|

市场调查报告书

商品编码

1740955

自助储存软体市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Self-Storage Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

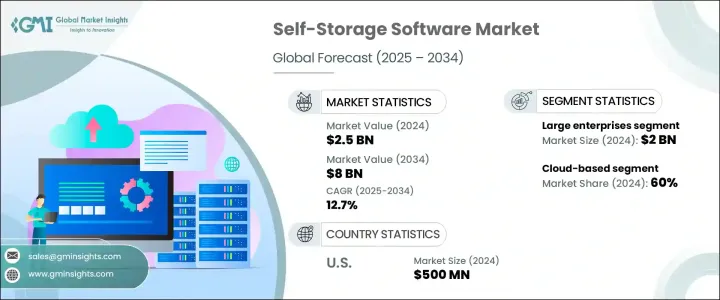

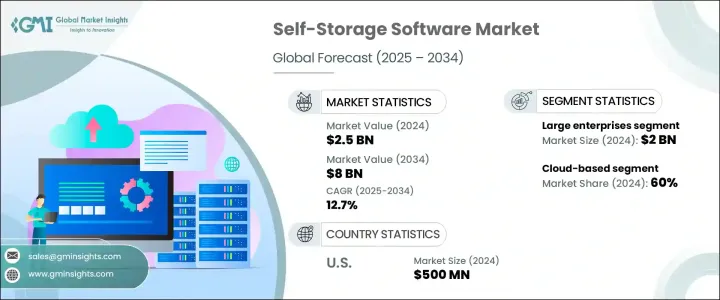

2024年,全球自助仓储软体市场规模达25亿美元,预计年复合成长率将达12.7%,到2034年将达到80亿美元。这主要得益于房地产行业对数位化解决方案需求的激增、城市人口的快速迁移,以及住宅和商业环境中对高效空间管理日益增长的需求。随着房地产市场动态的不断发展,自助仓储企业越来越多地转向数位化平台,以简化营运流程、提升租户体验并加强设施安全。人们对便利性、自动化和数据驱动决策的日益重视,推动着尖端软体系统的采用。营运商正在寻求可扩展的云端工具,以实现即时监控、改善入住率管理并提高营运效率,而不受传统基础设施的限制。

在当今科技前沿的环境中,自助储存软体在设施运作现代化中发挥着至关重要的作用。这些解决方案具备非接触式租赁、自动计费、线上支付和即时库存追踪等功能,可协助营运商在竞争激烈的市场中保持领先地位。整合客户关係管理 (CRM) 工具、数位门禁系统和进阶分析功能,进一步提升企业可见度并改善整体使用者体验。随着数位安全的重要性日益凸显,平台现已整合加密、行动警报和详细存取日誌,以提高透明度并建立租户信任。预测分析、用于安全合约管理的区块链以及用于沉浸式虚拟导览的扩增实境 (AR) 等新兴技术的融合,正在重塑企业与资料和客户的互动方式,最终提高敏捷性和盈利能力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 25亿美元 |

| 预测值 | 80亿美元 |

| 复合年增长率 | 12.7% |

基于云端的自助储存软体占据市场主导地位,2024 年占全球收入的近 60%。该细分市场的受欢迎程度源于其灵活性、经济实惠以及无缝支援跨地域营运的能力。云端平台更易于扩展和管理,是自助仓储业者拓展业务范围的理想选择。这些系统支援部署人工智慧 (AI) 驱动的工具、预测性维护计划和动态定价模型——这些功能通常难以透过本地基础设施部署。企业受益于集中存取、即时更新和极低的 IT 开销,从而显着提升绩效和决策能力。

订阅模式已成为自助储存软体产业首选的定价结构。这些模式提供了无与伦比的经济性和整合灵活性,尤其适合希望避免前期资本投资负担的中小型业者。透过定期付款结构,企业可以持续获得最新的软体功能、即时更新、技术支援和强大的网路安全增强功能。这种设置确保了营运的一致性,同时帮助营运商始终符合不断变化的行业标准。订阅模式也使供应商能够更频繁地提供产品改进,使企业在快速发展的数位生态系统中保持敏捷。

美国自助储存软体市场规模在2024年达到5亿美元,预计复合年增长率约为12.9%。随着自助储存产业的成熟以及消费者对数位化便利性的期望不断提升,美国正经历着向云端管理平台的重大转变。主要软体供应商的策略性投资以及政府为升级数位基础设施和增强资料安全性所采取的倡议,进一步加速了软体的普及。全国各地的企业逐渐认识到可扩展的、支援人工智慧的解决方案在优化空间利用率、改善服务交付和确保合规性方面的价值。

全球自助储存软体市场的领导者包括 OpenTech Alliance、storEDGE、QuikStor、Yardi Systems、Cascade Self-Storage 和 Space Management。这些公司专注于透过先进的云端原生解决方案扩展其产品组合,以提升用户体验并简化后端流程。透过利用人工智慧、物联网和区块链技术,他们提供更智慧、更安全、更有效率的平台。许多公司也积极进行策略合作、收购和合资企业,以增强其市场影响力,扩大业务覆盖范围,并推动自助储存软体领域的创新。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 配销通路分析

- 最终用途

- 利润率分析

- 供应商格局

- 川普政府关税的影响

- 贸易影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 贸易影响

- 技术与创新格局

- 专利分析

- 监管格局

- 成本細項分析

- 重要新闻和倡议

- 衝击力

- 成长动力

- 设施管理的数位转型

- 都市化进程加速与空间限制

- 对非接触式和远端存取的需求

- 与智慧科技的融合

- 产业陷阱与挑战

- 初期实施成本高

- 资料隐私与网路安全风险

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按部署,2021 - 2034 年

- 主要趋势

- 基于云端

- 本地

第六章:市场估计与预测:依组织规模,2021 - 2034 年

- 主要趋势

- 大型企业

- 中型企业(SME)

