|

市场调查报告书

商品编码

1740949

轧製或挤压铝棒、铝条和铝线市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Rolled or Extruded Aluminum Rods, Bars, and Wires Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球轧製或挤压铝棒、铝条和铝线市场价值为237亿美元,预计到2034年将以6%的复合年增长率增长,达到431亿美元,这得益于工业应用的激增和高增长行业需求的增长。这一上升趋势反映了铝凭藉其多功能性、高强度重量比和可回收性在各个领域发挥的关键作用。节能製造的推动,加上全球工业化的不断推进,推动了铝产品在各种应用中的使用。像铝这样的轻质材料在耐用性、效率和低能耗是关键要求的应用中尤其受到追捧。此外,随着技术进步简化了生产流程,製造商能够更好地满足不断增长的需求,同时又不影响品质或成本效益。自动化和数位化整合在铝棒、铝条和铝线的製造过程中日益普及,从而提高了生产速度并最大限度地减少了材料浪费。这些创新对于支持整个供应链的产量可扩展性和品质一致性至关重要。

预计到2025年,该市场规模将从257亿美元成长至未来十年,并保持健康成长动能。推动这一成长的最大因素之一是市场对轻量化金属零件的日益青睐,因为轻量化金属零件能够提升效能并降低营运成本。各行各业越来越重视永续性和可回收性,这与铝製品的优势完美契合。一些行业的结构性转变进一步推动了铝材需求,这些行业需要兼具耐用性和耐腐蚀性且不增加额外重量的材料。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 237亿美元 |

| 预测值 | 431亿美元 |

| 复合年增长率 | 6% |

在更广泛的市场中,压延铝线细分市场在2024年的市值达到70亿美元,预计在2025年至2034年期间的复合年增长率将达到5.8%。由于其延展性以及在不同环境条件下始终如一的性能,该细分市场在各种应用中发挥着不可或缺的作用。这些特性使压延铝线成为兼具柔韧性和耐用性的工业应用的首选。

轧製铝棒细分市场保持着强劲的竞争优势,这主要得益于其在机械和运输系统中的应用,这些系统对高精度和机械强度的要求至关重要。儘管在特定应用中面临来自低成本替代品的适度竞争,但该细分市场仍受益于稳定的原料供应和轧製製程技术的进步。

在各种合金牌号中,6xxx系列在2024年成为最大的细分市场,贡献了60亿美元的市场价值。预计2025年至2034年的复合年增长率为6.7%。该系列因其优异的耐腐蚀性、强度和多功能性而备受青睐,适用于结构和建筑用途。

就加工方法而言,热挤压领域在2024年达到72亿美元,预计到2034年将以6.5%的复合年增长率成长。这种方法因其能够生产尺寸均匀的高强度零件而受到青睐。热轧技术也因其材料灵活性、成本效益和相对较低的能耗而受到青睐,使其成为大规模生产的经济高效的解决方案。

从终端用途来看,光是汽车产业在2024年就为市场贡献了56亿美元,占24%的份额。预计2025年至2034年期间,该细分市场的复合年增长率将达到5.7%。汽车製造业对燃油效率和永续性的日益追求,推动了对轻质高强度材料的需求,例如铝,它们是车架、车身面板和结构加强件的关键部件。

从地理来看,中国以2024年110亿美元的估值领先市场,预计2025年至2034年的复合年增长率将达到5.9%。作为全球最大的铝生产国,中国在2024年铝产量占全球产量的一半以上,达4,400万吨。中国在铝业的稳固地位得益于其强大的製造业基础以及促进基础设施建设和能源转型的扶持性政策框架。在先进的製造能力和战略性经济规划的支持下,中国作为生产和消费大国的地位仍然是全球铝市场的关键驱动力。

近年来,移动混凝土搅拌站产业的几家关键参与者已采取重大策略倡议,以巩固其市场地位并推动创新。领先的公司正在积极投资研发,以推出符合不断演变的监管标准的先进、节能、环保的配料解决方案。除了产品创新外,许多公司还透过併购和策略合作扩大其全球影响力,旨在提升分销能力并拓展新的客户群。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 主要出口国

