|

市场调查报告书

商品编码

1740984

卡式空调市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cassette Air Conditioner Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

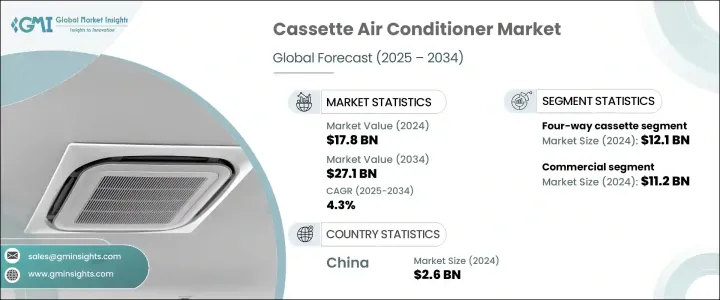

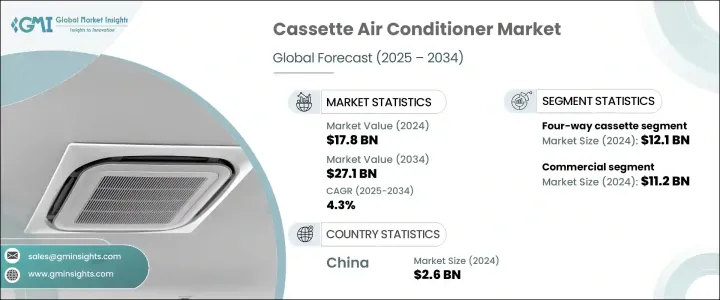

2024年,全球卡式空调市场规模达178亿美元,预计在技术进步的推动下,年复合成长率将达到4.3%,到2034年将达到271亿美元。随着对更紧凑、更有效率的製冷解决方案的需求不断增长,卡式空调正成为热门选择。这些安装在天花板上的空调能够将空气均匀地输送到四个方向,特别适用于办公室和商业建筑等较大的空间。消费者对节能、现代美学和卓越性能的偏好不断变化,进一步推动了卡式空调的广泛应用。

节能製冷解决方案在商业和住宅领域都备受追捧,这推动了卡式空调的普及。这些系统不仅满足了性能预期,其时尚现代的外观也提升了室内设计的风格。製造商透过整合降噪功能和智慧连接选项等先进技术来满足这些需求。透过智慧型手机或语音指令控制空调的功能提升了便利性,并推动了对这些技术先进设备的需求。因此,智慧节能製冷解决方案的成长预计将在未来几年加速市场扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 178亿美元 |

| 预测值 | 271亿美元 |

| 复合年增长率 | 4.3% |

市场按产品类型细分为单向、四向和其他类型的卡式空调。四向卡式空调占据市场领先地位,2024 年市场价值达 121 亿美元,预计复合年增长率为 4.2%。这类空调非常适合大型住宅和商业空间,因为它们能够提供多方向的均衡冷却。四向设计因其在办公室、商店和会议厅中高效均匀的温度控製而备受青睐。这类空调也受惠于先进的变频技术,可降低功耗和营运成本。

在应用领域,商业领域占最大份额,2024 年市场价值达 112 亿美元,预计到 2034 年增长率为 4.5%。卡式空调因其能够均匀製冷,同时保持安静、美观的环境,在办公室、饭店、医院和其他商业场所的应用日益广泛。卡式空调与物联网和变频技术的融合,使其成为希望降低能耗、提升舒适度和功能性的企业的理想选择。

2024年,亚太地区卡式空调市场规模达26亿美元,2025年至2034年的成长率为4.8%。中国市场对节能空调系统的需求日益增长,加上商业房地产的快速发展,推动了卡式空调的普及。许多建筑正在进行大规模升级改造,以提高能源效率,而向现代暖通空调系统的转变也进一步加速了卡式空调的普及。

卡式空调市场的主要参与者包括开利全球、大金工业、格力电器、LG电子、美的集团、三菱电机、松下和东芝等大型企业。这些公司专注于开发创新、节能且美观的空调解决方案,以占据更大的市场份额。他们也投资智慧技术,以增强产品供应,满足住宅和商业市场日益增长的便利性和节能需求。透过策略合作、技术进步和对永续性的重视,这些公司正在巩固其全球市场地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业回应

- 供应链重构

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 定价分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 增加商业和住宅建设

- 越来越注重美学和空间优化

- 产业陷阱与挑战

- 初始成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 单向卡式磁带

- 四通卡式磁带

- 其他(八路卡带等)

第六章:市场估计与预测:依产能,2021-2034

- 主要趋势

- 5千瓦以下

- 5千瓦-10千瓦

- 10千瓦以上

第七章:市场估计与预测:依价格区间,2021-2034

- 主要趋势

- 低的

- 中等的

- 高的

第八章:市场估计与预测:依安装类型,2021-2034

- 主要趋势

- 天花板安装

- 嵌入式

第九章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 住宅

- 商业的

- 办公室

- 饭店

- 餐厅

- 购物中心

- 其他(教育机构等)

- 工业的

第 10 章:市场估计与预测:按最终用途,2021-2034 年

- 主要趋势

- 新建筑

- 改造

第 11 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接的

- 间接

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十三章:公司简介

- Carrier Global

- Daikin Industries

- Fujitsu General

- Gree Electric Appliances

- Haier Group

- Hitachi

- LG Electronics

- Midea Group

- Mitsubishi Electric

- Panasonic

- Samsung Electronics

- Toshiba

- Trane Technologies

- York International

The Global Cassette Air Conditioner Market was valued at USD 17.8 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 27.1 billion by 2034, driven by technological advancements. As the need for more compact and efficient cooling solutions rises, cassette air conditioners are becoming a popular choice. These units, mounted on the ceiling, are designed to distribute air evenly in all four directions, making them particularly suitable for larger spaces such as offices and commercial buildings. This widespread adoption is further fueled by evolving consumer preferences that demand energy efficiency, modern aesthetics, and superior performance.

