|

市场调查报告书

商品编码

1750267

真空卡车市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Vacuum Truck Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

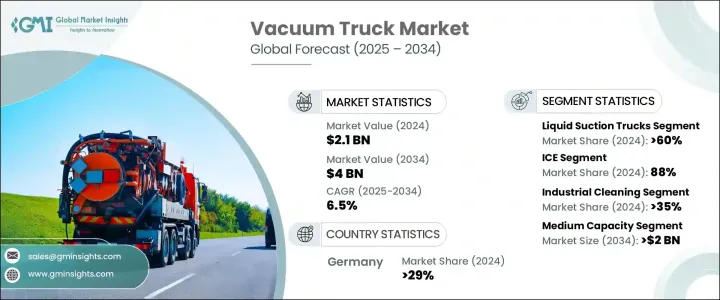

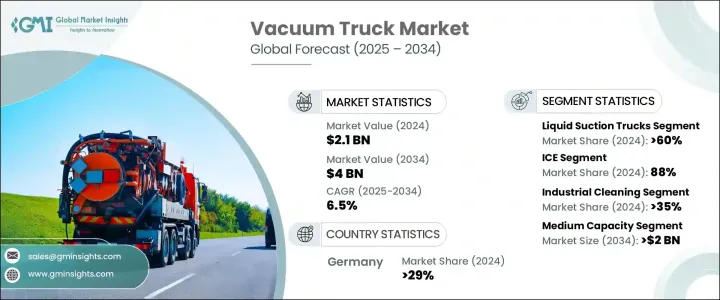

2024年,全球真空卡车市场价值为21亿美元,预计到2034年将以6.5%的复合年增长率增长,达到40亿美元,这得益于城镇化进程加快和工业快速发展,尤其是在新兴经济体。这些车辆对于处理固体和液体废物、下水道维护以及各行各业的清洁作业至关重要。随着城市发展和基础设施扩张,公共和私人实体越来越多地使用真空卡车来有效清除废物并进行卫生清洁。采矿、建筑和能源等工业部门也依赖真空卡车来处理洩漏物、污泥和危险材料,这进一步凸显了该车辆在现代废弃物管理生态系统中的重要性。

全球范围内出台的更严格的环境法规促使市政当局和各行各业纷纷采用真空吸污车来满足污染控制要求。这些车辆提供了一种安全运输危险和非危险材料的方法,不会污染环境。它们在确保化学品、公用事业和石油等行业的安全合规性方面发挥着日益重要的作用。随着环境标准的不断发展,人们对技术先进、性能更佳、排放更低、安全性更高的真空吸污车的兴趣日益浓厚。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 21亿美元 |

| 预测值 | 40亿美元 |

| 复合年增长率 | 6.5% |

液体吸污卡车市场在2024年占据了60%的市场份额,预计到2034年将达到20亿美元。这一成长主要得益于先进技术的采用,包括即时资料监控、物联网整合和远端资讯处理。这些智慧增强功能可以实现更好的路线优化,减少非计划停机时间,并支援预测性维护策略,从而提高车队营运的成本效益和可靠性。此外,液压部件和真空泵系统的创新使卡车具有更高的吸力和更低的噪音水平,从而提高了营运效率,同时符合更严格的环保法规。

就燃料类型而言,2024 年内燃机 (ICE) 真空吸污车占据市场主导地位,占 88%。儘管占据主导地位,但随着人们对清洁燃料替代品的兴趣日益浓厚,人们正朝着永续发展的方向转变。再生天然气 (RNG)(通常从农业或垃圾掩埋场甲烷中获取)和液化天然气 (LNG) 正逐渐成为传统柴油的热门替代品,它们不仅碳排放更低,而且在监管方面也更具优势。氢动力内燃机作为过渡解决方案,也越来越受到青睐,它填补了传统柴油引擎与纯电动或零排放车之间的空白。

