|

市场调查报告书

商品编码

1741034

医疗电子市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Medical Electronics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

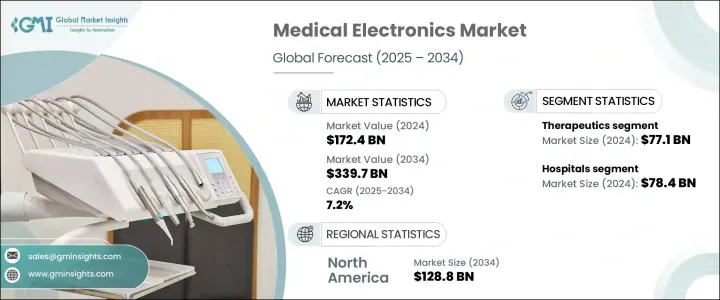

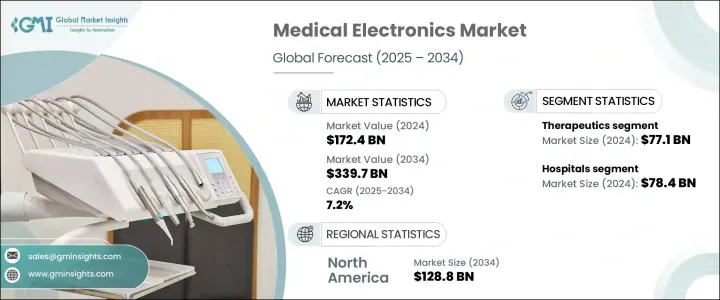

2024年,全球医疗电子市场规模达1,724亿美元,预计到2034年将以7.2%的复合年增长率成长,达到3,397亿美元。这一增长主要源于医疗保健领域电子系统和设备的广泛应用,这些系统和设备用于支援诊断、治疗、预防和病患监护。随着医疗保健领域日益数位化,医疗电子技术正在改变临床医生的诊疗方式。从诊断影像工具和穿戴式监视器到机器人手术系统和互联治疗系统,这些设备正在重塑患者体验和临床疗效。人工智慧、物联网和云端运算等智慧技术的整合正在重新定义营运效率,加快诊断速度,提高资料准确性,并减少人为错误。医院、诊所,甚至家庭护理环境如今都依赖互联的医疗电子设备来简化工作流程、管理慢性疾病并增强病患参与度。随着全球人口老化和非传染性疾病发病率的上升,人们明显转向技术驱动的医疗保健解决方案。消费者要求个人化、便利和即时的医疗保健服务,推动公司加速创新并推出更直觉、更可靠的医疗电子设备。

慢性病和传染病(包括心血管疾病、癌症和呼吸系统疾病)的发生率持续上升,这在很大程度上推动了对先进医疗电子产品的需求激增。大众对早期疾病检测和预防保健的认识日益增强,促进了诊断技术的广泛应用。同时,微创手术技术的进步也加速了对高精准度电子工具的需求。这些创新正在帮助提高即时手术的准确性,缩短復健时间,并改善全球患者的临床疗效。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1724亿美元 |

| 预测值 | 3397亿美元 |

| 复合年增长率 | 7.2% |

医疗机器人、远端监控和穿戴式诊断等领域的持续技术创新也为市场带来了强劲发展势头。随着消费者越来越倾向于更智慧、更互联的医疗工具,电子产品在医疗应用中的整合也日益受到青睐。全球医疗保健支出的不断增长进一步推动了先进电子设备的普及,尤其是那些用于管理复杂手术和长期照护的设备。这一趋势在专业医疗领域尤其明显,因为这些领域对即时资料、增强成像和精准控制的需求仍然至关重要。

2024年,治疗领域收入达771亿美元,这得益于植入式和体外设备在慢性病管理的应用日益增加。这些治疗技术融合了先进的电子功能,以提高安全性、精准度和个人化护理,尤其是在心血管、神经系统和呼吸系统治疗领域。心律调节器、神经刺激器和输液帮浦等设备正被广泛应用,以提高生活品质并减少就诊次数。

