|

市场调查报告书

商品编码

1741014

瓦斯低温商用锅炉市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Gas Fired Low Temperature Commercial Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

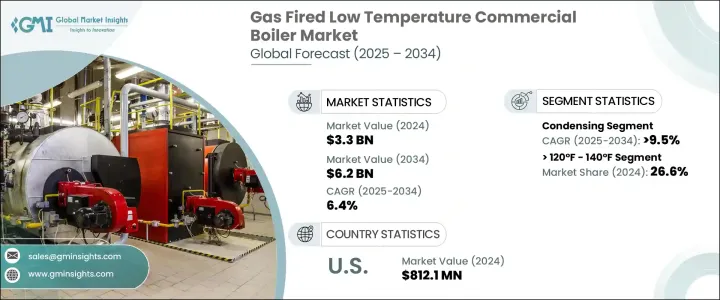

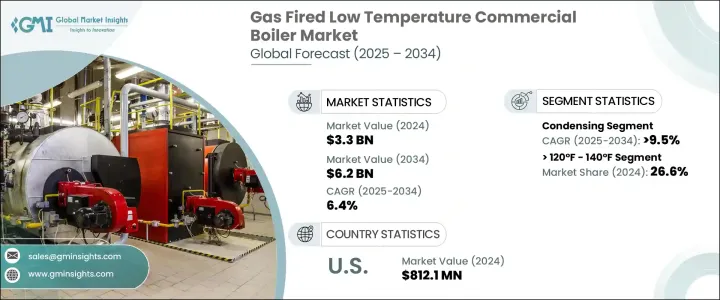

2024年,全球燃气低温商用锅炉市场规模达33亿美元,预计2034年将以6.4%的复合年增长率成长,达到62亿美元。这主要得益于高效供暖系统需求的不断增长,以及政府降低能耗、最大限度减少环境影响的压力。随着企业日益转向永续运营,市场发展势头强劲。随着气候变迁问题日益加剧,商业领域面临越来越大的压力,需要采用符合国际减碳目标的清洁技术。

快速的城市化、商业房地产的扩张以及对节能改造项目日益增长的需求,也推动了供暖系统的普及率。企业不再将高效供暖系统视为奢侈品,而是将其视为保持竞争力和合规性的必需品。建筑规范的转变、公共资金用于能源效率升级,以及对生命週期成本节约的更加重视,进一步加速了市场的发展轨迹。此外,物联网和人工智慧等数位技术日益融入暖气系统,正将传统锅炉转变为智慧、反应迅速的资产,有助于优化能耗和营运效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 33亿美元 |

| 预测值 | 62亿美元 |

| 复合年增长率 | 6.4% |

更严格的排放法规和对永续能源解决方案的迫切需求,正推动商业领域转向更清洁、更有效率的暖气技术。锅炉系统的技术进步,加上全球商业基础设施的不断扩张,正在塑造一个充满希望的市场前景。随着碳排放控制力道的加大,企业正迅速转向兼具合规性和成本效益的低排放技术。这些以天然气为燃料的锅炉运行温度较低,非常适合那些希望在不影响性能的情况下降低能耗的商业环境。

商业建筑和高等教育的投资正在推动进一步成长,从而刺激学校、办公大楼和混合用途建筑对高效供暖的需求。虽然全球贸易政策可能会因进口零件关税而影响生产成本,但它们同时也鼓励国内製造业扩张,并培育更强大、更具韧性的供应链。

预计到2034年,冷凝式瓦斯低温商用锅炉市场将以9.5%的强劲复合年增长率成长。这些先进的系统正日益互联互通,具备云端整合、预测性维护和智慧能源优化等功能。这些功能在显着提升效能的同时,也能控制营运成本。公共资金对商业场所能源改造的支持,也进一步推动了智慧锅炉技术的普及。

预计到2034年,低于120°F(约摄氏47度)的瓦斯低温锅炉市场规模将达到14亿美元。这些锅炉符合现代永续性基准和监管能源效率标准,比传统系统提供更卓越的热性能。对于希望降低营运成本并满足不断变化的环保要求的企业而言,它们正迅速成为首选。

