|

市场调查报告书

商品编码

1740996

模塑纸浆包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Molded Pulp Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

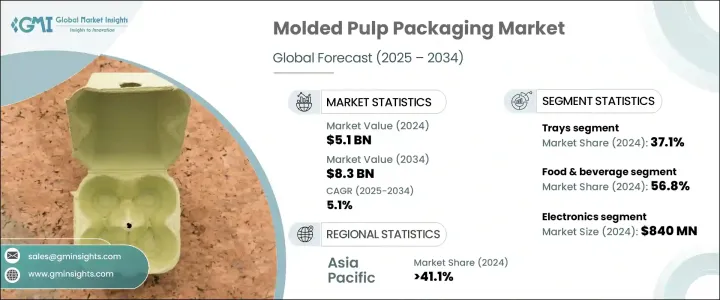

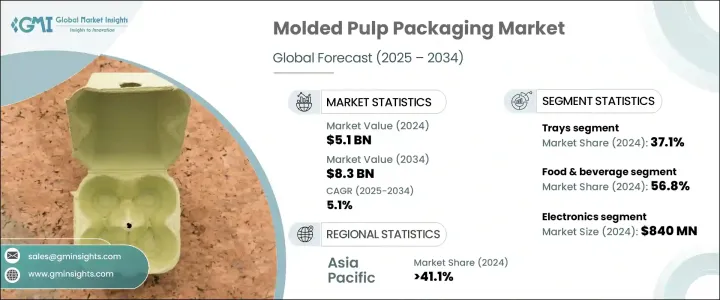

2024年,全球模塑纸浆包装市场规模达51亿美元,预计到2034年将以5.1%的复合年增长率成长,达到83亿美元。推动这一成长的因素包括:全球日益转向永续包装解决方案,以及全球减少环境浪费的努力。随着一次性塑胶製品监管趋严,消费者环保意识增强,对可生物降解和可回收替代品的需求持续成长。由可再生纤维材料製成的模塑纸浆包装正在各行各业中日益流行,为传统塑胶包装提供了一种可持续的替代方案。这种材料的可堆肥性和可回收性使其成为致力于实现环保目标和提升环保形象的品牌的首选。

由于塑胶使用限制日益增多,尤其是在电子商务和零售领域,纸浆模塑包装市场也呈现强劲成长动能。这些限制措施正促使企业寻求环保包装解决方案。支持绿色替代品的国家和国际政策进一步加速了该市场的采用,例如美国进口关税等贸易政策鼓励国内采购纸浆,有助于加强本地供应链。这一趋势可能会减少对外国供应商的依赖,使区域纸浆生产商受益,尤其是在进口成本持续上升的情况下。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 51亿美元 |

| 预测值 | 83亿美元 |

| 复合年增长率 | 5.1% |

在产品类型中,纸浆模塑托盘已成为主导细分市场,预计到2024年将创造19亿美元的市场价值。受其防护性能和环保理念的驱动,该细分市场预计将以5.2%的复合年增长率成长。随着各行各业朝着更永续的营运模式发展,对纸浆模塑托盘的需求预计将持续成长,从而推动该细分市场的成长。

食品和饮料产业也是市场扩张的主要驱动力,2024 年其市值将达到 29 亿美元。预计到 2034 年,该产业的复合年增长率将达到 4.9%。为了符合监管法规并满足注重环保的消费者的需求,该行业越来越多地采用纸浆模塑包装。随着企业优先考虑永续性,他们提升了消费者忠诚度,并鼓励在食品相关应用中继续采用纸浆模塑包装。

亚太地区在2024年占了41.1%的市场份额,预计复合年增长率将达到5.6%。快速的工业化进程、蓬勃发展的电子商务产业以及中国、印度、日本和东南亚等主要市场对永续包装的认识不断提高,正在推动对纸浆模塑替代塑胶的需求。原材料供应充足、生产成本较低以及大规模生产能力进一步增强了该地区的竞争优势。

Huhtamaki、Eco Pulp Packaging、Dart Container Corporation、Henry Molded Products Inc.、Pactiv Evergreen Inc. 和 UFP Technologies, Inc. 等领先的市场参与者正致力于拓展产品线并投资自动化,以满足日益增长的需求。与零售商和快速消费品品牌建立的策略合作伙伴关係正在增强其分销网络,而对永续创新和可生物降解材料的投资则有助于其巩固市场地位。此外,这些公司正在进军新的区域市场,并积极回应循环经济倡议,以提升品牌的长期价值。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商矩阵

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 产业衝击力

- 成长动力

- 电子商务越来越多地采用永续包装

- 医疗保健包装产业的采用率不断提高

- 促进环保包装的法规日益增多

- 消费者对环境影响的意识不断提高

- 新兴市场永续实践的出现

- 产业陷阱与挑战

- 生产週期长

- 来自生物塑胶的竞争

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

- 监管格局

第四章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 托盘

- 蛤壳

- 杯子和碗

- 盘子

- 其他的

第五章:市场估计与预测:按成型技术,2021 - 2034 年

- 主要趋势

- 厚壁成型

- 传递模塑

- 热成型纸浆

- 加工纸浆

第六章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 食品和饮料

- 电子产品

- 卫生保健

- 汽车

- 化妆品和个人护理

- 其他的

第七章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 日本

- 中国

- 印度

- 韩国

- 澳新银行

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 南非

- 阿联酋

- 沙乌地阿拉伯

- 中东和非洲其他地区

第八章:公司简介

- Best Plus Pulp Factory

- buhl-paperform GmbH

- CKF Inc.

