|

市场调查报告书

商品编码

1750277

维生素 K2 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Vitamin K2 Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

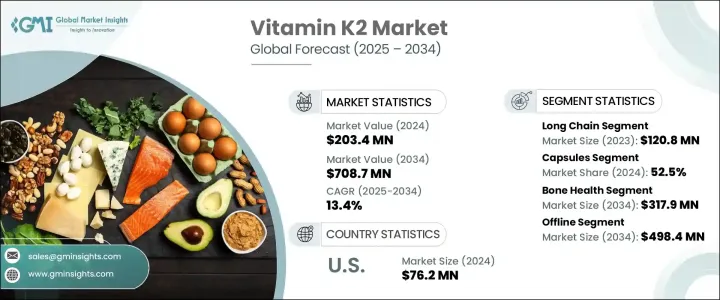

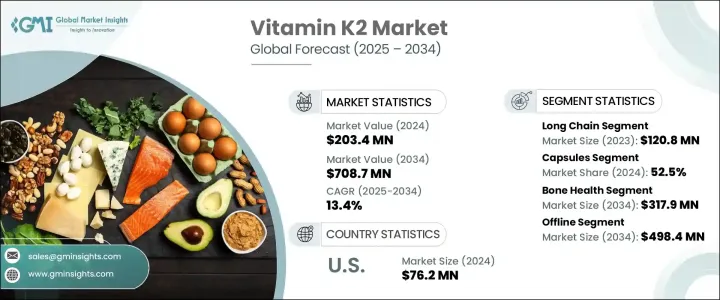

2024年,全球维生素K2市场规模达2.034亿美元,预计到2034年将以13.4%的复合年增长率增长,达到7.087亿美元,这主要得益于骨质疏鬆症、心臟病和某些癌症等慢性疾病发病率的上升。人们日益认识到维生素K2的益处,尤其是在维持心血管和骨骼健康方面,这在各年龄层补充剂消费的增长中发挥了重要作用。随着越来越多的消费者关注营养和预防保健,对有针对性的补充剂的需求持续增长。人们对骨密度健康和骨质疏鬆症等疾病管理的日益重视也加速了维生素K2产品的普及。

此外,医学界对新生儿维生素K缺乏症(尤其是迟发性出血的风险)的担忧日益加剧,促使医疗机构加强了对新生儿补充维生素K的建议。这导致维生素K2在儿科护理中的使用量上升,开启了一个以婴儿健康为重点的快速新兴领域。随着父母和照护者对早期营养重要性的认识不断提高,对安全、有效且耐受性良好的婴儿专用维生素K2配方的需求也不断增长。如今,儿科补充剂以滴剂或口服液等较温和的剂型提供,这些剂型易于服用,专为新生儿需求而设计。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.034亿美元 |

| 预测值 | 7.087亿美元 |

| 复合年增长率 | 13.4% |

长链形式的MK-7凭藉其卓越的吸收率和更长的体内半衰期,在2024年占据了产品类别的主导地位。 MK-7赢得了医疗保健专业人士的信赖,他们现在更倾向于用它来管理骨质脆弱性和降低心血管风险。越来越多的临床研究支持MK-7在预防骨折和提高骨密度方面的作用,这进一步提升了它的受欢迎程度,尤其是在寻求天然解决方案的老年人群中。随着人们对有机植物补充剂的认识不断提高,对源自天然成分的MK-7的需求也持续增长。

胶囊剂型在剂型方面占据市场领先地位,2024 年的市占率为 52.5%。胶囊配方的灵活性及其高吸收率促成了这一增长。软胶囊因其能够提高维生素 K2 等脂溶性营养素的生物利用度而备受讚誉,从而提高依从性并加快起效。卫生部门对软胶囊剂型的监管支持也支持其在非处方补充剂中的广泛应用。

2024年,美国维生素K2市场规模达7,620万美元,这得益于人们对骨骼健康的关注日益增长,尤其是在老年人群中,以及更广泛的宣传活动。线上销售管道的成长使得维生素K2产品更加便捷,为消费者提供了更广泛的选择和便利的配送方式。此外,大众对维生素K2在预防骨骼和心臟问题方面所扮演的角色的宣传教育也持续推动着美国市场的扩张。

全球维生素 K2 市场的主要参与者,例如 Zenith Nutrition、Carlyle Nutritionals、Doctor's Best、Health Veda Organics、Vlado's Himalayan Organics、Amway Nutrilite、NattoPharma、Pharma Cure Laboratories、Kappa Biosciences (Balchem Corporation、NattoPharma、Pharma Cure Laboratories、Kappa Biosciences (Balchem Corporation)、WOW Lifes、Smarter Organics,正在采取策略方法来提升其市场地位。这些策略包括开发清洁标籤和有机产品、投资科学研究以验证其健康声明、扩大其数位影响力以及建立分销合作伙伴关係以提升全球影响力。许多公司也专注于透过提高生物利用度和独特的给药方式来实现产品差异化。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 人口老化加剧和生活方式相关疾病

- 骨骼和心血管健康意识不断提高

- 日益转向预防性医疗保健

- 产业陷阱与挑战

- 监管挑战和品质问题

- 替代产品的可用性

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 短链(MK - 4)

- 长链(MK-7)

