|

市场调查报告书

商品编码

1741037

碳酸氢钠市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Sodium Bicarbonate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

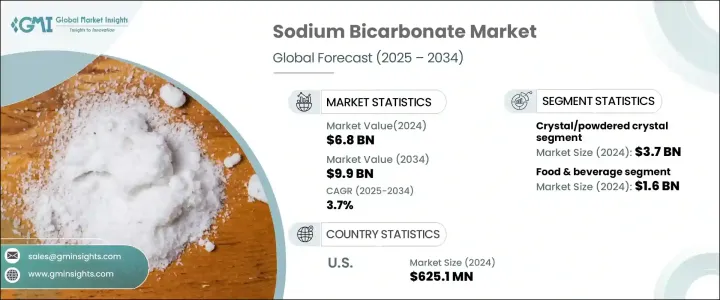

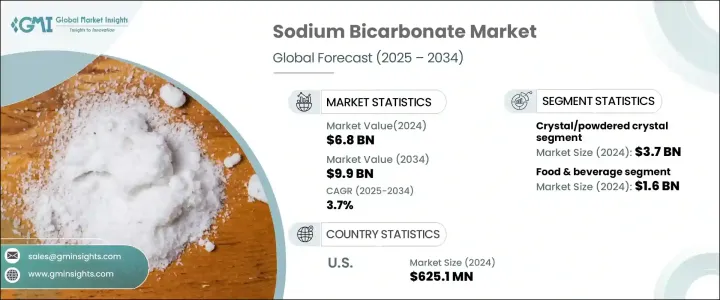

2024年,全球碳酸氢钠市场规模达68亿美元,预计到2034年将以3.7%的复合年增长率增长,达到99亿美元,这得益于工业应用的不断扩展以及各行业法规合规性不断提高。从历史上看,碳酸氢钠一直是许多行业的主要产品,包括製药、食品加工和环境解决方案。儘管全球供应链不稳定导致碳酸氢钠供应中断,但其需求仍表现出显着的韧性,这主要得益于其在各种製造和加工业务中不可或缺的作用。

亚太、北美和欧洲等地区的需求成长主要源自于快速的工业化进程和日益增强的环保意识。这些地区正在积极采取措施,以符合不断发展的环保标准,从而对碳酸氢钠的需求持续成长。此外,碳酸氢钠在医疗保健配方中的应用以及作为药物pH值控製剂的应用也持续提升了其重要性。在农业和动物饲料领域,碳酸氢钠也显着成长,在这些领域中,碳酸氢钠既可用作杀菌剂,也可用作营养添加剂。这些因素共同确保了该产品在全球供应链和消费週期中占据重要地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 68亿美元 |

| 预测值 | 99亿美元 |

| 复合年增长率 | 3.7% |

晶体和粉状碳酸氢钠继续占据市场主导地位。预计2024年该细分市场的市值将达到37亿美元,2025年至2034年间的复合年增长率将达到4.2%。粉状碳酸氢钠因其化学稳定性、易储存性和更长的保质期而脱颖而出。这种形态在食品生产、製药和个人护理等注重稳定品质和可靠配方的行业中尤为有利。粉末状碳酸氢钠因其细腻、流动性好的质地而备受青睐,这使其适合直接混合、高效包装和精确配製。此外,它还具有优异的溶解性和一致的粒径,从而简化了严格监管行业中的计量操作。其在烟气脱硫的应用也增强了其在工业应用领域的需求。

在食品和饮料领域,碳酸氢钠在2024年的估值为16亿美元,预计2025年至2034年的复合年增长率为4.1%。该领域约占总市场份额的22.9%。碳酸氢钠在烘焙、加工食品和饮料中的应用日益广泛,凸显了其作为重要膨鬆剂和pH调节剂的作用。消费者越来越倾向于选择方便、即食和健康的食品,这促使製造商使用既能提升产品品质又不损害健康的配料。碳酸氢钠凭藉其清洁标籤的吸引力和多功能性,完美契合了这些偏好。

在美国,2024年碳酸氢钠市值为6.251亿美元,预计到2034年将以3.5%的复合年增长率成长。美国市场的成长主要受工业活动、不断变化的法规和持续的经济发展的影响。政府的支持性政策、完善的工业基础设施以及严格的环境和食品安全法规促进了稳定的需求。疫情后消费者行为的转变,以及新的工业投资,进一步推动了成长。医疗保健和便利消费品领域的需求均显着上升,巩固了美国在全球市场中的优势地位。

