|

市场调查报告书

商品编码

1740978

骨科支撑系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Orthopedic Support Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

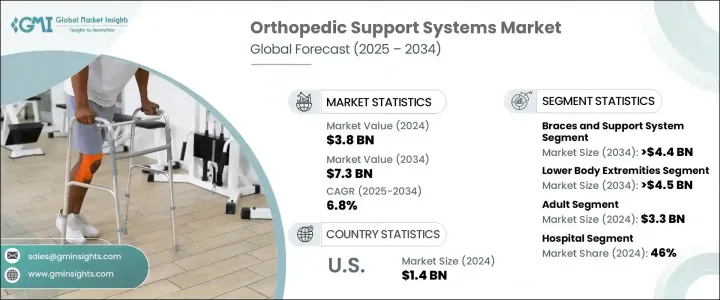

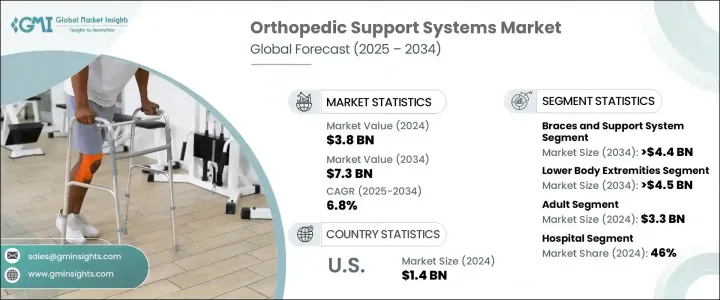

2024 年全球骨科支撑系统市场规模达 38 亿美元,预计到 2034 年将以 6.8% 的复合年增长率成长至 73 亿美元。这一增长趋势主要源于肌肉骨骼和运动伤害数量的增加,以及需要持续骨科护理和行动辅助的老年人口的增长。人们也更重视预防性医疗保健,包括使用支撑设备以降低受伤风险。随着支撑系统技术的进步,包括更用户友好、适应性更强和透气性更好的材料,市场规模持续扩大。这些创新使产品更适合长期佩戴,并提高了用户的依从性。人们对早期干预以及未治疗的关节和肌肉损伤的长期影响的认识不断提高,导致了文化的转变。许多人,尤其是那些正在从体力活动或復原中恢復的人,现在都积极使用骨科支撑作为日常保健的一部分。这种行为变化反映了人们对预防和復健后医疗实践的更广泛接受。

按产品类型细分,骨科支撑系统市场包括支架和支撑件、夹板、绷带和护套以及绑带。其中,支架和支撑件类别预计将推动主要成长。预计该细分市场的复合年增长率将达到 6.6%,到 2034 年市场规模将超过 44 亿美元。这些设备因其多功能性和在治疗各种肌肉骨骼疾病方面的广泛应用而占据主导地位。它们旨在支撑特定的身体部位,有助于稳定关节、缓解不适,并有助于术后或创伤后的癒合。各年龄层的损伤和退化性关节问题日益增多,导致对此类解决方案的需求日益增长。此外,现代製造技术的融合也为产品设计带来了显着改进。从客製化的贴合选项到可调节的绑带和更轻的材料,这些创新提升了整体舒适度并提高了每台设备的有效性,从而进一步推动了市场需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 38亿美元 |

| 预测值 | 73亿美元 |

| 复合年增长率 | 6.8% |

按应用细分,市场涵盖上肢和下肢器械。预计下肢器械市场将成为强劲的成长动力,预计到2034年其市场规模将超过45亿美元,复合年增长率为6.7%。这项需求源自于膝盖、臀部和脚踝等部位的损伤频率。许多人因为频繁参与体育活动和运动而患上这些部位的疾病。这些损伤通常需要有针对性的矫形解决方案来缓解疼痛、稳定和癒合。专为下肢设计的支撑器材不仅用于治疗,还可用于预防,尤其适用于近期接受过手术或患有退化性疾病的患者。预防性医疗保健和矫形復健的兴起,使得这些产品的应用范围远远超出了传统的復健领域。

