|

市场调查报告书

商品编码

1740963

暖通空调市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测HVAC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

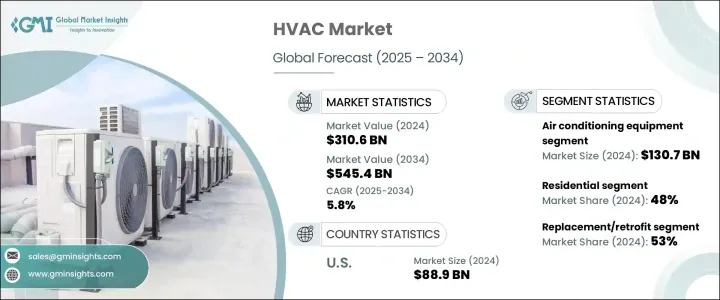

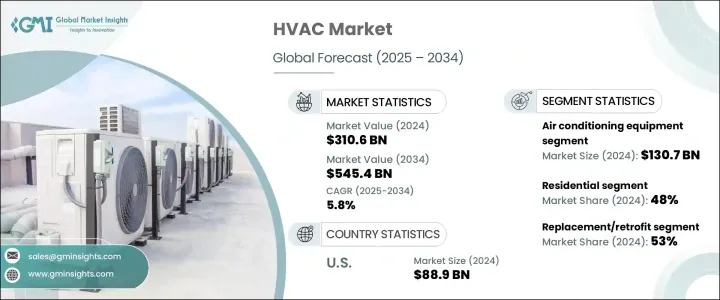

2024年,全球暖通空调市场规模达3,106亿美元,预计到2034年将以5.8%的复合年增长率成长,达到5,454亿美元。推动这一成长的主要因素之一是已开发国家和发展中国家对节能环保冷冻技术的需求不断增长。随着全球对永续发展和环境保护的日益关注,製造商被鼓励创新和开发先进的暖通空调系统,以降低能耗和排放。监管机构正在实施各种节能项目,以推广此类系统的使用,这促使企业和消费者都选择节能型暖通空调解决方案。这种偏好的转变正在加速智慧变速空调系统的普及,这些系统性能更佳,营运成本更低。人们对降低能耗的需求日益增长,尤其是在气候控制系统方面,这使得节能暖通空调技术在住宅、商业和工业应用中越来越具有吸引力。此外,气候变迁和全球气温上升正在推动更多地区持续使用冷冻系统,这进一步加剧了对高性能暖通空调设备的需求。

新兴市场的快速城市化,加上住宅区、商业空间和工业基础建设的增加,也推动了市场的发展。现代建筑正在采用符合最新能源标准的智慧系统和整合式暖通空调 (HVAC) 技术。世界各国政府都在强制执行建筑规范,要求在新开发案中使用节能的气候控制解决方案。对更智慧、更互联建筑的追求,大大促进了配备自动温控、智慧感测器和物联网连接等功能的暖通空调系统的需求。此外,改造安装也越来越受到关注,尤其是在需要升级以满足最新监管标准和永续发展目标的老旧建筑中。到2024年,改造/更换部分将占暖通空调市场总量的53%,在仍在使用传统系统的市场中显示出强劲的发展势头。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3106亿美元 |

| 预测值 | 5454亿美元 |

| 复合年增长率 | 5.8% |

按产品类型细分,暖通空调 (HVAC) 市场包括空调设备、暖气设备、通风系统、冷水机组和冷却水塔。 2024 年,空调设备占据主导地位,创造了 1,307 亿美元的收入。其持续成长主要得益于人们对节能製冷解决方案的认识不断提高,尤其是在空气品质和气温上升日益令人担忧的城市地区。另一方面,受对经济高效、低排放供暖系统日益增长的需求推动,供暖设备市场预计在 2025 年至 2034 年期间以约 5.7% 的复合年增长率增长。

