|

市场调查报告书

商品编码

1741017

弹道防护市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Ballistic Protection Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

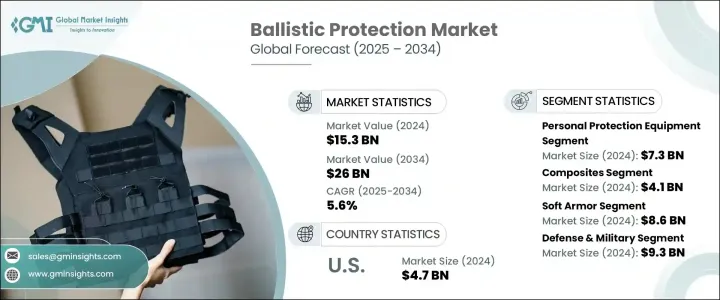

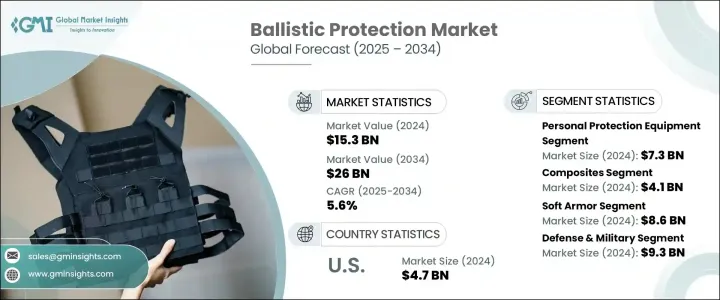

2024 年全球弹道防护市场价值为 153 亿美元,预计到 2034 年将以 5.6% 的复合年增长率成长,达到 260 亿美元。这一持续增长得益于全球国防开支的增加以及执法和国土安全部门日益增长的需求。地缘政治紧张局势、恐怖主义、内乱和暴力犯罪等威胁日益加剧,使得各国更加迫切需要投资有效的防护解决方案。这种需求不仅限于军事行动——政府、公共安全机构,甚至高风险地区的平民都在积极寻求先进的弹道防护技术。市场上升势头也得益于对防护设备创新的日益关注,如今的防护设备包括更轻、更灵活、适应性更强的材料,这些材料可在恶劣环境下提供更高的效率。

然而,国际贸易政策等外部因素对製造商产生了重大影响。尤其是美国近几届政府推出的关税决定,对钢铁和铝等关键原料征收高额关税,扰乱了全球供应链。这些关税推高了头盔、防弹衣和装甲车的生产成本,迫使承包商和製造商重新评估其定价结构,或探索更具成本效益的采购策略,包括迁移生产设施。此外,这些经济障碍也给跨国国防合作带来了压力,影响了联合开发项目,并降低了对防弹装备供应链至关重要的战略部件的可及性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 153亿美元 |

| 预测值 | 260亿美元 |

| 复合年增长率 | 5.6% |

市场按产品类型细分为个人防护设备、车辆防护设备以及结构和固定基础设施。其中,个人防护设备占据主导地位,2024 年市场价值达 73 亿美元。全球武装衝突、恐怖活动和安全威胁的激增,推动了军民防护装备的需求。轻质复合材料、高强度陶瓷和高性能聚合物等更先进材料的使用趋势,正在提高产品的耐用性和耐磨性。这种转变在公共安全问题日益严重的地区尤其重要,因为执法机构和平民都在日益不稳定的环境中寻求可靠的保护。

从材料角度来看,防弹市场可分为防弹玻璃、复合材料、陶瓷、金属及合金、织物等。复合材料占据了相当大的市场份额,2024年价值达41亿美元。这些材料,尤其是纤维增强聚合物,因其轻盈且高度耐用的特性而需求旺盛。它们在个人防护装备和装甲车辆领域中广泛应用。人们对能够提供多功能防护(既能抵抗弹道衝击,又能抵御化学物质和极端气候)的材料的日益青睐,也推动了该领域的加速成长。

