|

市场调查报告书

商品编码

1750276

纤维肌痛治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Fibromyalgia Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

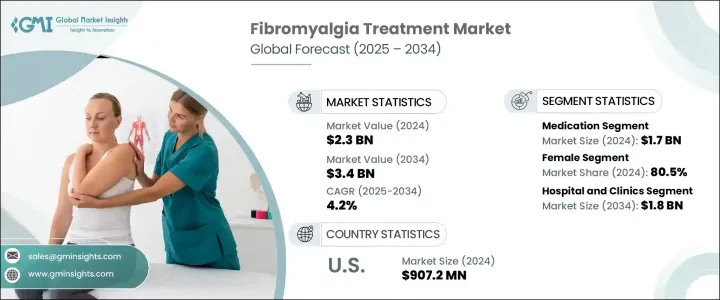

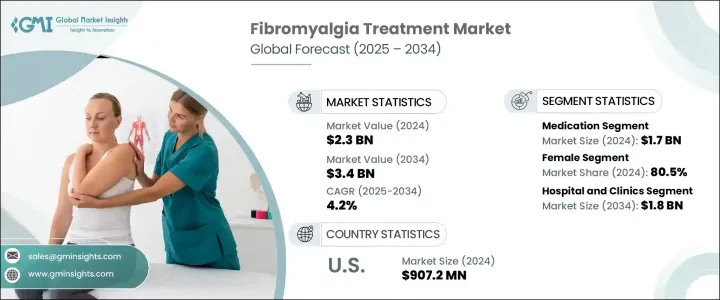

2024年,全球纤维肌痛治疗市场规模达23亿美元,预计2034年将以4.2%的复合年增长率成长,达到34亿美元。这得归功于对纤维肌痛复杂病理生理机制(包括神经化学失衡和中枢敏化)的深入了解。定量感觉测试等诊断方法的进步以及慢性疼痛综合征生物标记的开发,提高了早期诊断的准确性。功能性磁振造影和蛋白质体学分析等技术的整合有助于识别特定的疼痛路径并制定个人化治疗策略,从而促进市场成长。

此外,人工智慧 (AI) 平台和数位健康技术的结合增强了症状追踪和管理,从而实现了更个人化的护理方案。神经调节和生物回馈等非侵入性治疗的兴起,显示整体治疗框架的接受度日益提高。製药公司、学术机构和临床医生之间的跨产业合作促进了先进疗法的发展,改变了治疗方法和疗效的进程。市场涵盖旨在控制慢性疼痛、疲劳和纤维肌痛相关症状的药物和非药物治疗,包括镇痛药和抗忧郁药等药物以及替代疗法。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 23亿美元 |

| 预测值 | 34亿美元 |

| 复合年增长率 | 4.2% |

由于患者对疼痛、疲劳及其后续症状管理的期望不断提高,2024年药物市场收入达到17亿美元。对药物治疗方法的需求不断增长,这也解释了药物市场为何占据主导地位。主要药物类别包括抗忧郁药、抗惊厥药和镇痛药,这些药物有助于患者享受更高品质的生活。新药及其配方改良的上市,以及现有药物上市许可的增加,例如普瑞巴林,它是首批获得FDA批准的纤维肌痛治疗药物之一。

根据性别,纤维肌痛治疗市场分为男性和女性两部分。 2024年,女性市场占据了80.5%的显着市场。由于该疾病对女性的影响尤其严重,因此女性市场占有一定份额。美国国家生物技术资讯中心 (NCBI) 报告称,纤维肌痛症候群在女性中发病率较高,占病例总数的80%-96%。这些差异可能是由于荷尔蒙因素、更强烈的疼痛感以及神经系统功能的差异所致。

美国纤维肌痛治疗市场规模在2024年达到9.072亿美元,得益于其优质的医疗体系、高发生率和庞大的製药产业。 FDA核准的度洛西汀、米那普崙和普瑞巴林等药物占据处方药市场的主导地位。此外,由于相关宣传项目和医疗保险覆盖范围的扩大,患者寻求治疗的动机也进一步提升。新兴趋势包括远距医疗诊断以及更个人化的医疗方法。新疗法的临床研究涵盖了非药物疗法,例如认知行为疗法和生活方式改变。

全球纤维肌痛治疗产业的主要参与者包括雅培实验室、艾伯维、Amneal Pharmaceuticals、阿斯特捷利康、科罗拉多纤维肌痛中心、礼来公司、鲁宾製药、梅奥诊所、诺华、辉瑞、太阳製药、梯瓦製药、综合医院集团、德克萨斯大学奥斯汀分校健康中心、Viatris 和 Zydus Lifesciences。为了巩固市场地位,纤维肌痛治疗领域的公司正透过大力投资研发来强调创新。这包括改进药物配方、优化给药方案和改进给药技术,以提高患者依从性和治疗效果。许多领先公司也与学术机构和研究组织建立策略联盟,以加速下一代疗法的发现和商业化。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球纤维肌痛盛行率不断上升