2024年,医院引领了终端用户的采用,创造了784亿美元的市场规模,占据了45.5%的市场。这些机构高度依赖诊断和治疗电子设备来有效管理门诊和住院护理。医院致力于优化临床工作流程,尽量减少治疗延误,持续投资于下一代监测设备、手术技术和影像系统,以期获得更佳的治疗效果。

2023年,美国医疗电子市场规模达574亿美元,这得益于心血管疾病、糖尿病、癌症和神经系统疾病等慢性疾病日益加重的负担。随着越来越多的患者需要持续监测和治疗,对先进电子医疗设备的需求持续高涨。美国也受益于强大的研发基础设施和早期的技术应用,这有助于其在医疗创新领域中保持领先地位。

全球医疗电子市场的领导者——包括奥林巴斯、深圳迈瑞生物医疗电子、西门子医疗、乐普医疗、波士顿科学、东芝医疗系统、富士胶片控股、通用电气医疗、雅培实验室、微创医疗科学、三星电子、美敦力、锐珂医疗、荷兰皇家飞利浦和百胜——正在实施关键战略以增强其市场影响力。这些策略包括增加研发投入以加速创新、与医疗服务供应商合作获取即时回馈、拓展新兴市场以及利用人工智慧和物联网推出智慧诊断和远端护理平台。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病和传染病负担加重

- 技术先进的医疗电子产品日益普及

- 越来越倾向微创手术

- 资本密集型机器租赁的兴起和外国直接投资(FDI)重大政策的发展

- 产业陷阱与挑战

- 严格的监管情景

- 缺乏熟练的医疗保健专业人员

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 各国应对措施

- 对产业的影响

- 供应方影响(製造成本)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(消费者成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(製造成本)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 疗法

- 起搏器

- 植入式心臟復律去颤器

- 神经刺激装置

- 手术机器人

- 呼吸照护设备

- 诊断

- 病人监护设备

- PET-CT设备

- MRI扫描仪

- 超音波设备

- X射线设备

- CT扫描仪

- 其他产品类型

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 诊所

- 其他最终用途

第七章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第八章:公司简介

- Abbott Laboratories

- Boston Scientific

- Carestream Health

- Esaote

- FUJIFILM Holdings

- GE HealthCare

- Koninklijke Philips

- Lepu Medical Technology

- Medtronic

- MicroPort Scientific

- Olympus

- Samsung Electronics

- Shenzhen Mindray Bio-Medical Electronics

- Siemens Healthineers

- Toshiba Medical Systems

The Global Medical Electronics Market was valued at USD 172.4 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 339.7 billion through 2034. This growth is driven by the expanding use of electronic systems and devices across healthcare sectors to support diagnosis, treatment, prevention, and patient monitoring. As the healthcare landscape becomes increasingly digitized, medical electronics are transforming how clinicians deliver care. From diagnostic imaging tools and wearable monitors to robotic surgery systems and connected therapeutics, these devices are reshaping patient experiences and clinical outcomes. The integration of smart technologies like AI, IoT, and cloud computing is redefining operational efficiency, enabling faster diagnostics, improving data accuracy, and reducing human error. Hospitals, clinics, and even home care environments now rely on interconnected medical electronics to streamline workflows, manage chronic diseases, and enhance patient engagement. With an aging global population and the rising incidence of non-communicable diseases, there's a clear shift toward tech-driven healthcare solutions. Consumers are demanding personalized, accessible, and real-time healthcare services, pushing companies to innovate faster and introduce more intuitive, reliable medical electronic devices.

