|

市场调查报告书

商品编码

1740953

铜和黄铜扁平材市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Copper And Brass Flat Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

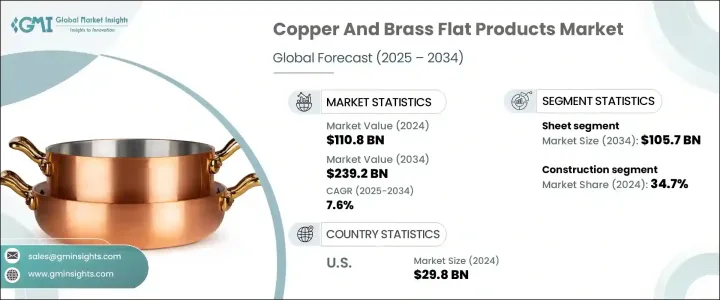

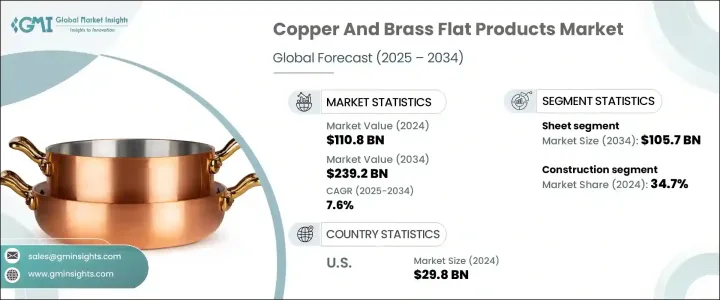

2024年,全球铜和黄铜扁平材市场规模达1,108亿美元,预计2034年将以7.6%的复合年增长率成长,达到2,392亿美元。全球基础设施投资和工业发展不断增长,推动了对这些金属产品的需求。铜和黄铜因其优异的导电性、耐腐蚀性和在众多应用中的适应性而广受欢迎。电动车、再生能源系统的日益普及以及电子产业的持续技术进步,推动了市场稳步扩张。电气和电子元件对铜的依赖性也日益增强,这得益于铜的卓越性能。

此外,众多产业对能源效率和先进工程技术的追求,进一步推动了对铜和黄铜扁平材的需求。随着各行各业持续将节能放在首位,这些金属在需要最佳性能和长期耐用性的应用中的应用日益广泛。铜和黄铜以其优异的导热性和导电性而闻名,这使得它们成为需要高效管理热量和能源的系统和组件的理想选择。例如,在工业机械中,铜和黄铜扁平材通常用于热交换器、散热器和冷却系统,其高效的导热能力有助于优化能源利用并防止过热。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1108亿美元 |

| 预测值 | 2392亿美元 |

| 复合年增长率 | 7.6% |

在铜和黄铜扁平材市场的所有产品类型中,板材已成为领先细分市场,2024 年市场价值达 497 亿美元。预计该细分市场将大幅成长,到 2034 年将达到 1,057 亿美元。铜和黄铜板材因其柔韧性、易加工性和多功能性而备受青睐,在许多行业中备受追捧。这些材料以其卓越的强度、延展性和美观性而闻名,所有这些都使其得到了广泛的应用。它们易于切割、成型和加工成各种尺寸和形状,使其能够适应各种应用。

建筑业对铜和黄铜板材的需求尤其高,该行业是最大的市场驱动力,占34.7%。这些材料是现代建筑结构和装饰元素不可或缺的一部分。铜和黄铜板材以及带材和板材广泛用于屋顶系统、墙面覆层、檐槽、落水管以及门窗框架的建造。它们的耐腐蚀性使其成为对耐用性和使用寿命至关重要的外部应用的理想选择。此外,它们兼具美观性,包括温暖、光泽的外观,使其成为建筑细节设计的热门选择,例如装饰性特征和装饰性立面。随着全球城镇化进程的持续加速,预计对铜和黄铜板材的需求将快速增长。

