|

市场调查报告书

商品编码

1740992

电缆组件市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cable Assembly Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

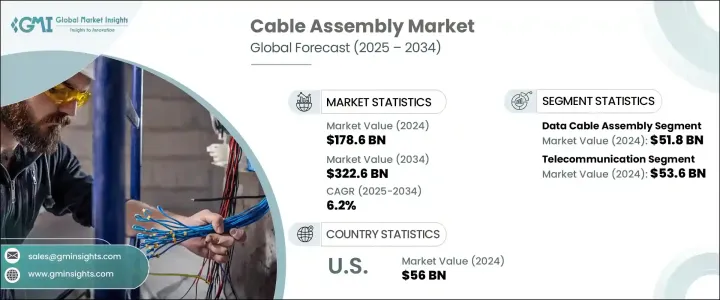

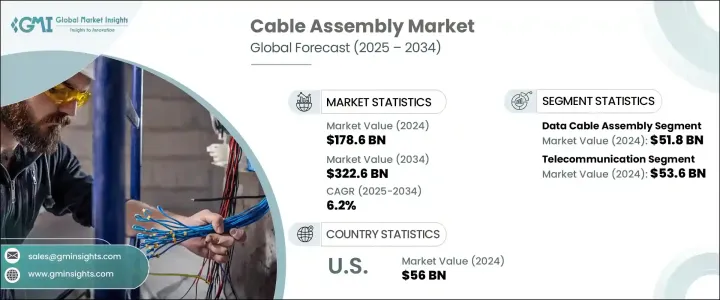

2024年,全球电缆组件市场规模达1,786亿美元,预计到2034年将以6.2%的复合年增长率成长,达到3,226亿美元,这得益于消费性电子产品需求的飙升和5G网路的快速扩张。电缆组件已成为高速通讯、高效能资料传输和无缝连接的支柱,对各行各业都至关重要。随着世界迈向数位转型、智慧製造、车联网和物联网设备迈进,对先进电缆技术的依赖日益加深。光纤、混合电缆和高频同轴电缆的日益普及,反映了人们对能够处理大量资料并支援超低延迟应用的更快、更可靠的解决方案日益增长的需求。目前,各行各业都在大力投资升级基础设施,这刺激了对支援下一代技术的创新电缆组件前所未有的需求。随着人工智慧、云端运算和智慧城市在全球范围内的持续扩张,电缆组件市场有望在建立高速互联的未来中发挥关键作用。

5G技术的扩展引发了对高性能电缆(例如光纤、同轴电缆和混合解决方案)的需求急剧增长,这些电缆对于可靠的资料传输、电力传输和高容量连接至关重要。这些电缆组件对于支援更快的通讯速度、更低的延迟以及管理指数级增长的资料量至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1786亿美元 |

| 预测值 | 3226亿美元 |

| 复合年增长率 | 6.2% |

美国实施的贸易政策和关税严重扰乱了电缆组装行业,尤其影响了从中国进口的零件和原材料。这种扰乱导緻美国製造商成本上升,迫使他们探索其他采购策略,并将业务迁往越南和墨西哥等国家,以抵消关税影响。儘管最初少数国内企业受益,但整体市场波动加剧,促使企业实现供应链多元化,并考虑区域生产,以增强长期韧性。

2024年,资料线组装市场规模达518亿美元,这得益于5G基础设施、光纤网路和乙太网路网路系统所必需的高速资料线需求的激增。云端运算的扩张和超大规模资料中心的快速发展,持续推高了对高频宽资料线的需求。此外,智慧型手机、游戏机、穿戴式科技和智慧家居设备的日益普及,也为市场成长增添了新的动力。

电信业已成为一个主要的应用领域,2024 年市场价值达 536 亿美元,这得益于对更快资料传输和低延迟通讯的需求。 5G 的蓬勃发展、智慧监控等物联网应用以及自动化系统的不断增长,正在推动该行业对先进电缆解决方案的需求。人工智慧和云端资料中心的扩张进一步扩大了这一成长空间。

受消费性电子产业蓬勃发展、自动化趋势和5G基础设施扩张的推动,美国电缆组件市场在2024年创收560亿美元。对智慧製造和资料中心连接的日益依赖,进一步加速了对尖端电缆组件的需求。

全球电缆组件市场的关键公司包括 TE Connectivity、安费诺公司、普睿司曼公司、耐吉森公司、RF Industries Ltd.、史密斯集团、Samtec Inc.、康宁公司、明尼苏达电线电缆公司、Fischer Connectors Holding SA、BizLink Holding Inc. 和 WL Gore & Associates Inc.。这些公司专注于产品创新、扩大製造能力、投资下一代解决方案的研发、与电信和资料中心领导者建立策略合作伙伴关係以及加强供应链以解决关税不确定性并确保长期成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业回应

- 供应链重构

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 消费性电子产品需求不断成长

- 5G网路的扩展

- 再生能源领域的成长

- 增加资料中心基础设施

- 物联网 (IoT) 应用的兴起

- 产业陷阱与挑战

- 材料成本上涨

- 供应链中断导致收入损失

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 电力电缆组件

- 数据线元件

- 讯号电缆组件

- 带状电缆组件

- 客製化电缆组件

- 同轴电缆组件

- 其他的

第六章:市场估计与预测:按产业垂直划分,2021 年至 2034 年

- 主要趋势

- 汽车

- 电信

- 消费性电子产品

- 航太与国防

- 卫生保健

- 能源与公用事业

- 其他的

第七章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第八章:公司简介

- Amphenol Corporation

- Aptiv

- BizLink Holding Inc

- Carrio Cabling Corp.

- Copartner Tech Corp.

- Corning Inc.

- Dongguan Luxshare Technology Co., Ltd.

