|

市场调查报告书

商品编码

1741002

伺服马达和驱动器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Servo Motors and Drives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

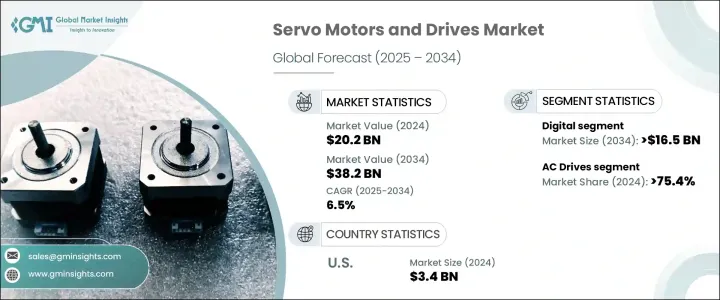

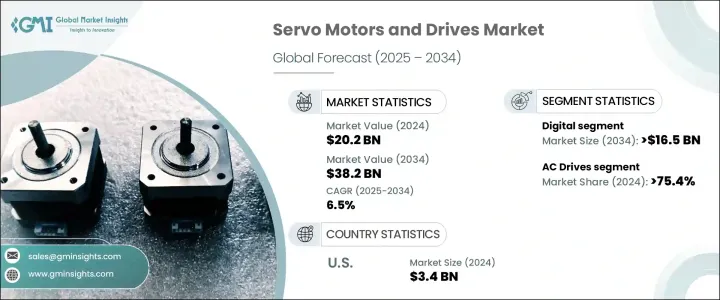

2024 年全球伺服马达和驱动器市场价值为 202 亿美元,预计到 2034 年将以 6.5% 的复合年增长率增长,达到 382 亿美元,这得益于工业环境中自动化、机器人和节能技术的日益融合。随着各行各业都在努力提高生产力并降低营运成本,采用能够提供高精度速度和位置精度的先进运动控制系统变得越来越重要。增加对研发的投资,特别是在工业自动化和智慧製造领域的投资,在推动这一成长方面发挥着重要作用。企业正在优先考虑降低能耗和最大限度减少环境影响的技术,全球范围内出台的严格的效率要求和排放控制法规进一步支持了这一趋势。这些变化为长期的市场扩张奠定了坚实的基础。

随着需求的成长,人们明显转向更智慧、更具成本效益的传统设备替代方案。伺服马达和驱动器的创新正在满足现代製造和物流系统的需求,这些系统要求在各种条件下都具备卓越的精度和稳定的性能。此外,工业数位化的兴起和智慧工厂计画的蓬勃发展正在加速伺服技术在多个领域的部署。企业正在寻找能够适应动态工作负载、提供远端监控并与其他智慧子系统无缝整合的系统。这些发展正在塑造一个竞争激烈的环境,製造商被迫提高产品效率、精确度和灵活性,以保持竞争力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 202亿美元 |

| 预测值 | 382亿美元 |

| 复合年增长率 | 6.5% |

市场按类别细分为数位和类比两大类。数位伺服马达和驱动器日益受到青睐,预计到2034年市场规模将超过165亿美元。它们日益普及的原因是其功能增强、维持力增强,以及能够提供先进的回馈和控制特性。这些系统非常适合需要即时监控和快速调整的应用,是满足不断发展的自动化需求的理想选择。数位领域受益于自动化生产设施投资的增加,以及对减少停机时间和维护成本的日益重视。

从驱动器的角度来看,市场分为交流驱动器和直流驱动器。预计交流驱动器将占据主导地位,占据2024年整个市场的75.4%以上,并预计到2034年将稳定成长。随着各行各业自动化的普及以及工业4.0技术的日益普及,对交流伺服驱动器的需求急剧增长。这些驱动器因其卓越的能源效率、与先进工业协议的兼容性以及在各种运行条件下的灵活性而备受青睐。持续的技术升级,包括即时资料分析和预测性维护功能,正在进一步支援交流驱动器解决方案的扩展。