2024年,美国铜和黄铜扁平材市场规模达298亿美元,预计2025年至2034年复合年增长率为7.4%。美国对铜和黄铜扁平材的高需求与电动车、再生能源和现代通讯系统等先进技术的扩张息息相关。铜在散热和高效输电方面发挥着重要作用,使其成为新兴科技基础设施不可或缺的材料。因此,预计美国在未来几年仍将是铜和黄铜扁平材的主要消费国。

全球铜和黄铜扁平材市场的领导者包括 Global Copper Conductors、Gujarat Copper Alloys Ltd、Aurubis、Chhajed Steel Limited 和 KME Copper。为了扩大市场份额并保持竞争力,主要参与者正在实施多项有效策略。企业投资先进的製造技术,以提高精度、品质和产量。策略伙伴关係和收购有助于扩大其地域覆盖范围和产品组合。永续性是企业关注的重点,企业采用环保的生产方法和可回收材料。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(销售价格)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 2021-2024年主要出口国

- 2021-2024年主要进口国

註:以上贸易统计仅提供重点国家

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 餐饮和酒店业的需求不断增长

- 生质能发电的成长

- 电子商务和直接面向消费者的销售扩张

- 产业陷阱与挑战

- 森林砍伐与监管限制

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场规模及预测:依木材类型,2021 - 2034

- 主要趋势

- 原木

- 木屑

- 颗粒

- 林业残留物

- 其他的

第六章:市场规模及预测:依最终用途,2021 - 2034

- 主要趋势

- 食品服务

- 配电

- 其他的

第七章:市场规模及预测:按配销通路,2021 - 2034

- 主要趋势

- 大型超市和超市

- 专卖店

- 电子商务

- 企业对企业 (B2B)

- 其他的

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Cornish Firewood

- Firewood Fuel

- Lost Coast Forest Products

- JB Firewood

- Pinnacle Firewood Company

- Surefire Wood

- Wilson Enterprises

- Cutting Edge Firewood

- Wood Step

- The Log Store Group

- Woodmill

- Premier Firewood Company

- UAB Vli Timber

- Woodbioma

The Global Copper and Brass Flat Products Market was valued at USD 110.8 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 239.2 billion by 2034, driven by the rising investments in infrastructure and industrial development worldwide drives the growing demand for these metal products. Copper and brass are widely chosen for their excellent conductivity, corrosion resistance, and adaptability in numerous applications. The rising popularity of electric vehicles, renewable energy systems, and ongoing technological progress across the electronics sector contribute to steady market expansion. Electrical and electronic components increasingly rely on copper due to their superior performance.

Moreover, the drive toward energy efficiency and advanced engineering across numerous industries is further boosting the demand for copper and brass flat products. As industries continue to prioritize energy savings, these metals are being increasingly utilized in applications that require optimal performance and long-term durability. Copper and brass are known for their excellent thermal and electrical conductivity, which makes them ideal for systems and components that need to efficiently manage heat and energy. For example, in industrial machinery, copper and brass flat products are commonly used in heat exchangers, radiators, and cooling systems, where their ability to conduct heat effectively helps optimize energy use and prevent overheating.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $110.8 Billion |

| Forecast Value | $239.2 Billion |

| CAGR | 7.6% |

Among the product types in the copper and brass flat products market, the sheets segment has emerged as the leading segment, with a market value of USD 49.7 billion in 2024. This segment is expected to grow significantly, reaching USD 105.7 billion by 2034. Copper and brass sheets are favored for their flexibility, ease of processing, and versatility, making them highly sought after across numerous industries. These materials are known for their superior strength, malleability, and aesthetic appeal, all contribute to their widespread use. Their ability to be easily cut, shaped, and fabricated into various sizes and forms enables them to be adapted to varied applications.

