|

市场调查报告书

商品编码

1740958

汽车门槛市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Door Sills Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

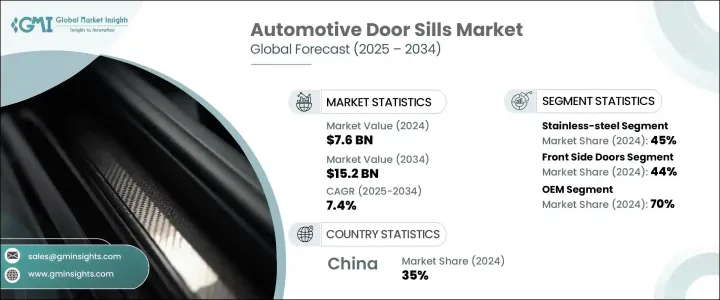

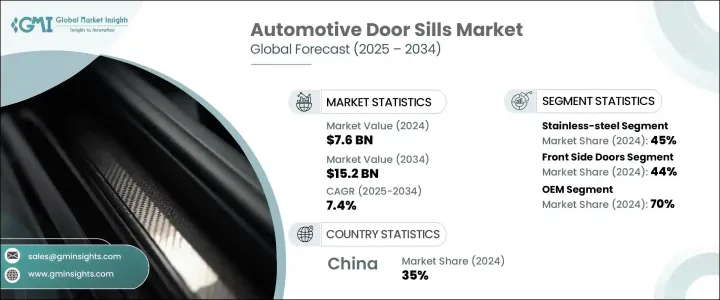

2024年,全球汽车门槛板市场规模达76亿美元,预计到2034年将以7.4%的复合年增长率成长,达到152亿美元。推动这一成长的关键因素是人们对车辆进入系统的高度关注以及全球汽车产量的持续成长。随着汽车技术日趋智能化,外观设计也愈发精緻,门槛板不再被视为简单的保护性饰条,而是兼具设计感和功能性的多功能部件。汽车製造商正在整合照明系统、接近侦测和高强度材料等先进功能,以提升使用者体验、耐用性和视觉吸引力。轻量化设计在电动和混合动力汽车中尤其重要,这推动了对既能提供强度又不增加额外重量的材料的需求。碳纤维、铝和抗衝击聚合物在打造兼具性能和造型标准的现代门槛板方面正变得至关重要。这些材料能够实现复杂的设计、提升结构性能并增强对环境条件的耐受性,所有这些都有助于实现更广泛的节能和长期使用目标。

汽车门槛也正在透过基于感测器的创新进行变革,这些创新将互动元素融入其中。製造商正在探索能够响应人体接近、与环境照明协调,甚至支援触控或手势控制的智慧门槛。这些功能将门槛定位为现代汽车智慧架构的一部分,并与汽车更广泛的资讯娱乐和门禁系统无缝整合。随着科技与汽车内装的不断融合,这些增强型门槛对于提供高品质、个人化的驾驶体验至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 76亿美元 |

| 预测值 | 152亿美元 |

| 复合年增长率 | 7.4% |

2024年,不銹钢占据了最大的市场份额,约占45%,预计到2034年,其复合年增长率将超过7%。这种优势得益于不銹钢无与伦比的耐用性、成本效益和抗衝击性。它能够承受频繁进出,尤其是在SUV和车队车辆等高流量车辆中。其耐腐蚀性还能确保即使在恶劣的天气或路况下,不銹钢也能保持外观和结构完好。对于电动和混合动力车型,不锈钢可提供支撑车身完整性所需的结构强度,同时还能容纳发光标誌、动态照明或智慧门禁模组等现代化功能。

从应用角度来看,前侧门领域在2024年以44%的市占率领先市场,预计在2025年至2034年期间的复合年增长率将超过7%。前侧门与驾驶和乘客的互动最为频繁,因此成为防护和装饰升级的主要重点。汽车製造商利用这一区域引入品牌元素和以用户为中心的功能,因为它是进入车辆时主要的视觉和触觉接触点。发光侧门和带有标识的装饰条经常被整合在这里,以留下持久的第一印象,并强调车辆的整体设计品质。

