|

市场调查报告书

商品编码

1740947

水产养殖饲料挤压市场机会、成长动力、产业趋势分析及2025-2034年预测Aquaculture Feed Extrusion Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

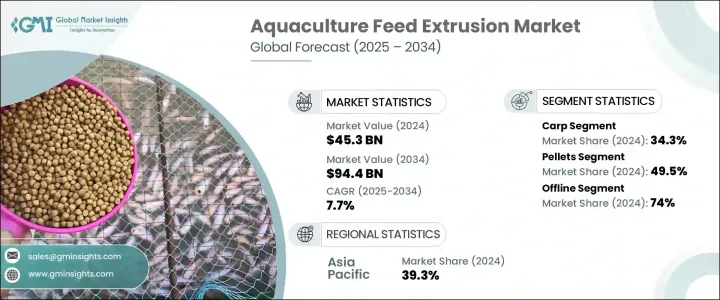

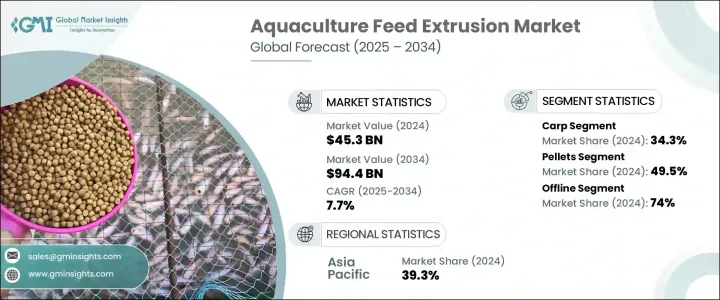

2024 年全球水产饲料挤压市场规模达 453 亿美元,预计到 2034 年将以 7.7% 的复合年增长率成长至 944 亿美元。过去十年,该市场稳步扩张,主要得益于高蛋白海鲜需求的不断增长以及全球向集约化水产养殖模式的转变。传统的饲养方法已被更先进的挤压技术所取代,这些技术可以提供营养丰富、耐水生的饲料。这些创新不仅提高了饲料效率和动物健康,也最大限度地减少了水产养殖系统对环境的影响。饲料挤压技术能够实现精准配方和有针对性的营养,对于满足不同水生物种的饮食需求至关重要。挤压饲料在消化率、稳定性和转换率方面均具有优势,使其成为商业营运的首选。设备技术的进步进一步支持了这一转变,使全球和地区饲料生产商能够大规模地客製化饲料解决方案。

特定物种的饲料需求持续影响市场动态。 2024年,鲤鱼占了按物种分類的最大市场份额,达34.3%,这得益于饲料生产的成本效益和易用性。每种水生物种都面临不同的营养和生长挑战,这增加了饲料配方和挤压加工需求的复杂性。虽然肉食性鱼类受益于富含蛋白质的挤压加工配方,但製造商也被迫保持价格的可负担性,尤其是在成本敏感的地区。转向营养更优质、水稳定性更高的饲料对于改善鱼类健康和最大限度地减少营养物质的流失至关重要,而营养物质的流失仍然是水生环境中的关键问题。同时,养殖户寻求易于在食用过程中监控并有助于减少整体浪费的饲料,尤其是在高产量养殖环境中。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 453亿美元 |

| 预测值 | 944亿美元 |

| 复合年增长率 | 7.7% |

例如,罗非鱼饲料生产已转向使用植物蛋白,以减少对鱼粉的依赖,从而支持转向更永续的饲料成分。鲶鱼饲料通常蛋白质含量较低,且以下沉颗粒形式存在,目前正在重新评估,以满足集约化养殖对高消化率饲料日益增长的需求。随着饲料转换率受到越来越严格的审查,生产商正在努力在品质和成本之间取得平衡,力求在不增加成本的情况下保持效率。

依饲料类型分类,颗粒饲料在2024年占据水产养殖饲料挤压市场的49.5%份额,占据主导地位。预计颗粒饲料将继续以7.3%的复合年增长率成长,这主要得益于大型水产养殖设施对饲料输送一致性和性能的追求。其浮力、水稳定性以及高营养负荷能力使其成为众多水生物种的理想选择。挤压技术的不断进步使得开发出满足特定摄食行为和环境条件的专用漂浮型和缓沉型颗粒饲料成为可能。然而,优质颗粒饲料的生产成本高昂,这对于预算有限的小规模生产者来说可能是一个障碍。