竞争格局由主要参与者主导,他们旨在透过创新和策略扩张来获取更大的市场份额。企业正在实现产品线多元化,投资永续解决方案,并加强全球影响力以满足不断增长的需求。持续的研发投入,尤其是在增强产品功能性和永续性方面的投入,正在重塑这些企业的定位。尤其值得一提的是,它们更重视产品创新、注重环保的生产实践,并透过生产优化和併购进军高需求地区。随着市场动态日益受到消费趋势和监管变化的影响,企业正在调整策略,以保持竞争力并回应全球需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 供给侧影响(原料)

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 2021-2024年主要出口国

- 2021-2024年主要进口国

- 製造流程和供应链分析

- 原料分析

- 关键原料

- 原物料采购

- 原物料价格趋势

- 原物料供应商

- 製造流程分析

- 索尔维法

- 天然碱法

- 碳酸钠法

- 氢氧化钠法

- 苏打石提取

- 新兴生产技术

- 成本结构分析

- 供应链分析

- 供应链结构和映射

- 分销通路分析

- 主要物流供应商

- 供应链挑战

- 供应链优化策略

- 生产能力分析

- 全球生产能力

- 产能利用率

- 计画中的产能扩张

- 库存管理和仓储

- 品质控制和认证标准

- 原料分析

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 全球监管格局

- 食品级法规

- 药品级法规

- 工业级法规

- 区域监管分析

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

- 进出口法规

- 产品标籤和包装法规

- 安全和处理指南

- 环境法规

- 排放控制法规

- 废弃物管理法规

- 监理影响评估

- 对生产成本的影响

- 对市场进入障碍的影响

- 对产品开发的影响

- 全球监管格局

- 衝击力

- 成长动力

- 製药业的需求不断增加。

- 扩大在食品和饮料领域的应用。

- 人们对环境议题的关注度不断提高,对环保产品的需求也不断增加。

- 个人护理和化妆品行业的成长。

- 产业陷阱与挑战

- 原物料价格波动。

- 对生产过程有严格的环境法规。

- 成长动力

- 未来市场展望与策略机会

- 2025-2034年市场预测

- 短期预测(1-3年)

- 中期预测(4-7年)

- 长期预测(8-10年)

- 新兴市场机会

- 高成长应用领域

- 尚未开发的区域市场

- 利基市场机会

- 策略成长机会

- 产品开发机会

- 市场拓展机会

- 加值服务机会

- 技术采用与创新路线图

- 永续发展驱动的机会

- 策略建议

- 对于製造商

- 对于分销商和供应商

- 最终用途

- 对于投资者

- 未来情境规划

- 乐观情境

- 现实场景

- 悲观情景

- 2025-2034年市场预测

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

- 风险分析和缓解策略

- 市场风险评估

- 需求波动风险

- 价格波动风险

- 竞争风险

- 替代风险

- 营运风险

- 供应链中断

- 生产风险

- 品质控制风险

- 监理与合规风险

- 环境和永续性风险

- 地缘政治风险

- 风险缓解策略

- 多元化策略

- 对冲策略

- 保险和风险转移机制

- 应急计划

- 产业利害关係人的风险管理框架

- 市场风险评估

第五章:市场估计与预测:依形式,2021-2034

- 主要趋势

- 水晶/粉晶

- 液体

- 泥

第六章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 食品和饮料

- 工业的

- 製药

- 个人护理

- 农业化学品

- 动物饲料

- 其他的

第七章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Akshar Chemical India Private Limited

- Ciner Group

- Church & Dwight

- Crystal Mark

- FMC

- GHCL

- Haohua Honghe Chemical

- Natural Soda

- Opta Minerals

- Sisecam

- Solvay

- Tata Chemicals

- Tosoh

The Global Sodium Bicarbonate Market was valued at USD 6.8 billion in 2024 and is estimated to grow at a CAGR of 3.7% to reach USD 9.9 billion by 2034, driven by a combination of expanding industrial applications and rising regulatory compliance across various sectors. Historically, sodium bicarbonate has remained a staple across numerous industries, including pharmaceuticals, food processing, and environmental solutions. Despite facing disruptions due to global supply chain instability, the demand for sodium bicarbonate displayed significant resilience, largely due to its indispensable role in diverse manufacturing and processing operations.

