|

市场调查报告书

商品编码

1741048

飞轮储能市场机会、成长动力、产业趋势分析及2025-2034年预测Flywheel Energy Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

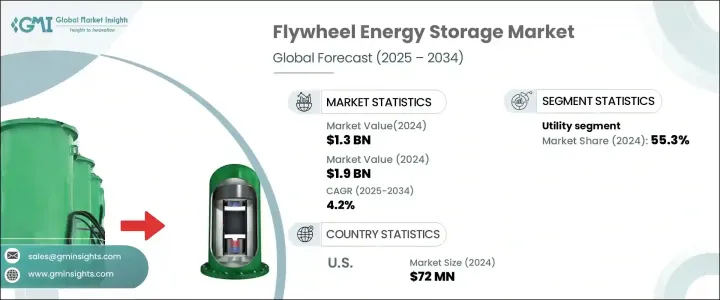

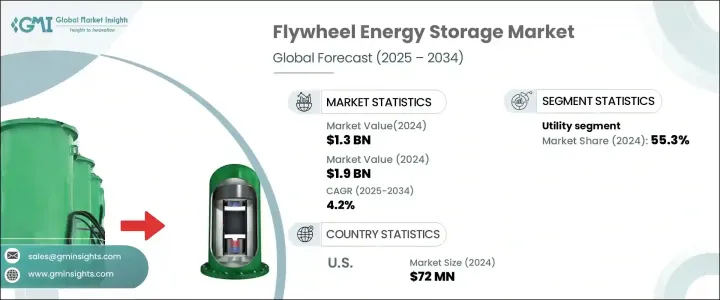

2024年,全球飞轮储能市场规模达13亿美元,预计2034年将以4.2%的复合年增长率成长,达到19亿美元。这一成长主要源自于各行各业对高效、可靠、可持续储能解决方案日益增长的需求。飞轮在应对电网稳定性、电力备份和再生能源整合等挑战方面发挥着日益重要的作用。随着对清洁、不间断电力的需求持续成长,飞轮正逐渐成为一种高效的短时储能技术,具有快速充放电循环和卓越的耐用性。飞轮几乎瞬时的响应速度使其成为从工业运营到先进能源系统等对时间和可靠性至关重要的应用的理想选择。

飞轮储能市场正在各个领域获得关注。值得注意的是,严重依赖恆定电源的资料中心正在转向飞轮以确保连续运作。混合能源系统(其中飞轮与电池配对以优化电源管理)的作用日益增强,也推动了飞轮的采用。飞轮现已成为动态负载管理、快速充电和维持电网频率调节不可或缺的一部分,为公用事业、交通、国防、航太和其他产业提供服务。它们越来越多地用于交通运输系统以捕获和重复使用能源,从而降低营运成本和能耗。飞轮还帮助公用事业稳定电压,处理尖峰需求负载,并支援再生能源输入,使其成为全球转型为永续能源系统的关键组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 19亿美元 |

| 复合年增长率 | 4.2% |

2024年,公用事业产业引领市场,占总份额的55.3%。这一成长主要归功于支援性监管框架以及智慧电网和分散式能源网路对快速响应储能解决方案日益增长的需求。飞轮正成为即时电网管理的重要组成部分,尤其是在先进的电网系统中,它们能够整合分散式能源和虚拟发电厂。飞轮在电动车充电基础设施中的作用也不断扩大,有助于缓解高需求快速充电期间电网的压力。随着电动车普及率的提高,对飞轮系统稳定和确保高效充电基础设施的需求将持续成长。

在美国,飞轮储能市场在2024年创造了7,200万美元的市场规模,这得益于政府对提升电能品质、增强电网弹性和推广再生能源的大力支持。在重大政策措施的支持下,飞轮技术正在公用事业规模项目和关键国防基础设施中迅速部署,尤其是在微电网应用中。

领先的市场参与者包括 Energiestro、POWERTHRU、PUNCH Flybrid、VYCON、Langley Holdings、STORNETIC、Amber Kinetics、BC New Energy、Adaptive Balancing Power 和 OXTO Energy。这些公司正透过与公用事业公司进行策略合作、大力投资研发以提高效率和可扩展性以及扩大其在新兴市场的影响力来提升其市场地位。他们的工作重点包括混合动力系统、将飞轮与电池或再生能源技术结合、申请先进飞轮设计的专利,以及探索公私合作伙伴关係以扩大业务。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 贸易管理关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模与预测:按应用,2021 - 2034