颗粒饲料因其体积小、易于摄食,仍广泛用于幼年水生生物的餵食。虽然它们使用方便,但通常缺乏足够的水稳定性,导致浪费增多,并且在高密度养殖系统中需要精心管理。粉状饲料通常用于早期鱼虾的孵化场,它能提供必需的营养物质,但需要精准投餵,以避免过度餵食和水质恶化。

市场分销管道分为线上和线下。 2024年,线下销售占据市场主导地位,占总收入的74%。由于线下通路在主要水产养殖地区的强劲成长,预计其复合年增长率将达到8.9%。线下通路因其提供的个人化支援而广受欢迎,包括灵活的付款条件、客製化的营养计划和随时可用的库存供应。这些因素在水产养殖基础设施完善的地区尤其重要。

从区域来看,亚太地区在2024年以39.3%的营收份额领先全球市场。该地区受益于高水产养殖产量以及政府旨在推动饲料现代化和永续性的有利措施。中国、印度和东南亚等市场继续保持区域主导地位,其海鲜消费量不断增长,并致力于提高饲料效率。相较之下,北美等地区则呈现温和但稳定的成长,这得益于人们对永续水产养殖实践的认识不断提高以及对本地采购海鲜的重视。

领先的市场参与者包括ADM、嘉吉、Biomar、普瑞纳动物营养有限公司、Skretting、帝斯曼和爱乐水产集团。这些公司透过创新、蛋白质来源多样化以及环保饲料产品的开发来塑造市场格局。他们的努力既支持全球规模运营,也支持本地化饲料定制,从而增强了整个水产养殖饲料挤压生态系统。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 对贸易的影响

- 贸易量中断

- 报復措施

- 贸易统计(HS编码)

- 2021-2024年主要出口国

- 2021-2024年主要进口国

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 供应方影响(原料)

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 转向可持续和替代原料

- 饲料挤压技术进步

- 高性能功能性饲料需求不断成长

- 产业陷阱与挑战

- 价格波动

- 原料供应有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按物种,2021 年至 2034 年

- 主要趋势

- 鲤鱼

- 海虾

- 罗非鱼

- 鲶鱼

- 海洋鱼类

第六章:市场估计与预测:依饲料类型,2021 年至 2034 年

- 主要趋势

- 颗粒

- 颗粒

- 粉末

- 其他的

第七章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 在线的

- 离线

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Cargill

- ADM

- Biomar

- Skretting

- Purina Animal Nutrition llc.

- Marubeni Nisshin Feed co.,ltd.

- Fish Feed Extruder

- DSM

- Aller Aqua Group

- Heritage Nutrient Limited

The Global Aquaculture Feed Extrusion Market was valued at USD 45.3 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 94.4 billion by 2034. Over the last decade, this market has witnessed steady expansion, largely fueled by the rising demand for high-protein seafood and the global shift toward intensive aquaculture practices. Traditional feeding methods have given way to more advanced extrusion techniques that provide nutrient-dense, water-stable feed options. These innovations have not only improved feed efficiency and animal health but have also minimized the environmental impact of aquaculture systems. Feed extrusion, which allows for precise formulation and targeted nutrition, has become critical to meeting the dietary needs of diverse aquatic species. Extruded feeds offer advantages in terms of digestibility, stability, and conversion rates, making them the preferred choice across commercial operations. Enhanced equipment technology has further supported this transition by giving both global and regional feed producers the ability to create tailored feed solutions at scale.

Species-specific feed demand continues to shape market dynamics. In 2024, carp held the largest market share by species at 34.3%, driven by the cost-effectiveness of feed production and ease of application. Each aquatic species poses different nutritional and growth challenges, contributing to the complexity of feed formulation and extrusion requirements. While carnivorous species benefit from protein-rich extruded formulations, manufacturers are also being pushed to maintain affordability-particularly in cost-sensitive regions. The shift toward nutritionally superior, water-stable feeds is central to improving fish health and minimizing nutrient leaching, which remains a key concern in aquatic environments. At the same time, farmers seek feeds that are easy to monitor during consumption and contribute to reducing overall wastage, especially in high-volume farming setups.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $45.3 Billion |

| Forecast Value | $94.4 Billion |

| CAGR | 7.7% |

Tilapia feed production, for instance, has seen a transition toward plant-based proteins to reduce reliance on fishmeal, supporting the move toward more sustainable feed ingredients. Catfish feeds, typically lower in protein and presented in sinking pellet forms, are being re-evaluated to meet the rising need for highly digestible feed in intensive farming operations. As feed conversion ratios come under greater scrutiny, producers are working to strike a balance between quality and cost, aiming to maintain efficiency without driving up expenses.