- Fischer Connectors Holding SA

- Minnesota Wire & Cable Co.

- Nexans SA

- Prysmian Spa

- RF Industries Ltd.

- Samtec Inc.

- Smiths Group Plc

- TE Connectivity

- WL Gore & Associates Inc.

The Global Cable Assembly Market was valued at USD 178.6 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 322.6 billion by 2034, driven by the soaring demand for consumer electronics and the rapid expansion of 5G networks. Cable assemblies have become the backbone of high-speed communication, efficient data transmission, and seamless connectivity, making them critical across industries. As the world shifts towards digital transformation, smart manufacturing, connected vehicles, and IoT-enabled devices, the reliance on advanced cable technologies is intensifying. The growing popularity of fiber optics, hybrid cables, and high-frequency coaxial cables reflects the rising need for faster, more reliable solutions capable of handling large data volumes and supporting ultra-low latency applications. Industries are now investing heavily in upgrading infrastructure, fueling unprecedented demand for innovative cable assemblies that enable next-generation technologies. As AI, cloud computing, and smart cities continue to scale globally, the cable assembly market is poised to play a pivotal role in enabling a connected, high-speed future.

The expansion of 5G technology has triggered a sharp rise in demand for high-performance cables such as fiber optics, coaxial, and hybrid solutions, crucial for reliable data transmission, power delivery, and high-capacity connectivity. These cable assemblies are vital for supporting faster communication speeds, lower latency, and the management of exponentially growing data volumes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $178.6 Billion |

| Forecast Value | $322.6 Billion |

| CAGR | 6.2% |

Trade policies and tariffs implemented by the U.S. have significantly disrupted the cable assembly industry, particularly impacting the import of components and raw materials from China. This disruption has led to elevated costs for U.S. manufacturers, compelling them to explore alternative sourcing strategies and relocate operations to countries like Vietnam and Mexico to counter tariff effects. Although a few domestic players benefited initially, the broader market faces heightened volatility, prompting companies to diversify supply chains and consider regional production to enhance long-term resilience.

The data cable assembly segment generated USD 51.8 billion in 2024, propelled by skyrocketing demand for high-speed data cables essential for 5G infrastructure, fiber optic networks, and Ethernet systems. Cloud computing expansion and the rapid proliferation of hyperscale data centers continue to boost the need for high-bandwidth cables. Additionally, the growing adoption of smartphones, gaming consoles, wearable tech, and smart home devices adds further momentum to market growth.

Telecommunications emerged as a major application area, valued at USD 53.6 billion in 2024, supported by the need for faster data transmission and low-latency communication. The boom in 5G rollouts, IoT applications like smart surveillance, and the rising number of automated systems are driving demand for advanced cable solutions in this sector. Expansion of AI-powered and cloud-based data centers further amplifies this growth.

The U.S. Cable Assembly Market generated USD 56 billion in 2024, fueled by the booming consumer electronics sector, automation trends, and 5G infrastructure expansion. Increased reliance on smart manufacturing and data center connectivity further accelerates demand for cutting-edge cable assemblies.

Key companies in the Global Cable Assembly Market include TE Connectivity, Amphenol Corporation, Prysmian Spa, Nexans SA, RF Industries Ltd., Smiths Group Plc, Samtec Inc., Corning Inc., Minnesota Wire & Cable Co., Fischer Connectors Holding SA, BizLink Holding Inc., and W. L. Gore & Associates Inc. These players are focusing on product innovation, expanding manufacturing capabilities, investing in R&D for next-gen solutions, forming strategic partnerships with telecom and data center leaders, and strengthening supply chains to address tariff uncertainties and ensure long-term growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump Administration Tariffs

- 3.2.1 Impact on Trade

- 3.2.1.1 Trade Volume Disruptions

- 3.2.1.2 Retaliatory Measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-Side Impact

- 3.2.2.1.1 Price Volatility in Key Components

- 3.2.2.1.2 Supply Chain Restructuring

- 3.2.2.1.3 Production Cost Implications

- 3.2.2.2 Demand-Side Impact (Selling Price)

- 3.2.2.2.1 Price Transmission to End Markets

- 3.2.2.2.2 Market Share Dynamics

- 3.2.2.2.3 Consumer Response Patterns

- 3.2.2.1 Supply-Side Impact

- 3.2.3 Key Companies Impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on Trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for consumer electronics

- 3.3.1.2 Expansion of 5G networks

- 3.3.1.3 Growth in renewable energy sector

- 3.3.1.4 Increasing data center infrastructure

- 3.3.1.5 Rising internet of things (IoT) adoption

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Rising material costs

- 3.3.2.2 Supply chain disruptions leading to revenue loss

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Power cable assemblies

- 5.3 Data cable assemblies

- 5.4 Signal cable assemblies

- 5.5 Ribbon cable assemblies

- 5.6 Custom cable assemblies

- 5.7 Coaxial cable assemblies

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Industry Vertical, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Automotive

- 6.3 Telecommunications

- 6.4 Consumer electronics

- 6.5 Aerospace & defense

- 6.6 Healthcare

- 6.7 Energy & utilities

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Amphenol Corporation

- 8.2 Aptiv

- 8.3 BizLink Holding Inc

- 8.4 Carrio Cabling Corp.

- 8.5 Copartner Tech Corp.

- 8.6 Corning Inc.

- 8.7 Dongguan Luxshare Technology Co., Ltd.

- 8.8 Fischer Connectors Holding SA

- 8.9 Minnesota Wire & Cable Co.

- 8.10 Nexans SA

- 8.11 Prysmian Spa

- 8.12 RF Industries Ltd.

- 8.13 Samtec Inc.

- 8.14 Smiths Group Plc

- 8.15 TE Connectivity

- 8.16 W. L. Gore & Associates Inc.