|

市场调查报告书

商品编码

1750263

化妆品软管包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cosmetic Tube Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

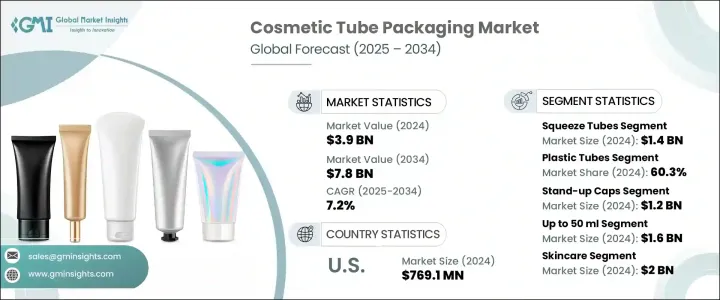

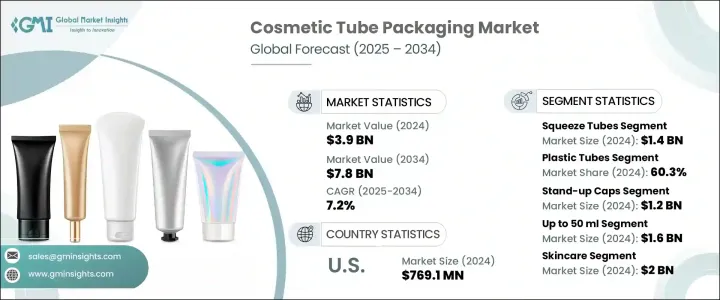

2024年,全球化妆品软管包装市场价值39亿美元,预计到2034年将以7.2%的复合年增长率成长,达到78亿美元。这主要得益于护肤品和个人护理产品需求的不断增长、电子商务的扩张以及对功能性和可持续包装的日益重视。随着消费者越来越关注护肤品,包括保湿霜、精华液和防晒霜等产品,对能够确保产品安全性、便利性和便携性的包装的需求也日益强烈。此外,向永续解决方案的转变促使製造商采用环保材料。高端保养品和清洁美容产品日益流行,促使各大品牌专注于打造兼具视觉吸引力和环保意识的包装。

为了满足日益增长的可持续解决方案需求,製造商开始转向使用环保材料进行化妆品包装。这种转变在化妆品产业尤其明显,高端护肤品和清洁美容产品的流行促使各大品牌打造兼具美观和环保的包装。随着消费者环保意识的增强,兼具功能性和永续性的包装正成为人们的优先事项。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 39亿美元 |

| 预测值 | 78亿美元 |

| 复合年增长率 | 7.2% |

挤压管是该市场中最大的细分市场,2024 年市场规模达 14 亿美元。这类管子因其易用性、多功能性和成本效益而备受青睐。它们特别受个人护理产品欢迎,因为它们提供卫生的包装,并可容纳液体和半固体製剂。挤压管还支援先进的装饰方法,增强产品的视觉吸引力,使其对消费者更具吸引力。另一个值得注意的趋势是,随着消费者和製造商越来越重视永续性,对单一材料可回收管的需求日益增长,尤其是在高端品牌中。

2024年,塑胶管市场占了60.3%的市场。其柔韧性、轻质特性和相对较低的生产成本使其成为各种化妆品的理想选择。随着永续发展的势头强劲,对高密度聚乙烯(HDPE)和消费后树脂(PCR)等环保塑胶的需求也不断增长。这些材料有助于减少塑胶垃圾,对于那些希望顺应包装可持续性发展趋势的品牌来说,它们是一个相当吸引人的选择。

由于护肤品和清洁美容产品需求激增,美国化妆品软管包装市场在2024年的价值达到7.691亿美元。此外,人们对真空软管和防篡改软管等功能性包装解决方案的日益青睐,也推动了市场扩张。严格的监管框架和消费者日益增强的环保意识,正促使品牌转向单一材料、可回收软管,进一步加速市场的成长。