The demand for copper and brass sheets is particularly high in the construction sector, which is the largest market driver, accounting for 34.7% share. These materials are integral to both structural and decorative elements in modern buildings. Copper and brass sheets, along with strips and plates, are used extensively in the construction of roofing systems, wall cladding, gutters, downspouts, and window and door frames. Their corrosion resistance makes them ideal for exterior applications where durability and longevity are critical. Additionally, their aesthetic qualities, including their warm, lustrous appearance, make them a popular choice for architectural detailing, such as ornamental features and decorative facades. As urbanization continues to accelerate globally, the demand for copper and brass sheets is expected to grow rapidly.

United States Copper and Brass Flat Products Market accounted for USD 29.8 billion in 2024 and is projected to grow at a CAGR of 7.4% from 2025 to 2034. The nation's high demand for copper and brass flat products is tied to the expansion of advanced technologies, including electric mobility, renewable power, and modern communication systems. Copper's role in heat dissipation and efficient power transmission makes it indispensable for emerging tech infrastructure. As a result, the U.S. is expected to remain a leading consumer in the coming years.

Leading companies in the Global Copper and Brass Flat Products Market include Global Copper Conductors, Gujarat Copper Alloys Ltd, Aurubis, Chhajed Steel Limited, and KME Copper. To expand market presence and stay competitive, key players are implementing several effective strategies. Companies invest in advanced manufacturing technologies to improve precision, quality, and output. Strategic partnerships and acquisitions are helping expand their geographical reach and product portfolios. Sustainability is a strong focus, with firms adopting eco-friendly production methods and recyclable materials.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-Side impact (Raw Materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-Side impact (Selling Price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-Side impact (Raw Materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021-2024 (USD Mn)

- 3.3.2 Major importing countries, 2021-2024 (USD Mn)

Note: The above trade statistics will be provided for key countries only

- 3.4 Impact on trade

- 3.4.1 Trade volume disruptions

- 3.4.2 Retaliatory measures

- 3.5 Impact on the industry

- 3.5.1 Supply-side impact (raw materials)

- 3.5.1.1 Price volatility in key materials

- 3.5.1.2 Supply chain restructuring

- 3.5.1.3 Production cost implications

- 3.5.2 Demand-side impact (selling price)

- 3.5.2.1 Price transmission to end markets

- 3.5.2.2 Market share dynamics

- 3.5.2.3 Consumer response patterns

- 3.5.1 Supply-side impact (raw materials)

- 3.6 Key companies impacted

- 3.7 Strategic industry responses

- 3.7.1 Supply chain reconfiguration

- 3.7.2 Pricing and product strategies

- 3.7.3 Policy engagement

- 3.8 Outlook and future considerations

- 3.9 Supplier landscape

- 3.10 Profit margin analysis

- 3.11 Key news & initiatives

- 3.12 Regulatory landscape

- 3.13 Impact forces

- 3.13.1 Growth drivers

- 3.13.1.1 Rising demand from food services & hospitality

- 3.13.1.2 Growth in biomass power generation

- 3.13.1.3 E-commerce & direct-to-consumer sales expansion

- 3.13.2 Industry pitfalls & challenges

- 3.13.2.1 Deforestation & regulatory restrictions

- 3.13.1 Growth drivers

- 3.14 Growth potential analysis

- 3.15 Porter's analysis

- 3.16 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Wood Type, 2021 - 2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Log wood

- 5.3 Wood chips

- 5.4 Pellets

- 5.5 Forestry residues

- 5.6 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Food services

- 6.3 Power distribution

- 6.4 Others

Chapter 7 Market Size and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Hypermarkets and supermarkets

- 7.3 Specialty stores

- 7.4 E-commerce

- 7.5 Business to business

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Cornish Firewood

- 9.2 Firewood Fuel

- 9.3 Lost Coast Forest Products

- 9.4 JB Firewood

- 9.5 Pinnacle Firewood Company

- 9.6 Surefire Wood

- 9.7 Wilson Enterprises

- 9.8 Cutting Edge Firewood

- 9.9 Wood Step

- 9.10 The Log Store Group

- 9.11 Woodmill

- 9.12 Premier Firewood Company

- 9.13 UAB Vli Timber

- 9.14 Woodbioma