市场终端用途细分包括住宅、商业和工业领域。 2024年,住宅领域占据了48%的市场份额,这得益于快速的城市扩张和不断增长的中产阶级人口,他们越来越多地投资于空调和气候控制系统,以提高个人舒适度。办公大楼、零售店和饭店等商业场所对先进暖通空调系统的需求也日益增长。这些设施优先考虑空气品质、舒适度和营运效率,推动了智慧互联暖通空调技术的安装。商业领域也受益于基础设施升级和更严格的环境标准的遵守,这些因素促使建筑业主使用现代化的节能解决方案来改造旧系统。

从地理分布来看,美国仍然是暖通空调 (HVAC) 市场的主要贡献者,约占北美市场份额的 79%,2024 年市场收入达 889 亿美元。美国市场的成长得益于联邦政府为提高暖气和冷气系统能源效率而出台的各项法规和激励措施。为使用现代化节能设备取代老旧暖通空调 (HVAC) 提供税收抵免的计划,正在加速住宅和商业建筑的系统升级。因此,对具有先进连接性、更佳能源管理且环境影响更低的暖通空调 (HVAC) 系统的需求强劲增长。

一些知名公司正透过产品创新和策略合作积极塑造暖通空调 (HVAC) 市场格局。主要的行业参与者包括开利 (Carrier)、博世 (Bosch)、大金工业 (Daikin Industries)、格力电器 (GREE Electric Appliances)、丹佛斯 (Danfoss)、海尔 (Haier)、江森自控 (Johnson Controls)、海信诺克斯、金融暖通设备 (Hisense HVAC ELGpment)、海信诺克斯和国际暖通空调设备 (Hisense HVAC ELGpment)、海信克斯Electronics)、三菱电机 (Mitsubishi Electric)、Rheem Manufacturing Company、松下 (Panasonic) 和特灵科技 (Trane Technologies)。这些公司持续投入研发,以满足不断变化的消费者期望和监管要求,推动市场迈向更智慧、更环保、更有效率的暖通空调 (HVAC) 解决方案迈进。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製成品

- 经销商

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 加强基础建设

- 在各行各业的用途日益广泛

- 技术进步

- 产业陷阱与挑战

- 投资成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 加热设备

- 熔炉

- 锅炉

- 热泵

- 通风设备

- 空气处理器

- 管道系统

- 风扇

- 空调设备

- 冷水机组

- 冷却水塔

第六章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 住宅

- 商业的

- 工业

第七章:市场估计与预测:按安装量,2021-2034

- 主要趋势

- 新建筑

- 更换/改造

第八章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直销

- 间接销售

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Bosch

- Carrier

- Daikin Industries

- Danfoss

- GREE Electric Appliances

- Haier

- Hisense HVAC equipment

- Johnson Controls

- Lennox International

- LG Electronics

- Midea

- Mitsubishi Electric

- Panasonic

- Rheem Manufacturing Company

- Trane Technologies

The Global HVAC Market was valued at USD 310.6 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 545.4 billion by 2034. One of the major factors supporting this growth is the rising demand for energy-efficient and eco-friendly cooling technologies across both developed and developing countries. As global focus intensifies on sustainability and environmental protection, manufacturers are being encouraged to innovate and develop advanced HVAC systems that consume less energy and produce fewer emissions. Regulatory bodies are implementing various energy efficiency programs that promote the use of such systems, which is prompting both businesses and consumers to opt for energy-conscious HVAC solutions. This shift in preference is accelerating the adoption of smart and variable-speed air conditioning systems, which offer better performance and lower operational costs. The growing need to reduce power consumption, particularly in climate control systems, has made energy-efficient HVAC technologies increasingly attractive across residential, commercial, and industrial applications. Additionally, climate change and rising global temperatures are pushing more regions toward consistent use of cooling systems, further amplifying the need for high-performance HVAC units.