全球化妆品软管包装产业的主要参与者包括 Albea SA、Berry Global Inc.、Hoffmann Neopac AG、Amcor Ltd. 和 Essel Propack Limited。这些公司正积极提升其市场地位,专注于永续性、推出创新包装解决方案并扩展产品组合以满足消费者不断变化的需求。为了巩固市场地位,Amcor Ltd. 和 Berry Global Inc. 等公司正专注于开发永续包装解决方案,例如环保软管和单一材料包装。 Albea SA 正在增加对先进软管技术的投资,强调可回收材料。同时,Essel Propack Limited 和 Hoffmann Neopac AG 正在扩大其生产能力,以满足对真空和防篡改软管日益增长的需求,顺应消费者安全和产品完整性日益增长的趋势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 护肤品和个人护理产品需求激增

- 电子商务和直接面向消费者的管道的成长

- 具有增值功能的功能性包装的兴起

- 管线製造技术不断进步

- 高端和小众化妆品品牌的扩张

- 产业陷阱与挑战

- 原物料价格波动

- 严格的环境法规和对塑胶使用的严格审查

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 挤压管

- 扭管

- 棒管

- 无气管

- 其他的

第六章:市场估计与预测:依材料类型,2021-2034 年

- 主要趋势

- 塑胶管

- 铝管

- 层压管

- 纸管

第七章:市场估计与预测:依容量类型,2021-2034

- 主要趋势

- 直立式帽

- 喷嘴盖

- 土耳其毡帽

- 翻盖瓶盖

- 其他的

第八章:市场估计与预测:依产能,2021-2034

- 主要趋势

- 最多 50 毫升

- 51毫升至100毫升

- 101毫升至150毫升

- 150毫升以上

第九章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 保养品

- 护髮

- 化妆品

- 其他的

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Albea Group

- ALPLA Group

- Aluminum Packaging Group (APG)

- Amcor plc

- APC Packaging

- Berlin Packaging

- Berry Global Group

- CCL Industries Inc.

- Cosmogen

- Cosmopak Corp.

- CTL Packaging

- Essel Propack Ltd.

- FusionPKG

- HCP Packaging

- HCT Packaging

- Hoffmann Neopac AG

- Huhtamaki Oyj

- Libo Cosmetics Co. Ltd.

- Mpack Poland Sp. z oo

- PR Packagings Ltd

- Prutha Packaging Pvt.Ltd..

- Quadpack Industries

- Tubex

- UKPACKCHINA

- VisiPak Inc.

The Global Cosmetic Tube Packaging Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 7.8 billion by 2034, driven by the rising demand for skincare and personal care products, the expansion of e-commerce, and a growing emphasis on functional and sustainable packaging. As consumers become increasingly focused on skincare, including products like moisturizers, serums, and sunscreens, the need for packaging that ensures product safety, convenience, and portability has intensified. Furthermore, the shift toward sustainable solutions pushes manufacturers to adopt eco-friendly materials. The increasing popularity of high-end skincare and clean beauty products has led brands to focus on creating visually appealing and environmentally responsible packaging.

In response to the growing demand for sustainable solutions, manufacturers turn to eco-friendly materials for cosmetic packaging. This shift is particularly evident in the cosmetic industry, where the popularity of high-end skincare and clean beauty products is prompting brands to create packaging that is both aesthetically appealing and environmentally responsible. As consumers become more eco-conscious, packaging that combines function and sustainability is becoming a priority.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $7.8 Billion |

| CAGR | 7.2% |

The squeeze tubes segment is the largest in this market, accounting for USD 1.4 billion in 2024. These tubes are favored for their ease of use, versatility, and cost-effectiveness. They are particularly popular for personal care products because they offer hygienic packaging and can accommodate liquid and semi-solid formulations. Squeeze tubes also allow for advanced decorating methods that enhance the visual appeal of products, making them more attractive to consumers. Another notable trend is the increasing demand for mono-material recyclable tubes, particularly among premium brands, as consumers and manufacturers prioritize sustainability.

