|

市场调查报告书

商品编码

1740959

可部署军用掩体市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Deployable Military Shelters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

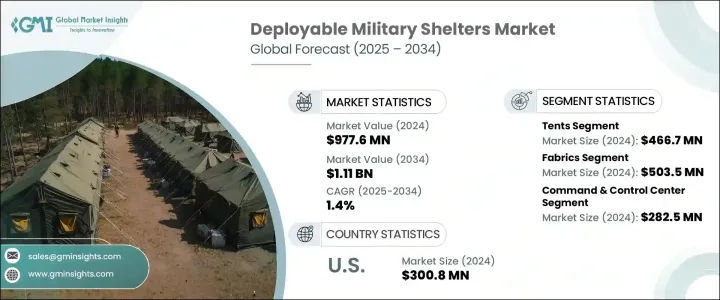

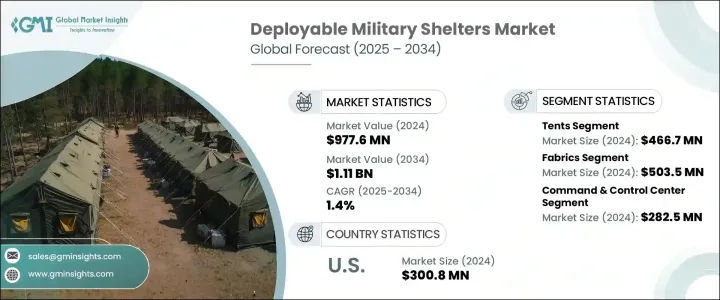

2024 年全球可部署军用方舱市场价值为 9.776 亿美元,预计到 2034 年将以 1.4% 的复合年增长率成长,达到 11.1 亿美元。这一稳步增长得益于全球国防预算的增加以及紧急和人道主义行动期间对行动基础设施日益增长的需求。全球各地的国防部队都在不断投资于多功能、坚固的方舱系统,以满足不断变化的战场和后勤需求。这些方舱不再仅仅用于军事需求;它们现在还支援灾难应变和復原任务期间的民用应用。随着军队和政府优先考虑快速机动和即时作战能力,对紧凑、耐用且易于部署的方舱的需求呈上升趋势。这包括移动野战医院、作战指挥中心和紧急住房单元。此外,随着各国都致力于提高对陆、空、海、网路和太空等多个作战领域中不可预测威胁的应对能力,市场正在获得发展动力。为了应对这项挑战,製造商正在迅速创新,设计出能够承受恶劣气候、提供高效能能源解决方案并能在战斗和危机情况下迅速部署的系统。

近年来,贸易政策变化对可部署掩体的成本结构产生了显着影响。根据232条款和301条款征收的关税大幅提高了钢铁、铝和先进技术布料等重要原料的成本。这些关税扰乱了依赖进口零件的现有国际供应链,导致采购延误并推高了整体价格。结果,製造商被迫调整采购策略,转而选择来自北美或未受关税影响地区的供应商。儘管这些政策旨在促进国内製造业发展,但却造成了短期不稳定,并暴露了可部署掩体生产和交付网路中的脆弱性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.776亿美元 |

| 预测值 | 11.1亿美元 |

| 复合年增长率 | 1.4% |

就产品细分而言,掩体可分为帐篷、货柜单元和其他结构。其中,帐篷是2024年最大的细分市场,价值4.667亿美元。帐篷用途广泛且搭建快捷,是战术用途和短期部署的理想选择。现代帐篷采用增强型材料,提供先进的防护功能,例如防火、防紫外线和红外线探测。这些创新技术支援作战区域的隐蔽性和安全性,提高了在各种条件下掩体部署的可靠性和安全性。

