.9% |

2024年,纯电动车 (BEV) 市场规模达到180亿美元,在电动大众运输系统领域占据推进系统类别的最大份额。 BEV持续的领先地位与城市交通向电动转型的加速发展息息相关,低排放目标与日益增长的智慧化、以用户为中心的车载技术需求完美契合。 BEV具备零废气排放、更低维护需求,并且易于与即时路线更新、互动式仪錶板和先进驾驶辅助系统等数位创新技术集成,使其成为市政当局车队现代化改造的首选。

在各类车型中,电动公车占据主导地位,2024 年的市占率达 60%,成为最广泛采用的电动大众运输方式。全球环保政策的不断出台、政府补贴的不断增加以及公共充电网路的加速扩张,共同支撑了电动公车的领先地位。现代电动公车超越了可持续出行的范畴,提供电容式触控萤幕、直觉的驾驶显示器、自适应照明和符合人体工学的内装等智慧功能,提升了驾驶体验和乘客舒适度。电动公车的可扩展性和成本效益使其成为人口密集城市的理想选择,因为这些城市对清洁、高容量交通的需求正在飙升。

2024年,中国电动大众运输系统市场规模达30亿美元,预计2034年将以25.4%的惊人复合年增长率成长。中国在该领域的主导地位得益于其大力推行的国家战略,这些战略有利于永续旅行和智慧城市发展。大量的政府资金投入、快速的城市化进程以及广泛的公共交通电气化规划,使中国继续处于创新的前沿。地方政府正在大力投资高容量电动公车车队和智慧交通生态系统,这些生态系统整合了电池管理系统、人工智慧调度、云端监控和自动驾驶功能,有助于减少车辆故障时间、优化路线并延长车辆生命週期。

全球电动公共运输系统市场的主要参与者包括 VDL 巴士及客车、比亚迪、宇通客车、氦氧混合气、EasyMile、塔塔汽车、日立铁路、西门子交通、阿尔斯通和沃尔沃。领先公司正在透过投资模组化电动平台、开发可互通的充电系统以及与城市交通机构建立战略合作伙伴关係来巩固其市场地位。他们还透过能源优化的电动车扩展产品组合,并将研发重点放在高级驾驶辅助系统 (ADAS)、远端资讯处理和车队管理软体上,以保持敏捷性并满足全球市场不断变化的监管、营运和环境要求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 配销通路分析

- 最终用途

- 利润率分析

- 供应商格局

- 川普政府关税的影响

- 贸易影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 贸易影响

- 技术与创新格局

- 专利分析

- 监管格局

- 成本細項分析

- 重要新闻和倡议

- 衝击力

- 成长动力

- 车载连线和使用者体验的需求不断增长

- 材料和製造技术的进步

- 电动车和自动驾驶汽车的成长

- OEM注重减轻重量和设计集成

- 产业陷阱与挑战

- 生产成本高

- 耐久性和环境敏感性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依运输方式,2021 - 2034 年

- 主要趋势

- 电动公车

- 电动火车

- 电动渡轮

- 电动出租车/叫车

第六章:市场估计与预测:以推进方式,2021 - 2034 年

- 主要趋势

- 纯电动车(BEV)

- 插电式混合动力电动车(PHEV)

- 燃料电池电动车(FCEV)

第七章:市场估计与预测:按充电方式,2021 - 2034 年

- 主要趋势

- 车库充电

- 机会充电

- 无线充电

- 电池更换

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 政府交通管理部门

- 私人车队营运商

- 公私部门合作(PPP)

- 机场和工业运输运营商

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- ABB

- Alexander Dennis

- Alstom

- Ashok Leyland

- BYD

- CAF

- CRRC

- EasyMile

- Heliox

- Hitachi Rail

- Keolis

- Navya

- Proterra

- Schneider Electric

- Siemens eMobility

- Soltaro

- Tata Motors

- VDL Bus & Coach

- Volvo

- Yutong Bus

The Global Electric Public Transport System Market was valued at USD 23.7 billion in 2024 and is estimated to grow at a CAGR of 14.9% to reach USD 94.6 billion by 2034, driven by increased urban density, stricter environmental regulations, and the global momentum toward clean mobility solutions. Governments and transit agencies worldwide are prioritizing the shift to sustainable, smart transportation systems to combat rising emissions, congestion, and urban sprawl. As cities grow denser and populations surge, the demand for energy-efficient, low-emission public transport networks is becoming a critical priority. Electric public transport systems, combining automation, digitalization, and zero-emission technology, are redefining the future of urban mobility. Cities are investing heavily in electrified fleets, modern infrastructure, and intelligent traffic management systems to create seamless, connected travel experiences for millions of commuters. Innovation in battery technologies, telematics, and wireless charging is further enhancing the operational efficiency and reliability of electric fleets. As smart city initiatives expand globally, electric public transportation is emerging as the backbone of next-generation urban transit ecosystems, making public commuting greener, faster, and smarter.