第六章:市场估计与预测:按剂型,2021 - 2034 年

- 主要趋势

- 胶囊

- 平板电脑

- 掉落

- 其他剂型

第七章:市场估计与预测:按适应症,2021 - 2034 年

- 主要趋势

- 骨骼健康

- 心臟健康

- 血液凝固

- 其他适应症

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 离线

- 药局和药局

- 超市/大卖场

- 其他线下门市

- 在线的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Amway Nutrilite

- Carlyle Nutritionals

- Doctor's Best

- Health Veda Organics

- Innovix labs

- Kappa Biosciences (Balchem Corporation)

- Mary Ruth Organics

- NattoPharma

- Pharma Cure Laboratories

- Phi Naturals

- Smarter Vitamins

- Vlado's Himalayan Organics

- WOW Lifesciences

- Zenith Nutrition

The Global Vitamin K2 Market was valued at USD 203.4 million in 2024 and is estimated to grow at a CAGR of 13.4% to reach USD 708.7 million by 2034, driven by the rising occurrence of chronic illnesses such as osteoporosis, heart disease, and certain cancers. The growing awareness of vitamin K2's benefits, especially in maintaining cardiovascular and bone health, has played a major role in increasing supplement consumption across all age groups. As more consumers focus on nutrition and preventive care, demand for targeted supplements continues to rise. The increased emphasis on bone density health and the management of conditions like osteoporosis is also accelerating the uptake of vitamin K2 products.

Furthermore, growing medical concern surrounding vitamin K deficiency in newborns, particularly the risk of late-onset bleeding, have prompted healthcare authorities to strengthen recommendations for supplementation at birth. This has led to an uptick in the use of vitamin K2 in pediatric care, opening a rapidly emerging segment focused on infant health. As awareness increases among parents and caregivers about the importance of early-life nutrition, the demand for safe, effective, and well-tolerated vitamin K2 formulations tailored for infants is expanding. Pediatric supplements are now being offered in gentler forms such as drops or oral solutions, which are easy to administer and designed specifically for neonatal needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $203.4 million |

| Forecast Value | $708.7 million |

| CAGR | 13.4% |

The long-chain form, MK-7, dominated the product category in 2024 due to its superior absorption and extended half-life in the body. MK-7 has gained trust among healthcare professionals who now prefer it for managing bone fragility and reducing cardiovascular risk. Increased clinical research supporting the role of MK-7 in preventing fractures and improving bone mineral density has further propelled its popularity, particularly among aging adults seeking natural solutions. As awareness of organic, plant-based supplements grows, demand for MK-7 sourced from natural ingredients continues to rise.

The capsules segment led the market in terms of dosage form, holding 52.5% share in 2024. The flexibility in formulating capsules, combined with their high absorption rate, has contributed to this growth. Soft gel variants are praised for their ability to improve the bioavailability of fat-soluble nutrients like vitamin K2, resulting in better compliance and faster action. Regulatory backing for soft gel formats from health authorities also supports their expanding use in over-the-counter supplements.

United States Vitamin K2 Market was valued at USD 76.2 million in 2024, driven by the rising interest in bone health, especially among older adults, alongside broader awareness campaigns. The growth of online sales channels has made vitamin K2 products more accessible, offering consumers a wider selection and convenient delivery options. Additionally, efforts to educate the public on the role in preventing bone and heart issues continue to drive market expansion in the country.

Key players in the Global Vitamin K2 Market such as Zenith Nutrition, Carlyle Nutritionals, Doctor's Best, Health Veda Organics, Vlado's Himalayan Organics, Amway Nutrilite, NattoPharma, Pharma Cure Laboratories, Kappa Biosciences (Balchem Corporation), WOW Lifesciences, Smarter Vitamins, Innovix Labs, Phi Naturals, and Mary Ruth Organics are employing strategic approaches to enhance their market position. These include the development of clean-label and organic products, investment in scientific research to validate health claims, expanding their digital presence, and forming distribution partnerships to boost global reach. Many also focus on product differentiation through enhanced bioavailability and unique delivery forms.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing aging population and lifestyle related disorders

- 3.2.1.2 Rising awareness of bone and cardiovascular health

- 3.2.1.3 Increasing shift toward preventive healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory challenges and quality concerns

- 3.2.2.2 Availability of alternative products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Short chain (MK--4)

- 5.3 Long chain (MK-7)

Chapter 6 Market Estimates and Forecast, By Dosage Form, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Capsules

- 6.3 Tablets

- 6.4 Drops

- 6.5 Other dosage form

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bone health

- 7.3 Heart health

- 7.4 Blood clotting

- 7.5 Other indications

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Offline

- 8.2.1 Pharmacies and drug stores

- 8.2.2 Supermarkets/ hypermarkets

- 8.2.3 Other offline stores

- 8.3 Online

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amway Nutrilite

- 10.2 Carlyle Nutritionals

- 10.3 Doctor's Best

- 10.4 Health Veda Organics

- 10.5 Innovix labs

- 10.6 Kappa Biosciences (Balchem Corporation)

- 10.7 Mary Ruth Organics

- 10.8 NattoPharma

- 10.9 Pharma Cure Laboratories

- 10.10 Phi Naturals

- 10.11 Smarter Vitamins

- 10.12 Vlado's Himalayan Organics

- 10.13 WOW Lifesciences

- 10.14 Zenith Nutrition