|

市场调查报告书

商品编码

1740951

PEF(聚呋喃甲酸乙二醇酯)市场机会、成长动力、产业趋势分析及2025-2034年预测PEF (Polyethylene Furanoate) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

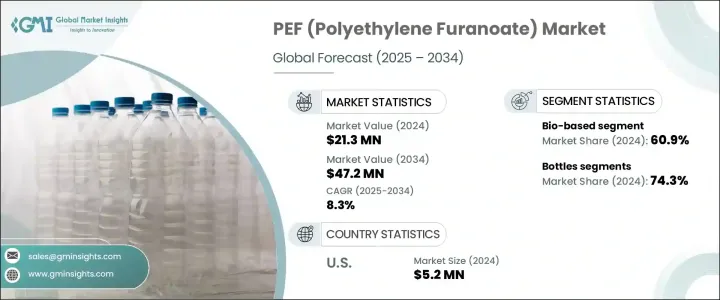

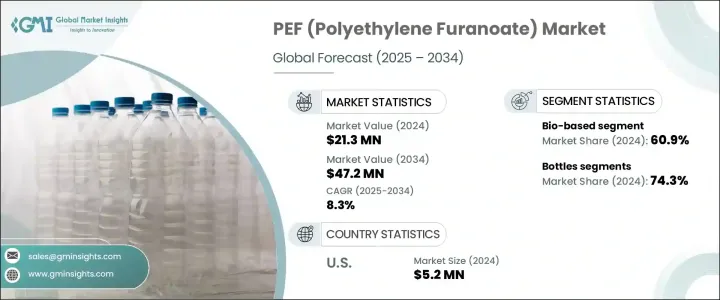

2024年,全球PEF(聚呋喃甲酸乙二醇酯)市值为2,130万美元,预计到2034年将以8.3%的复合年增长率成长,达到4,720万美元。 PEF是一种新一代生物基聚酯,其原料主要来自植物糖等再生原料。作为传统石油基塑胶(例如聚对苯二甲酸乙二酯 (PET))的环保替代品,PEF因消费者和监管机构日益转向永续性而备受青睐。市场成长主要得益于对环保包装解决方案日益增长的需求、旨在减少塑胶垃圾的更严格法规,以及PEF固有的材料特性(这些特性使其比PET等传统塑胶更具优势)。

全球对永续包装的日益重视是推动PEF市场扩张的关键因素之一。消费者、企业和政府都越来越关注减少包装对环境的影响,而源自可再生植物的PEF则提供了一个极具前景的解决方案。这种聚酯纤维不仅比传统塑胶减少了碳足迹,而且由于可生物降解,也有助于减少废物累积。此外,其卓越的阻隔性能,包括比PET(聚对苯二甲酸乙二醇酯)更优异的抗氧、抗二氧化碳和抗水蒸气性能,使其在食品和饮料包装等产品品质和保质期至关重要的领域尤为重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2130万美元 |

| 预测值 | 4720万美元 |

| 复合年增长率 | 8.3% |

随着对PEF的需求持续成长,全球各地企业对该市场的兴趣也日益浓厚。尤其是PEF瓶,占了最大的市场份额,占PEF总用量的74.3%。这得归功于PEF先进的阻隔性能,能够更长时间地保持饮料的新鲜度。在产品寿命至关重要的饮料产业,从传统塑胶转向生物基替代品不仅是一种趋势,更是必然。此外,消费者对环境永续性的意识日益增强,也促使饮料製造商采用这些更环保的材料。随着各国政府对塑胶废弃物和碳排放的监管愈发严格,饮料业的主要企业正在转向PEF等生物基塑胶。

全球PEF市场也分为两大类:生物基和植物基。生物基市场占据主导地位,由于生物基原料的多功能性,到2024年将占60.9%的市场。与通常依赖特定作物的植物性原料不同,生物基生产方法允许製造商使用各种原材料,例如农业副产品、工业残留物和富含糖分的生物质。这种灵活性不仅保障了供应链的安全,还增强了PEF生产的可扩展性和韧性,确保其在需求成长的同时持续成长。

美国是PEF市场的重要参与者,2024年其PEF市场规模达520万美元。推动这一成长的主要因素是政府支持采用生物基材料的措施。旨在推广可再生塑胶使用的计划,尤其是透过联邦采购授权,为PEF创造了有利的市场环境。这些措施不仅有助于减少对环境的影响,也为PEF在包装、纺织品和薄膜等多种应用领域开闢了机会。透过营造有利于永续塑胶发展的环境,美国正在确立其在全球转型为环保材料的领先地位。

为了抓住这一快速成长的市场机会,PEF 产业的主要参与者正在采取一系列策略,包括扩大产能、与其他产业领导者建立策略合作伙伴关係,以及大力投资研发以改善 PEF 生产方法并提升其材料效能。巴斯夫 SE、Avantium、安姆科、Alpla 集团和东洋纺等公司走在这项创新的前沿,将自己定位为环保包装市场的关键参与者。透过采用永续解决方案并利用政府激励措施,这些公司力求在快速发展的包装行业中保持领先地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 主要製造商