Public sector investments in electric mass transit-including trams, buses, and metros-are rapidly accelerating as cities aim to lower carbon footprints and upgrade transportation infrastructure. Electrification combined with digital connectivity and automation is transforming urban mobility, bringing advanced functionality and greater efficiency into daily transit operations. Electric public transport networks are now integrating intelligent route planning, zero-emission vehicles, and real-time fleet tracking systems. Operators are adopting energy-saving technologies such as battery management systems, fast-charging solutions, and regenerative braking to drive down operating costs and boost performance. Simultaneously, demand is rising for rider-focused innovations like advanced driver assistance, onboard surveillance systems, and integrated digital ticketing. These upgrades not only enhance transit safety and passenger comfort but also increase ridership appeal. Technological breakthroughs, including over-the-air software updates, lightweight composite materials, and wireless energy transfer systems, are accelerating the market growth trajectory. As electric alternatives steadily replace fossil-fuel-based transit modes, the market is thriving with continuous innovations focused on improving sustainability, automation, and commuter experience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.7 Billion |

| Forecast Value | $94.6 Billion |

| CAGR | 14.9% |

The battery electric vehicles (BEVs) segment generated USD 18 billion in 2024, securing the largest share among propulsion categories within the electric public transport system sector. Their sustained leadership is tied to the accelerating shift toward electric urban mobility, where low-emission goals align perfectly with the rising demand for intelligent, user-centric onboard technology. BEVs offer zero tailpipe emissions, lower maintenance needs, and easy integration with digital innovations such as real-time route updates, interactive dashboards, and advanced driver assistance systems, making them the top choice for municipalities modernizing their fleets.

Among vehicle types, the electric buses segment dominated with a 60% market share in 2024, standing out as the most widely adopted mode of electric public transport. This leadership is backed by a global wave of environmental policies, increasing government subsidies, and accelerated expansion of public charging networks. Modern electric buses go beyond sustainable mobility, offering smart features like capacitive touchscreens, intuitive driver displays, adaptive lighting, and ergonomic interiors that enhance both driver experience and passenger comfort. Their scalability and cost-efficiency make them ideal for densely populated cities where demand for clean, high-capacity transit is soaring.

The China Electric Public Transport System Market generated USD 3 billion in 2024 and is forecasted to grow at a remarkable CAGR of 25.4% through 2034. China's dominance in the sector is reinforced by aggressive national strategies favoring sustainable mobility and smart city development. Massive government funding, rapid urbanization, and extensive mass transit electrification plans continue to place China at the forefront of innovation. Local authorities are investing heavily in high-capacity electric bus fleets and intelligent traffic ecosystems that integrate battery management systems, AI-powered scheduling, cloud-based monitoring, and autonomous driving capabilities, all helping to reduce downtime, optimize routes, and extend vehicle lifecycles.

Major players in the Global Electric Public Transport System Market include VDL Bus & Coach, BYD, Yutong Bus, Heliox, EasyMile, Tata Motors, Hitachi Rail, Siemens Mobility, Alstom, and Volvo. Leading companies are strengthening their market positions by investing in modular electric platforms, developing interoperable charging systems, and forming strategic partnerships with urban transit agencies. They are also expanding product portfolios with energy-optimized electric vehicles and focusing R&D efforts on ADAS, telematics, and fleet management software to stay agile and meet evolving regulatory, operational, and environmental requirements across global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Trade impact

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Trade impact

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for in-vehicle connectivity and UX

- 3.8.1.2 Technological advancements in materials & manufacturing

- 3.8.1.3 Growth in electric and autonomous vehicles

- 3.8.1.4 OEM focus on weight reduction and design integration

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High Production Costs

- 3.8.2.2 Durability and Environmental Sensitivity

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Mode of Transport, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Electric buses

- 5.3 Electric trains

- 5.4 Electric ferries

- 5.5 Electric taxis/ride-hailing

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Battery Electric Vehicles (BEV)

- 6.3 Plug-in Hybrid Electric Vehicles (PHEV)

- 6.4 Fuel Cell Electric Vehicles (FCEV)

Chapter 7 Market Estimates & Forecast, By Charging, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Depot charging

- 7.3 Opportunity charging

- 7.4 Wireless charging

- 7.5 Battery swapping

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Government transit authorities

- 8.3 Private fleet operators

- 8.4 Public-Private Partnerships (PPPs)

- 8.5 Airport & industrial transit operators

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Alexander Dennis

- 10.3 Alstom

- 10.4 Ashok Leyland

- 10.5 BYD

- 10.6 CAF

- 10.7 CRRC

- 10.8 EasyMile

- 10.9 Heliox

- 10.10 Hitachi Rail

- 10.11 Keolis

- 10.12 Navya

- 10.13 Proterra

- 10.14 Schneider Electric

- 10.15 Siemens eMobility

- 10.16 Soltaro

- 10.17 Tata Motors

- 10.18 VDL Bus & Coach

- 10.19 Volvo

- 10.20 Yutong Bus