Energy-efficient cooling solutions are highly sought for both commercial and residential spaces, pushing the popularity of cassette air conditioners. These systems not only meet performance expectations but also enhance interior design with their sleek, modern appearance. Manufacturers respond to these needs by integrating advanced technologies such as noise reduction features and smart connectivity options. The ability to control air conditioners via smartphones or voice commands has increased convenience and driven the demand for these technologically advanced units. As a result, the growth of smart and energy-efficient cooling solutions is expected to accelerate market expansion in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.8 Billion |

| Forecast Value | $27.1 Billion |

| CAGR | 4.3% |

The market is segmented by product type into single-way, four-way, and other cassette air conditioners. The four-way cassette segment leads the market, valued at USD 12.1 billion in 2024, and is expected to grow at a CAGR of 4.2%. These units are ideal for large residential and commercial spaces, as they offer balanced cooling across multiple directions. The four-way design is favored for its efficiency in delivering uniform temperature control in offices, stores, and conference halls. These air conditioners also benefit from advanced inverter technology, which reduces power consumption and operational costs.

Regarding applications, the commercial sector holds the largest share, with a value of USD 11.2 billion in 2024 and a projected growth rate of 4.5% through 2034. Cassette air conditioners are increasingly used in office spaces, hotels, hospitals, and other commercial establishments due to their ability to provide uniform cooling while maintaining a quiet, aesthetically pleasing environment. Their integration with IoT and inverter technologies makes them an ideal choice for businesses looking to reduce energy consumption while enhancing comfort and functionality.

Asia Pacific Cassette Air Conditioner Market was valued at USD 2.6 billion in 2024, with a growth rate of 4.8% from 2025 to 2034. The growing demand for energy-efficient air conditioning systems, combined with the rapid development of commercial real estate, is driving the popularity of cassette air conditioners in China. Many buildings are undergoing extensive upgrades to improve energy efficiency, and the shift toward modern HVAC systems is further accelerating the adoption of cassette units.

Key players in the cassette air conditioner market include major companies such as Carrier Global, Daikin Industries, Gree Electric Appliances, LG Electronics, Midea Group, Mitsubishi Electric, Panasonic, and Toshiba. These companies focus on developing innovative, energy-efficient, and aesthetically pleasing air conditioning solutions to capture a larger market share. They are also investing in smart technologies to enhance product offerings and meet the growing demand for convenience and energy savings in residential and commercial markets. Through strategic collaborations, technological advancements, and an emphasis on sustainability, these companies are strengthening their market position globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.4.2.1 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump Administration Tariffs Analysis

- 3.2.1 Impact on Trade

- 3.2.1.1 Trade Volume Disruptions

- 3.2.1.2 Retaliatory Measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-Side Impact (Raw Materials)

- 3.2.2.2 Price Volatility in Key Materials

- 3.2.2.3 Supply Chain Restructuring

- 3.2.2.4 Production Cost Implications

- 3.2.2.5 Demand-Side Impact (Selling Price)

- 3.2.2.6 Price Transmission to End Markets

- 3.2.2.7 Market Share Dynamics

- 3.2.2.8 Consumer Response Patterns

- 3.2.3 Key Companies Impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on Trade

- 3.3 Supplier landscape

- 3.4 Pricing analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Manufacturers

- 3.9 Distributors

- 3.10 Retailers

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Increasing commercial and residential construction

- 3.11.1.2 Growing focus on aesthetics and space optimization

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial costs

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single-way cassette

- 5.3 Four-way cassette

- 5.4 Others (eight-way cassette, etc)

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Below 5 KW

- 6.3. 5 KW - 10 KW

- 6.4 Above 10 KW

Chapter 7 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Installation Type, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Ceiling mounted

- 8.3 Recessed mounted

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.3.1 Offices

- 9.3.2 Hotels

- 9.3.3 Restaurants

- 9.3.4 Shopping malls

- 9.3.5 Others (educational institutions, etc)

- 9.4 Industrial

Chapter 10 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 New construction

- 10.3 Retrofit

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Carrier Global

- 13.2 Daikin Industries

- 13.3 Fujitsu General

- 13.4 Gree Electric Appliances

- 13.5 Haier Group

- 13.6 Hitachi

- 13.7 LG Electronics

- 13.8 Midea Group

- 13.9 Mitsubishi Electric

- 13.10 Panasonic

- 13.11 Samsung Electronics

- 13.12 Toshiba

- 13.13 Trane Technologies

- 13.14 York International