按车型分类,由于轿车、掀背车和小型SUV的全球产量较高,乘用车市场继续占据主导地位。由于消费者更注重外观和功能性的内装升级,製造商正在为这些车辆配备不銹钢和照明的门槛板,将安全性与奢华感融为一体。随着电动车和自动驾驶汽车的普及,门槛板部件也在不断发展,以相容于整合式电子系统,这进一步凸显了它们的重要性,而不仅仅是起到美观的作用。

在亚太地区,中国在2024年成为主导市场,创造了约7亿美元的市场规模,占据该地区约35%的份额。中国作为全球最大汽车生产国的地位以及国内对电动车日益增长的需求,为其占据领先地位做出了重要贡献。中国强大的製造业生态系统使其能够高效生产和出口先进的门槛系统。

汽车产业趋势正在塑造市场,例如以用户为中心的人体工学、高性能材料和环境整合。为了应对机械应力、天气暴露和电子元件稳定性等挑战,製造商如今采用具有高抗衝击性的热塑性塑胶、抗紫外线涂层和防水LED系统。这些升级增强了门槛在极端气候和持续使用条件下的耐用性,尤其是在高阶汽车领域。

先进的製造技术正在提高组装精度,尤其适用于整合照明灯和感测器的车型。快速组装黏合剂和卡扣系统的使用可最大限度地减少振动损伤,并确保安装更清洁。同时,EMI屏蔽线路和最佳化的线缆布线有助于避免照明门槛板中的讯号干扰。基于人工智慧和3D视觉化技术的智慧设计平台如今能够快速实现门槛板模组的原型设计和客製化。这些工具能够精确地匹配品牌目标、使用者介面预期和车辆美观度,使门槛板成为下一代汽车座舱的关键互动点。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 製造商

- 原物料供应商

- 汽车OEM

- 配销通路

- 最终用途

- 川普政府关税的影响

- 贸易影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(客户成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 贸易影响

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 价格趋势分析

- 产品

- 地区

- 成本細項分析

- 对部队的影响

- 成长动力

- 车辆客製化需求不断成长

- 室内防护意识不断增强

- 电动车和豪华汽车销售成长

- 全球汽车产量增加

- 产业陷阱与挑战

- 先进设计的製造成本高

- 恶劣环境下的耐久性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 不銹钢

- 铝

- 橡皮

- 塑胶

- 碳纤维

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 前侧门

- 后侧门

- 尾门

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 商用车

- 轻型商用车

- 中型商用车

- 重型商用车

第八章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- AC Schnitzer

- BMW

- Bosch

- Galio

- Gestamp

- Gronbach

- Hangzhou Green Offroad Auto Parts

- Honda Access

- Innotec

- Key Safety Systems (KSS)

- Mahle

- Mopar (FCA)

- Normic Industries

- Prius Auto Industries

- Rugged Ridge

- Shenzhen ATR Industry

- Shenzhen Yanming Plate Process

- SKS Kontakttechnik

- STEProtect (Sliplo)

- Zealio Electronics

The Global Automotive Door Sills Market was valued at USD 7.6 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 15.2 billion by 2034. A key factor fueling this expansion is the heightened focus on vehicle entry systems and the consistent rise in global automobile production. As vehicles evolve with smarter technologies and more refined aesthetics, door sills are no longer viewed as simple protective trims but as multifunctional components that enhance both design and functionality. Automakers are integrating advanced features like lighting systems, proximity detection, and high-strength materials to improve user experience, durability, and visual appeal. Lightweight designs are especially important in electric and hybrid vehicles, driving the demand for materials that provide strength without adding extra weight. Carbon fiber, aluminum, and impact-resistant polymers are becoming essential in creating modern sills that meet both performance and styling standards. These materials allow for intricate designs, improved structural performance, and better resistance to environmental conditions, all of which support the broader goals of energy efficiency and long-term use.

Automotive door sills are also being transformed through sensor-based innovations that bring interactive elements into the mix. Manufacturers are exploring smart sills that can respond to human proximity, coordinate with ambient lighting, and even enable touch or gesture controls. These features position the door sill as part of the intelligent architecture of modern vehicles, seamlessly integrating with the car's broader infotainment and entry systems. As technology continues to merge with automotive interiors, these enhanced sills are becoming crucial for delivering a high-quality, customized driving experience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.6 billion |

| Forecast Value | $15.2 Billion |

| CAGR | 7.4% |

In 2024, stainless steel held the largest share of the market, accounting for approximately 45%, and is projected to grow at a CAGR exceeding 7% through 2034. This dominance is due to stainless steel's unmatched durability, cost-effectiveness, and impact resistance. It holds up well under repeated entry and exit, especially in high-traffic vehicles like SUVs and fleet cars. Its corrosion resistance also ensures that it remains visually and structurally intact even under harsh weather or road conditions. For electric and hybrid models, stainless steel offers the structural strength needed to support vehicle body integrity while accommodating modern features like illuminated logos, dynamic lighting, or smart access modules.