- 提高对纤维肌痛诊断和治疗方案的认识

- 针对疼痛管理的药物疗法的进展

- 产业陷阱与挑战

- 晚期纤维肌痛治疗费用高

- 专门针对纤维肌痛症的有效药物供应有限

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按治疗类型,2021-2034

- 主要趋势

- 药物

- 抗忧郁药

- 抗惊厥药

- 止痛药

- 肌肉鬆弛剂

- 其他药物

- 治疗

- 物理治疗

- 职能治疗

- 其他疗法

第六章:市场估计与预测:依性别,2021-2034

- 主要趋势

- 男性

- 女性

第七章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 医院

- 专科诊所

- 其他最终用途

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- AbbVie

- Amneal Pharmaceuticals

- AstraZeneca

- Colorado Fibromyalgia Center

- Eli Lilly and Company

- Lupin

- Mayo Clinic

- Novartis

- Pfizer

- Sun Pharmaceutical

- Teva Pharmaceutical

- The General Hospital Corporation

- UT Health Austin

- Viatris

- Zydus Lifesciences

The Global Fibromyalgia Treatment Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 3.4 billion by 2034, driven by a deeper understanding of fibromyalgia's complex pathophysiology, including neurochemical imbalances and central sensitization. Advances in diagnostic methods, such as quantitative sensory testing and the development of biomarkers for chronic pain syndromes, have improved early and accurate diagnosis. Integrating technology, including functional MRI and proteomic analysis, helps in identifying specific pain pathways and tailoring treatment strategies, thereby boosting market growth.

Additionally, incorporating artificial intelligence (AI)-powered platforms and digital health technologies has enhanced symptom tracking and management, enabling more personalized care approaches. The shift towards non-invasive treatments, such as neuromodulation and biofeedback, indicates a growing acceptance of holistic frameworks. Cross-industry collaboration among pharmaceutical companies, academic institutions, and clinical practitioners has catalyzed the development of advanced therapeutics, changing the course of treatment approaches and outcomes. The market encompasses pharmaceutical and non-pharmacological treatments aimed at managing chronic pain, fatigue, and associated symptoms of fibromyalgia, including medications like analgesics and antidepressants, as well as alternative therapies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 4.2% |

The medication segment generated USD 1.7 billion in 2024 due to increased patient expectations regarding pain, fatigue, and subsequent symptom management. Demand is rising for pharmacological approaches, which explains why the medication segment dominates the market. Key drug classes include antidepressants, anticonvulsants, and analgesic drugs that help patients enjoy a better quality of life. The growth in this segment is supported by the launch of new drugs and their reformulations, along with increased marketing authorizations of existing ones, such as pregabalin, one of the first FDA-approved drugs specifically for fibromyalgia.

Based on gender, the fibromyalgia treatment market is divided into male and female segments. The female segment accounted for a significant market share of 80.5% in 2024. The female segment represents a market share, as the condition disproportionately affects women. As reported by the National Center for Biotechnology Information (NCBI), fibromyalgia syndrome has a high female predominance, comprising 80%-96% of cases. These differences have been explained based on hormonal factors, greater pain perception, and variations in the functions of the nervous system.

U.S. Fibromyalgia Treatment Market was valued at USD 907.2 million in 2024 due to its quality healthcare system, high disease prevalence, and extensive pharmaceutical industry. FDA-approved drugs such as duloxetine, milnacipran, and pregabalin dominate the prescription landscape. Patients are further motivated to seek treatment due to awareness programs and insurance coverage. Emerging trends include telemedicine for diagnosis and a shift toward a more personalized approach to medicine. Clinical research for new therapy approaches includes non-pharmaceutical options such as cognitive behavioral therapy and lifestyle changes.

Major players operating in the Global Fibromyalgia Treatment Industry include Abbott Laboratories, AbbVie, Amneal Pharmaceuticals, AstraZeneca, Colorado Fibromyalgia Center, Eli Lilly and Company, Lupin, Mayo Clinic, Novartis, Pfizer, Sun Pharmaceutical, Teva Pharmaceutical, The General Hospital Corporation, UT Health Austin, Viatris, and Zydus Lifesciences. To strengthen their market foothold, companies in the fibromyalgia treatment sector are emphasizing innovation through robust investments in research and development. This includes advancing drug formulations, optimizing dosage regimens, and improving delivery technologies to increase patient adherence and therapeutic effectiveness. Many leading firms are also forming strategic alliances with academic institutions and research organizations to accelerate the discovery and commercialization of next-generation treatments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of fibromyalgia globally

- 3.2.1.2 Rising awareness about fibromyalgia diagnosis and treatment options

- 3.2.1.3 Advances in pharmaceutical therapies targeting pain management

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced fibromyalgia treatments

- 3.2.2.2 Limited availability of effective medications specifically approved for fibromyalgia

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Medication

- 5.2.1 Antidepressants

- 5.2.2 Anticonvulsants

- 5.2.3 Analgesics

- 5.2.4 Muscle relaxants

- 5.2.5 Other medications

- 5.3 Therapy

- 5.3.1 Physical therapy

- 5.3.2 Occupational therapy

- 5.3.3 Other therapies

Chapter 6 Market Estimates and Forecast, By Gender, 2021-2034 ($ Mn)

- 6.1 Key trends

- 6.2 Male

- 6.3 Female

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 AbbVie

- 9.3 Amneal Pharmaceuticals

- 9.4 AstraZeneca

- 9.5 Colorado Fibromyalgia Center

- 9.6 Eli Lilly and Company

- 9.7 Lupin

- 9.8 Mayo Clinic

- 9.9 Novartis

- 9.10 Pfizer

- 9.11 Sun Pharmaceutical

- 9.12 Teva Pharmaceutical

- 9.13 The General Hospital Corporation

- 9.14 UT Health Austin

- 9.15 Viatris

- 9.16 Zydus Lifesciences