- 主要进口国

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 汽车产业对轻量化材料的需求不断增长

- 政府推动永续基础建设的倡议

- 航太和国防领域的成长

- 消费性电子产品需求不断扩大

- 产业陷阱与挑战

- 原物料价格波动

- 铝生产对环境的影响

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 平轧钢板

- 轧製铝棒

- 挤压铝棒

- 铝棒

- 铝线

第六章:市场估计与预测:依合金类型,2021-2034

- 主要趋势

- 1xxx系列

- 2xxx系列

- 3xxx系列

- 5xxx系列

- 6xxx系列

- 7xxx系列

- 8xxx系列

第七章:市场估计与预测:依加工方法,2021-2034 年

- 主要趋势

- 热轧

- 冷轧

- 热挤压

- 冷挤压

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 汽车

- 航太

- 建造

- 电气和电子产品

- 机械

- 其他的

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Hydro Aluminium

- Alcoa Corporation

- China Zhongwang Holdings Limited

- Rusal (UC Rusal)

- Chalco (Aluminum Corporation of China)

- Kaiser Aluminum Corporation

- Norsk Hydro ASA

- Constellium SE

- Novelis Inc.

- Bonnell Aluminum

- UACJ Corporation

- Southwire Company, LLC

- Jiangsu Dingsheng New Material

- Sapa Group (now part of Hydro)

- Vedanta Aluminium

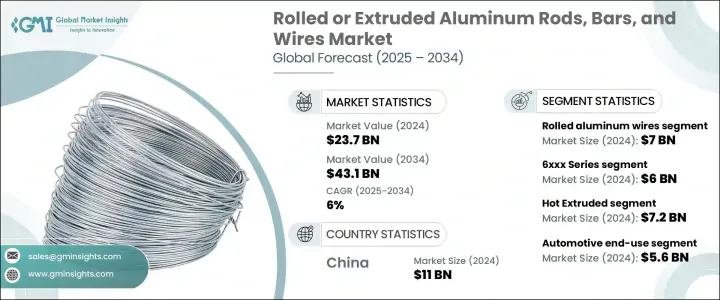

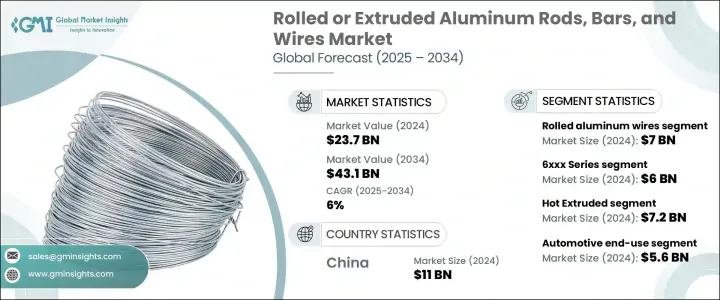

The Global Rolled Or Extruded Aluminum Rods, Bars, And Wires Market was valued at USD 23.7 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 43.1 billion by 2034, driven by a surge in industrial applications and increasing demand from high-growth sectors. This upward trajectory reflects the critical role aluminum plays across various sectors, thanks to its versatility, strength-to-weight ratio, and recyclability. The push for energy-efficient manufacturing, coupled with rising global industrialization, has propelled the use of aluminum products in diverse applications. Lightweight materials like aluminum are particularly sought after in applications where durability, efficiency, and reduced energy consumption are key requirements. Moreover, with technological advancements streamlining production processes, manufacturers are better equipped to meet the growing demand without compromising on quality or cost-efficiency. Automation and digital integration are becoming widespread in the manufacturing of aluminum rods, bars, and wires, which in turn enhances production speed and minimizes material waste. These innovations are proving vital in supporting both volume scalability and quality consistency across the supply chain.

As of 2025, the market is forecasted to grow from USD 25.7 billion, maintaining a healthy pace throughout the decade. One of the largest contributors to this expansion is the rising preference for lightweight metal components, which allow for improved performance and lower operational costs. Industries are increasingly prioritizing sustainability and recyclability, aligning perfectly with the benefits offered by aluminum products. Demand is further fueled by structural shifts in sectors that require materials offering durability and corrosion resistance without adding excessive weight.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.7 Billion |

| Forecast Value | $43.1 billion |

| CAGR | 6% |

Within the broader market, the rolled aluminum wires segment was valued at USD 7 billion in 2024 and is anticipated to grow at a CAGR of 5.8% between 2025 and 2034. This segment plays an integral role in various applications due to its malleability and consistent performance under different environmental conditions. These features make rolled aluminum wires a preferred choice in industrial applications that require both flexibility and durability.