从应用角度来看,弹道防护产业可分为国防和军事、执法和国土安全以及其他领域。国防和军事领域是主要的应用领域,2024年创造了93亿美元的收入。不断升级的区域衝突以及升级过时军事基础设施的需求,促使各国政府大力投资先进的防护技术。各国正拨出大量国防预算,用于采购高性能装备、车辆和基础设施解决方案,以增强高风险地区部队的安全。

美国已成为领先市场,2024 年估值达 47 亿美元。持续存在的国家安全挑战、家庭暴力威胁和枪击事件,扩大了军用和民用领域对个人装甲和车辆防护的需求。美国庞大的国防开支进一步推动了旨在在各种作战条件下提供高性能结果的下一代弹道解决方案的采用。

该行业高度分散,既有国际公司,也有区域製造商。前三名的公司合计占20.4%的市场份额,正积极投资先进技术,专注于打造更轻、更坚固、更聪明的防护系统。这些技术包括模组化装甲平台、奈米材料增强织物以及整合感测器用于即时威胁检测的自适应装甲系统。向灵活、可自订任务防护的转变正在加速,尤其是在全球军事战略转向城市作战、非对称战争和维和任务的背景下。弹道解决方案在战术车辆、飞机、海军系统以及急救人员穿戴装备中的应用日益广泛,正在塑造市场发展的下一阶段。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 全球国防预算不断增加

- 地缘政治衝突与恐怖主义加剧

- 执法和国土安全的需求

- 日益增长的平民和贵宾安全需求

- 轻质材料技术创新

- 产业陷阱与挑战

- 先进材料成本高昂

- 复杂多样的监管标准

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 个人防护装备

- 车辆防护装备

- 结构和固定基础设施

第六章:市场估计与预测:按材料类型,2021 - 2034 年

- 主要趋势

- 防弹玻璃

- 复合材料

- 陶瓷

- 金属及合金

- 织物

- 其他的

第七章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 软甲

- 硬装甲

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 国防与军事

- 执法及国土安全

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- ADA

- ArmorSource

- ArmorWorks

- Avon Technologies

- BAE Systems

- Craig International Ballistics

- Elmon

- FMS Enterprises Migun

- Koninklijke Ten Cate

- MKU

- NP Aerospace

- Pacific Safety Products

- Paul Boye Technologies

- Point Blank Enterprises

- Revision Military

- Rheinmetall

- Roketsan

- Seyntex

- Southern States

- Survitec Group

The Global Ballistic Protection Market was valued at USD 15.3 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 26 billion by 2034. This consistent growth is fueled by an uptick in defense spending worldwide and rising demands from law enforcement and homeland security sectors. Increasing threats such as geopolitical tensions, terrorism, civil unrest, and violent crime have created a heightened sense of urgency across countries to invest in effective protection solutions. The demand is not limited to military operations-governments, public safety bodies, and even civilians in high-risk areas are actively seeking advanced ballistic protection technologies. The market's upward momentum is also supported by the growing focus on innovation in protective equipment, which now includes more lightweight, flexible, and adaptable materials that offer higher efficiency in hostile environments.

However, external factors like international trade policies have significantly impacted manufacturers. In particular, tariff decisions introduced under recent U.S. administrations have disrupted global supply chains by imposing high duties on essential raw materials such as steel and aluminum. These levies have driven up production costs for helmets, body armor, and armored vehicles, forcing contractors and manufacturers to reevaluate their pricing structures or explore more cost-effective sourcing strategies, including relocating production facilities. Moreover, these economic barriers have strained cross-border defense collaborations, affecting joint development projects and reducing the accessibility of strategic components critical to the supply chain of ballistic protection equipment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.3 Billion |

| Forecast Value | $26 Billion |

| CAGR | 5.6% |

The market is segmented by product type into personal protection equipment, vehicle protection, and structural and fixed infrastructure. Among these, personal protection equipment led the category with a market value of USD 7.3 billion in 2024. The surge in armed conflicts, terrorist activities, and security threats globally is pushing demand for protective gear designed for both military personnel and civilians. The trend toward more advanced materials like lightweight composites, high-strength ceramics, and high-performance polymers is improving product durability and wearability. This shift is especially relevant in regions facing elevated public safety concerns, as both law enforcement agencies and civilians seek reliable protection in increasingly unstable environments.