2024年,欧洲真空吸污车市场占据29%的市场份额,这得益于该地区严格的环境法规强制推行高效的废弃物处理和污染控制技术,使得真空吸污车成为公共事业、建筑和工业清洁领域的必备设备。这些车辆广泛用于维护下水道系统、处理危险废物以及管理基础设施建设项目产生的垃圾。欧洲持续的城市化进程和对绿色基础设施的投资进一步推动了对技术先进、低排放真空吸污车日益增长的需求。随着对永续性和市政清洁的日益重视,预计该地区公共和私营部门的需求都将保持强劲。

为了维持并巩固市场地位,主要公司正在投资创新和永续发展。 Amphitec BV、Federal Signal、GapVax、东正教专用车、DISAB Vacuum Technology、Alamo Group、福龙马集团、Cappellotto、贝克休斯和Super Products等公司正在整合更清洁的燃油系统,推进真空技术,并扩大其地理覆盖范围。他们还专注于与市政当局和工业运营商建立战略合作伙伴关係,以确保长期合约和可靠的服务管道。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- OEM製造商

- 零件供应商

- 底盘和引擎供应商

- 租赁和车队服务提供者

- 系统整合商和客製化製造商

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 主要材料价格波动

- 供应链重组

- 价格传导至终端市场

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 对贸易的影响

- 利润率分析

- 技术与创新格局

- 重要新闻和倡议

- 成本細項分析

- 定价分析

- 产品

- 地区

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 都市化进程加快,城市垃圾管理需求增加

- 石油天然气和采矿业务的扩张

- 更严格的环境和安全法规

- 技术进步和自动化

- 产业陷阱与挑战

- 高昂的资本和维护成本

- 发展中地区基础建设有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 吸液车

- 干吸卡车

- 组合卡车

第六章:市场估计与预测:按燃料,2021 - 2034 年

- 主要趋势

- 冰

- 电的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 工业清洁

- 挖掘

- 市政

- 常规清洁

- 其他的

第八章:市场估计与预测:依产能,2021 - 2034 年

- 主要趋势

- 容量小(最多 5 立方米)

- 中等容量(5-10 m³)

- 容量大(10m³以上)

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Alamo Group

- Amphitec BV

- Cappellotto

- DISAB Vacuum Technology

- Dongzheng Special Purpose Vehicle

- Federal Signal

- Fulongma Group

- GapVax

- Gradall Industries

- Guzzler Manufacturing

- Hi-Vac Corporation

- Kanematsu Engineering

- Keith Huber

- KOKS Group

- Ledwell & Son

- Rivard

- Sewer Equipment

- Super Products

- Vacall Industries

- Vac-Con

The Global Vacuum Truck Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 4 billion by 2034, driven by the rise in urbanization and rapid industrial development, especially across emerging economies. These vehicles are essential for handling solid and liquid waste, sewer maintenance, and cleaning operations across a wide range of industries. As cities grow and infrastructure expands, public and private entities are increasingly turning to vacuum trucks for efficient waste removal and sanitation. Industrial sectors such as mining, construction, and energy also rely on vacuum trucks to manage spills, sludge, and hazardous materials, reinforcing the vehicle's importance in modern waste management ecosystems.

Stricter environmental regulations introduced globally have prompted municipalities and industries to adopt vacuum trucks to meet pollution control requirements. These vehicles offer a secure method of transporting hazardous and non-hazardous materials without contaminating the environment. Their role in ensuring safety compliance across sectors like chemicals, utilities, and petroleum continues to gain prominence. As environmental standards evolve, there's growing interest in technologically advanced vacuum trucks that provide better performance, reduced emissions, and enhanced safety.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $4 Billion |

| CAGR | 6.5% |

The liquid suction truck segment held a 60% share in 2024 and is projected to reach USD 2 billion by 2034. This growth is largely fueled by the adoption of advanced technologies, including real-time data monitoring, IoT integration, and telematics. These smart enhancements enable better route optimization, reduce unplanned downtimes, and support predictive maintenance strategies, making fleet operations more cost-effective and reliable. Additionally, innovations in hydraulic components and vacuum pump systems have resulted in trucks that operate with higher suction power and reduced noise levels, which improves operational efficiency while aligning with stricter environmental mandates.