The rolled aluminum rods segment maintains strong competitive positioning, largely due to its relevance in machinery and transportation systems where high precision and mechanical strength are essential. Despite facing moderate competition from lower-cost substitutes in specific applications, this segment continues to benefit from stable raw material availability and technological advancements in rolling mill operations.

Among the different alloy grades, the 6xxx Series segment emerged as the largest in 2024, contributing USD 6 billion in market value. With a projected CAGR of 6.7% from 2025 to 2034, this series is favored for its excellent corrosion resistance, strength, and versatility, making it suitable for structural and architectural uses.

In terms of processing methods, the hot extruded segment accounted for USD 7.2 billion in 2024 and is expected to grow at a CAGR of 6.5% through 2034. This method is preferred for its ability to produce high-strength components with uniform dimensions. The hot rolling technique is also gaining traction due to its material flexibility, cost efficiency, and relatively low energy requirements, making it a cost-effective solution for mass production.

From an end-use perspective, the automotive sector alone contributed USD 5.6 billion to the market in 2024, capturing a 24% share. This segment is forecasted to expand at a CAGR of 5.7% between 2025 and 2034. The growing push for fuel efficiency and sustainability in vehicle manufacturing is steering demand toward lightweight and high-strength materials, such as aluminum, which serve as key components in frames, body panels, and structural reinforcements.

Geographically, China led the market with a valuation of USD 11 billion in 2024 and is expected to expand at a CAGR of 5.9% from 2025 to 2034. As the top global producer of aluminum, China accounted for over half of global aluminum output in 2024, with production reaching 44 million tons. Its strong foothold in the aluminum industry is underpinned by a robust manufacturing base and supportive policy frameworks that promote infrastructure development and energy transition efforts. China's role as a production and consumption powerhouse remains a key driver for the global aluminum market, backed by advanced manufacturing capabilities and strategic economic planning.

Several key players in the mobile concrete batch plant industry have made significant strategic moves in recent years to strengthen their market presence and drive innovation. Leading companies are actively investing in research and development to introduce advanced, energy-efficient, and eco-friendly batching solutions that meet evolving regulatory standards. Alongside product innovation, many of these firms have expanded their global footprint through mergers, acquisitions, and strategic partnerships aimed at improving distribution capabilities and accessing new customer segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for lightweight materials in automotive industry

- 3.7.1.2 Government initiatives for sustainable infrastructure

- 3.7.1.3 Growth in aerospace and defense sector

- 3.7.1.4 Expanding demand in consumer electronics

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Fluctuating raw material prices

- 3.7.2.2 Environmental impact of aluminum production

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.1.1 Flat rolled sheets

- 5.1.2 Rolled aluminum rods

- 5.1.3 Extruded aluminum rods

- 5.1.4 Aluminum bars

- 5.1.5 Aluminum wires

Chapter 6 Market Estimates & Forecast, By Alloy Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 1xxx series

- 6.3 2xxx series

- 6.4 3xxx series

- 6.5 5xxx series

- 6.6 6xxx series

- 6.7 7xxx series

- 6.8 8xxx series

Chapter 7 Market Estimates & Forecast, By Processing Method, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Hot rolled

- 7.3 Cold rolled

- 7.4 Hot extruded

- 7.5 Cold extruded

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace

- 8.4 Construction

- 8.5 Electrical & electronics

- 8.6 Machinery

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Hydro Aluminium

- 10.2 Alcoa Corporation

- 10.3 China Zhongwang Holdings Limited

- 10.4 Rusal (UC Rusal)

- 10.5 Chalco (Aluminum Corporation of China)

- 10.6 Kaiser Aluminum Corporation

- 10.7 Norsk Hydro ASA

- 10.8 Constellium SE

- 10.9 Novelis Inc.

- 10.10 Bonnell Aluminum

- 10.11 UACJ Corporation

- 10.12 Southwire Company, LLC

- 10.13 Jiangsu Dingsheng New Material

- 10.14 Sapa Group (now part of Hydro)

- 10.15 Vedanta Aluminium