The increasing demand in regions such as Asia Pacific, North America, and Europe has primarily been driven by rapid industrialization and growing environmental awareness. These regions are taking proactive steps to align with evolving environmental standards, resulting in sustained demand for sodium bicarbonate. Additionally, the compound's use in healthcare formulations and as a pH control agent in medications continues to fuel its relevance. There has also been notable growth in the agriculture and animal feed sectors, where sodium bicarbonate is used both as a fungicide and nutritional additive. These dynamics collectively ensure that the product retains a strong foothold in global supply chains and consumption cycles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.8 Billion |

| Forecast Value | $9.9 Billion |

| CAGR | 3.7% |

The crystal and powdered crystal forms of sodium bicarbonate continue to dominate the market landscape. Valued at USD 3.7 billion in 2024, this segment is projected to grow at a CAGR of 4.2% between 2025 and 2034. The powdered crystal form stands out for its chemical stability, ease of storage, and longer shelf life. This format is particularly advantageous in sectors like food production, pharmaceuticals, and personal care, where consistent quality and reliable formulation are key. Powdered sodium bicarbonate is preferred for its fine, free-flowing texture, which makes it suitable for direct blending, efficient packaging, and precise formulation. Furthermore, it offers excellent solubility and consistent particle size, which simplifies dosing in tightly regulated industries. Its utility in flue gas desulfurization also strengthens its demand across industrial applications.

Within the food and beverage sector, sodium bicarbonate held a valuation of USD 1.6 billion in 2024, with expectations to grow at a 4.1% CAGR from 2025 to 2034. This segment accounts for approximately 22.9% of the total market share. The increasing incorporation of sodium bicarbonate in baking, processed foods, and beverages underscores its role as a vital leavening and pH-regulating agent. Rising consumer inclination toward convenient, ready-to-eat, and health-oriented food options is pushing manufacturers to use ingredients that enhance product quality without compromising health. Sodium bicarbonate aligns well with these preferences due to its clean-label appeal and functional versatility.

In the United States, the sodium bicarbonate market was valued at USD 625.1 million in 2024 and is projected to expand at a CAGR of 3.5% through 2034. Growth in the U.S. market is largely shaped by industrial activity, evolving regulations, and ongoing economic developments. Supportive government policies, an established industrial infrastructure, and stringent environmental and food safety regulations are contributing to steady demand. Post-pandemic shifts in consumer behavior, alongside new industrial investments, have further bolstered growth. There is an observable uptick in demand across both healthcare and convenience-focused consumer goods sectors, reinforcing the country's stronghold in the global landscape.

The competitive landscape is dominated by key players aiming to secure larger market shares through innovation and strategic expansion. Companies are diversifying product lines, investing in sustainable solutions, and strengthening their global presence to meet rising demand. Continuous efforts in research and development, particularly toward enhancing product functionality and sustainability, are reshaping how these companies position themselves. In particular, there is a noticeable emphasis on product innovation, eco-conscious manufacturing practices, and tapping into high-demand regions through production optimization and mergers. With market dynamics increasingly shaped by consumer trends and regulatory shifts, businesses are adjusting strategies to stay competitive and responsive to global needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Demand-side impact (selling price)

- 3.2.3.1 Price transmission to end markets

- 3.2.3.2 Market share dynamics

- 3.2.3.3 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries, 2021-2024 (kilo tons)

- 3.3.2 Major importing countries, 2021-2024 (kilo tons)

- 3.4 Manufacturing process and supply chain analysis

- 3.4.1 Raw materials analysis

- 3.4.1.1 Key raw materials

- 3.4.1.2 Raw material sourcing

- 3.4.1.3 Raw material price trends

- 3.4.1.4 Raw material suppliers

- 3.4.2 Manufacturing process analysis

- 3.4.2.1 Solvay process

- 3.4.2.2 Trona process

- 3.4.2.3 Sodium carbonate method

- 3.4.2.4 Sodium hydroxide method

- 3.4.2.5 Nahcolite extraction

- 3.4.2.6 Emerging production technologies

- 3.4.2.7 Cost structure analysis

- 3.4.3 Supply chain analysis

- 3.4.3.1 Supply chain structure and mapping

- 3.4.3.2 Distribution channels analysis

- 3.4.3.3 Key logistics providers

- 3.4.3.4 Supply chain challenges

- 3.4.3.5 Supply chain optimization strategies

- 3.4.4 Production capacity analysis

- 3.4.4.1 Global production capacity

- 3.4.4.2 Capacity utilization rates

- 3.4.4.3 Planned capacity expansions

- 3.4.5 Inventory management and warehousing

- 3.4.6 Quality control and certification standards

- 3.4.1 Raw materials analysis

- 3.5 Supplier landscape

- 3.6 Profit margin analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.8.1 Global regulatory landscape