2024年,美国燃气低温商用锅炉市场规模达8.121亿美元。商业建筑活动的成长持续推动对可靠、高效供暖解决方案的需求。这些锅炉安装简单、维护要求低、安全性能强,是大型商业应用的理想选择。

为了巩固市场地位,Precision Boilers、Fondital、Bosch Industriekessel、Ariston Holding、Viessmann、Hurst Boiler & Welding、Immergas、Lochinvar、Burnham Commercial Boilers、FerroliWeilford、Cleaver-Brooks、Vaillham Commercial Boilers、FerroliWeilford、Cleaver-Brooks、Vaillant Corporation. Wilcox和Wolf等公司正在拓展其产品线,推出节能机型,大力投资智慧锅炉技术,并与建筑公司和能源服务公司建立合作关係。这些公司也正在加速低碳系统的研发,并扩大关键地区的製造能力,以配合全球气候目标。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依温度,2021 年至 2034 年

- 主要趋势

- ≤ 120°F

- > 120°F - 140°F

- > 140°F - 160°F

- > 160°F - 180°F

第六章:市场规模及预测:依产能,2021 年至 2034 年

- 主要趋势

- ≤ 0.3 - 2.5 百万英热单位/小时

- > 2.5 - 10 百万英热单位/小时

- > 10 - 50 百万英热单位/小时

- > 50 - 100 百万英热单位/小时

- > 100 - 250 百万英热单位/小时

第七章:市场规模及预测:依技术分类,2021 年至 2034 年

- 主要趋势

- 冷凝

- 无凝结

第 8 章:市场规模与预测:按应用,2021 年至 2034 年

- 主要趋势

- 办公室

- 医疗保健设施

- 教育机构

- 住宿

- 零售店

- 其他的

第九章:市场规模及预测:依地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 法国

- 英国

- 波兰

- 义大利

- 西班牙

- 奥地利

- 德国

- 瑞典

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 菲律宾

- 日本

- 韩国

- 澳洲

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 伊朗

- 阿联酋

- 奈及利亚

- 南非

- 拉丁美洲

- 阿根廷

- 智利

- 巴西

第十章:公司简介

- Ariston Holding

- Babcock & Wilcox

- Bosch Industriekessel

- Bradford White Corporation

- Burnham Commercial Boilers

- Cleaver-Brooks

- Ferroli

- Fondital

- Fulton

- Hoval

- Hurst Boiler & Welding

- Immergas

- Lochinvar

- Precision Boilers

- Vaillant Group International

- Viessmann

- Weil-McLain

- Wolf

The Global Gas Fired Low Temperature Commercial Boiler Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 6.2 billion by 2034, driven by the rising demand for high-efficiency heating systems and growing government pressure to reduce energy consumption and minimize environmental impact. The market is witnessing strong momentum as businesses increasingly shift toward sustainable operations. With climate change concerns intensifying, commercial sectors are under mounting pressure to adopt cleaner technologies that align with international carbon reduction goals.

Rapid urbanization, expanding commercial real estate, and the growing need for energy-efficient retrofitting projects are also fueling adoption rates. Businesses are no longer viewing efficient heating systems as a luxury but as a necessity to stay competitive and compliant. Shifts in building codes, public funding for energy efficiency upgrades, and a sharper focus on lifecycle cost savings are further accelerating the market trajectory. Additionally, the rising integration of digital technologies such as IoT and AI into heating systems is transforming traditional boilers into smart, responsive assets that help optimize energy consumption and operational efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 6.4% |

Stricter emission regulations and the urgent need for sustainable energy solutions are pushing commercial sectors toward cleaner and more efficient heating technologies. Technological advancements in boiler systems, coupled with expanding commercial infrastructure worldwide, are shaping a promising market outlook. As efforts to control carbon emissions intensify, companies are moving rapidly toward low-emission technologies that offer both compliance and cost-efficiency. These boilers, fueled by natural gas, operate at lower temperatures, making them a perfect fit for commercial environments looking to cut energy use without compromising performance.

