|

市场调查报告书

商品编码

1741029

变频驱动器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Variable Frequency Drives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

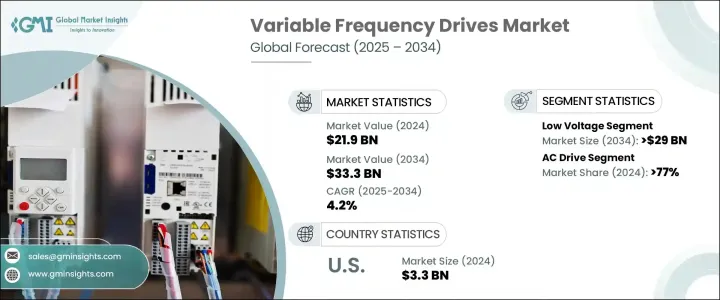

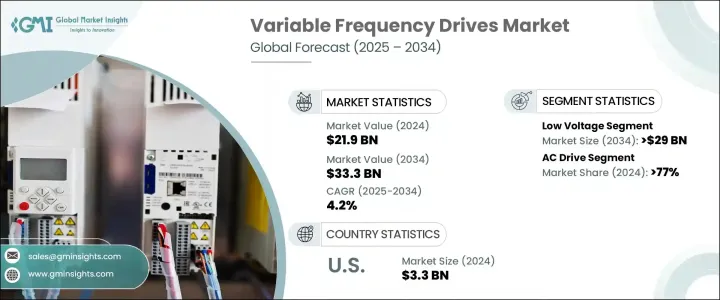

2024年,全球变频驱动器市场规模达219亿美元,预计到2034年将以4.2%的复合年增长率成长,达到333亿美元。这一成长趋势主要归因于人们对永续性和节能日益增长的重视。全球许多政府正在加强环境政策,敦促各行各业遵守最新的能源效率法规。这些法规,加上鼓励采用节能技术的激励措施,正在推动製造商和工厂实现营运现代化。因此,变频器已成为这些转型的关键组成部分,有助于降低能耗并减少工业排放。

在日益数位化和自动化的世界里,物联网和机器学习功能与工业运作的融合,在重塑变频器(VFD)的使用方式方面发挥关键作用。这些智慧技术能够实现即时监控、故障检测和预测性维护,从而提高营运效率并减少停机时间。如今,各行各业都要求变频器解决方案具备更高的精度、适应性和可靠性。随着企业寻求更智慧、更快回应的能源控制系统,这种转变正在为市场开闢新的成长途径。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 219亿美元 |

| 预测值 | 333亿美元 |

| 复合年增长率 | 4.2% |

历史资料显示,全球变频器 (VFD) 市场持续保持年成长,2022 年市场规模为 207 亿美元,2023 年为 211 亿美元,2024 年为 219 亿美元。依电压细分,市场主要分为两大类:低电压变频器和中压变频器。其中,低压变频器预计将在预测期内保持主导地位,预计到 2034 年收入将超过 290 亿美元。该领域持续保持领先地位的驱动力源于自动化技术的广泛应用、对节能的日益重视以及全行业向经济高效的性能提升的转变。紧凑、高效且易于整合的系统日益受到青睐,这使得低压变频器成为多个行业的理想选择。

市场进一步细分,根据驱动器类型划分,包括交流驱动器、直流驱动器和伺服驱动器。交流驱动器目前占据最大份额,到2024年将贡献全球77%以上的市场份额。预计其受欢迎程度将保持强劲,到2034年预计将成长至260亿美元。交流驱动器的持续需求源自于持续的技术改进,这些改进融合了智慧功能,提升了其整体性能,并增强了其在广泛应用中的吸引力。这些驱动器提供卓越的能量控制,使其非常适合效率和自动化至关重要的现代工业环境。

从地区来看,美国仍然是全球市场收入的重要贡献者。美国变频器市场规模在2022年及2023年均为32亿美元,2024年将达33亿美元。製造业、工业自动化和气候控制系统等领域广泛应用节能解决方案,推动了市场稳定成长。这些地区的企业正在大力投资有助于降低营运成本并满足环保合规目标的技术,这进一步刺激了对先进变频器系统的需求。

市场竞争态势持续加剧,领导企业合计占超过30%的市占率。其中,知名企业包括罗克韦尔自动化、丹佛斯、ABB、西门子和三菱电机。这些产业领导者正致力于透过推出创新产品线和建立策略联盟来扩大市场覆盖范围。他们采取的措施包括合资企业、合作伙伴关係和技术合作,旨在增强品牌影响力并赢得更大的客户群。

产品创新、营运效率和能源优化仍然是变频器製造商的核心关注领域。为了满足日益增长的市场需求,许多公司正在扩大生产能力,并推出能够无缝整合到数位生态系统的下一代产品。随着各国政府持续推行严格的环境政策,变频器在减少碳足迹和增强永续性方面的作用将日益增强,为产业的长期发展奠定基础。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:市场规模及预测:按电压,2021 - 2034