材料选择对掩体性能至关重要,尤其是在作战压力下。 2024年,织物领域占据市场主导地位,价值达5.035亿美元。这些材料轻巧灵活,满足了日益增长的高效移动物流需求。纺织品技术的进步——例如阻燃涂层、紫外线阻隔功能和红外线伪装——使织物成为战术环境的首选。这些织物注重最大限度地提高耐用性,同时最大限度地减轻重量,使其能够满足快速移动、大量部署的需求。

根据应用,市场细分为指挥控制中心、医疗设施、维护单位、人道主义部署和宿舍。指挥控制中心市场占据主导地位,2024 年估值达 2.825 亿美元。随着全球国防力量转向一体化多域作战,对能够支援安全通讯、卫星链路和即时决策工具的方舱系统的需求持续增长。这些方舱正在开发内置电磁干扰屏蔽和强化通讯模组,以确保其在对抗环境中保持运作。

美国以2024年3.008亿美元的估值领先全球市场。这一领先地位源于其广泛的军事存在、日益增长的移动基础设施需求以及积极推进国防现代化的方针。美国快速部署部队和紧急管理机构是可部署方舱的主要采用者,并在各种国内和国际任务中使用它们。预算拨款和对先进方舱技术的投资进一步巩固了其市场地位。

製造商正专注于下一代创新,例如模组化设计、整合太阳能功能以及内建通讯基础设施的方舱。这些特性符合永续性、快速部署和极端环境适应性的需求。该行业正朝着可扩展的解决方案迈进,这些解决方案能够提供灵活性和韧性,满足从战场协调到灾难应变等各种作战需求。随着对耐候性、节能性和易于运输的结构的需求不断增长,可部署军事方舱市场预计将快速发展,以应对新的复杂挑战。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 全球军费开支不断增加

- 武装部队现代化

- 在人道和救灾行动中的应用增加

- 注重部队安全和作战效率

- 环境和气候考虑

- 产业陷阱与挑战

- 初期投资和生命週期成本高

- 气候和地形调适问题

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依房屋类型,2021 年至 2034 年

- 主要趋势

- 帐篷

- 货柜庇护所

- 其他的

第六章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 织物

- 金属

- 复合材料

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 指挥与控制中心

- 医疗设施

- 维护设施

- 人道主义

- 宿舍

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- AAR

- Alaska Structures

- Blu-Med

- CAMSS Shelters

- Camel Manufacturing

- General Dynamics

- HDT Global

- Litefighter Systems

- Losberger

- Marshall Aerospace and Defense Group

- Outdoor Venture

- Rapid Deployable Systems

- RDD USA

- Rubb Buildings

- Saab

- Sprung Structures

- UTS Systems

- Weatherhaven Global Resources

- Western Shelter Systems

The Global Deployable Military Shelters Market was valued at USD 977.6 million in 2024 and is estimated to grow at a CAGR of 1.4% to reach USD 1.11 billion by 2034. This steady growth is fueled by rising global defense budgets and an increasing need for mobile infrastructure during emergency and humanitarian operations. Defense forces across the globe are continually investing in versatile and robust shelter systems to meet evolving battlefield and logistical requirements. These shelters are no longer used solely for military needs; they now support civil applications during disaster response and recovery missions. As militaries and governments prioritize rapid mobility and real-time operational capabilities, the demand for compact, durable, and easily deployable shelters is witnessing an upward trend. This includes mobile field hospitals, operational command centers, and emergency housing units. Moreover, the market is gaining momentum as nations aim to enhance readiness for unpredictable threats across multiple operational domains-land, air, sea, cyber, and space. In response, manufacturers are innovating rapidly to design systems that can withstand harsh climates, offer efficient energy solutions, and be swiftly deployed in both combat and crisis situations.