在美国,伺服马达和驱动器市场持续保持逐年成长。 2022年市场规模为30亿美元,2023年攀升至32亿美元,2024年将达34亿美元。工业物联网、智慧製造技术的日益普及以及全自动生产线的日益普及,为美国的成长轨迹提供了支撑。联邦政府和私营部门的研发投入,以及对人工智慧在工业环境中整合的支持,正在为该产业的发展创造肥沃的土壤。

市场集中度维持适中,前五大製造商合计市占率约25%。这些领导企业不仅投资于产品创新,还在拓展业务范围,涵盖完整的工业自动化生态系统。透过建立策略合作伙伴关係并增强与互补技术的兼容性,他们致力于提供超越传统驱动系统的全面解决方案。重点关注领域包括将人工智慧、机器学习演算法和物联网功能整合到伺服系统中,这有助于开发能够自我调节和即时优化的智慧自适应系统。

随着技术进步不断重塑製造业格局,产业参与者正投入资源开发支援即时响应、更高效率和更广泛连接性的伺服马达和驱动器。这些进步反映了向智慧自动化的更大转变,并满足了各种工业应用中对具有灵活性、长寿命和可扩展性的系统日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 监管格局

- 对贸易的影响

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:市场规模及预测:依类别,2021-2034

- 主要趋势

- 数位的

- 模拟

第五章:市场规模及预测:按驱动力,2021-2034

- 主要趋势

- 交流驱动

- 直流驱动

第六章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 石油和天然气

- 金属切割与成型

- 物料搬运设备

- 包装和标籤机械

- 机器人技术

- 医疗机器人

- 橡胶和塑胶机械

- 仓储

- 自动化

- 极端环境应用

- 半导体机械

- 自动导引车

- 电子产品

- 其他的

第七章:市场规模及预测:依地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 挪威

- 瑞典

- 丹麦

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 泰国

- 马来西亚

- 菲律宾

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 南非

- 奈及利亚

- 埃及

- 阿尔及利亚

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第八章:公司简介

- ABB

- Advanced Motion Controls

- Allied Motion

- Baumueller

- Bosch Rexroth

- Danfoss

- Delta Electronics

- Fuji Electric

- Hitachi

- Ingenia Cat

- KEB Automation

- Kollmorgen

- Mitsubishi Electric

- Nidec

- Panasonic

- Rockwell Automation

- Schneider Electric

- Siemens

- Yaskawa Electric

The Global Servo Motors and Drives Market was valued at USD 20.2 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 38.2 billion by 2034, fueled by the rising integration of automation, robotics, and energy-efficient technologies in industrial settings. The adoption of advanced motion control systems that offer high precision in speed and positional accuracy is becoming more critical as industries strive to enhance productivity while cutting operational costs. Increasing investment in research and development, especially in industrial automation and smart manufacturing, is playing a major role in driving this growth. Businesses are prioritizing technologies that reduce energy consumption and minimize environmental impact, a trend further supported by stringent efficiency mandates and emission control regulations introduced globally. These changes are creating a strong foundation for long-term market expansion.

As demand grows, there is a noticeable shift toward smarter, cost-effective alternatives to traditional equipment. Innovations in servo motors and drives are meeting the needs of modern manufacturing and logistics systems that require exceptional accuracy and consistent performance under variable conditions. Additionally, rising industrial digitization and the proliferation of smart factory initiatives are accelerating the deployment of servo technologies across multiple sectors. Companies are looking for systems that can adapt to dynamic workloads, offer remote monitoring, and integrate seamlessly with other intelligent subsystems. These developments are shaping a competitive environment where manufacturers are compelled to improve product efficiency, precision, and flexibility to stay relevant.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.2 Billion |

| Forecast Value | $38.2 Billion |

| CAGR | 6.5% |

The market is segmented based on category into digital and analog types. Digital servo motors and drives are gaining traction and are anticipated to surpass USD 16.5 billion by 2034. Their increasing popularity is attributed to enhanced functionality, better holding power, and the ability to provide advanced feedback and control features. These systems are well-suited for applications that demand real-time monitoring and rapid adjustments, making them an ideal fit for evolving automation needs. The digital segment benefits from increased investment in automated production facilities and a growing emphasis on reducing downtime and maintenance costs.