- 小型企业

第七章:市场估计与预测:依商业模式,2021 - 2034 年

- 主要趋势

- 基于订阅

- 基于永久许可证

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 住宅

- 商业的

- 工业的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Apex

- Beloit

- Cascade

- Easy Storage

- iStorage

- MyStorage

- OpenTech Alliance

- QuikStor

- Rentec Direct

- Secure Self Storage

- Self Storage Manager

- Shedul

- SiteLink

- Space Management

- Storage Commander

- Storage Pro Software

- storEDGE

- STORIS

- StorTrack

- Yardi Systems

The Global Self-Storage Software Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 12.7% to reach USD 8 billion by 2034, driven by the surging demand for digital solutions across the real estate sector, rapid urban migration, and the rising need for efficient space management in both residential and commercial environments. As real estate dynamics continue to evolve, self-storage businesses are increasingly turning to digital platforms to streamline operations, elevate tenant experiences, and strengthen facility security. The growing emphasis on convenience, automation, and data-driven decision-making is driving the adoption of cutting-edge software systems. Operators are seeking scalable, cloud-based tools that enable real-time monitoring, improve occupancy management, and enhance operational efficiency without the limitations of traditional infrastructure.

In today's tech-forward landscape, self-storage software plays a critical role in modernizing facility operations. With features like contactless rentals, automated billing, online payments, and real-time availability tracking, these solutions help operators stay ahead in a competitive market. Integrating customer relationship management (CRM) tools, digital access control systems and advanced analytics further allows businesses to boost visibility and improve the overall user experience. As digital security becomes more important, platforms now incorporate encryption, mobile alerts, and detailed access logs to enhance transparency and build tenant trust. The integration of emerging technologies such as predictive analytics, blockchain for secure contract management, and augmented reality (AR) for immersive virtual tours is reshaping how businesses interact with both data and customers, ultimately driving greater agility and profitability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $8 Billion |

| CAGR | 12.7% |

Cloud-based self-storage software dominates the market and accounted for nearly 60% of the global revenue in 2024. This segment's popularity stems from its flexibility, affordability, and ability to seamlessly support operations across multiple locations. Cloud platforms are easier to scale and manage, making them ideal for self-storage operators expanding their footprint. These systems allow for the implementation of artificial intelligence (AI)-driven tools, predictive maintenance schedules, and dynamic pricing models-features that are often difficult to deploy with on-premises infrastructure. Businesses benefit from centralized access, real-time updates, and minimal IT overhead, which significantly enhances performance and decision-making capabilities.

Subscription-based models have emerged as the preferred pricing structure across the self-storage software industry. These models offer unmatched affordability and integration flexibility, especially for small and mid-sized operators looking to avoid the financial burden of upfront capital investments. Through a recurring payment structure, businesses gain continuous access to the latest software features, real-time updates, technical support, and robust cybersecurity enhancements. This setup ensures operational consistency while helping operators remain compliant with changing industry standards. The subscription model also enables providers to offer more frequent product improvements, keeping businesses agile in a fast-moving digital ecosystem.

The U.S. Self-Storage Software Market reached USD 500 million in 2024 and is projected to grow at a CAGR of around 12.9%. With a well-established self-storage sector and rising consumer expectations for digital convenience, the U.S. is witnessing a significant shift toward cloud-based management platforms. Strategic investments by key software providers and government initiatives to upgrade digital infrastructure and enhance data security are further accelerating software adoption. Businesses across the country are recognizing the value of scalable, AI-enabled solutions in optimizing space utilization, improving service delivery, and ensuring regulatory compliance.

Leading players in the global self-storage software market include OpenTech Alliance, storEDGE, QuikStor, Yardi Systems, Cascade Self-Storage, and Space Management. These companies are focused on expanding their portfolios with advanced, cloud-native solutions that elevate user experience and streamline back-end processes. By leveraging AI, IoT, and blockchain technologies, they are offering smarter, more secure, and highly efficient platforms. Many are also engaging in strategic partnerships, acquisitions, and collaborative ventures to strengthen their market presence, broaden their reach, and drive innovation in the self-storage software space.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Trade impact

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Trade impact

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Digital transformation of facility management

- 3.8.1.2 Rising urbanization & space constraints

- 3.8.1.3 Demand for contactless & remote access

- 3.8.1.4 Integration with smart technologies

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial implementation costs

- 3.8.2.2 Data privacy & cybersecurity risks

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Cloud-based

- 5.3 On-premises

Chapter 6 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Large enterprises

- 6.3 Medium-Sized Enterprises (SME)

- 6.4 Small enterprises

Chapter 7 Market Estimates & Forecast, By Business Model, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Subscription-based

- 7.3 Perpetual License-based

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Apex

- 10.2 Beloit

- 10.3 Cascade

- 10.4 Easy Storage

- 10.5 iStorage

- 10.6 MyStorage

- 10.7 OpenTech Alliance

- 10.8 QuikStor

- 10.9 Rentec Direct

- 10.10 Secure Self Storage

- 10.11 Self Storage Manager

- 10.12 Shedul

- 10.13 SiteLink

- 10.14 Space Management

- 10.15 Storage Commander

- 10.16 Storage Pro Software

- 10.17 storEDGE

- 10.18 STORIS

- 10.19 StorTrack

- 10.20 Yardi Systems