When it comes to fuel types, internal combustion engine (ICE) vacuum trucks dominated the market in 2024 with an 88% share. Despite this dominance, the shift toward sustainability is evident with increased interest in cleaner fuel alternatives. Renewable natural gas (RNG), often captured from agricultural or landfill methane, and liquefied natural gas (LNG) are emerging as popular substitutes to conventional diesel, offering lower carbon emissions and regulatory benefits. Hydrogen-powered ICEs are also gaining traction as an interim solution, bridging the gap between traditional diesel engines and fully electric or zero-emission vehicles.

Europe Vacuum Truck Market held 29% share in 2024, driven by the region's strict environmental regulations have made efficient waste handling and pollution control technologies mandatory, positioning vacuum trucks as essential for public utilities, construction, and industrial cleaning. These vehicles are widely utilized for maintaining sewer systems, handling hazardous waste, and managing debris from infrastructure development projects. Continued urbanization and investments in green infrastructure across Europe further support the rising need for technologically advanced, low-emission vacuum trucks. With a growing emphasis on sustainability and municipal cleanliness, demand is expected to stay strong across both public and private sectors in the region.

To maintain and strengthen market positioning, key companies are investing in innovation and sustainability. Players like Amphitec BV, Federal Signal, GapVax, Dongzheng Special Purpose Vehicle, DISAB Vacuum Technology, Alamo Group, Fulongma Group, Cappellotto, Baker Hughes, and Super Products are integrating cleaner fuel systems, advancing vacuum technologies, and expanding their geographic presence. They also focus on building strategic partnerships with municipalities and industrial operators to ensure long-term contracts and dependable service pipelines.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 OEM Manufacturers

- 3.2.2 Component Suppliers

- 3.2.3 Chassis & Engine Providers

- 3.2.4 Rental & Fleet Service Providers

- 3.2.5 System Integrators & Custom Fabricators

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on the Industry

- 3.3.2.1 Price volatility in key materials

- 3.3.2.2 Supply chain restructuring

- 3.3.2.3 Price transmission to end markets

- 3.3.3 Strategic industry responses

- 3.3.3.1 Supply chain reconfiguration

- 3.3.3.2 Pricing and product strategies

- 3.3.1 Impact on trade

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Cost breakdown analysis

- 3.8 Pricing analysis

- 3.8.1 Product

- 3.8.2 Region

- 3.9 Patent analysis

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Increasing Urbanization and Municipal Waste Management Needs

- 3.11.1.2 Expansion in Oil & Gas and Mining Operations

- 3.11.1.3 Stricter Environmental and Safety Regulations

- 3.11.1.4 Technological Advancements and Automation

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High Capital and Maintenance Costs

- 3.11.2.2 Limited Infrastructure in Developing Regions

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Liquid suction trucks

- 5.3 Dry suction trucks

- 5.4 Combination trucks

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 ICE

- 6.3 Electric

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Industrial cleaning

- 7.3 Excavation

- 7.4 Municipal

- 7.5 General cleaning

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Small capacity (Up to 5 m³)

- 8.3 Medium capacity (5–10 m³)

- 8.4 Large capacity (Above 10 m³)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Alamo Group

- 10.2 Amphitec BV

- 10.3 Cappellotto

- 10.4 DISAB Vacuum Technology

- 10.5 Dongzheng Special Purpose Vehicle

- 10.6 Federal Signal

- 10.7 Fulongma Group

- 10.8 GapVax

- 10.9 Gradall Industries

- 10.10 Guzzler Manufacturing

- 10.11 Hi-Vac Corporation

- 10.12 Kanematsu Engineering

- 10.13 Keith Huber

- 10.14 KOKS Group

- 10.15 Ledwell & Son

- 10.16 Rivard

- 10.17 Sewer Equipment

- 10.18 Super Products

- 10.19 Vacall Industries

- 10.20 Vac-Con