|

市场调查报告书

商品编码

1741022

汽车共享远端资讯处理市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Car Sharing Telematics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

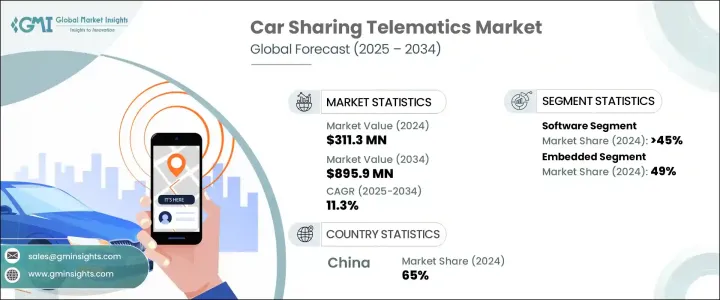

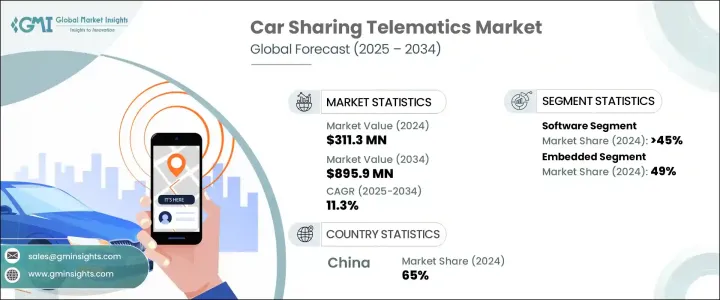

2024 年全球汽车共享远端资讯处理市场价值为 3.113 亿美元,预计到 2034 年将以 11.3% 的复合年增长率增长至 8.959 亿美元。随着越来越多的公司进入该行业,并制定旨在重塑出行格局的创新策略,市场发展势头强劲。人们对环境恶化和交通拥堵的担忧日益加剧,这促使人们从传统汽车所有权转向共享汽车模式。城市人口越来越意识到可持续的交通替代方案,这些替代方案不仅可以减少道路上的车辆数量,还有助于降低碳排放和缓解交通流量。市政府正在透过实施绿色交通政策和减排目标来鼓励这些变化,推动共享旅游营运商在其车队中采用电动车。这种转变与旨在优化城市基础设施和减少环境影响的更广泛的智慧城市计划相一致。

数位化和环保交通的推动极大地影响了远端资讯处理系统的设计和部署。随着汽车共享日益成为主流,远端资讯处理软体正成为其中最关键的组成部分,将车辆转变为互联的资料中心。 2024年,软体领域占据了超过45%的市场份额,预计在预测期内将大幅成长。这些平台使营运商能够追踪车辆性能、监控维护计划、分析用户行为并提高车队整体效率。人工智慧在远端资讯处理软体中的应用,使系统能够根据即时需求动态调整车队规模,从而降低营运成本并提升服务品质。无钥匙车辆进入、远端锁定、计费自动化和使用者友善介面等功能都源自于先进的软体功能。同时,升级的加密协定和基于云端的基础设施确保了资料保护和网路安全,使平台更加稳健,并符合监管标准。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.113亿美元 |

| 预测值 | 8.959亿美元 |

| 复合年增长率 | 11.3% |

按组件细分,市场包括GPS接收器、加速度计、引擎介面模组、SIM卡和软体。这些组件协同工作,提供无缝连接和精准分析。软体继续占据主导地位,为车队管理人员提供即时可视性和营运控制。透过与云端网路集成,软体模组还支援用户身份验证、地理围栏和预测性诊断等高级功能,从而确保安全并最大限度地提高车队可用性。

市场也按形式细分为嵌入式、系留式和整合式远端资讯处理。嵌入式系统在2024年占据了49%的市场份额,预计在预测期内仍将占据主导地位。这些系统由製造商直接安装到车辆中,并深度整合到车辆的电子设备中。嵌入式系统的整合度可让车辆和后端系统之间进行即时资料传输,有助于即时效能洞察和远端控制功能。随着车辆连接需求的不断增长,嵌入式系统正在成为汽车共享专案的行业标准。

从商业模式来看,订阅模式占据主导地位。城市用户倾向于这种模式,因为它可以以可预测的月费或年费持续使用车队。这种方式透过提供透明、经济实惠的价格并消除了拥有汽车的种种麻烦,从而支持用户的长期参与。采用此模式营运的企业由于服务可靠性高,客户留存率较高。