The continuous rise in chronic and infectious diseases-including cardiovascular conditions, cancer, and respiratory disorders-is contributing heavily to the surging demand for advanced medical electronics. There's growing public awareness around early disease detection and preventive care, which is encouraging the widespread use of diagnostic technologies. At the same time, advancements in minimally invasive surgical techniques are accelerating the need for high-precision electronic tools. These innovations are helping improve real-time procedural accuracy, reduce recovery times, and enhance clinical outcomes for patients globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $172.4 Billion |

| Forecast Value | $339.7 Billion |

| CAGR | 7.2% |

The market is also seeing robust momentum from ongoing technological innovation in areas like medical robotics, remote monitoring, and wearable diagnostics. As consumers lean toward smarter, more connected healthcare tools, the integration of electronics in medical applications continues to gain traction. Rising global healthcare expenditures further support the adoption of sophisticated electronic devices, especially those designed to manage complex procedures and long-term care. This trend is particularly evident in specialized medical fields where demand for real-time data, enhanced imaging, and precision control remains critical.

In 2024, the therapeutics segment generated USD 77.1 billion, driven by the increasing use of implantable and external devices to manage chronic conditions. These therapeutic technologies combine advanced electronic features to improve safety, delivery accuracy, and personalized care-especially in cardiovascular, neurological, and respiratory treatment. Devices such as pacemakers, neurostimulators, and infusion pumps are being widely adopted to boost quality of life and reduce hospital visits.

Hospitals led end-user adoption in 2024, generating USD 78.4 billion and accounting for 45.5% of the market share. These institutions depend heavily on both diagnostic and therapeutic electronics to manage outpatient and inpatient care efficiently. With a focus on optimizing clinical workflows and minimizing treatment delays, hospitals continue to invest in next-generation monitoring equipment, surgical technologies, and imaging systems to drive better outcomes.

The U.S. Medical Electronics Market generated USD 57.4 billion in 2023, fueled by the growing burden of chronic diseases such as cardiovascular disorders, diabetes, cancer, and neurological conditions. With more patients requiring continuous monitoring and treatment, the demand for advanced electronic medical devices remains high. The U.S. also benefits from strong R&D infrastructure and early tech adoption, helping sustain its leadership in medical innovation.

Leading players in the Global Medical Electronics Market-including Olympus, Shenzhen Mindray Bio-Medical Electronics, Siemens Healthineers, Lepu Medical Technology, Boston Scientific, Toshiba Medical Systems, FUJIFILM Holdings, GE HealthCare, Abbott Laboratories, MicroPort Scientific, Samsung Electronics, Medtronic, Carestream Health, Koninklijke Philips, and Esaote-are implementing key strategies to strengthen their market presence. These include boosting R&D investments to fast-track innovation, collaborating with healthcare providers for real-time feedback, expanding into emerging markets, and leveraging AI and IoT to launch intelligent diagnostic and remote care platforms.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising burden of chronic and infectious diseases

- 3.2.1.2 Growing adoption of technologically advanced medical electronics

- 3.2.1.3 Increasing preference towards minimally invasive surgeries

- 3.2.1.4 Upsurge in leasing of capital-intensive machines and development of significant policies for foreign direct investment (FDI)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenario

- 3.2.2.2 Lack of skilled healthcare professionals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Therapeutics

- 5.2.1 Pacemakers

- 5.2.2 Implantable cardioverter-defibrillators

- 5.2.3 Neurostimulation devices

- 5.2.4 Surgical robots

- 5.2.5 Respiratory care devices

- 5.3 Diagnostics

- 5.3.1 Patient monitoring devices

- 5.3.2 PET-CT devices

- 5.3.3 MRI scanners

- 5.3.4 Ultrasound devices

- 5.3.5 X-rays devices

- 5.3.6 CT scanners

- 5.4 Other product types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Ambulatory surgical centers

- 6.4 Clinics

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 Boston Scientific

- 8.3 Carestream Health

- 8.4 Esaote

- 8.5 FUJIFILM Holdings

- 8.6 GE HealthCare

- 8.7 Koninklijke Philips

- 8.8 Lepu Medical Technology

- 8.9 Medtronic

- 8.10 MicroPort Scientific

- 8.11 Olympus

- 8.12 Samsung Electronics

- 8.13 Shenzhen Mindray Bio-Medical Electronics

- 8.14 Siemens Healthineers

- 8.15 Toshiba Medical Systems