From the drive perspective, the market is divided into AC and DC drives. AC drives are expected to dominate with a significant share, accounting for over 75.4% of the total market in 2024, and are projected to grow steadily through 2034. The demand for AC servo drives has risen sharply, driven by widespread automation across industries and the growing adoption of Industry 4.0 technologies. These drives are favored due to their superior energy efficiency, compatibility with advanced industrial protocols, and flexibility in various operational conditions. Continued technological upgrades, including real-time data analytics and predictive maintenance capabilities, are further supporting the expansion of AC drive solutions.

In the United States, the servo motors and drives market has shown consistent year-on-year growth. Valued at USD 3 billion in 2022, it climbed to USD 3.2 billion in 2023 and reached USD 3.4 billion in 2024. The country's growth trajectory is underpinned by the increasing adoption of industrial IoT, smart manufacturing technologies, and the rising presence of fully automated production lines. Federal and private initiatives focused on R&D, alongside support for AI integration in industrial environments, are creating fertile ground for the sector's development.

Market concentration remains moderate, with the top five manufacturers holding a combined share of approximately 25%. These leading firms are not only investing in product innovation but are also broadening their scope to include complete industrial automation ecosystems. By forming strategic partnerships and enhancing compatibility with complementary technologies, they are positioning themselves to deliver comprehensive solutions that go beyond traditional drive systems. Key areas of focus include the integration of artificial intelligence, machine learning algorithms, and IoT-enabled features into servo systems, which helps develop smart, adaptive systems capable of self-regulation and real-time optimization.

With technological advancements continuously reshaping the manufacturing landscape, industry players are channeling resources into developing servo motors and drives that support real-time responsiveness, higher efficiency levels, and broader connectivity. These advancements reflect a larger shift toward intelligent automation and support the rising need for systems that offer flexibility, longevity, and scalability across diverse industrial applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.2 Retaliatory measures

- 3.2.3 Impact on the industry

- 3.2.3.1 Supply-side impact (raw materials)

- 3.2.3.1.1 Price volatility in key materials

- 3.2.3.1.2 Supply chain restructuring

- 3.2.3.1.3 Production cost implications

- 3.2.3.2 Demand-side impact (selling price)

- 3.2.3.2.1 Price transmission to end markets

- 3.2.3.2.2 Market share dynamics

- 3.2.3.2.3 Consumer response patterns

- 3.2.3.1 Supply-side impact (raw materials)

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.7 Regulatory landscape

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Market Size and Forecast, By Category, 2021 - 2034, ('000 Units & USD Million)

- 4.1 Key trends

- 4.2 Digital

- 4.3 Analog

Chapter 5 Market Size and Forecast, By Drive, 2021 - 2034, ('000 Units & USD Million)

- 5.1 Key trends

- 5.2 AC drive

- 5.3 DC drive

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034, ('000 Units & USD Million)

- 6.1 Key trends

- 6.2 Oil and gas

- 6.3 Metal cutting & forming

- 6.4 Material handling equipment

- 6.5 Packaging and labeling machinery

- 6.6 Robotics

- 6.7 Medical robotics

- 6.8 Rubber & plastics machinery

- 6.9 Warehousing

- 6.10 Automation

- 6.11 Extreme environment applications

- 6.12 Semiconductor machinery

- 6.13 AGV

- 6.14 Electronics

- 6.15 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034, ('000 Units & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Norway

- 7.3.7 Sweden

- 7.3.8 Denmark

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Thailand

- 7.4.7 Malaysia

- 7.4.8 Philippines

- 7.4.9 Indonesia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 South Africa

- 7.5.5 Nigeria

- 7.5.6 Egypt

- 7.5.7 Algeria

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Advanced Motion Controls

- 8.3 Allied Motion

- 8.4 Baumueller

- 8.5 Bosch Rexroth

- 8.6 Danfoss

- 8.7 Delta Electronics

- 8.8 Fuji Electric

- 8.9 Hitachi

- 8.10 Ingenia Cat

- 8.11 KEB Automation

- 8.12 Kollmorgen

- 8.13 Mitsubishi Electric

- 8.14 Nidec

- 8.15 Panasonic

- 8.16 Rockwell Automation

- 8.17 Schneider Electric

- 8.18 Siemens

- 8.19 Yaskawa Electric