- 3.8.1.1 Food grade regulations

- 3.8.1.2 Pharmaceutical grade regulations

- 3.8.1.3 Industrial grade regulations

- 3.8.2 Regional regulatory analysis

- 3.8.2.1 North America

- 3.8.2.2 Europe

- 3.8.2.3 Asia pacific

- 3.8.2.4 Rest of the world

- 3.8.3 Import-export regulations

- 3.8.4 Product labeling and packaging regulations

- 3.8.5 Safety and handling guidelines

- 3.8.6 Environmental regulations

- 3.8.6.1 Emission control regulations

- 3.8.6.2 Waste management regulations

- 3.8.7 Regulatory impact assessment

- 3.8.7.1 Impact on production costs

- 3.8.7.2 Impact on market entry barriers

- 3.8.7.3 Impact on product development

- 3.8.1 Global regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing demand in the pharmaceutical industry.

- 3.9.1.2 Expanding applications in food and beverage sectors.

- 3.9.1.3 Rising environmental concerns and demand for eco-friendly products.

- 3.9.1.4 Growth in the personal care and cosmetics industry.

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Price volatility of raw materials.

- 3.9.2.2 Stringent environmental regulations on production processes.

- 3.9.1 Growth drivers

- 3.10 Future market outlook and strategic opportunities

- 3.10.1 Market forecast 2025–2034

- 3.10.1.1 Short-term forecast (1–3 years)

- 3.10.1.2 Medium-term forecast (4–7 years)

- 3.10.1.3 Long-term forecast (8–10 years)

- 3.10.2 Emerging market opportunities

- 3.10.2.1 High-growth application areas

- 3.10.2.2 Untapped regional markets

- 3.10.2.3 Niche segment opportunities

- 3.10.3 Strategic growth opportunities

- 3.10.3.1 Product development opportunities

- 3.10.3.2 Market expansion opportunities

- 3.10.3.3 Value-added services opportunities

- 3.10.4 Technology adoption and innovation roadmap

- 3.10.5 Sustainability-driven opportunities

- 3.10.6 Strategic recommendations

- 3.10.7 For manufacturers

- 3.10.8 For distributors and suppliers

- 3.10.9 For end use

- 3.10.10 For investors

- 3.10.11 Future scenario planning

- 3.10.11.1 Optimistic scenario

- 3.10.11.2 Realistic scenario

- 3.10.11.3 Pessimistic scenario

- 3.10.1 Market forecast 2025–2034

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Risk analysis and mitigation strategies

- 4.5.1 Market risks assessment

- 4.5.1.1 Demand fluctuation risks

- 4.5.1.2 Price volatility risks

- 4.5.1.3 Competitive risks

- 4.5.1.4 Substitution risks

- 4.5.2 Operational risks

- 4.5.2.1 Supply chain disruptions

- 4.5.2.2 Production risks

- 4.5.2.3 Quality control risks

- 4.5.3 Regulatory and compliance risks

- 4.5.4 Environmental and sustainability risks

- 4.5.5 Geopolitical risks

- 4.5.6 Risk mitigation strategies

- 4.5.6.1 Diversification strategies

- 4.5.6.2 Hedging strategies

- 4.5.6.3 Insurance and risk transfer mechanisms

- 4.5.6.4 Contingency planning

- 4.5.7 Risk management framework for industry stakeholders

- 4.5.1 Market risks assessment

Chapter 5 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Crystal/powdered crystal

- 5.3 Liquid

- 5.4 Slurry

Chapter 6 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverage

- 6.3 Industrial

- 6.4 Pharmaceutical

- 6.5 Personal care

- 6.6 Agrochemical

- 6.7 Animal feed

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Akshar Chemical India Private Limited

- 8.2 Ciner Group

- 8.3 Church & Dwight

- 8.4 Crystal Mark

- 8.5 FMC

- 8.6 GHCL

- 8.7 Haohua Honghe Chemical

- 8.8 Natural Soda

- 8.9 Opta Minerals

- 8.10 Sisecam

- 8.11 Solvay

- 8.12 Tata Chemicals

- 8.13 Tosoh