Material-wise, the market is categorized into bulletproof glass, composites, ceramics, metals and alloys, fabrics, and others. Composites held a significant portion of the market, valued at USD 4.1 billion in 2024. These materials, especially fiber-reinforced polymers, are in high demand due to their lightweight yet highly durable nature. Their application is prominent across both personal protective gear and armored vehicles. The increasing preference for materials that offer multifunctional protection-capable of resisting ballistic impact as well as exposure to chemicals and extreme climates-is contributing to the accelerated growth of this segment.

In terms of application, the ballistic protection industry is divided into defense and military, law enforcement and homeland security, and others. The defense and military sector stood as the dominant application area, generating USD 9.3 billion in revenue in 2024. Escalating regional conflicts and the need to upgrade outdated military infrastructure are pushing governments to invest heavily in state-of-the-art protective technologies. Countries are allocating significant portions of their defense budgets to acquire high-performance gear, vehicles, and infrastructure solutions that enhance troop safety in high-risk zones.

The United States emerged as the leading market, with a valuation of USD 4.7 billion in 2024. Ongoing national security challenges, domestic violence threats, and active shooter incidents have amplified the demand for personal armor and vehicle protection in both military and civilian sectors. The country's substantial defense expenditure has further propelled the adoption of next-generation ballistic solutions designed to deliver high-performance results in diverse operational conditions.

The industry is highly fragmented, marked by the presence of both international corporations and regional manufacturers. The top three companies, accounting for a collective 20.4% market share, are aggressively investing in advanced technologies that focus on lighter, stronger, and smarter protection systems. These include modular armor platforms, nanomaterial-enhanced fabrics, and adaptable armor systems integrated with sensors for real-time threat detection. The transition toward agile, mission-customizable protection is gaining pace, especially as global military strategies shift toward urban operations, asymmetric warfare, and peacekeeping missions. The increasing use of ballistic solutions in tactical vehicles, aircraft, naval systems, and wearable gear for first responders is shaping the next phase of the market's evolution.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing global defense budgets

- 3.3.1.2 Rising geopolitical conflicts and terrorism

- 3.3.1.3 Demand from law enforcement and homeland security

- 3.3.1.4 Growing civilian and VIP security needs

- 3.3.1.5 Technological innovations in lightweight materials

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High costs of advanced materials

- 3.3.2.2 Complex and varying regulatory standards

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Personal protection equipment

- 5.3 Vehicle protection equipment

- 5.4 Structural & fixed infrastructure

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Bulletproof glass

- 6.3 Composites

- 6.4 Ceramics

- 6.5 Metal & alloys

- 6.6 Fabric

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Soft armor

- 7.3 Hard armor

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 Defense & military

- 8.3 Law enforcement & homeland security

- 8.4 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ADA

- 10.2 ArmorSource

- 10.3 ArmorWorks

- 10.4 Avon Technologies

- 10.5 BAE Systems

- 10.6 Craig International Ballistics

- 10.7 Elmon

- 10.8 FMS Enterprises Migun

- 10.9 Koninklijke Ten Cate

- 10.10 MKU

- 10.11 NP Aerospace

- 10.12 Pacific Safety Products

- 10.13 Paul Boye Technologies

- 10.14 Point Blank Enterprises

- 10.15 Revision Military

- 10.16 Rheinmetall

- 10.17 Roketsan

- 10.18 Seyntex

- 10.19 Southern States

- 10.20 Survitec Group