- 主要趋势

- 低的

- 中等的

第五章:市场规模及预测:按驱动力,2021-2034

- 主要趋势

- 交流电

- 直流

- 伺服

第六章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 泵浦

- 扇子

- 输送带

- 压缩机

- 挤出机

- 其他的

第七章:市场规模及预测:依最终用途,2021-2034

- 主要趋势

- 石油和天然气

- 发电

- 采矿和金属

- 纸浆和造纸

- 海洋

- 其他的

第八章:市场规模及预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 丹麦

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- ABB

- Beckhoff Automation

- Bosch Rexroth

- Danfoss

- Eaton

- Emerson Electric

- Fuji Electric

- GE Vernova

- Hiconics Eco-energy Technology

- Hitachi Industrial Equipment Systems

- Honeywell International

- Invertek Drives

- Johnson Controls

- Mitsubishi Electric

- Nidec Motor

- Rockwell Automation

- Schneider Electric

- Siemens

- WEG

- Yaskawa Electric

The Global Variable Frequency Drives Market was valued at USD 21.9 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 33.3 billion by 2034. This upward trend is primarily attributed to the growing importance placed on sustainability and energy conservation. Many governments around the world are reinforcing environmental policies, prompting industries to comply with updated energy efficiency regulations. These regulations, combined with incentives for adopting energy-saving technologies, are pushing manufacturers and facilities to modernize their operations. As a result, VFDs have become a critical part of these transitions, helping reduce energy consumption and curb industrial emissions.

In an increasingly digital and automated world, the integration of IoT and machine learning capabilities into industrial operations is playing a key role in reshaping how VFDs are used. These smart technologies enable real-time monitoring, fault detection, and predictive maintenance, which enhance operational efficiency and reduce downtime. Industries are now demanding VFD solutions that offer higher levels of precision, adaptability, and reliability. This shift is opening up new growth avenues for the market as enterprises look for smarter and more responsive energy control systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.9 Billion |

| Forecast Value | $33.3 Billion |

| CAGR | 4.2% |

Historical data highlights consistent year-over-year growth, with the global VFD market valued at USD 20.7 billion in 2022, USD 21.1 billion in 2023, and USD 21.9 billion in 2024. Market segmentation based on voltage reveals two main categories: low voltage and medium voltage drives. Among these, low voltage VFDs are expected to remain dominant through the forecast period, with revenue projected to surpass USD 29 billion by 2034. This segment's continued leadership is driven by the widespread adoption of automation technologies, a growing focus on energy savings, and an industry-wide shift toward cost-effective performance enhancements. The increasing preference for compact, efficient, and easy-to-integrate systems makes low voltage drives an ideal fit across multiple sectors.

The market is further divided based on drive types, which include AC drives, DC drives, and servo drives. AC drives currently account for the largest share, contributing over 77% of the global market in 2024. Their popularity is expected to remain strong, with projections indicating growth to USD 26 billion by 2034. The sustained demand for AC drives stems from ongoing technological improvements that incorporate smart functionality, which has enhanced their overall performance and increased their appeal across a broad range of applications. These drives offer superior energy control, which makes them well-suited for modern industrial environments where efficiency and automation are paramount.

Regionally, the United States remains a significant contributor to global market revenue. The U.S. VFD market stood at USD 3.2 billion in both 2022 and 2023, and reached USD 3.3 billion in 2024. The steady rise is driven by widespread implementation of energy-efficient solutions across sectors such as manufacturing, industrial automation, and climate control systems. Businesses in these areas are investing heavily in technologies that help lower operational costs while meeting environmental compliance goals, further bolstering demand for advanced VFD systems.

Competitive dynamics in the market continue to intensify, with leading players collectively holding more than 30% of the total market share. Prominent companies include Rockwell Automation, Danfoss, ABB, Siemens, and Mitsubishi Electric Corporation. These industry leaders are focusing on expanding their market reach through the introduction of innovative product lines and strategic alliances. Efforts include joint ventures, partnerships, and technology collaborations aimed at strengthening brand presence and capturing a larger customer base.

Product innovation, operational efficiency, and energy optimization remain the core focus areas for VFD manufacturers. To address growing market needs, many companies are scaling up production capabilities and introducing next-generation products that integrate seamlessly into digital ecosystems. As governments continue enforcing stringent environmental policies, the role of VFDs in reducing carbon footprints and enhancing sustainability will only grow stronger, setting the stage for long-term industry advancement.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Market Size and Forecast, By Voltage, 2021 - 2034, ('000 Units & USD Million)

- 4.1 Key trends

- 4.2 Low

- 4.3 Medium

Chapter 5 Market Size and Forecast, By Drive, 2021 - 2034, ('000 Units & USD Million)

- 5.1 Key trends

- 5.2 AC

- 5.3 DC

- 5.4 Servo

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034, ('000 Units & USD Million)

- 6.1 Key trends

- 6.2 Pump

- 6.3 Fan

- 6.4 Conveyor

- 6.5 Compressor

- 6.6 Extruder

- 6.7 Others

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034, ('000 Units & USD Million)

- 7.1 Key trends

- 7.2 Oil & gas

- 7.3 Power generation

- 7.4 Mining & metals

- 7.5 Pulp & paper

- 7.6 Marine

- 7.7 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034, ('000 Units & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Denmark

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Beckhoff Automation

- 9.3 Bosch Rexroth

- 9.4 Danfoss

- 9.5 Eaton

- 9.6 Emerson Electric

- 9.7 Fuji Electric

- 9.8 GE Vernova

- 9.9 Hiconics Eco-energy Technology

- 9.10 Hitachi Industrial Equipment Systems

- 9.11 Honeywell International

- 9.12 Invertek Drives

- 9.13 Johnson Controls

- 9.14 Mitsubishi Electric

- 9.15 Nidec Motor

- 9.16 Rockwell Automation

- 9.17 Schneider Electric

- 9.18 Siemens

- 9.19 WEG

- 9.20 Yaskawa Electric