- 主要趋势

- 公用事业

- 运输

- 国防与航太

- 其他的

第六章:市场规模及预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 世界其他地区

第七章:公司简介

- Adaptive Balancing Power

- Amber Kinetics

- BC New Energy

- Energiestro

- Langley Holdings

- OXTO Energy

- PUNCH Flybrid

- POWERTHRU

- STORNETIC

- VYCON

The Global Flywheel Energy Storage Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 1.9 billion by 2034. This growth is being driven by the increasing demand for efficient, reliable, and sustainable energy storage solutions across various industries. Flywheels are becoming increasingly critical in addressing the challenges associated with grid stability, power backup, and integrating renewable energy sources. As the need for clean, uninterrupted power continues to rise, flywheels are emerging as a highly effective technology for short-duration energy storage, offering fast charge/discharge cycles and remarkable durability. Their nearly instantaneous response time makes them an attractive choice for applications where timing and reliability are paramount, from industrial operations to advanced energy systems.

The flywheel energy storage market is gaining traction across a variety of sectors. Notably, data centers, which rely heavily on constant power supply, are turning to flywheels to ensure continuous operations. The growing role of hybrid energy systems, where flywheels are paired with batteries to optimize power management, is also fueling adoption. Flywheels are now integral to dynamic load management, fast charging, and maintaining grid frequency regulation, serving utilities, transportation, defense, aerospace, and other industries. They are increasingly being used in transit systems to capture and reuse energy, lowering operational costs and energy consumption. Flywheels are also helping utilities stabilize voltage, handle peak demand loads, and support renewable energy inputs, making them a critical component of the global transition to sustainable energy systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $1.9 Billion |

| CAGR | 4.2% |

The utility sector led the market in 2024, accounting for 55.3% of the total share. This growth is largely attributed to supportive regulatory frameworks and the rising demand for rapid-response storage solutions in smart grids and decentralized energy networks. Flywheels are becoming a vital part of real-time grid management, particularly in advanced grid systems where they enable the integration of distributed energy sources and virtual power plants. Their role in electric vehicle charging infrastructure is also expanding, helping to ease the strain on the grid during high-demand fast charging sessions. As electric vehicle adoption grows, the need for flywheel systems to stabilize and ensure efficient charging infrastructure will continue to increase.

In the U.S., the Flywheel Energy Storage Market generated USD 72 million in 2024, fueled by strong government support for power quality enhancement, grid resilience, and the promotion of renewable energy sources. Backed by significant policy initiatives, flywheel technologies are rapidly being deployed in utility-scale projects and critical defense infrastructure, particularly for microgrid applications.

Leading market players include Energiestro, POWERTHRU, PUNCH Flybrid, VYCON, Langley Holdings, STORNETIC, Amber Kinetics, BC New Energy, Adaptive Balancing Power, and OXTO Energy. These companies are enhancing their market positions through strategic collaborations with utilities, heavy investments in research and development to improve efficiency and scalability, and expanding their presence in emerging markets. Their efforts are focusing on hybrid systems, integrating flywheels with batteries or renewable energy technologies, patenting advanced flywheel designs, and exploring public-private partnerships to grow their operations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trade administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034, (USD Million, '000 Units)

- 5.1 Key trends

- 5.2 Utility

- 5.3 Transportation

- 5.4 Defense & aerospace

- 5.5 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034, (USD Million, '000 Units)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 UK

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Spain

- 6.3.6 Russia

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 India

- 6.4.4 South Korea

- 6.4.5 Australia

- 6.5 Rest of World

Chapter 7 Company Profiles

- 7.1 Adaptive Balancing Power

- 7.2 Amber Kinetics

- 7.3 BC New Energy

- 7.4 Energiestro

- 7.5 Langley Holdings

- 7.6 OXTO Energy

- 7.7 PUNCH Flybrid

- 7.8 POWERTHRU

- 7.9 STORNETIC

- 7.10 VYCON