从区域来看,亚太地区在2024年引领市场,中国占据该地区约65%的市场份额,创造了7,420万美元的收入。中国的领先地位得益于其快速的城镇化、强大的汽车生产能力以及互联汽车基础设施的技术进步。旨在促进智慧出行和汽车电气化的国家发展政策,使得远端资讯处理系统在共享电动和混合动力汽车中广泛部署。此外,对5G网路、云端运算和物联网 (IoT) 平台的投资支援了复杂的汽车共享生态系统的扩展。电池管理系统、基于人工智慧的车辆追踪和即时车队分析正在整合到共享出行服务中,使中国成为该领域的全球领导者。

塑造全球汽车共享远端资讯处理产业的主要参与者包括即时追踪、行为分析和预测性维护技术的提供者。这些系统如今配备了先进的感测器阵列、集中控制单元和支援 5G 的 eSIM 卡,可提供跨境资料交换和云端诊断。市场对更智慧、更安全、更有效率的交通解决方案的需求持续推动着市场的发展,这些解决方案旨在满足城市生活方式和永续发展目标的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:汽车共享远端资讯处理产业洞察

- 产业生态系统分析

- 供应商格局

- 组件提供者

- 汽车製造商

- 技术提供者

- 系统整合商

- 最终用途

- 川普政府关税的影响

- 贸易影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(客户成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 贸易影响

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 物联网与人工智慧在交通运输产业的融合

- 永续交通需求不断成长

- 促进共享出行的支持性法规和政府倡议

- 产业陷阱与挑战

- 对资料隐私的担忧

- 大量的前期和持续成本

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按服务,2021-2034 年

- 主要趋势

- 自动崩溃通知 (ACN)

- 紧急状况

- 导航

- 协助与访问

- 诊断

- 车队管理

- 计费

- 其他的

第六章:市场估计与预测:依形式,2021-2034

- 主要趋势

- 嵌入式

- 繫留

- 融合的

第七章:市场估计与预测:依组件,2021-2034

- 主要趋势

- GPS接收器

- 加速度计

- 引擎介面

- Sim 卡

- 软体

- 其他的

第八章:市场估计与预测:依商业模式,2021-2034 年

- 主要趋势

- 基于订阅的模式

- 按使用付费模式

- 企业车队管理

- 与原始设备製造商的合作

- 其他的

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- CalAmp

- cambio Mobilitatsservice

- Cantamen

- Carmine

- Citiz Reseau

- CityBee Solutions

- Continental Aftermarket & Services

- Fleetster (Next Generation Mobility)

- Geotab

- INVERS

- Mobility Tech Green

- Mojio

- Octo Group

- Ridecell

- Samsara

- Targa Telematics

- Turo

- Verizon Communications

- Vulog

- WeGo

The Global Car Sharing Telematics Market was valued at USD 311.3 million in 2024 and is estimated to grow at a CAGR of 11.3% to reach USD 895.9 million by 2034. The market is gaining momentum due to the increasing number of companies entering the sector with innovative strategies aimed at reshaping the mobility landscape. Rising concerns over environmental degradation and traffic congestion are fueling the shift from traditional car ownership to shared vehicle models. Urban populations are becoming more aware of sustainable transportation alternatives that not only reduce the number of vehicles on the road but also contribute to lowering carbon emissions and easing traffic flow. Municipal governments are encouraging these changes by implementing green transportation policies and emission-reduction targets, pushing shared mobility operators to adopt electric vehicles in their fleets. This transition aligns with broader smart city initiatives that aim to optimize urban infrastructure and reduce environmental impact.

The push for digitized and eco-conscious transportation has significantly influenced how telematics systems are designed and deployed. As car sharing becomes more mainstream, telematics software is emerging as the most crucial component, transforming vehicles into connected data hubs. In 2024, the software segment held more than 45% of the total market share, and it is expected to witness substantial growth during the forecast period. These platforms allow operators to track vehicle performance, monitor maintenance schedules, analyze user behavior, and improve overall fleet efficiency. The adoption of artificial intelligence in telematics software now enables systems to adjust fleet sizes dynamically based on real-time demand, reducing operational costs and boosting service quality. Features such as keyless vehicle entry, remote locking, billing automation, and user-friendly interfaces all stem from advanced software capabilities. At the same time, upgraded encryption protocols and cloud-based infrastructure ensure data protection and cybersecurity, making the platforms more robust and compliant with regulatory standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $311.3 Million |

| Forecast Value | $895.9 Million |

| CAGR | 11.3% |

When segmented by component, the market includes GPS receivers, accelerometers, engine interface modules, SIM cards, and software. These components work together to offer seamless connectivity and precise analytics. Software continues to lead in importance, offering real-time visibility and operational control for fleet managers. By integrating with cloud networks, software modules also enable advanced functions like user authentication, geo-fencing, and predictive diagnostics, which ensure safety and maximize fleet availability.