Trade policy changes in recent years have had a noticeable impact on the cost structure of deployable shelters. The introduction of tariffs under Section 232 and Section 301 significantly increased the costs of vital raw materials, including steel, aluminum, and advanced technical fabrics. These tariffs disrupted established international supply chains that relied on imported components, causing delays in procurement and driving up overall prices. As a result, manufacturers were compelled to shift sourcing strategies, favoring suppliers from North America or regions unaffected by the tariffs. Although the policies aimed to boost domestic manufacturing, they created short-term instability and exposed vulnerabilities in the production and delivery networks of deployable shelters.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $977.6 Million |

| Forecast Value | $1.11 Billion |

| CAGR | 1.4% |

In terms of product segmentation, shelters are categorized into tents, container-based units, and other structures. Among these, tents represented the largest market segment in 2024, valued at USD 466.7 million. Their versatility and rapid setup capability make them ideal for tactical use and short-term deployments. Modern tents have evolved with enhanced materials that offer advanced protection features, such as resistance to fire, UV rays, and infrared detection. These innovations support stealth and safety in operational zones, improving the reliability and security of shelter deployments in diverse conditions.

Material selection plays a crucial role in shelter performance, especially under operational stress. The fabric segment led the market in 2024, with a value of USD 503.5 million. Lightweight and flexible, these materials meet the growing need for efficient, mobile logistics. Technological advancements in textiles-like flame-retardant coatings, UV blocking capabilities, and infrared camouflage-have made fabrics a preferred choice for tactical environments. The focus on maximizing durability while minimizing weight makes these fabrics suitable for fast-moving, high-volume deployment needs.

By application, the market is segmented into command and control centers, medical facilities, maintenance units, humanitarian deployments, and living quarters. The command and control center segment dominated the market with a valuation of USD 282.5 million in 2024. As global defense forces shift toward integrated multi-domain operations, the need for shelter systems that can support secure communications, satellite links, and real-time decision-making tools continues to grow. These shelters are being developed with built-in electromagnetic interference shielding and hardened communication modules to ensure they remain operational in contested environments.

The United States led the global market with a valuation of USD 300.8 million in 2024. This leadership is driven by its expansive military presence, increasing demand for mobile infrastructure, and a proactive approach to defense modernization. The country's rapid deployment forces and emergency management agencies are key adopters of deployable shelters, using them in a variety of domestic and international missions. Budget allocations and investments in advanced shelter technologies have further strengthened its market position.

Manufacturers are focusing on next-generation innovations such as modular designs, integrated solar capabilities, and shelters with embedded communication infrastructure. These features align with the need for sustainability, quick deployment, and adaptability in extreme environments. The industry is moving toward scalable solutions that offer flexibility and resilience for a wide range of operational demands, from battlefield coordination to disaster response. As the requirement for climate-resistant, energy-efficient, and easily transportable structures continues to rise, the deployable military shelters market is expected to evolve rapidly to meet new and complex challenges.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing global military expenditure

- 3.3.1.2 Modernization of armed forces

- 3.3.1.3 Increased use in humanitarian & disaster relief operations

- 3.3.1.4 Focus on troop safety and operational efficiency

- 3.3.1.5 Environmental and climate considerations

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial investment and lifecycle cost

- 3.3.2.2 Climate and terrain adaptability issues

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Shelter Type, 2021 – 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Tents

- 5.3 Container-based shelters

- 5.4 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Fabric

- 6.3 Metal

- 6.4 Composite materials

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Command & control centers

- 7.3 Medical facilities

- 7.4 Maintenance facilities

- 7.5 Humanitarian

- 7.6 Living quarters

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AAR

- 9.2 Alaska Structures

- 9.3 Blu-Med

- 9.4 CAMSS Shelters

- 9.5 Camel Manufacturing

- 9.6 General Dynamics

- 9.7 HDT Global

- 9.8 Litefighter Systems

- 9.9 Losberger

- 9.10 Marshall Aerospace and Defense Group

- 9.11 Outdoor Venture

- 9.12 Rapid Deployable Systems

- 9.13 RDD USA

- 9.14 Rubb Buildings

- 9.15 Saab

- 9.16 Sprung Structures

- 9.17 UTS Systems

- 9.18 Weatherhaven Global Resources

- 9.19 Western Shelter Systems