Rapid urbanization in emerging markets, combined with increased construction of residential complexes, commercial spaces, and industrial infrastructure, is also fueling the market. Modern buildings are being designed with smart systems and integrated HVAC technologies that comply with the latest energy standards. Governments around the world are enforcing building codes that mandate the use of energy-efficient climate control solutions in new developments. The push for smarter, more connected buildings has significantly contributed to the demand for HVAC systems equipped with features like automated temperature control, smart sensors, and IoT connectivity. In addition, retrofit installations are gaining traction, especially in older buildings that require upgrades to meet updated regulatory standards and sustainability goals. The retrofit/replacement segment accounted for 53% of the total HVAC market in 2024, showing strong momentum in markets where legacy systems are still in use.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $310.6 Billion |

| Forecast Value | $545.4 Billion |

| CAGR | 5.8% |

When broken down by product type, the HVAC market includes air conditioning equipment, heating equipment, ventilation systems, chillers, and cooling towers. In 2024, air conditioning equipment was the dominant category, generating revenue of USD 130.7 billion. Its continued growth is largely driven by increased awareness of energy-efficient cooling solutions, particularly in urban areas where air quality and rising temperatures are a growing concern. On the other hand, the heating equipment segment is poised to grow at a CAGR of approximately 5.7% from 2025 to 2034, supported by growing demand for cost-effective and low-emission heating systems.

End-use segmentation of the market includes residential, commercial, and industrial sectors. The residential segment comprised 48% of the market in 2024, backed by rapid urban expansion and a growing middle-class population that is increasingly investing in air conditioning and climate control systems for personal comfort. Commercial spaces, such as office buildings, retail outlets, and hospitality venues, are also witnessing heightened demand for advanced HVAC systems. These facilities prioritize air quality, comfort, and operational efficiency, driving the installation of smart and connected HVAC technologies. The commercial segment is further benefitting from infrastructure upgrades and compliance with stricter environmental standards, which are pushing building owners to retrofit older systems with modern, energy-efficient solutions.

Geographically, the United States remained a leading contributor to the HVAC market, accounting for approximately 79% of the North American share and generating revenue of USD 88.9 billion in 2024. The market growth in the US is being fueled by federal mandates and incentives that promote energy efficiency in heating and cooling systems. Programs offering tax credits for replacing older HVAC units with modern, energy-efficient alternatives are supporting the acceleration of system upgrades in both residential and commercial buildings. As a result, there has been a strong uptick in demand for HVAC systems that feature advanced connectivity, improved energy management, and reduced environmental impact.

Several prominent companies are actively shaping the HVAC landscape through product innovation and strategic partnerships. Key industry players include Carrier, Bosch, Daikin Industries, GREE Electric Appliances, Danfoss, Haier, Johnson Controls, Hisense HVAC Equipment, Lennox International, Midea, LG Electronics, Mitsubishi Electric, Rheem Manufacturing Company, Panasonic, and Trane Technologies. These companies are continually investing in R&D to meet evolving consumer expectations and regulatory requirements, helping to drive the market toward smarter, greener, and more efficient HVAC solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing infrastructure development

- 3.6.1.2 Growing uses in various industries

- 3.6.1.3 Technological advancements

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High costs of investments

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Heating equipment

- 5.2.1 Furnaces

- 5.2.2 Boiler

- 5.2.3 Heat pumps

- 5.3 Ventilation equipment

- 5.3.1 Air handlers

- 5.3.2 Ductwork

- 5.3.3 Fans

- 5.4 Air conditioning equipment

- 5.5 Chillers

- 5.6 Cooling towers

Chapter 6 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrials

Chapter 7 Market Estimates & Forecast, By Installation, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 New construction

- 7.3 Replacement/Retrofit

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Bosch

- 10.2 Carrier

- 10.3 Daikin Industries

- 10.4 Danfoss

- 10.5 GREE Electric Appliances

- 10.6 Haier

- 10.7 Hisense HVAC equipment

- 10.8 Johnson Controls

- 10.9 Lennox International

- 10.10 LG Electronics

- 10.11 Midea

- 10.12 Mitsubishi Electric

- 10.13 Panasonic

- 10.14 Rheem Manufacturing Company

- 10.15 Trane Technologies