- Dart Container Corporation

- Eco Pulp Packaging

- EnviroPAK

- Green Pack.

- Hartmann Packaging

- Henry Molded Products Inc.

- Huhtamaki

- HZ Green Pulp Sdn Bhd

- Keiding, Inc.

- Pacific Pulp Molding, Inc

- Pactiv Evergreen Inc.

- Primapack

- Sabert Corporation

- UFP Technologies, Inc.

- Western Pulp Products Company

The Global Molded Pulp Packaging Market was valued at USD 5.1 billion in 2024 and is projected to grow at a CAGR of 5.1% to reach USD 8.3 billion by 2034. This growth is being driven by the increasing shift toward sustainable packaging solutions alongside a global effort to reduce environmental waste. As stricter regulations on single-use plastics take hold and consumers become more environmentally conscious, the demand for biodegradable and recyclable alternatives continues to rise. Molded pulp packaging, made from renewable fiber-based materials, is gaining traction across various industries, offering a sustainable alternative to traditional plastic packaging. This material's compostability and recyclability make it the preferred choice for brands aiming to meet their environmental goals and bolster their eco-friendly image.

The molded pulp packaging market is also experiencing substantial momentum due to growing restrictions on plastic use, particularly in the e-commerce and retail sectors. These restrictions are pushing companies toward eco-friendly packaging solutions. National and international policies favoring green alternatives are further accelerating the market's adoption, with trade policies, like import tariffs in the U.S., helping to strengthen local supply chains by encouraging domestic sourcing of pulp. This trend could reduce reliance on foreign suppliers, benefiting regional pulp producers, especially if import costs continue to rise.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $8.3 Billion |

| CAGR | 5.1% |

Among product types, molded pulp trays have become a dominant segment, generating USD 1.9 billion in 2024. This segment is expected to grow at a CAGR of 5.2%, driven by the trays' protective properties and eco-conscious appeal. As industries move toward more sustainable operations, demand for molded pulp trays is expected to increase, fueling segment growth.

The food and beverage industry, valued at USD 2.9 billion in 2024, is also a major driver of market expansion. Projected to grow at a CAGR of 4.9% through 2034, the sector is increasingly adopting molded pulp packaging to comply with regulatory mandates and cater to environmentally aware consumers. As companies prioritize sustainability, they enhance consumer loyalty and encourage the continued adoption of molded pulp packaging in food-related applications.

The Asia Pacific region, which held a 41.1% share of the market in 2024, is forecasted to grow at a CAGR of 5.6%. Rapid industrialization, a booming e-commerce sector, and heightened awareness of sustainable packaging in key markets such as China, India, Japan, and Southeast Asia are driving demand for molded pulp alternatives to plastic. The region's competitive edge is further strengthened by the availability of raw materials, lower production costs, and large-scale manufacturing capabilities.

Leading market players such as Huhtamaki, Eco Pulp Packaging, Dart Container Corporation, Henry Molded Products Inc., Pactiv Evergreen Inc., and UFP Technologies, Inc. are focusing on expanding their product lines and investing in automation to meet growing demand. Strategic partnerships with retailers and FMCG brands are enhancing their distribution networks, while investments in sustainable innovations and biodegradable materials are helping them solidify their market position. Additionally, these companies are entering new regional markets and aligning with circular economy initiatives to foster long-term brand value.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Vendor matrix

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news and initiatives

- 3.8 Industry impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Growing adoption of sustainable packaging in e-commerce

- 3.8.1.2 Increased adoption by healthcare packaging sectors

- 3.8.1.3 Rising regulations promoting eco-friendly packaging

- 3.8.1.4 Rising consumer awareness of environmental impacts

- 3.8.1.5 Emergence of sustainable practices in emerging markets

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Lengthy production cycles

- 3.8.2.2 Competition from bioplastics

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Future market trends

- 3.13 Regulatory landscape

Chapter 4 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Bn & Kilo Tons)

- 4.1 Key trends

- 4.2 Trays

- 4.3 Clamshells

- 4.4 Cups and bowls

- 4.5 Plates

- 4.6 Others

Chapter 5 Market Estimates and Forecast, By Molding Technology, 2021 - 2034 (USD Bn & Kilo Tons)

- 5.1 Key trends

- 5.2 Thick-Wall molding

- 5.3 Transfer molding

- 5.4 Thermoformed pulp

- 5.5 Processed pulp

Chapter 6 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Bn & Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverage

- 6.3 Electronics

- 6.4 Healthcare

- 6.5 Automotive

- 6.6 Cosmetics & personal care

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Bn & Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 China

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 ANZ

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 UAE

- 7.6.3 Saudi Arabia

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Best Plus Pulp Factory

- 8.2 buhl-paperform GmbH

- 8.3 CKF Inc.

- 8.4 Dart Container Corporation

- 8.5 Eco Pulp Packaging

- 8.6 EnviroPAK

- 8.7 Green Pack.

- 8.8 Hartmann Packaging

- 8.9 Henry Molded Products Inc.

- 8.10 Huhtamaki

- 8.11 HZ Green Pulp Sdn Bhd

- 8.12 Keiding, Inc.

- 8.13 Pacific Pulp Molding, Inc

- 8.14 Pactiv Evergreen Inc.

- 8.15 Primapack

- 8.16 Sabert Corporation

- 8.17 UFP Technologies, Inc.

- 8.18 Western Pulp Products Company