From an application perspective, the front side doors segment led the market with a 44% share in 2024 and is expected to expand at a CAGR of over 7% between 2025 and 2034. Front door sills see the highest interaction from both drivers and passengers, making them the primary focus for protective and decorative upgrades. Auto manufacturers leverage this section to introduce branding elements and user-centric features, as it forms a major visual and tactile contact point when entering the vehicle. Illuminated sills and logo-enhanced trims are frequently integrated here to leave a lasting first impression and emphasize the vehicle's overall design quality.

When classified by vehicle type, the passenger cars segment continues to dominate due to the high global production volumes of sedans, hatchbacks, and compact SUVs. As buyers lean toward visually appealing and functional interior upgrades, manufacturers are equipping these vehicles with stainless steel and lighted sill plates that combine protection with a touch of luxury. With the increasing shift toward electric and autonomous models, door sill components are also evolving to be compatible with integrated electronic systems, reinforcing their importance beyond just cosmetic roles.

In the Asia-Pacific region, China emerged as the dominant market player in 2024, generating approximately USD 700 million and holding around 35% of the regional share. Its position as the world's largest vehicle producer and growing domestic appetite for electric vehicles contribute significantly to this leadership. The country's robust manufacturing ecosystem enables efficient production and export of advanced door sill systems.

The market is being shaped by automotive industry trends such as user-focused ergonomics, high-performance materials, and ambient integration. To address challenges like mechanical stress, weather exposure, and electronic component stability, manufacturers now employ thermoplastics with high impact resistance, UV-stable finishes, and waterproof LED systems. These upgrades enhance the sills' durability in extreme climates and under constant use, especially in premium vehicle segments.

Advanced manufacturing techniques are improving fitment accuracy, particularly for models featuring integrated lights and sensors. The use of quick-assembly adhesives and clip-lock systems minimizes vibration damage and ensures cleaner installations. Meanwhile, EMI-shielded wiring and optimized cable routing helps avoid signal interference in illuminated sills. Intelligent design platforms powered by AI and 3D visualization are now enabling rapid prototyping and customization of sill modules. These tools allow for precise alignment with branding goals, user interface expectations, and vehicle aesthetics, making door sills a key point of interaction in next-generation vehicle cabins.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Raw material suppliers

- 3.2.3 Automotive OEM

- 3.2.4 Distribution channel

- 3.2.5 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Pricing trend analysis

- 3.9.1 Product

- 3.9.2 Region

- 3.10 Cost breakdown analysis

- 3.11 Impact on forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising demand for vehicle customization

- 3.11.1.2 Growing awareness of interior protection

- 3.11.1.3 Growth in electric and luxury vehicle sales

- 3.11.1.4 Increasing automotive production globally

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High manufacturing costs of advanced designs

- 3.11.2.2 Durability concerns in harsh environments

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Stainless steel

- 5.3 Aluminum

- 5.4 Rubber

- 5.5 Plastic

- 5.6 Carbon fiber

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Front side doors

- 6.3 Back side door

- 6.4 Tailgate

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles

- 7.3.2 Medium commercial vehicles

- 7.3.3 Heavy commercial vehicles

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 AC Schnitzer

- 10.2 BMW

- 10.3 Bosch

- 10.4 Galio

- 10.5 Gestamp

- 10.6 Gronbach

- 10.7 Hangzhou Green Offroad Auto Parts

- 10.8 Honda Access

- 10.9 Innotec

- 10.10 Key Safety Systems (KSS)

- 10.11 Mahle

- 10.12 Mopar (FCA)

- 10.13 Normic Industries

- 10.14 Prius Auto Industries

- 10.15 Rugged Ridge

- 10.16 Shenzhen ATR Industry

- 10.17 Shenzhen Yanming Plate Process

- 10.18 SKS Kontakttechnik

- 10.19 STEProtect (Sliplo)

- 10.20 Zealio Electronics