根据患者人口统计数据,市场分为成人和儿童两部分。 2024年,成人占据了市场的大多数,创造了33亿美元的收入。成人肌肉骨骼疾病的发生率较高,部分原因是体力劳动、体适能习惯以及与生活方式相关的健康问题。肥胖和糖尿病等疾病往往会加剧关节劳损和损伤的可能性。骨科支撑系统已成为成人管理慢性疼痛、术后恢復或应对与年龄相关的退化性疾病的必备工具。由于穿戴式骨科设备等非侵入性治疗手段的普及以及其益处的认知度不断提高,这类治疗手段在这群人中越来越受欢迎。

就最终用途而言,市场细分为医院、骨科中心、復健中心和其他机构。 2024年,医院占最大份额,收入达18亿美元,占整个市场的46%。预计到2034年,该细分市场的复合年增长率将达到6.9%。医院仍然是急性骨科护理的主要场所,涵盖从手术到术后復健的各个环节。医院拥有专业的医护人员和先进的医疗设备,是提供全面支援解决方案的理想场所。随着全球骨科手术数量的持续增长,对辅助患者復健的支援设备的需求也在增长。

在美国,骨科支撑系统市场规模在2024年达到14亿美元,未来几年呈现强劲成长动能。该地区的成长得益于运动伤害、慢性病的高发性以及发达的医疗基础设施。美国广泛采用的復健方案和先进的医疗技术支撑了对这些系统的持续需求。此外,领先製造商的强劲市场参与巩固了美国在该领域的主要地位。

全球约40%的市占率由前五的公司占据,这些公司在研发、产品创新和策略合作方面投入大量资金。这些公司正朝着更个人化、数位化和以数据为中心的解决方案迈进,并将穿戴式感测器等技术融入其产品中。这一方向确保了其持续发展,并使它们在不断发展的骨科领域中保持竞争力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 骨科疾病和病症的盛行率不断上升

- 运动和事故相关伤害案件增加

- 公众预防保健意识不断增强

- 技术进步

- 产业陷阱与挑战

- 设备成本高

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 报销场景

- 技术格局

- 差距分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 支架和支撑

- 夹板

- 绷带和袖套

- 带子

第六章:市场估计与预测:按应用 2021 - 2034

- 主要趋势

- 下肢

- 膝盖/大腿

- 臀部、脊椎和背部

- 踝

- 脚

- 其他下肢

- 上肢

- 手和腕部

- 弯头

- 肩膀

- 其他上肢

第七章:市场估计与预测:按患者,2021 - 2034 年

- 主要趋势

- 成人

- 儿科

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 骨科中心

- 復健中心

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 3M

- ALCARE

- aspen medical

- BAUERFEIND

- Bird & Cronin

- BREG

- DeRoyal

- Enovis

- essity

- HELY & WEBER

- MCDAVID

- medi

- OSSUR

- ottobock

- ZIMMER BIOMET

The Global Orthopedic Support Systems Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 7.3 billion by 2034. This rising trend is largely driven by the increasing number of musculoskeletal and athletic injuries, along with a growing elderly population that requires ongoing orthopedic care and mobility assistance. People are also paying more attention to preventive healthcare, which includes the use of support devices to reduce injury risks before they occur. The market continues to expand thanks to advancements in support system technologies, which include more user-friendly, adaptive, and breathable materials. These innovations make the products more comfortable for long-term wear and increase user adherence. Growing awareness around early intervention and the long-term effects of untreated joint and muscular injuries has led to a cultural shift. Many individuals, especially those recovering from physical activity or rehabilitation, now actively use orthopedic supports as part of their daily health routine. This behavioral change reflects a broader acceptance of preventive and post-rehabilitation medical practices.

Segmented by product type, the orthopedic support systems market includes braces and supports, splints, bandages and sleeves, and straps. Among these, the braces and supports category is projected to drive a major portion of the growth. This segment is expected to expand at a CAGR of 6.6%, reaching over USD 4.4 billion by 2034. These devices dominate due to their versatility and extensive use in managing various musculoskeletal conditions. Designed to support specific body areas, they help stabilize joints, alleviate discomfort, and assist in healing during post-surgical or post-trauma phases. A rising number of injuries and degenerative joint issues across all age groups has led to an increased need for such solutions. Moreover, the integration of modern manufacturing techniques has brought significant improvements in product design. From customized fitting options to adjustable straps and lighter materials, these innovations boost overall comfort and improve the effectiveness of each device, thereby driving further market demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 6.8% |