Investment in commercial construction and tertiary education is driving further growth, boosting the demand for efficient heating in schools, office complexes, and mixed-use buildings. While global trade policies may impact production costs due to tariffs on imported components, they are simultaneously encouraging domestic manufacturing expansion and fostering stronger, more resilient supply chains.

The condensing gas fired low temperature commercial boiler segment is projected to grow at a robust CAGR of 9.5% through 2034. These advanced systems are becoming increasingly connected, featuring cloud integration, predictive maintenance, and smart energy optimization. Such features significantly enhance performance while keeping operational costs in check. Supportive public funding for energy retrofitting in commercial spaces is giving an additional push to the adoption of smart boiler technologies.

The <= 120°F gas fired low temperature boiler market is forecasted to generate USD 1.4 billion by 2034. These boilers meet modern sustainability benchmarks and regulatory efficiency standards, offering better thermal performance than traditional systems. They are quickly becoming the preferred choice for businesses aiming to lower operational costs and meet evolving environmental mandates.

The U.S. Gas Fired Low Temperature Commercial Boiler Market reached USD 812.1 million in 2024. Growth in commercial construction activities continues to fuel the need for reliable, efficient heating solutions. Easy installation, low maintenance requirements, and enhanced safety features make these boilers an ideal option for large-scale commercial applications.

To strengthen their market position, companies such as Precision Boilers, Fondital, Bosch Industriekessel, Ariston Holding, Viessmann, Hurst Boiler & Welding, Immergas, Lochinvar, Burnham Commercial Boilers, Ferroli, Fulton, Cleaver-Brooks, Vaillant Group International, Bradford White Corporation, Weil-McLain, Hoval, Babcock & Wilcox, and Wolf are expanding their product lines with energy-efficient models, investing heavily in smart boiler technologies, and forming partnerships with construction firms and energy service companies. These firms are also accelerating R&D efforts for low-carbon systems and expanding manufacturing capabilities in key regions to align with global climate objectives.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Temperature, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 5.1 Key trends

- 5.2 ≤ 120°F

- 5.3 > 120°F - 140°F

- 5.4 > 140°F - 160°F

- 5.5 > 160°F - 180°F

Chapter 6 Market Size and Forecast, By Capacity, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 6.1 Key trends

- 6.2 ≤ 0.3 - 2.5 MMBTU/hr

- 6.3 > 2.5 - 10 MMBTU/hr

- 6.4 > 10 - 50 MMBTU/hr

- 6.5 > 50 - 100 MMBTU/hr

- 6.6 > 100 - 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Technology, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 7.1 Key trends

- 7.2 Condensing

- 7.3 Non-condensing

Chapter 8 Market Size and Forecast, By Application, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 8.1 Key trends

- 8.2 Offices

- 8.3 Healthcare facilities

- 8.4 Educational institutions

- 8.5 Lodgings

- 8.6 Retail stores

- 8.7 Others

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 France

- 9.3.2 UK

- 9.3.3 Poland

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Austria

- 9.3.7 Germany

- 9.3.8 Sweden

- 9.3.9 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Philippines

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.4.6 Australia

- 9.4.7 Indonesia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 Iran

- 9.5.3 UAE

- 9.5.4 Nigeria

- 9.5.5 South Africa

- 9.6 Latin America

- 9.6.1 Argentina

- 9.6.2 Chile

- 9.6.3 Brazil

Chapter 10 Company Profiles

- 10.1 Ariston Holding

- 10.2 Babcock & Wilcox

- 10.3 Bosch Industriekessel

- 10.4 Bradford White Corporation

- 10.5 Burnham Commercial Boilers

- 10.6 Cleaver-Brooks

- 10.7 Ferroli

- 10.8 Fondital

- 10.9 Fulton

- 10.10 Hoval

- 10.11 Hurst Boiler & Welding

- 10.12 Immergas

- 10.13 Lochinvar

- 10.14 Precision Boilers

- 10.15 Vaillant Group International

- 10.16 Viessmann

- 10.17 Weil-McLain

- 10.18 Wolf