The plastic tubes segment held a 60.3% share in 2024. Their flexibility, lightweight nature, and relatively low production costs make them ideal for a wide range of cosmetic products. As sustainability efforts gain momentum, the demand for eco-friendly plastics, such as HDPE and post-consumer resin (PCR), is rising. These materials help reduce plastic waste, making them an attractive option for brands aiming to align with the growing trend of sustainability in packaging.

U.S. Cosmetic Tube Packaging Market was valued at USD 769.1 million in 2024 due to the surge in demand for skincare and clean beauty products. Additionally, the increasing preference for functional packaging solutions, such as airless and tamper-proof tubes, is driving market expansion. Strict regulatory frameworks and growing consumer awareness regarding environmental issues are encouraging brands to transition to mono-material, recyclable tubes, further accelerating the growth of the market.

Key players in the Global Cosmetic Tube Packaging Industry include Albea S.A., Berry Global Inc., Hoffmann Neopac AG, Amcor Ltd., and Essel Propack Limited. These companies are actively enhancing their market positions by focusing on sustainability, introducing innovative packaging solutions, and expanding their product portfolios to meet the changing demands of consumers. To strengthen their market position, companies like Amcor Ltd. and Berry Global Inc. are focusing on the development of sustainable packaging solutions, such as eco-friendly tubes and mono-material packaging. Albea S.A. is increasing its investment in advanced tube technologies, emphasizing recyclable materials. Meanwhile, Essel Propack Limited and Hoffmann Neopac AG are expanding their production capabilities to meet the growing demand for airless and tamper-proof tubes, aligning with the rising trend of consumer safety and product integrity.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.3.1.1 Price volatility in key materials

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact (selling price)

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.4 Key companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in demand for skincare and personal care products

- 3.7.1.2 Growth in e-commerce and direct-to-consumer channels

- 3.7.1.3 Rise of functional packaging with value-added features

- 3.7.1.4 Increasing technological advancements in tube manufacturing

- 3.7.1.5 Expansion of premium and niche cosmetic brands

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Volatility in the prices of raw materials

- 3.7.2.2 Stringent environmental regulations and rising scrutiny on plastic usage

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Squeeze tubes

- 5.3 Twist-up tubes

- 5.4 Stick tubes

- 5.5 Airless tubes

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Plastic tubes

- 6.3 Aluminum tubes

- 6.4 Laminate tubes

- 6.5 Paper-based tubes

Chapter 7 Market Estimates & Forecast, By Cap Type, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Stand-up caps

- 7.3 Nozzle caps

- 7.4 Fez caps

- 7.5 Flip-top caps

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Up to 50 ml

- 8.3 51 ml to 100 ml

- 8.4 101 ml to 150 ml

- 8.5 Above 150 ml

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Skincare

- 9.3 Haircare

- 9.4 Makeup

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Albea Group

- 11.2 ALPLA Group

- 11.3 Aluminum Packaging Group (APG)

- 11.4 Amcor plc

- 11.5 APC Packaging

- 11.6 Berlin Packaging

- 11.7 Berry Global Group

- 11.8 CCL Industries Inc.

- 11.9 Cosmogen

- 11.10 Cosmopak Corp.

- 11.11 CTL Packaging

- 11.12 Essel Propack Ltd.

- 11.13 FusionPKG

- 11.14 HCP Packaging

- 11.15 HCT Packaging

- 11.16 Hoffmann Neopac AG

- 11.17 Huhtamaki Oyj

- 11.18 Libo Cosmetics Co. Ltd.

- 11.19 Mpack Poland Sp. z o.o.

- 11.20 P.R. Packagings Ltd

- 11.21 Prutha Packaging Pvt.Ltd..

- 11.22 Quadpack Industries

- 11.23 Tubex

- 11.24 UKPACKCHINA

- 11.25 VisiPak Inc.