When broken down by application, the market includes devices for upper and lower body extremities. The lower body extremities segment is anticipated to be a strong growth driver, with projections indicating it will reach over USD 4.5 billion by 2034, growing at a CAGR of 6.7%. This demand stems from the frequency of injuries involving the knees, hips, and ankles. Many individuals suffer from conditions in these regions due to increased involvement in physical activities and sports. These injuries often require targeted orthopedic solutions for pain relief, stability, and healing. Support devices tailored for the lower body are used not only for treatment but also for prevention, especially in patients who have recently undergone surgery or who suffer from degenerative diseases. The rise of preventive healthcare and orthopedic rehabilitation has expanded the use of these products far beyond traditional recovery settings.

Based on patient demographics, the market is divided into adult and pediatric segments. Adults made up the majority of the market in 2024, generating USD 3.3 billion in revenue. Adults face a higher incidence of musculoskeletal conditions, partly due to physically demanding jobs, fitness routines, and lifestyle-related health problems. Conditions such as obesity and diabetes often compound the likelihood of joint strain and injuries. Orthopedic support systems have become essential tools for adults managing chronic pain, recovering from surgery, or dealing with age-related degenerative issues. Non-invasive treatment options, such as wearable orthopedic devices, have gained popularity among this group, thanks to improved accessibility and greater awareness of the benefits.

In terms of end use, the market is segmented into hospitals, orthopedic centers, rehabilitation centers, and other facilities. Hospitals held the largest share in 2024, accounting for USD 1.8 billion in revenue and 46% of the total market. This segment is also projected to grow at a CAGR of 6.9% by 2034. Hospitals continue to be the primary setting for acute orthopedic care, from surgeries to post-operative rehabilitation. The availability of specialized staff and advanced medical equipment makes hospitals ideal for providing comprehensive support solutions. As the number of orthopedic surgeries continues to rise globally, so does the demand for support devices that aid in patient recovery.

In the United States, the orthopedic support systems market reached USD 1.4 billion in 2024, showing strong signs of expansion in the years ahead. Growth in this region is fueled by a high occurrence of sports-related injuries, chronic conditions, and a well-developed healthcare infrastructure. The country's extensive adoption of rehabilitation protocols and advanced medical technology supports ongoing demand for these systems. Furthermore, strong market participation from leading manufacturers reinforces the US's position as a major player in this field.

Around 40% of the global market is held by the top five companies, which are heavily investing in research, product innovation, and strategic partnerships. These companies are moving toward more personalized, digital, and data-focused solutions, incorporating technologies such as wearable sensors into their offerings. This direction ensures continuous development and positions them to remain competitive in the evolving orthopedic landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of orthopedic diseases and disorders

- 3.2.1.2 Rise in cases of sports and accident-related injuries

- 3.2.1.3 Growing public awareness of preventive care

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of the devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Reimbursement scenario

- 3.7 Technology landscape

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Braces and support

- 5.3 Splint

- 5.4 Bandage and sleeves

- 5.5 Strap

Chapter 6 Market Estimates and Forecast, By Application 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Lower body extremities

- 6.2.1 Knee/thigh

- 6.2.2 Hip, spine, and back

- 6.2.3 Ankle

- 6.2.4 Foot

- 6.2.5 Other lower body extremities

- 6.3 Upper body extremities

- 6.3.1 Hand and Wrist

- 6.3.2 Elbow

- 6.3.3 Shoulder

- 6.3.4 Other upper body extremities

Chapter 7 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adult

- 7.3 Pediatric

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital

- 8.3 Orthopedic centers

- 8.4 Rehabilitation centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 3M

- 10.2 ALCARE

- 10.3 aspen medical

- 10.4 BAUERFEIND

- 10.5 Bird & Cronin

- 10.6 BREG

- 10.7 DeRoyal

- 10.8 Enovis

- 10.9 essity

- 10.10 HELY & WEBER

- 10.11 MCDAVID

- 10.12 medi

- 10.13 OSSUR

- 10.14 ottobock

- 10.15 ZIMMER BIOMET