When categorized by feed type, pellets led the aquaculture feed extrusion market in 2024 with a 49.5% share. Pellets are expected to continue expanding at a CAGR of 7.3%, driven by demand from large-scale aquaculture facilities seeking consistency and performance in feed delivery. Their buoyancy, water stability, and ability to carry high nutrient loads make them ideal for a broad range of aquatic species. Ongoing advances in extrusion allow for the development of specialized floating and slow-sinking pellet types that meet specific feeding behaviors and environmental conditions. However, premium pellet feeds come with high production costs, which can be a hurdle for small-scale producers with limited budgets.

Granules remain widely used for juvenile aquatic species due to their small size and ease of intake. Although they are convenient, they often lack sufficient water stability, leading to higher waste and requiring careful management in high-density systems. Powdered feed, generally used in hatcheries for early-stage fish and shrimp, delivers essential nutrients but demands precise application to avoid overfeeding and deterioration in water quality.

The market's distribution channels are divided into online and offline modes. In 2024, offline sales dominated the market, accounting for 74% of total revenue. This channel is expected to grow at a robust CAGR of 8.9% due to its strong presence in key aquaculture regions. Offline channels are popular due to the personalized support they provide, including flexible payment terms, customized nutritional planning, and ready inventory supply. These factors are especially important in regions with well-established aquaculture infrastructure.

Regionally, Asia Pacific led the global market with a 39.3% revenue share in 2024. The region benefits from high aquaculture output and favorable government initiatives aimed at feed modernization and sustainability. Markets such as China, India, and Southeast Asia continue to drive regional dominance, with increasing seafood consumption and efforts to enhance feed efficiency. In contrast, regions like North America show moderate but steady growth, driven by growing awareness of sustainable aquaculture practices and a focus on locally sourced seafood.

Leading market players include ADM, Cargill, Biomar, Purina Animal Nutrition LLC, Skretting, DSM, and Aller Aqua Group. These companies shape the market landscape through innovation, diversification of protein sources, and development of environmentally conscious feed products. Their efforts support both global scale operations and localized feed customization, strengthening the overall aquaculture feed extrusion ecosystem.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Impact on trade

- 3.1.8 Trade volume disruptions

- 3.2 Retaliatory measures

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.3.2 Major importing countries, 2021-2024 (Kilo Tons)

- 3.4 Impact on the industry

- 3.4.1 Supply-Side impact (raw materials)

- 3.4.1.1 Price volatility in key materials

- 3.4.1.2 Supply chain restructuring

- 3.4.1.3 Production cost implications

- 3.4.1 Supply-Side impact (raw materials)

- 3.5 Demand-side impact (selling price)

- 3.5.1 Price transmission to end markets

- 3.5.2 Market share dynamics

- 3.5.3 Consumer response patterns

- 3.6 Key companies impacted

- 3.7 Strategic industry responses

- 3.7.1 Supply chain reconfiguration

- 3.7.2 Pricing and product strategies

- 3.7.3 Policy engagement

- 3.8 Outlook and Future considerations

- 3.9 Supplier landscape

- 3.10 Profit margin analysis

- 3.11 Key news & initiatives

- 3.12 Regulatory landscape

- 3.13 Impact forces

- 3.13.1 Growth drivers

- 3.13.1.1 Shift toward sustainable and alternative ingredients

- 3.13.1.2 Technological advancements in feed extrusion

- 3.13.1.3 Rising demand for high-performance functional feeds

- 3.13.2 Industry pitfalls & challenges

- 3.13.2.1 Volatile pricing

- 3.13.2.2 Limited availability of raw materials

- 3.13.1 Growth drivers

- 3.14 Growth potential analysis

- 3.15 Porter's analysis

- 3.16 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Species, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Carp

- 5.3 Marine shrimps

- 5.4 Tilapias

- 5.5 Catfishes

- 5.6 Marine fishes

Chapter 6 Market Estimates and Forecast, By Feed Type, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Pellets

- 6.3 Granules

- 6.4 Powder

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Online

- 7.3 Offline

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Cargill

- 9.2 ADM

- 9.3 Biomar

- 9.4 Skretting

- 9.5 Purina Animal Nutrition llc.

- 9.6 Marubeni Nisshin Feed co.,ltd.

- 9.7 Fish Feed Extruder

- 9.8 DSM

- 9.9 Aller Aqua Group

- 9.10 Heritage Nutrient Limited