- 经销商

- 整个产业的利润率

- 供应中断

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业回应

- 供应链重构

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 主要出口国

- 主要进口国

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 全球对永续和生物基包装材料的需求不断增长

- 减少塑胶垃圾和碳排放的监管压力不断增加

- PEF 相比 PET 具有更高的性能,例如更好的阻隔性和机械强度

- 产业陷阱与挑战

- 依赖原料的可用性,例如果糖衍生的 2,5-呋喃二甲酸 (FDCA)

- 来自 PLA 和生物 PET 等其他生物基聚合物的竞争

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按来源,2021-2034

- 主要趋势

- 植物基

- 生物基

第六章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 瓶子

- 纤维

- 电影

- 其他的

第七章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 包装

- 纺织品

- 电子产品

- 製药

- 其他的

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Alpla Group

- Amcor

- AVA Biochem

- Avantium

- BASF SE

- Origin Materials

- Sulzer

- Swicofil

- Toyobo

The Global PEF (Polyethylene Furanoate) Market was valued at USD 21.3 million in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 47.2 million by 2034. PEF is a next-generation, bio-based polyester derived from renewable feedstocks, primarily derived from plant-based sugars. As an eco-friendly alternative to traditional petroleum-based plastics, such as polyethylene terephthalate (PET), PEF has been gaining significant traction due to the increasing consumer and regulatory shift toward sustainability. The market growth is largely fueled by the rising demand for environmentally friendly packaging solutions, stricter regulations aimed at reducing plastic waste, and the inherent material properties of PEF, which offer superior advantages over conventional plastics like PET.

The growing global push toward sustainable packaging is one of the key factors driving the expansion of the PEF market. Consumers, companies, and governments alike are increasingly focused on reducing the environmental footprint of packaging, and PEF, derived from renewable plant sources, offers a promising solution. This polyester not only reduces the carbon footprint compared to traditional plastics but also contributes to less waste accumulation, as PEF is biodegradable. Moreover, its superior barrier properties, which include better resistance to oxygen, carbon dioxide, and water vapor compared to PET, make it particularly valuable in sectors such as food and beverage packaging, where product quality and shelf life are crucial.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.3 Million |

| Forecast Value | $47.2 Million |

| CAGR | 8.3% |

As demand for PEF continues to rise, the market is seeing increased interest from companies across the globe. PEF bottles, in particular, have captured the largest share of the market, accounting for 74.3% of the overall PEF usage. This is due to PEF's advanced barrier capabilities, which preserve the freshness of beverages for longer periods. In the beverage industry, where product longevity is vital, the shift from traditional plastics to bio-based alternatives is not just a trend but a necessity. Furthermore, the growing consumer awareness surrounding environmental sustainability is pushing beverage manufacturers to adopt these more eco-friendly materials. With governments enforcing stricter regulations on plastic waste and carbon emissions, major corporations in the beverage industry are making the switch to bio-based plastics like PEF.

The global PEF market is also divided into two primary categories: bio-based and plant-based sources. The bio-based segment is dominant, holding a 60.9% share in 2024, thanks to the versatility of bio-based feedstocks. Unlike plant-based sources, which often rely on specific crops, bio-based production methods allow manufacturers to use a wide range of raw materials, such as agricultural byproducts, industrial residues, and sugar-rich biomass. This flexibility not only secures supply chains but also strengthens the scalability and resilience of PEF production, ensuring its continued growth as demand increases.

The United States is a significant player in the PEF market, generating USD 5.2 million in 2024. A major driver of this growth has been government initiatives that support the adoption of bio-based materials. Programs designed to promote the use of renewable plastics, particularly through federal procurement mandates, have created a favorable landscape for PEF. These initiatives not only help reduce the environmental impact but also open up opportunities for PEF across diverse applications, including packaging, textiles, and films. By fostering an environment conducive to the growth of sustainable plastics, the U.S. is establishing itself as a leader in the global shift toward eco-friendly materials.

To capitalize on this rapidly growing market, key players in the PEF sector are employing a range of strategies, including expanding their production capacities, forming strategic partnerships with other industry leaders, and investing heavily in research and development to improve PEF production methods and enhance its material properties. Companies such as BASF SE, Avantium, Amcor, Alpla Group, and Toyobo are at the forefront of this innovation, positioning themselves as key players in the eco-friendly packaging market. By embracing sustainable solutions and leveraging government incentives, these companies aim to stay ahead of the curve in the fast-evolving packaging industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Key manufacturers

- 3.1.2 Distributors

- 3.1.3 Profit margins across the industry

- 3.1.4 Supply disruptions

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major Exporting Countries

- 3.3.2 Major Importing Countries

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising global demand for sustainable and bio-based packaging materials

- 3.7.1.2 Increasing regulatory pressure to reduce plastic waste and carbon emissions

- 3.7.1.3 High performance properties of PEF compared to PET, such as better barrier resistance and mechanical strength

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Dependency on feedstock availability such as fructose-derived 2,5-Furandicarboxylic acid (FDCA)

- 3.7.2.2 Competition from other bio-based polymers such as PLA and bio-PET

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Source, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plant based

- 5.3 Bio-based

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Bottles

- 6.3 Fibres

- 6.4 Film

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Packaging

- 7.3 Textiles

- 7.4 Electronics

- 7.5 Pharmaceuticals

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alpla Group

- 9.2 Amcor

- 9.3 AVA Biochem

- 9.4 Avantium

- 9.5 BASF SE

- 9.6 Origin Materials

- 9.7 Sulzer

- 9.8 Swicofil

- 9.9 Toyobo