The market is also segmented by form into embedded, tethered, and integrated telematics. Embedded systems accounted for 49% of the market share in 2024 and are expected to dominate over the forecast timeline. These systems are installed by manufacturers directly into the vehicle and are integrated deeply into its electronics. The level of integration in embedded systems allows instant data transfer between the vehicle and backend systems, facilitating real-time performance insights and remote control capabilities. With increasing vehicle connectivity demands, embedded systems are becoming the industry standard for car sharing programs.

From a business model perspective, the subscription-based model stands out as the leading segment. Urban users gravitate toward this model because it offers consistent access to vehicle fleets at predictable monthly or annual rates. This approach supports long-term user engagement by providing transparent, budget-friendly pricing and eliminating the hassles of car ownership. Businesses operating under this model enjoy higher customer retention rates due to the dependable nature of the service.

Regionally, Asia Pacific led the market in 2024, with China holding around 65% of the regional market share and generating USD 74.2 million in revenue. China's leadership position is driven by its rapid urbanization, extensive car production capabilities, and technological advancements in connected vehicle infrastructure. National development policies aimed at promoting smart mobility and vehicle electrification have enabled widespread deployment of telematics systems across shared electric and hybrid vehicles. Additionally, investments in 5G networks, cloud computing, and Internet of Things (IoT) platforms support the expansion of sophisticated car sharing ecosystems. Battery management systems, AI-based vehicle tracking, and real-time fleet analytics are being integrated into shared mobility services, making the country a global leader in this sector.

The major players shaping the global car sharing telematics industry include providers of real-time tracking, behavior analysis, and predictive maintenance technologies. These systems now feature advanced sensor arrays, centralized control units, and 5G-enabled eSIMs that offer cross-border data exchange and cloud-based diagnostics. The market's evolution continues to be driven by a need for smarter, safer, and more efficient transportation solutions tailored to urban lifestyles and sustainability goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Car Sharing Telematics Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component providers

- 3.2.2 Automotive manufacturers

- 3.2.3 Technology provider

- 3.2.4 System integrators

- 3.2.5 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news and initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Integration of IOT and AI in transportation industry

- 3.9.1.2 Rising demand for sustainable transportation

- 3.9.1.3 Supportive regulations and government initiatives promoting shared mobility

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Concerns about data privacy

- 3.9.2.2 Significant upfront and ongoing costs

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Service, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Automatic Crash Notification (ACN)

- 5.3 Emergency

- 5.4 Navigation

- 5.5 Assistance & access

- 5.6 Diagnostics

- 5.7 Fleet management

- 5.8 Billing

- 5.9 Others

Chapter 6 Market Estimates & Forecast, By Form, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Embedded

- 6.3 Tethered

- 6.4 Integrated

Chapter 7 Market Estimates & Forecast, By Component, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 GPS receiver

- 7.3 Accelerometer

- 7.4 Engine interface

- 7.5 Sim card

- 7.6 Software

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Business Model, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Subscription-based model

- 8.3 Pay-per-use model

- 8.4 Corporate fleet management

- 8.5 Partnerships with OEMs

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 U.K.

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 CalAmp

- 10.2 cambio Mobilitatsservice

- 10.3 Cantamen

- 10.4 Carmine

- 10.5 Citiz Reseau

- 10.6 CityBee Solutions

- 10.7 Continental Aftermarket & Services

- 10.8 Fleetster (Next Generation Mobility)

- 10.9 Geotab

- 10.10 INVERS

- 10.11 Mobility Tech Green

- 10.12 Mojio

- 10.13 Octo Group

- 10.14 Ridecell

- 10.15 Samsara

- 10.16 Targa Telematics

- 10.17 Turo

- 10.18 Verizon Communications

- 10.19 Vulog

- 10.20 WeGo